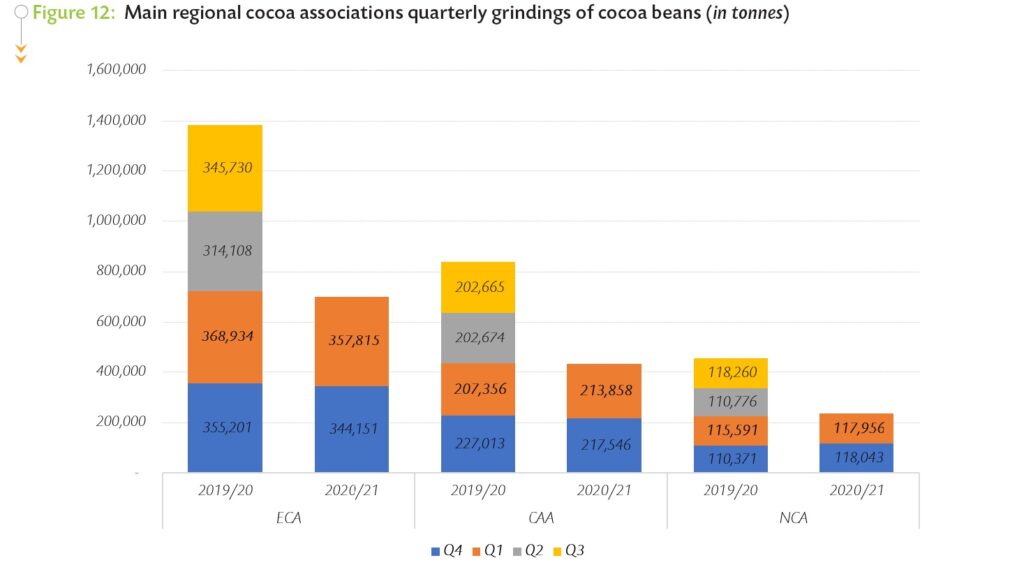

ABIDJAN, Côte d’Ivoire – This section of the report sheds some light on the movements of cocoa futures prices in April 2021 by focusing on the May-2021 (MAY-21) and July-2021 (JULY-21) futures contracts as listed on ICE Futures Europe (London) and ICE Futures U.S. (New York). It aims to provide insights into the price developments for the two specific futures contracts.

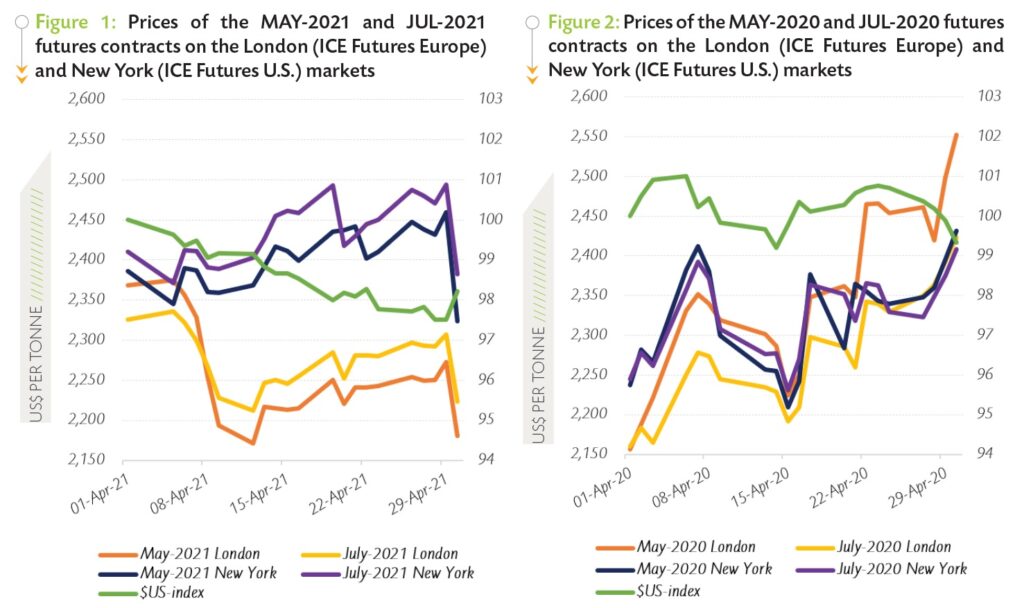

Figure 1 shows price movements on the London and New York futures markets respectively at the London closing time in April 2021, while Figure 2 presents the equivalent information for the year prior. Both figures include the US dollar index to highlight the impact of this currency on the US$-denominated cocoa prices.

Although prices during the initial four trading sessions in London were in backwardation, during April, cocoa futures prices on both sides of the Atlantic mainly remained in contango, with the nearby contract pricing lower compared to the deferred one (Figure 1).

Although prices during the initial four trading sessions in London were in backwardation, during April, cocoa futures prices on both sides of the Atlantic mainly remained in contango, with the nearby contract pricing lower compared to the deferred one (Figure 1).

In London, the nearby contract (MAY-21) priced at an average discount of US$23 per tonne over JUL-21, while New York an average discount of US$33 per tonne was applied.

Looking at the price configuration in April 2020 (Figure 2), the two nearest cocoa futures contracts were mostly in backwardation in both London and New York.

A factor that triggered the change in the configuration of futures prices in April 2020 and April 2021 is the level of certified stocks, which amounted on average to 152,936 tonnes in April 2020 and then increased to 160,275 tonnes a year later in Europe. Over the same period in the United States, certified stocks skyrocketed on average from 1,828 tonnes to 38,049 tonnes.

In London, as depicted in Figure 1, between 1-12 April, prices of the front-month contract dropped by 8% to US$2,171 per tonne; corresponding to a 4-month low. At the time, market participants were anticipating weaker year-on-year grindings for the first quarter of 2021 in Europe. In addition, massive supplies of cocoa beans were reported in Côte d’Ivoire and Ghana. However, on the last trading day of the month under review, as market participants revised upward their forecasts for the crop size of Côte d’Ivoire for the current cocoa year, prices fell by 4% to US2,181 per tonne.

In New York, compared to the settlement value recorded on the first day of the month, futures prices increased by 3% from US$2,386 to US$2,459 per tonne on 29 April. This bullish stance on prices was driven by increasing grindings data posted for North America and Southeast Asia by the respective regional cocoa associations, namely the National Confectioners’ Association (NCA) and the Cocoa Association of Asia (CAA).

Concurrently, chocolate industry leaders reported an optimistic rebound in the demand for chocolate products, mainly in Asia. However, the gain in cocoa prices on the New York market wore off during the last day of the month in reaction to favourable meteorological conditions for the mid-crop in West Africa.

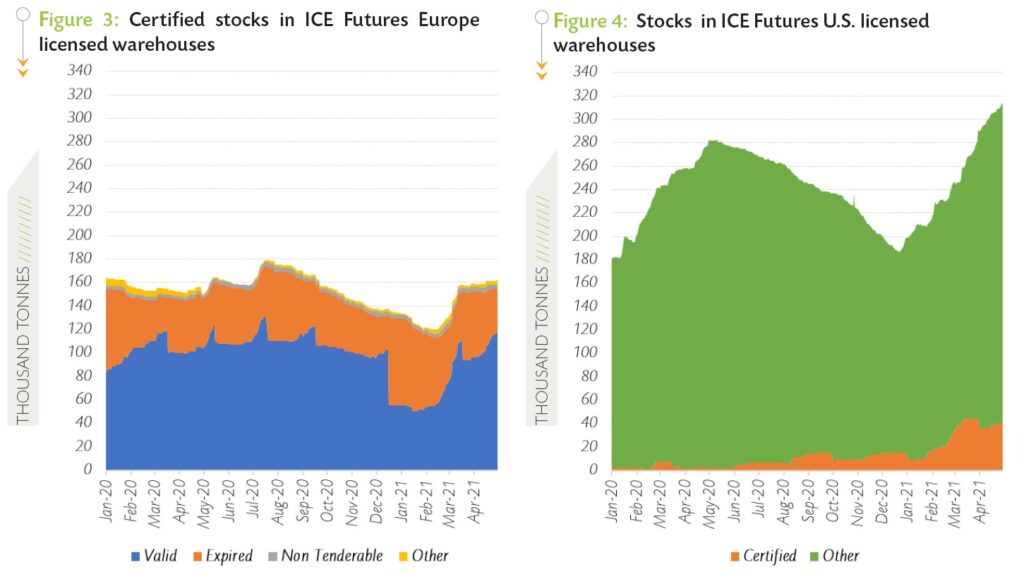

Cocoa gradings and stocks in exchange licensed warehouses

Data posted by the Exchange indicate that stocks of cocoa beans with valid certificates in European warehouses averaged 106,075 tonnes; representing approximately two-thirds (66%) of the total certified stocks in April 2021. As presented in Figure 3, stocks with valid certificates were up by 4% as compared to their average level of 101,801 tonnes seen in April 2020. In the United States, total stocks increased by 14% year-on-year to reach an average of 302,765 tonnes in April 2021 (Figure 4).

Figure 5 and Figure 6 present the main origins of cocoa graded on the ICE Futures Europe during the periods October 2019 – April 2020 and October 2020 – April 2021 while Figure 7 and Figure 8 show the same information for cocoa graded on the U.S Exchange.

Figure 5 and Figure 6 present the main origins of cocoa graded on the ICE Futures Europe during the periods October 2019 – April 2020 and October 2020 – April 2021 while Figure 7 and Figure 8 show the same information for cocoa graded on the U.S Exchange.

Cocoa graded by the ICE Futures Europe reached 95,840 tonnes over October 2020 – April 2021, up by 28% from 75,130 tonnes of cocoa graded over the same period of the previous season. Over the aforementioned time spans, the shares of Cameroonian cocoa beans at exchange gradings decreased from 70% to 38%. On the contrary, the share of Ivorian and Nigerian cocoa beans soared from 14% to 25% and 34% respectively.

The share of cocoa gradings from other origins went up from 2% to almost 3%. Over the first seven months of the 2020/21 cocoa year, the ICE Futures U.S. graded 53,359 tonnes of cocoa beans, up from 11,268 tonnes graded during the same period of the preceding year.

On a year-on-year basis, the share of cocoa beans from Cameroon and Ecuador in ICE Futures U.S. gradings increased from 6% to 15% and from less than 1% to 14% respectively. In contrast, the share of Ivorian cocoa beans at exchange gradings decreased from 75% to 59%, while that of Peruvian cocoa declined from 7% to 4%.

It should be noted that, the share of Venezuelan cocoa beans in the ICE Futures U.S. licensed warehouses remained flat at 5%. Additionally, the share of other origins graded on the ICE Futures U.S. declined from 7% to 3%.

The current supply glut in the global cocoa market has progressively reduced the differential (which will be discussed in the next section) and therefore, the opportunity to hold Ivorian beans – notwithstanding the LID – and Cameroonian beans, which are a close substitute for the former origin.

The current supply glut in the global cocoa market has progressively reduced the differential (which will be discussed in the next section) and therefore, the opportunity to hold Ivorian beans – notwithstanding the LID – and Cameroonian beans, which are a close substitute for the former origin.

As a result, owners of Cameroonian and Ivorian beans started to certify their stocks of cocoa beans according to exchange standards to be potentially used as collateral in trade financing and/or delivered against futures contracts.

Origin differentials

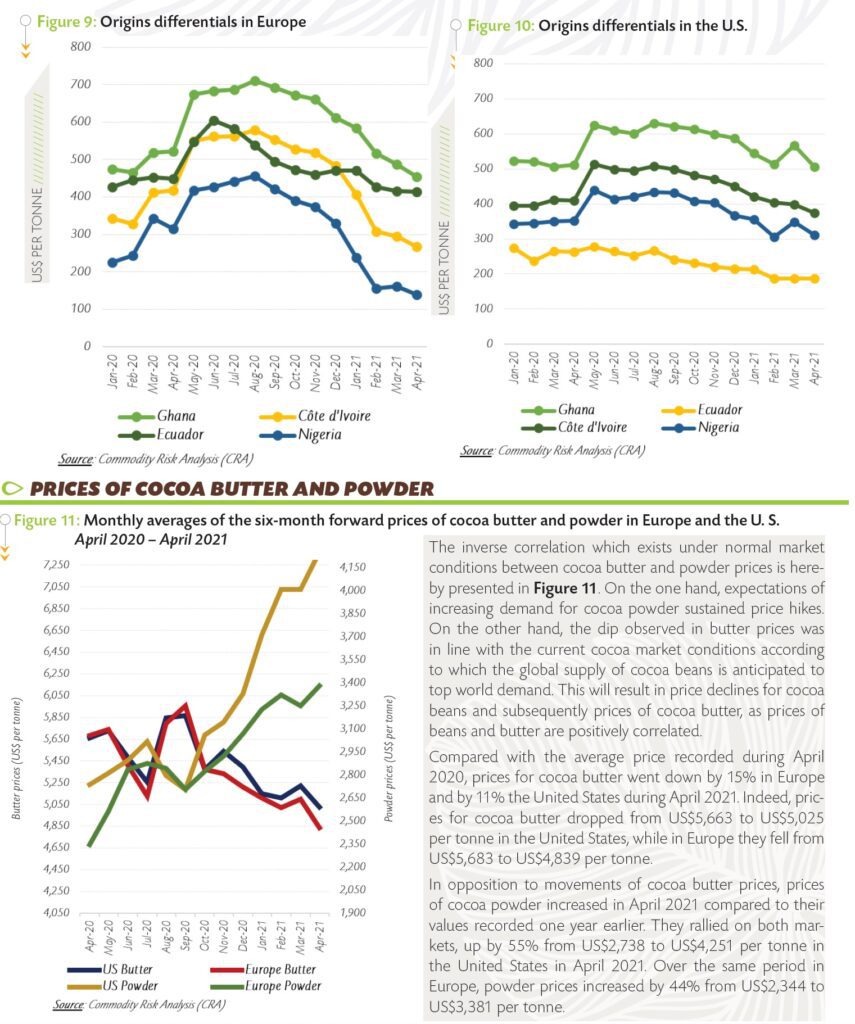

Figure 9 and Figure 10 show the overall declining trends in origin differentials on prices of the six-month forward cocoa contract in Europe and the U.S. for Ghana, Côte d’Ivoire, Ecuador and Nigeria.

On the European market, the differential for Ghanaian cocoa were established at US$453 per tonne in April 2021, 33% lower compared to US$672 per tonne recorded in October 2020. Similarly, the origin differential shrank by 49% from US$527 to US$268 per tonne for Ivorian cocoa beans.

On the European market, the differential for Ghanaian cocoa were established at US$453 per tonne in April 2021, 33% lower compared to US$672 per tonne recorded in October 2020. Similarly, the origin differential shrank by 49% from US$527 to US$268 per tonne for Ivorian cocoa beans.

A 65% plunge from US$390 to US$138 per tonne was recorded for the Nigerian cocoa country differential, while Ecuador’s differential dwindled by 12% from US$472 to US$414 per tonne.

Moving on to the U.S. market, cocoa beans from Ghana recorded a differential of US$506 per tonne in April 2021 against US$614 per tonne during October 2020. Over the same period, the premium applied to Ivorian cocoa beans plummeted by 22% from US$481 to US$374 per tonne. Premiums received for Ecuadorian beans in the U.S. dropped by 20% from US$231 to US$186 per tonne, while a 24% reduction from US$407 to US$311 per tonne was seen in the origin differential for Nigeria.

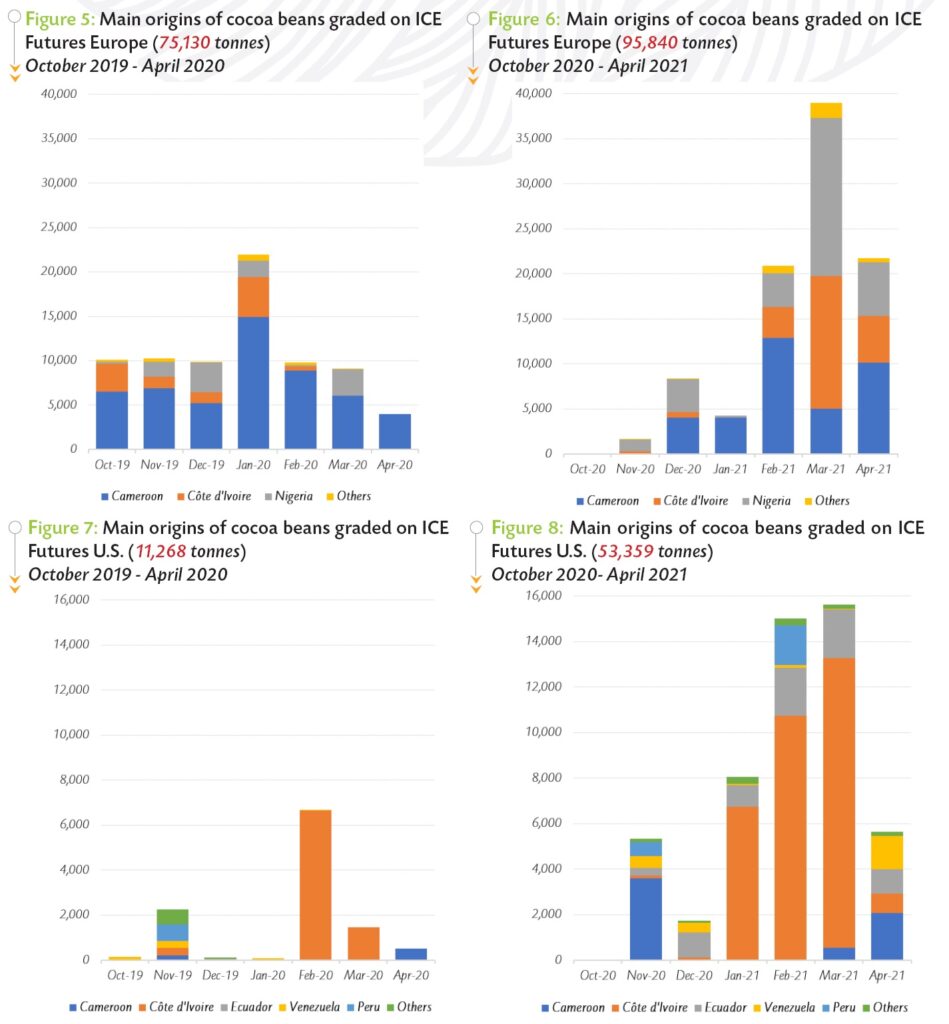

Production and grindings

Since the start of the 2020/21 cocoa season, cumulative arrivals of cocoa beans in Côte d’Ivoire are higher year-onyear. Additionally, the Conseil Café Cacao announced that the country’s cocoa production for the 2020/21 season is expected at 2.225 million tonnes. As at 16 May 2021, cumulative arrivals at Ivorian ports were established at 1.916 million tonnes, up by 7% compared to 1.790 million tonnes recorded a year earlier.

In Ghana, purchases of graded and sealed cocoa since October 2021 were reported at 849,266 tonnes by 29 April 2021; corresponding to a 19.6% increase year-on-year. In April, data for the first quarter of 2021 published by the main regional cocoa associations indicated that grindings fell in Europe while an increase was recorded in South-East Asia and North America.

Figure 12 shows that the European Cocoa Association (ECA) published data indicating a year-on-year decrease of 3% from 368,934 tonnes to 357,815 tonnes in grindings.

On the contrary, the Cocoa Association of Asia (CAA) announced a year-on-year increase of 3.14% from 207,356 tonnes to 213,858 tonnes. In the same vein, processing activities improved in North America during the first quarter of 2021, with the National Confectioners’ Association (NCA) reporting a 2.05% increase from 115,591 tonnes to 117,956 tonnes of cocoa beans ground.