ABIDJAN, Côte d’Ivoire – This review of the cocoa market situation reports on the prices of the nearby futures contracts listed on ICE Europe (London) and U.S. (New York) during the month of April 2019. It aims to highlight key insights on expected market developments and the effect of the exchange rates on the US-denominated prices.

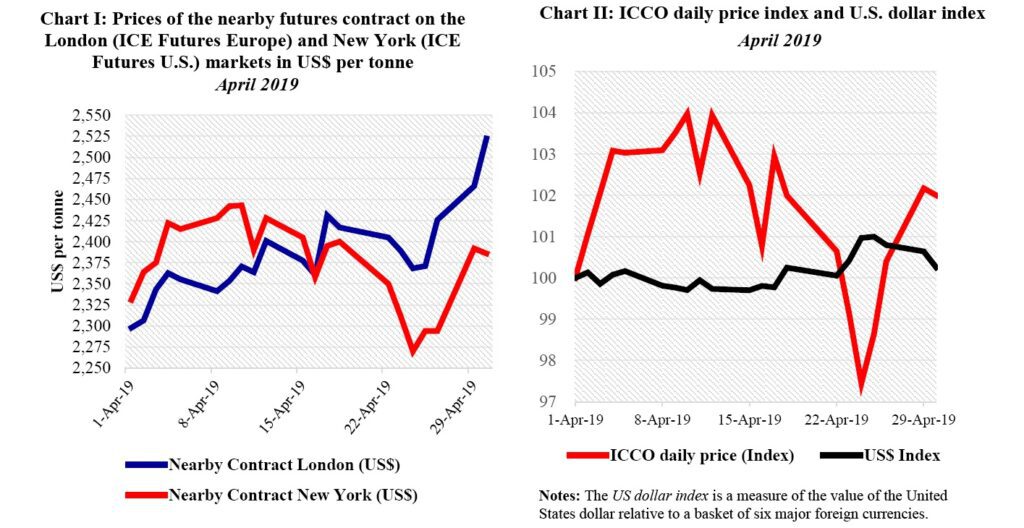

Chart I shows the development of the futures prices on the London and New York markets at the London closing time.

Both prices are expressed in US dollars. African origins are priced at par with the London market, whereas they receive a premium over the New York price.

Any departure from this expected price configuration is due to the differences in the size, composition and quality of tenderable cocoa stocks in London and New York as well as their certifications rules.

Chart II depicts the change in the ICCO daily price index and the US dollar index in April. By comparing these two developments, one can extricate the impact of the US dollar exchange rate on the development of the US dollar-denominated ICCO daily price index.

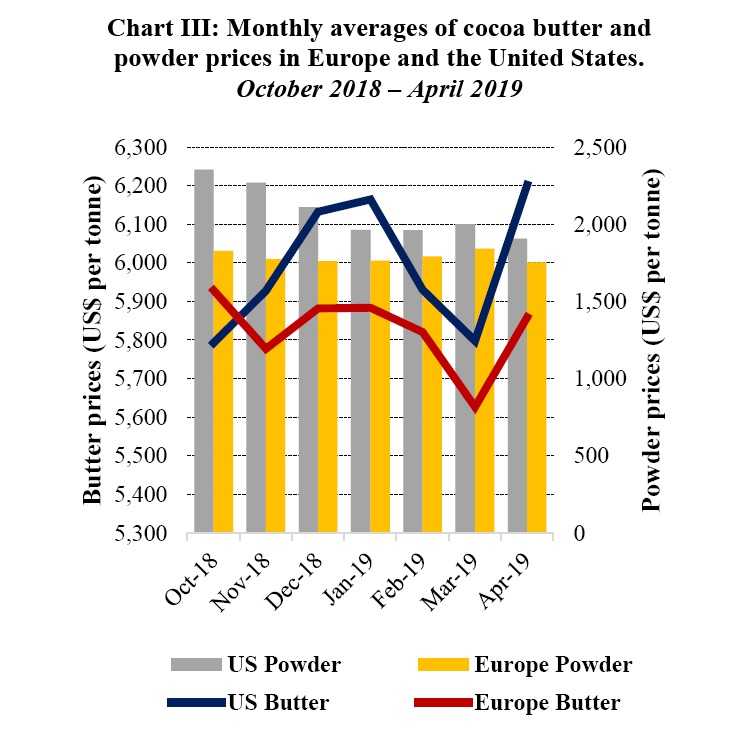

Finally, Chart III illustrates monthly averages of cocoa butter and powder prices in Europe and the United States since the beginning of the 2018/19 cocoa year.

Price movements

During April, the nearby cocoa contract prices followed an upward trend in London whilst in New York they roughly stagnated. Thus, they soared by 10% from US$2,298 to US$2,522 per tonne in London while in New York they shyly moved up by 2% from US$2,331 to US$2,386 per tonne.

Grindings data for the first quarter of 2019, as released by regional cocoa associations, which showed an augmentation in processing activities worldwide supported the positive trend observed in the front-month contract prices.

In London, cocoa futures prices went through three distinct stages. They first increased by 6% to US$2,431 per tonne over the period 1-17 April 2019 in response to the anticipation of a squeeze in the West African mid-crop harvests, combined with an increase of 3.3% to 370,359 tonnes in European grindings.

Thereafter, prices reverted from their increase in the course of the third trading week of the month plummeting by 3% to US$2,368 per tonne.

This bearish stance was partly explained by data showing a strong supply of cocoa beans from Côte d’Ivoire and Ghana. Finally, from 24 April onwards, prices climbed by 7% to US$2,522 per tonne on concerns of drought witnessed in West Africa which could negatively affect the mid-crop output in the region.

Futures prices in New York, as in London, followed three main sequences. Over the period 1-10 April 2019, the May-19 contract prices increased by 5% to US$2,443 per tonne on expectations of higher grindings data for North America. Afterwards, prices for the New York front month (May-19) contracts dropped to their lowest level of the month under review and settled at US$2,270 per tonne.

This downward trend was a consequence of strong supplies of cocoa beans recorded from West Africa during this period. Nevertheless, prices in New York halted their descent during the last five trading sessions of April and firmed by 5% to US$2,386 per tonne on thoughts that the market had reached a short-term bottom when compared to prices recorded during previous trading sessions.

The amelioration in the quality of cocoa beans originating from Africa and destined to be delivered in Europe against the May contract led the London market to price higher vis-à-vis the New York one from 17 April until the end of period under review.

Indeed, over the last week of the month being analyzed, grading results posted by the Exchange indicated a reduction in the discount applied to cocoa coming from West Africa origins as compared to the discount seen for cocoa graded during March. At the same time in New York, the monthly average of the weight percentage discounts based on beans count and waste criteria reduced.

The US dollar index was broadly flat during the month under review and subsequently had no significant impact on the increase observed in the US-denominated cocoa price (Chart II).

As depicted in Chart III, since the start of the 2018/19 crop year, cocoa butter and powder generally traded higher in the United States compared to Europe. Butter prices increased by 7% from US$5,792 to US$6,202 per tonne in the United States while in Europe these prices declined by 1%, moving from US$5,929 to US$5,829 per tonne.

On the other hand, compared to the levels reached at the start of the crop year, cocoa powder prices dwindled by 19% from US$2,353 to US$1,906 per tonne in the United States. Over the same time frame in Europe, powder prices tumbled by 4% from US$1,826 to US$1,753 per tonne.

Furthermore, since the beginning of the 2018/19 cocoa season, the monthly average for the nearby cocoa futures contract prices increased in both London and New York. Thus, futures contract prices increased by 14% from US$2,092 to US$2,382 in London, while in New York they expanded by 11% moving from US$2,140 to US$2,376 per tonne.

Cocoa supply and demand situation

Cocoa arrivals at ports in Côte d’Ivoire remain stronger than the levels reached last season. As at 13 May 2019, cumulative cocoa arrivals, since the start of the 2018/19 crop season, were seen at 1.9 million tonnes, up by 14% from 1.661 million tonnes reached during the same period in the previous season.

Between the start of the mid-crop on 1 April and 12 May 2019, cocoa beans at Ivorian ports totaled 247,000 tonnes, up from 167,000 tonnes recorded during the same period last year.

In Ghana, sources from the country’s cocoa sector regulator, COCOBOD, mentioned that the Ghanaian 2018/19 crop output is expected to retreat by 6% to 850,000 tonnes because of diseases and adverse climate conditions that prevailed in the main cocoa producing areas.

As at 28 April 2019, data posted by the Bahia Commercial Association showed that, cumulative arrivals of cocoa beans in Brazil since the beginning of the 2018/19 crop year attained 70,634 tonnes; 21% lower as compared to 89,191 tonnes recorded the same period of the previous season