ABIDJAN, Côte d’Ivoire – The first half of the 2021/22 cocoa season has so far witnessed a rebound in cocoa demand. Although the global economy is facing significant inflationary pressures and chocolate may be termed as a non-essential good as consumers are financially hard-pressed, positive sales of chocolate may be indicating that chocolate is a timeless product and comfort food.

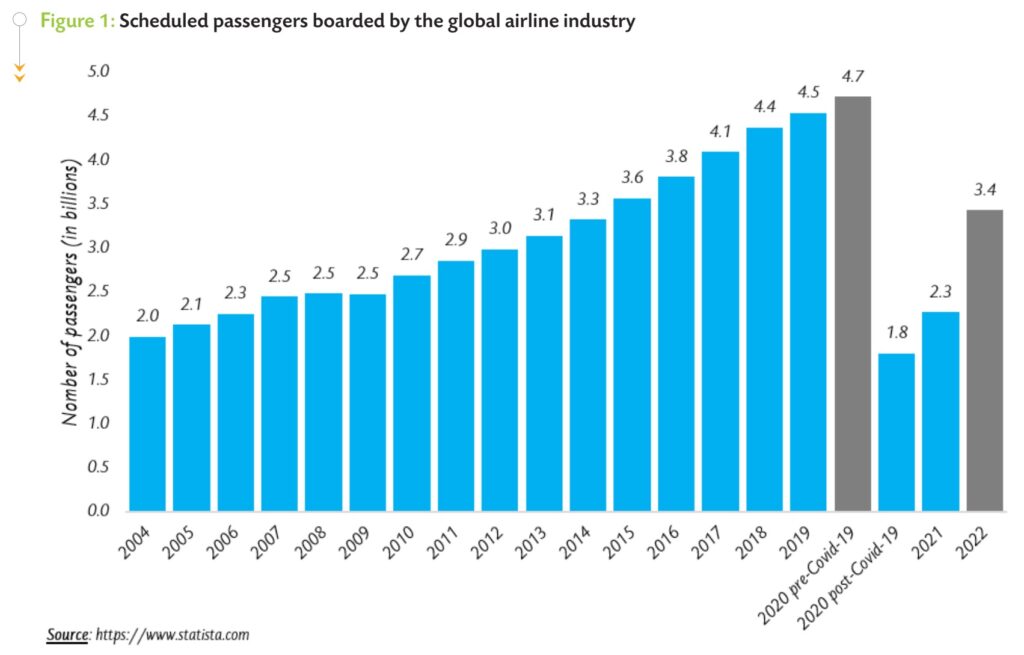

Factors that have contributed to the increase in cocoa demand include the resumption of the air travel sector which is a major gateway for chocolate sales as well as recommencement of seasonal festivities.

As seen in Figure 1, air travel is heading towards pre-covid-19 period.

Positive quarterly earnings reports from major confectionary manufacturers for the period January – March 2022, reveals that confectionary which includes chocolate sales have picked up and heading or at par with that of pre-covid-19 era. According to Nestlé “sales in confectionery grew at a double-digit rate, with strong growth for KitKat and gifting products”1.

For Mondelez, the CEO revealed that “our chocolate and biscuit businesses continue to power our virtuous cycle of attractive revenue growth, strong profitability and robust cash flow”2.

Hershey reported that demand for confectionery products remained strong with retail sales growth of 8.1% and further stated that “take-home chocolate sales and accelerating sales of Jolly Rancher and Twizzlers products drove this strong everyday growth”3.

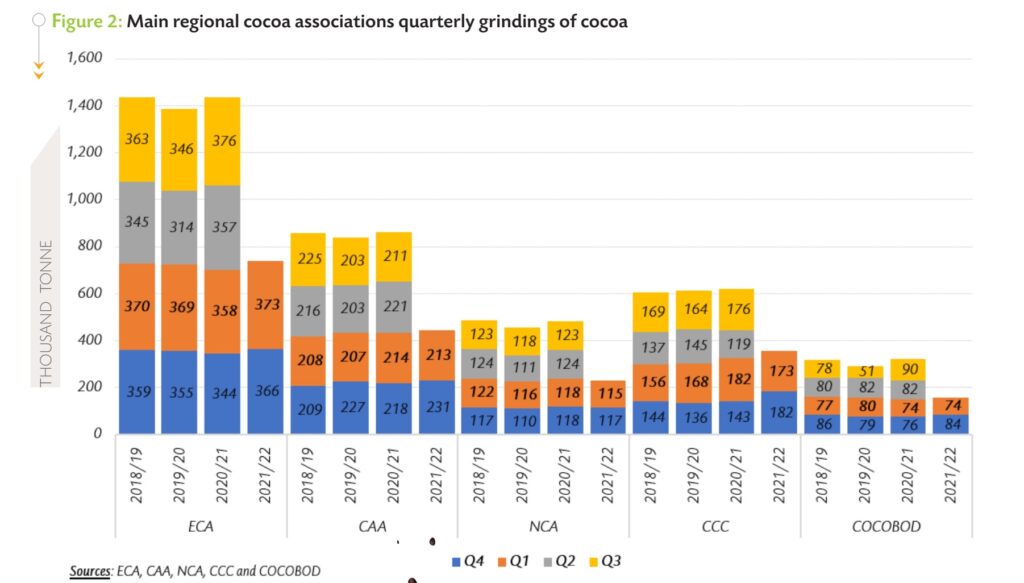

Figure 2 contains the quarterly grindings of three trade associations – the European Cocoa Association (ECA), the National Confectioners’ Association (NCA) and the Cocoa Association of Asia (CAA) – and two para-statal agencies regulating the cocoa sector in Côte d’Ivoire – Conseil du Café et du Cacao (CCC) – and in Ghana – Ghana Cocoa Board (COCOBOD).

The ECA posted that, grindings increased in Europe by 4.38% year-on-year to reach 357,815 tonnes during Q1.2022. It is worth noting that the latest ECA data is the highest quarterly data for the past 17 years.

The NCA reported a year-on-year decline of 2.77% in cocoa processing amounting to 114,694 tonnes against the 117,956 tonnes recorded during the first quarter of 2021. It should be noted that this reduction in cocoa grindings for North America caught market participants by surprise.

A reason for this reduction is that one company that provided the NCA with data last year, did not report its grindings data for the first quarter of 2022. In Southeast Asia, the CAA posted data showing that cocoa processing activities in the region were virtually flat at 213,313 tonnes in Q1.2022 compared with 213,858 tonnes in Q1.2021.

Finally, the CCC and COCOBOD reported a year-on-year increase in grindings of 9.35% and of 5.51%, respectively, since the start of the season, Q4.2021+Q1.2022.

At this stage, however, these grindings statistics cannot reveal any potentially negative drawbacks of the Russia-Ukraine war. Grindings statistics for Q2.2022 will become available in July 2022.

Challenges to cocoa demand growth

Despite the pent-up demand for cocoa, in an increasingly uncertain world, there is the need to look at factors that may derail the positive trend. As much as Europe has maintained its top position for cocoa processing, the continent relies heavily on Russia’s energy – though efforts are being made to wean Europe from this dependency.

Current high energy prices are prone to affect the operational cost of manufacturers, who are likely to turn the cost to customers.

Also, as governments revert to increase interest rates as a means to reduce the pace of rising prices, consumers are reining in their spending at the shops as other important expenses such as mortgages will shoot up.

Also, should investors optimism wane due to the rising interest rates, investments in cocoa processing are likely to be affected.

For example, the United Kingdom government raised interest rates from 0.75% to 1% – the highest level since 2009 4.

In the United States inflation is at a 40-year high and interest rates have been lifted to a range of 0.75% to 1% 5 .

Indeed, the next half of the season will tell if cocoa demand in traditional consuming regions can stand the test of time.

Côte d’Ivoire is expected to keep an upward momentum in its local cocoa processing operations. At the end of March 2022, the Ivorian Cocoa Exporters’ association (GEPEX) published cocoa grindings data mirroring a 4.3% increase year-on-year from 302,000 tonnes to 315,000 tonnes in the country’s cocoa processing activities.

The Ivorian government’s lower export tax policy on cocoa products that are further transformed locally continues to boost local cocoa processing. In spite of the poor crop in Ghana, the country is expected to grind over 300,000 tonnes during the 2021/22 cocoa year.

Update on the ongoing 2021/22 crop in West Africa

At the time of drafting this report, available information on crop sizes in main cocoa origin countries in West Africa suggests that the 2021/22 cocoa season is heading towards a world deficit of approximately 181,000 tonnes mainly due to a shortfall in the Ghanaian production. Indeed, less conducive meteorological conditions and the outbreak of swollen shoot disease are the major contributing factors for the production decline.

It is anticipated that the 2021/22 production will be nearly one-third less than the 2020/21 harvest. Also in Côte d’Ivoire, the 2021/22 cocoa production is expected to be lower than the 2020/21 crop. As at 1 May 2022, cumulative arrivals of cocoa beans in the country were seen at 1.807 million tonnes, down by 3.2% compared to the volumes recorded in the same period of the previous cocoa year.

Less supportive meteorological conditions can be cited as a cause of the expected lower production in Côte d’Ivoire

Futures prices developments

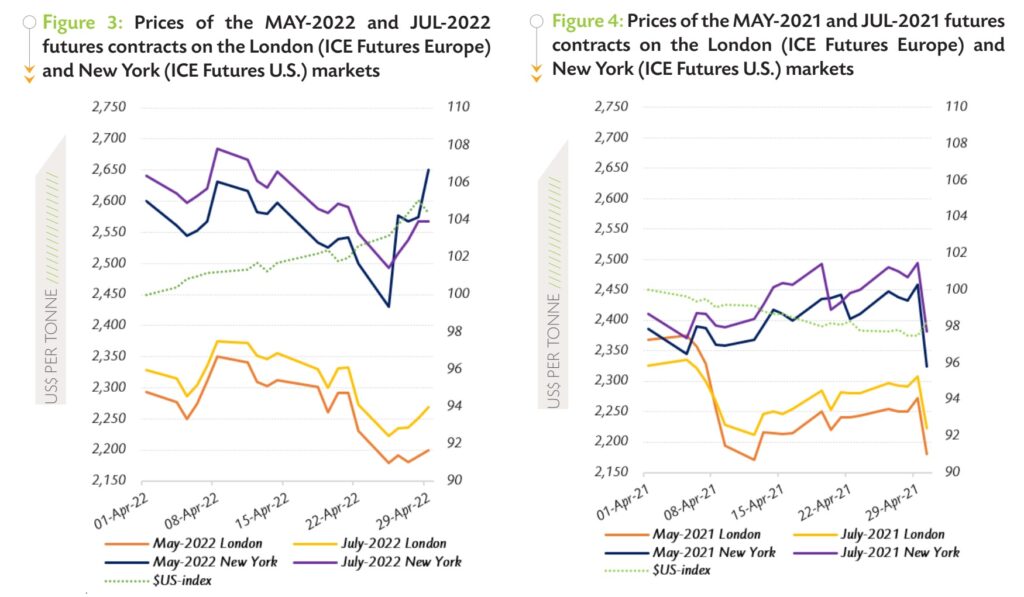

The global cocoa market was generally bearish in April with prices of the nearby cocoa futures contract reaching a 4-month low at US$2,179 per tonne in London and a 3-month low at US$2,430 per tonne in New York.

A contributing factor has been the 4% appreciation of the US dollar during the month under review. Figure 3 shows price movements of the first and second positions on the London and New York futures markets respectively at the London closing time in April 2022, while Figure 4 presents similar information for the previous year.

These two figures include the US dollar index to assess the impact of the strength of the currency on cocoa futures prices.

At a closer look at the movements of prices of the front-month cocoa futures contract (Figure 3), it emerges that notwithstanding an initial decline during the first three trading days of April, the MAY-22 contract prices witnessed a short-lived increase to reach their highest value of the month on 8 April 2022 at US$2,351 per tonne and at US$2,632 per tonne in London and New York respectively.

At a closer look at the movements of prices of the front-month cocoa futures contract (Figure 3), it emerges that notwithstanding an initial decline during the first three trading days of April, the MAY-22 contract prices witnessed a short-lived increase to reach their highest value of the month on 8 April 2022 at US$2,351 per tonne and at US$2,632 per tonne in London and New York respectively.

The upward stand in prices was a market reaction to adverse meteorological conditions that were reported in the main cocoa belt of West Africa. However, this positive trend was halted and over 11-25 April prices plummeted by 7% on both markets, moving from US$2,340 to US$2,179 per tonne in London and from US$2,616 to US$2,430 per tonne in New York.

At the time, certified stocks in the Exchange licensed warehouses increased by 1.6% from 159,630 tonnes to 162,120 tonnes in Europe and by 5.2% from 312,145 tonnes to 328,366 tonnes in the United States while ample supplies were reported in Côte d’Ivoire.

During the last trading week of the month under review, futures prices bounced back from their prolonged plunge on both sides of the Atlantic on concerns that the below-average rainfall recorded in West Africa could be detrimental to the size and quality of the ongoing mid-crop and possibly the main crop of the 2022/23 cocoa season.

Moreover, the increase in prices was more pronounced in the United States as financial reports for the first quarter of 2022 indicated substantial increases in the sales revenues of US-based candy and chocolate confectionery products manufacturers such as Mondelez International and Hershey, hence indicating an improving demand for cocoa on that side of the Atlantic. In London, prices settled at US$2,200 per tonne and in New York at US$2,650 per tonne.

1 https://www.nestle.com/media/pressreleases/allpressreleases/three-month-sales-2022

2 https://www.mondelezinternational.com/News/2022_Q1_Earnings

3 https://www.prnewswire.com/news-releases/hershey-reports-first-quarter-2022-financial-results-raises-2022-net-sales-and-earnings-outlook-301534729.html

4 https://www.bbc.com/news/business-61319867

5 https://www.bbc.com/news/business-61324482