ATLANTA, USA – The Coca-Cola Company today reported fourth quarter and full-year 2021 results, including another quarter of sequential improvement in volume trends compared to 2019. Global Ventures Group, which manages its Costa Coffee retail business, reported a net revenues growth of 27% for final quarter to $78m driven by Costa Coffee.

“In 2021, our system demonstrated resilience and flexibility by successfully navigating through another year of uncertainty,” said James Quincey, Chairman and CEO of The Coca-Cola Company. “We focused on our key strategies and emerged stronger.

We are confident that progress on our strategic transformation has made us a nimbler total beverage company. While the environment remains dynamic, we will build on the momentum from 2021 to drive topline growth and maximize returns.”

The Coca-Cola CompanyHighlights: Quarterly / Full-Year Performance

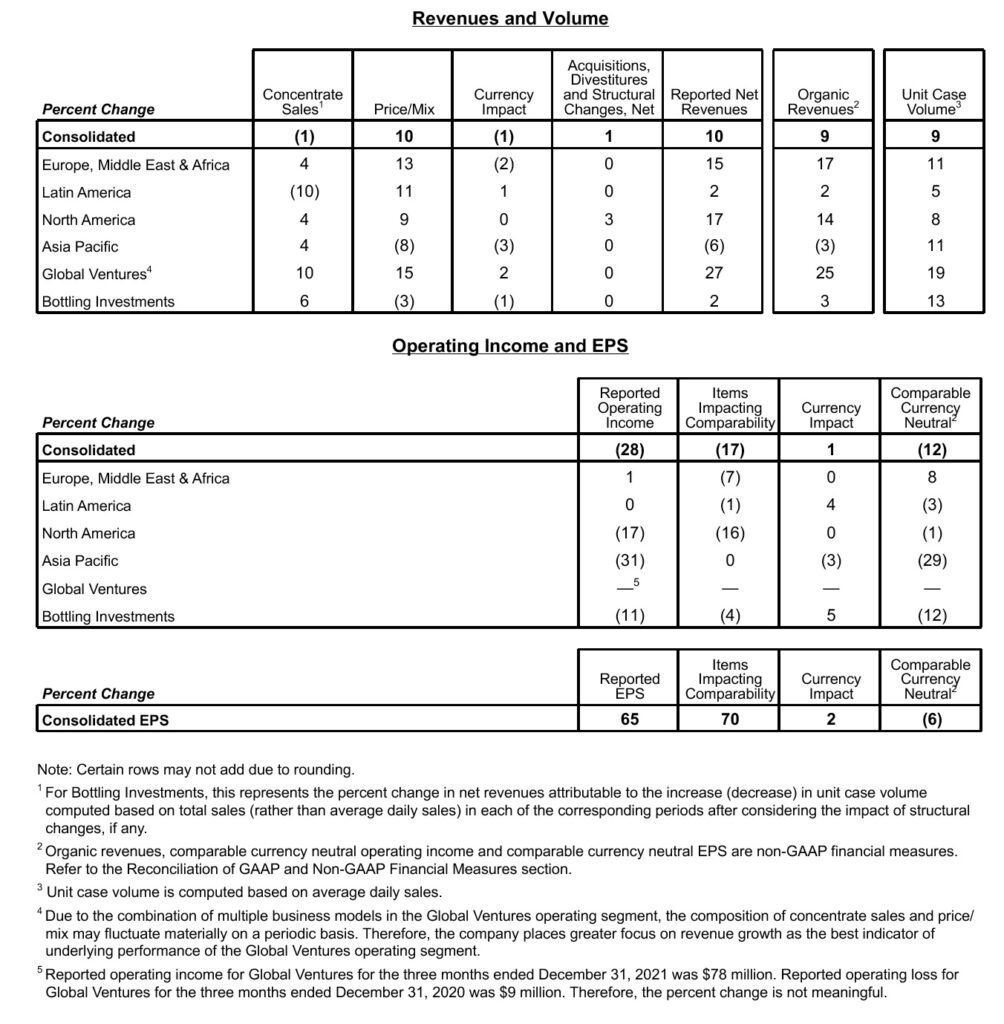

Revenues: For the quarter, net revenues grew 10% to $9.5 billion, resulting in net revenues ahead of 2019, and organic revenues (non-GAAP) grew 9%. Revenue performance included 10% growth in price/mix and a decline of 1% in concentrate sales.

The quarter included six fewer days, which resulted in an approximate 6-point headwind to revenue growth.

The quarter was also impacted by the timing of concentrate shipments. For the full year, net revenues grew 17% to $38.7 billion, and organic revenues (non-GAAP) grew 16%. This performance was driven by 9% growth in concentrate sales and 6% growth in price/mix.

Margin: For the quarter, operating margin, which included items impacting comparability, was 17.7% versus 27.2% in the prior year, while comparable operating margin (non-GAAP) was 22.1% versus 27.3% in the prior year. For the full year, operating margin, which included items impacting comparability, was 26.7% versus 27.3% in the prior year, while comparable operating margin (non-GAAP) was 28.7% versus 29.6% in the prior year.

For both the quarter and the full year, operating margin compression was primarily driven by a significant increase in marketing investments versus the prior year.

Additionally, fourth quarter operating margin was impacted by topline pressure from six fewer days in the quarter along with the timing of concentrate shipments.

Earnings per share: For the quarter, EPS grew 65% to $0.56, and comparable EPS (non-GAAP) declined 5% to $0.45. For the full year, EPS grew 26% to $2.25, and comparable EPS (non-GAAP) grew 19% to $2.32. Both fourth quarter and full-year comparable EPS (non-GAAP) performance included the impact of a 2-point currency tailwind.

Market share: For both the quarter and the full year, the company gained value share in total nonalcoholic ready-to-drink (NARTD) beverages, which included share gains in both at-home and away-from-home channels. The company’s value share in total NARTD beverages, and in both at-home and away-from-home channels, remains ahead of 2019.

Cash flow: Cash flow from operations for the year was $12.6 billion, up $2.8 billion versus the prior year, driven by strong business performance and working capital initiatives. Full-year free cash flow (non-GAAP) was $11.3 billion, up $2.6 billion versus the prior year, driven by strong cash flow from operations.

Category performance was as follows:

Sparkling soft drinks grew 8% for the quarter and 7% for the year, resulting in volume ahead of 2019, driven by strong performance across all geographic operating segments. Trademark Coca-Cola grew 7% for both the quarter and the year, resulting in volume ahead of 2019, led by Europe, Middle East & Africa and Asia Pacific. Coca-Cola® Zero Sugar grew double digits for both the quarter and the year.

Sparkling flavors grew 9% for both the quarter and the year, led by Europe, Middle East & Africa and Asia Pacific.

Nutrition, juice, dairy and plant-based beverages grew 11% for the quarter and 12% for the year, resulting in volume ahead of 2019. For both the quarter and the year, there was strong growth across all geographic

operating segments.

Hydration, sports, coffee and tea grew 12% for the quarter and 7% for the year. Hydration grew 11% for the quarter and 5% for the year, with growth across all geographic operating segments. Sports drinks grew 18% for the quarter and 13% for the year, resulting in volume ahead of 2019, primarily driven by strong growth of BODYARMOR in the United States. Tea grew 10% for the quarter and 6% for the year, led by growth in Japan and the United States. Coffee grew 17% for the quarter and 15% for the year, primarily driven by the ongoing reopening of Costa retail stores in the United Kingdom.

Global Ventures

Net revenues grew 27% for the quarter, which included a 2-point currency tailwind. Organic revenues (non-GAAP) grew 25%.

Revenue growth was primarily driven by the ongoing reopening of Costa retail stores in the United Kingdom.

Operating income growth and comparable currency neutral operating income (non-GAAP) growth for thequarter were driven by strong organic revenue (non-GAAP) growth.