ABIDJAN, Côte d’Ivoire – The current report provides a description of the fundamental factors that influenced the movements of cocoa futures prices and focuses on the December-2021 (DEC-21) and March-2022 (MAR-22) futures contracts as listed on ICE Futures Europe (London) and ICE Futures U.S. (New York).

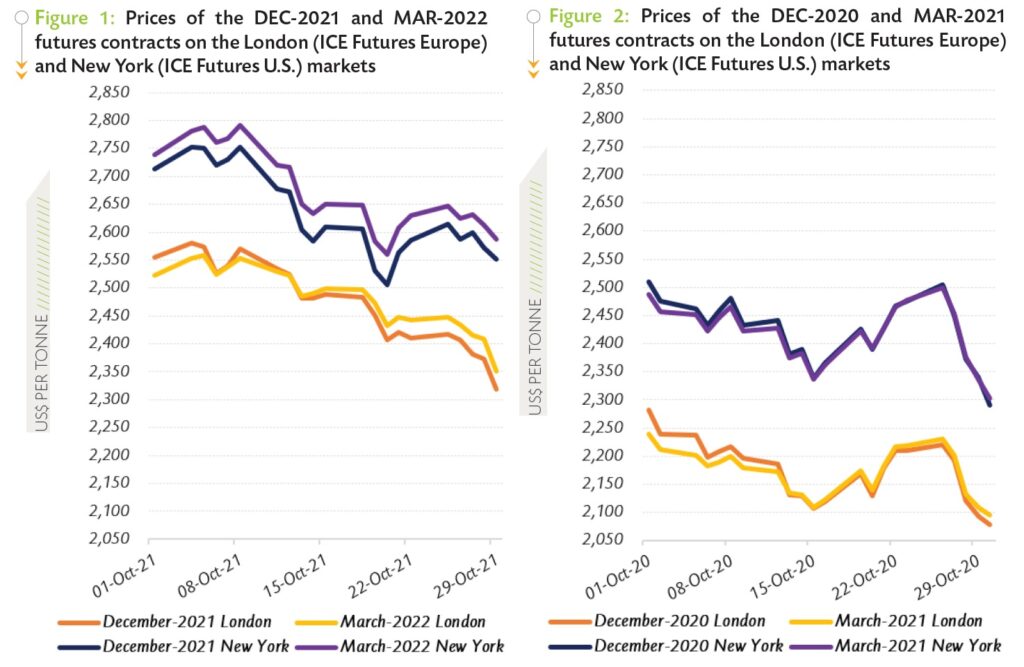

Figure 1 shows price movements on the London and New York futures markets respectively at the London closing time in October 2021, while Figure 2 presents similar information for the previous year.

Despite the backwardation observed in London over the first half of October, both the London and New York markets were in contango during October 2021, with the DEC-21 contract pricing lower than MAR-22 (Figure 1). Under normal market conditions, futures contracts with later expiries are more expensive than the nearest contracts to account for the cost of carry.

The average discount applied on the DEC-21 contract via-à-vis MAR-22 stood at US$9 per tonne on the London market and was lower compared to the discount of US$40 per tonne recorded for the same futures contract on the New York market.

The average discount applied on the DEC-21 contract via-à-vis MAR-22 stood at US$9 per tonne on the London market and was lower compared to the discount of US$40 per tonne recorded for the same futures contract on the New York market.

The lower average discount applied to the DEC-21 contract in London was a result of the price configuration change – from backwardation to contango – that occurred during the second half of the month under review, whereas in New York, prices remained in a permanent contango. As shown in Figure 2, a lesser form of backwardation was observed on both sides of the Atlantic over October 2020, in particular over the first half of the month.

The global cocoa market was bearish during the first month of the 2021/22 cocoa year. On both the London and New York markets, prices of the front-month cocoa futures contract witnessed pronounced drops.

Compared to the settlement values recorded at the beginning of October 2021, prices of the DEC-21 contract declined by 9% from US$2,555 to US$2,318 per tonne in London, while in New York, they plunged by 6% from US$2,713 to US$2,552 per tonne.

Prices declined as a result of excess supply despite the year-on-year increase in grindings for the third quarter of 2021 reported by the main regional cocoa associations.

Cocoa gradings and stocks in exchange licensed warehouses

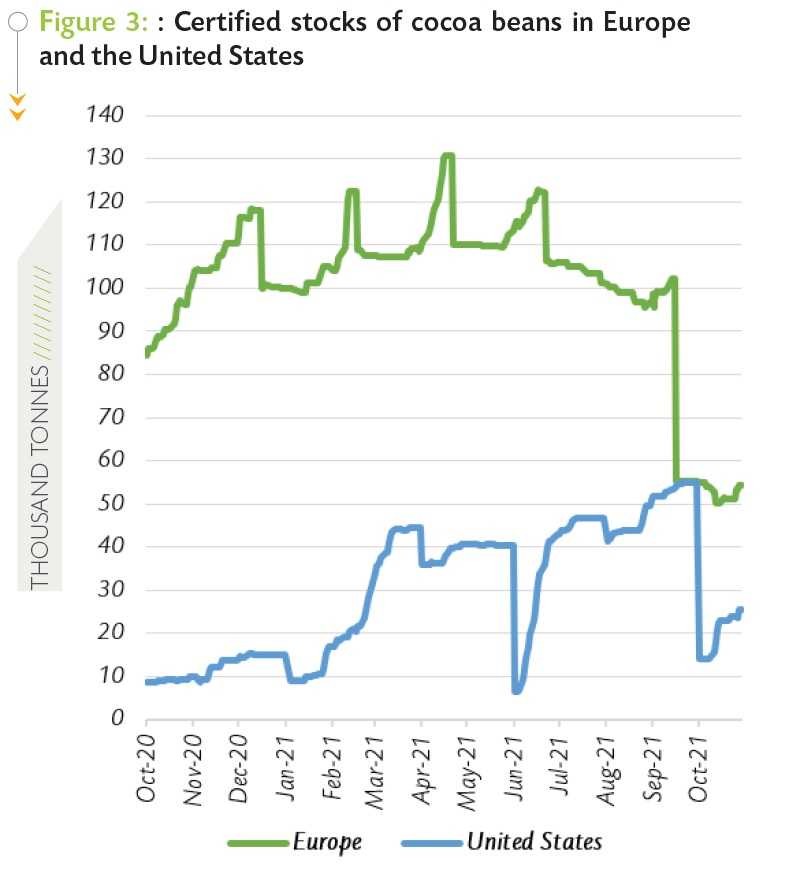

In October 2021, stocks of cocoa beans with valid certificates in European warehouses averaged 122,770 tonnes and represented 78% of the total average certified stocks. As indicated in Figure 3, stocks with valid certificates were up by 19% as compared to their average level of 103,461 tonnes seen in October 2020. In New York, total stocks increased by 51% year-on-year to reach an average of 350,340 tonnes in October 2021.

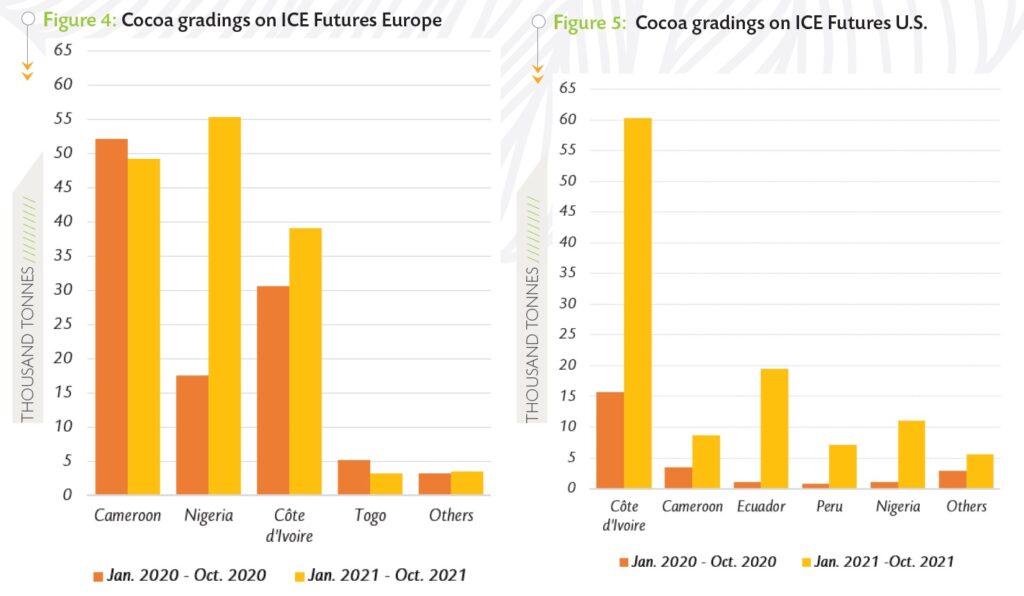

The main origins of cocoa graded on the ICE Futures Exchange over the periods January 2020 – October 2020 and January 2021 – October 2021 are presented in Figure 4 for Europe and in Figure 5 for the United States.

The main origins of cocoa graded on the ICE Futures Exchange over the periods January 2020 – October 2020 and January 2021 – October 2021 are presented in Figure 4 for Europe and in Figure 5 for the United States.

Over the first ten months of 2021, 150,430 tonnes were graded on the ICE Futures Europe, representing a 39% growth compared with 108,590 tonnes of cocoa graded over the corresponding period of the previous season. In the course of the above-mentioned time frame, the quantity of Cameroonian cocoa beans graded at the exchange was reduced from 52,110 tonnes to 49,200 tonnes.

Over the first ten months of 2021, 150,430 tonnes were graded on the ICE Futures Europe, representing a 39% growth compared with 108,590 tonnes of cocoa graded over the corresponding period of the previous season. In the course of the above-mentioned time frame, the quantity of Cameroonian cocoa beans graded at the exchange was reduced from 52,110 tonnes to 49,200 tonnes.

Origin Differentials

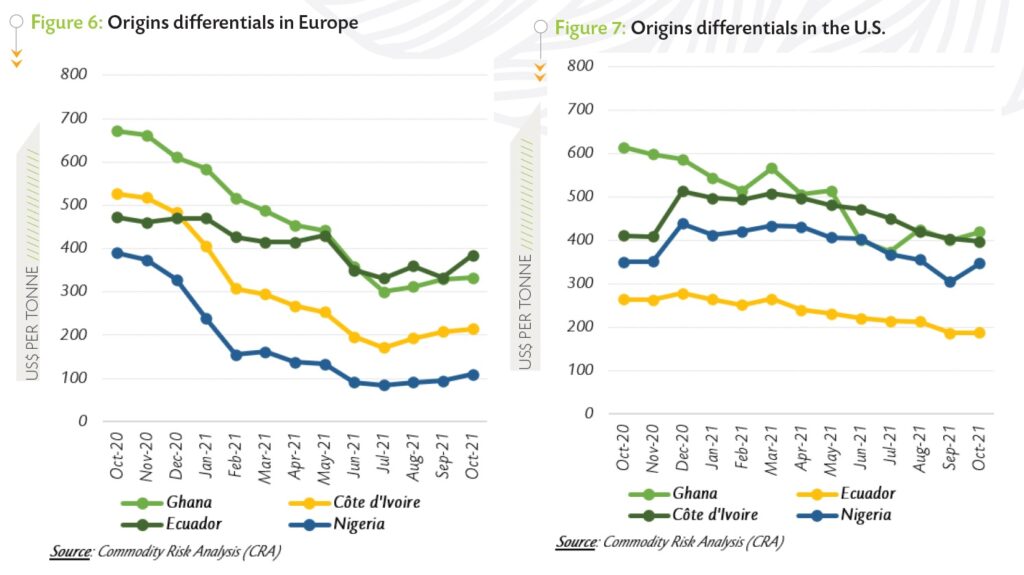

Compared to their levels recorded in October 2020, origin differentials over prices of the six-month forward cocoa contract in Europe and the United States for Ghana, Côte d’Ivoire, Ecuador and Nigeria followed a downwards trend in October 2021 (Figure 6 and Figure 7).

In Europe, the differential for Ghanaian cocoa averaged US$333 per tonne in October 2021, down by 50% compared to US$672 per tonne recorded in October 2020. Similarly, the origin differential decreased by 59% from US$527 to US$215 per tonne for Ivorian cocoa beans. While a 72% drop from US$390 to US$109 per tonne was recorded for the Nigerian country differential of cocoa, the country differential of Ecuador declined by 19% from US$472 to US$384 per tonne.

On the U.S. market, cocoa beans from Ghana recorded a differential of US$420 per tonne in October 2021 against US$614 per tonne during October 2020. Over the same period, the premium applied to Ivorian cocoa beans fell by 33% from US$481 to US$320 per tonne. Premiums received for Ecuadorian beans in the U.S. dropped by 39% from US$231 to US$142 per tonne. In the same vein, a 40% reduction from US$407 to US$244 per tonne was recorded in the origin differential for Nigeria.

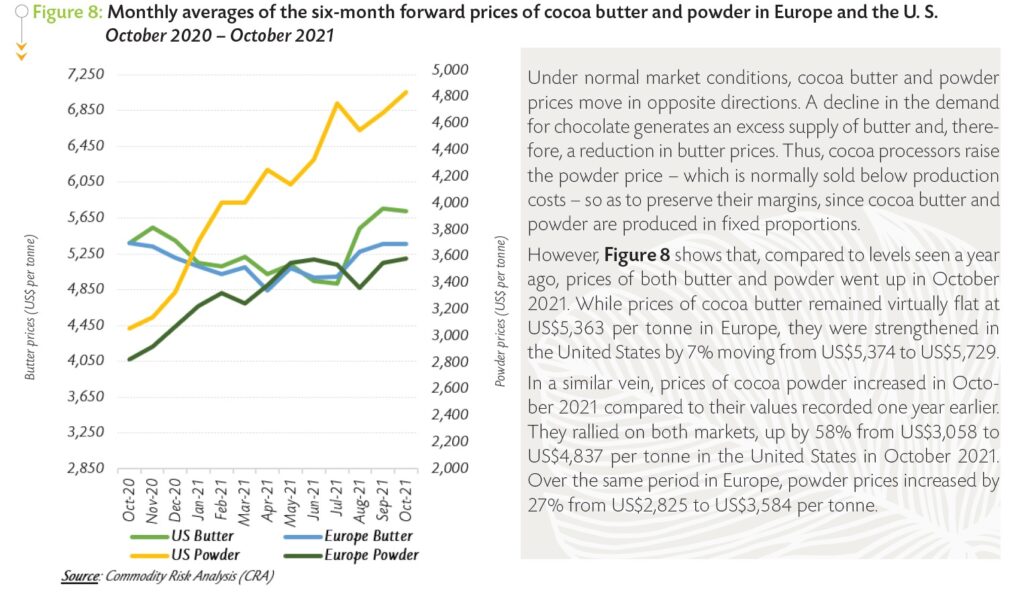

Prices of cocoa butter and powder

Production and grindings

Production and grindings

Since the start of the 2021/22 cocoa season, cumulative arrivals of cocoa beans in Côte d’Ivoire have been tighter year-on-year. Indeed, as at 15 November 2021, cumulative arrivals at Ivorian ports amounted to 489,000 tonnes, down by 10.9% compared to 549,000 tonnes recorded a year earlier. Furthermore, the country was reported to have exported 1.626 million tonnes of cocoa beans during the 2020/21 cocoa year against 1.572 million tonnes during the same period of the 2019/20 cocoa season.

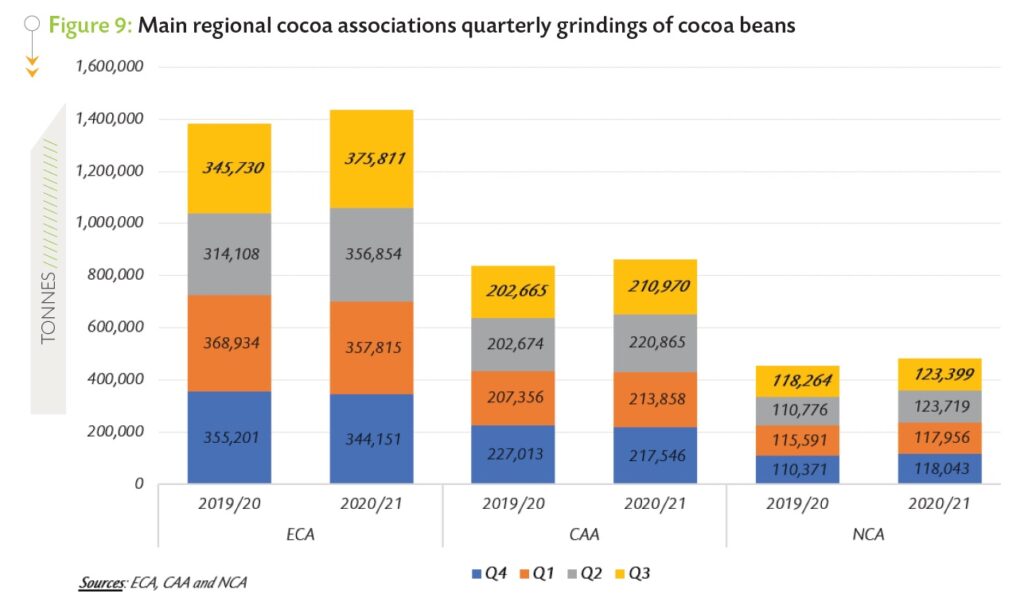

In October, data published by the main regional cocoa associations for the third quarter of 2021 indicated that grindings substantially increased in Europe, South-East Asia and North America. Figure 9 shows that the European Cocoa Association (ECA) published data indicating a year-on-year expansion of 8.7% from 345,730 tonnes to 375,811 tonnes in grindings.

Similarly, the Cocoa Association of Asia (CAA) posted a year-on-year increase of 4.1% from 202,665 tonnes to 210,970 tonnes. Furthermore, processing activities improved in North America during the third quarter of 2021 with the National Confectioners’ Association (NCA) reporting a 4.3% increase from 118,264 tonnes to 123,399 tonnes of cocoa beans grinded.

At the end of the 2020/21 cocoa season, the cumulative grindings of ECA members totaled 1,434,631 tonnes, up by 50,658 tonnes from the level reached at the end of the previous season. In South-East Asia, cumulative grindings soared by 3% year-on-year to 863,239 tonnes in 2020/21. Over the same period, grindings in North America rose by 6% from 455,002 tonnes to 483,117 tonnes.