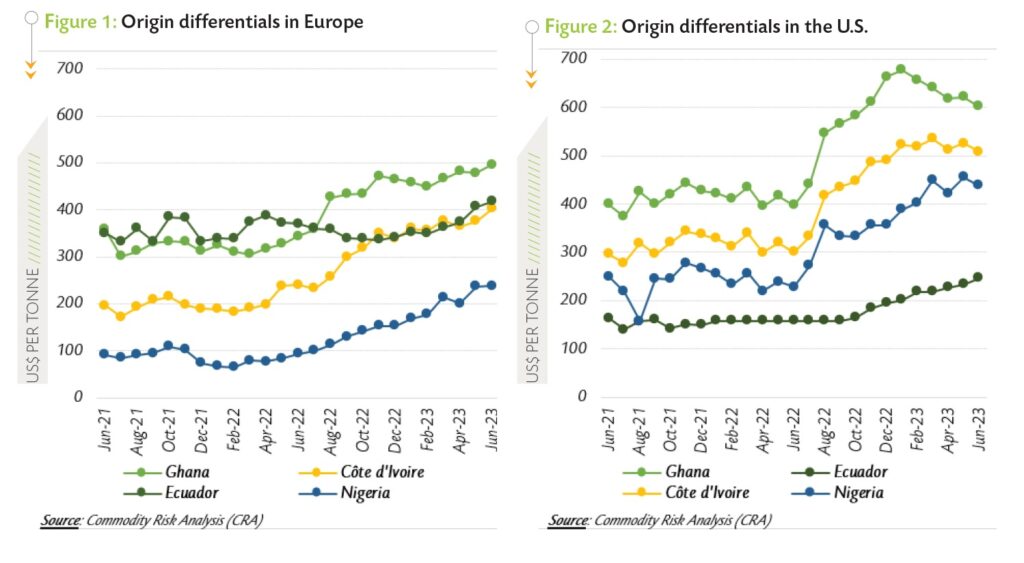

ABIDJAN, Côte d’Ivoire – Origin differentials on prices (see Figure 1 and Figure 2) of the six-month forward cocoa contract in Europe and the U.S. for Ghana, Côte d’Ivoire, Ecuador, and Nigeria significantly increased in reaction to persisting thoughts that the 2022/23 cocoa year could close with a larger-than-expected supply deficit, says the International Cocoa Organization in its latest Cocoa Market Report.

In June, the six-month forward contract corresponded to the DEC-23 contract and the price quoted for the next season’s main crop.

For the month under review, as compared to the differentials seen during the corresponding period of the previous season, the increase in the origin differentials in the European market was lower than observed in New York, says the Cocoa Market Report.

The broader picture of this scenario could be decomposed into specificities both within markets and across origin. In Europe, cocoa beans originating from Ghana and Côte d’Ivoire traded with the highest premium followed by Ecuadorian and Nigerian cocoa beans; while in the United States African origins received a higher premium compared to Ecuador.

From a geographic perspective, West Africa is closer to Western Europe compared to North America and Asia. Consequently, shipment costs are expected to be lower for close destinations and higher for longer distances, ceteris paribus.

The higher premium applied to African origins in the European market thus appears as a reward for quality, whereas the premium for Ecuadorian cocoa in Europe covers freight rates, which are in part due to the relatively long shipping distance between Latin America and Europe.

In the USA, the premiums applied to cocoa beans originating from Africa were substantially higher than for Ecuadorian cocoa beans. This suggests that the US market currently attracts Africa origin cocoa through competitive premiums compared to Europe.

In summary, during June 2023, the high premiums applied referred to the prices of the DEC-23 contract on both the London and New York markets and resulted from a combination of several factors including uncertainties about the expected supply and quality of the cocoa beans, as well as market incentives to attract quality cocoa from distinct cocoa origins.

Focusing on the European market, the differential over Ghanaian cocoa stood at US$497 per tonne in June 2023, up by 45% compared to US$344 per tonne recorded in June 2022. Similarly, the origin differential went up by 67% from US$240 to US$402 per tonne and by 13% from US$370 to US$418 per tonne for Ivorian and Ecuadorian cocoa beans, respectively.

Focusing on the European market, the differential over Ghanaian cocoa stood at US$497 per tonne in June 2023, up by 45% compared to US$344 per tonne recorded in June 2022. Similarly, the origin differential went up by 67% from US$240 to US$402 per tonne and by 13% from US$370 to US$418 per tonne for Ivorian and Ecuadorian cocoa beans, respectively.

The premium applied to Nigerian cocoa beans increased from US$93 to US$238 per tonne.

In June 2023, the U.S. market recorded a country differential of US$602 per tonne against US$398 per tonne during June 2022 for Ghana. Over the same period, the premium applied to Ecuadorian cocoa beans spiked by 70% from US$300 to US$509 per tonne. Premiums received for Ivorian beans in the U.S. dropped by 56% from US$158 to US$247 per tonne, while a 93% increase from US$228 to US$439 was seen in the origin differential for Nigeria

Cocoa Market Report: Futures price developments

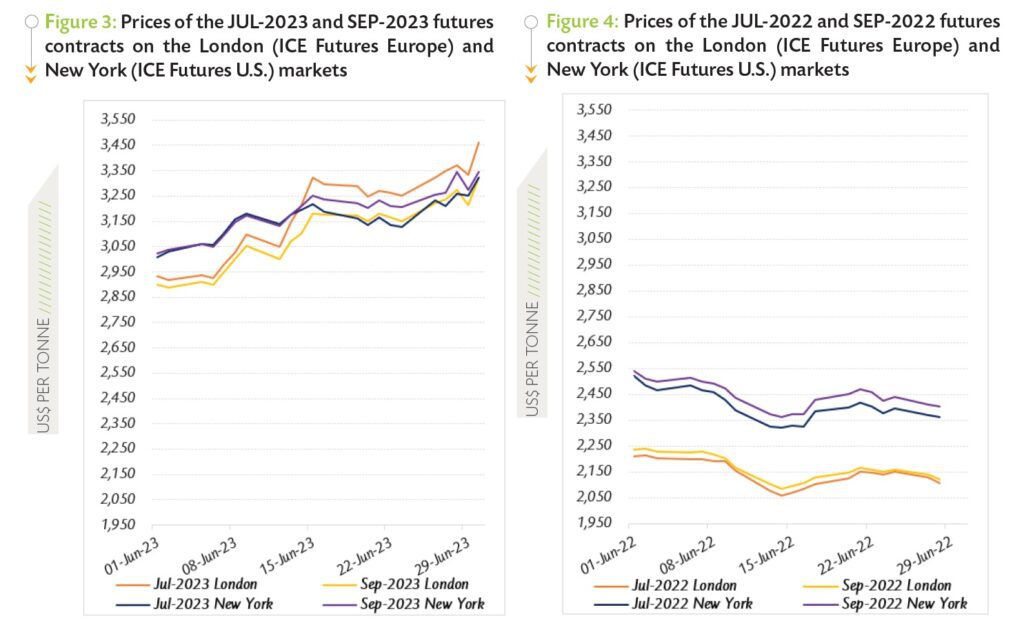

Figure 3 shows price movements of the first and second positions on the London and New York futures markets respectively at the London closing time in June 2023, while Figure 4 presents similar information for the previous year. On a year-on-year basis, prices of the first position cocoa contract averaged US$3,182 per tonne in London, up by 49% compared to US$2,139 per tonne. Meanwhile, in New York, the average price of the front-month cocoa futures contract settled at US$3,159 per tonne, representing an increase of 46% from US$2,396 per tonne.

During the month under review, prices of the nearby cocoa contract ranged between US$2,917 and US$3,460 per tonne in London, while in New York they oscillated between US$3,008 and US$3,324 per tonne.

In the course of June 2023, the global cocoa market was bullish and prices of the front-month contract were substantially higher, generally above the symbolic threshold of US$3,000 per tonne, on both the London and New York markets compared to the situation seen back in June 2022 (Figure 3 and Figure 4).

On both sides of the Atlantic, the monthly average price of the front-month cocoa contract settled at US$3,182 per tonne in London and US$3,159 per tonne in New York. The press reported that these were prices not seen in 46 years.

But accounting for the inflation and denominating them in US dollars, they represented only a 6-year and 3-year high in London and New York, respectively. The market was mostly constrained by the uncertainties surrounding the supply side due in part to the adverse meteorological conditions that prevailed in Côte d’Ivoire, says the Cocoa Market Report.

The heavy rains that occurred in the country’s main cocoa growing areas raised concerns that cocoa plantations were at risk of being flooded, which could in turn exacerbate the reduction in Côte d’Ivoire’s cocoa production during the latter part of the 2022/23 mid-crop, and even further extend the detrimental effects to the main crop of the 2023/24 season.

In a context where the global cocoa market has experienced consecutive years of supply deficit, the potentially harmful effect that the floods could have on the country’s production generated strong tension and thereby contributed to bolstering cocoa futures prices. In addition, since the start of the 2022/23 cocoa year, the supplies of cocoa beans in Côte d’Ivoire have been lower year-on-year.

In a context where the global cocoa market has experienced consecutive years of supply deficit, the potentially harmful effect that the floods could have on the country’s production generated strong tension and thereby contributed to bolstering cocoa futures prices. In addition, since the start of the 2022/23 cocoa year, the supplies of cocoa beans in Côte d’Ivoire have been lower year-on-year.

As at 9 July 2023, cumulative arrivals of cocoa beans in Côte d’Ivoire were reported at 2.238 million tonnes, down by 4.3% compared to 2.338 million tonnes recorded at the corresponding period of the previous season.

One of the direct market implications of the abovementioned bullish factors was that, compared to their settlement values recorded at the beginning of June 2023, prices of the JUL-23 contract witnessed robust increases on both sides of the Atlantic at the end of the month under review.

In London, prices of the JUL-23 contract firmed by 18% moving from US$2,933 to US$3,460 per tonne, while in New York they climbed by 11% moving from US$3,008 to US$3,324 per tonne.

CAPS: the new proprietary system using capsules made of 85% recycled aluminium

CAPS: the new proprietary system using capsules made of 85% recycled aluminium