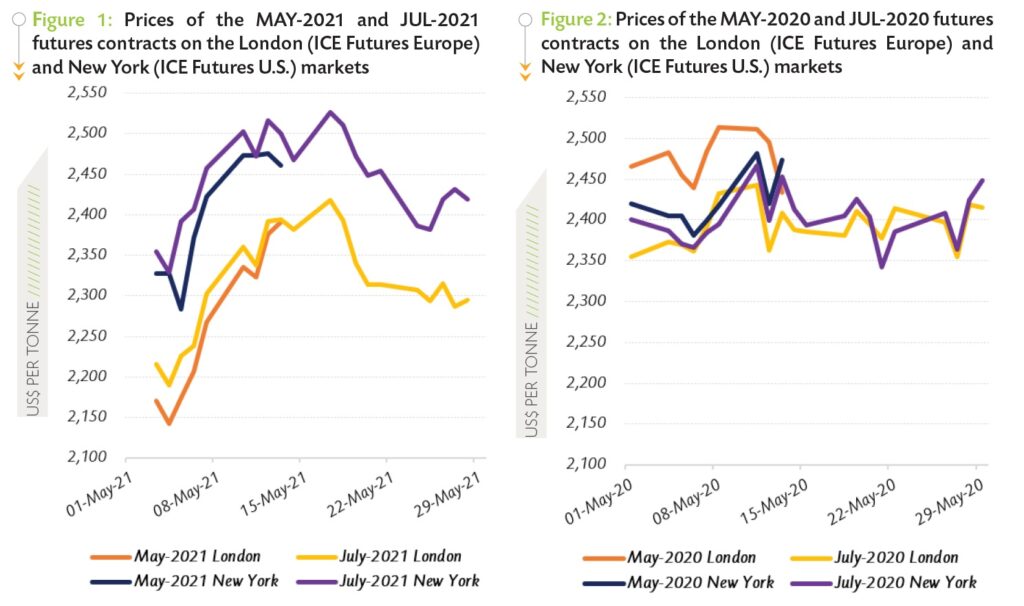

ABIDJAN, Côte d’Ivoire – The report on the movements of cocoa futures prices for the month under review are based on the May-2021 (MAY-21) and July-2021 (JUL-21) futures contracts as listed on ICE Futures Europe (London) and ICE Futures U.S. (New York). It aims to provide insights into the price developments for these two specific futures contracts.

Figure 1 shows price movements on the London and New York futures markets respectively at the London closing time in May 2021, while Figure 2 presents the equivalent information for the previous year.

Both the London and New York markets were in contango during the latter trading days of the MAY-21 contract (Figure 1). Indeed, the MAY-21 contract priced with an average discount of US$30 per tonne over JUL-21 in London, while in New York an average discount of US$35 per tonne was recorded on MAY-21 prices compared to JUL-21.

Both the London and New York markets were in contango during the latter trading days of the MAY-21 contract (Figure 1). Indeed, the MAY-21 contract priced with an average discount of US$30 per tonne over JUL-21 in London, while in New York an average discount of US$35 per tonne was recorded on MAY-21 prices compared to JUL-21.

Looking back at May 2020, a backwardation was observed on both sides of the Atlantic (Figure 2).

At the time, market participants were envisaging potential disruptions in the shipments of cocoa beans following the Ivorian government’s announcement of the extension of the state of emergency in the country to curb the spread of the coronavirus pandemic.

Furthermore, cumulative arrivals of cocoa beans in Côte d’Ivoire were lower in May 2020, year-on-year.

In terms of movements, Figure 1 indicates that prices of the nearby cocoa futures contract (MAY-21) followed an overall upward trend in both London and New York over 03-13 May 2021. In London, prices of the front-month cocoa futures contract rose by 10% from US$2,171 to US$2,390 per tonne whilst in New York, prices of the MAY-21 climbed by 6% from US$2,328 to US$2,461 per tonne.

The upward trend seen in prices during this period was mainly fuelled by weather concerns. Below-average precipitations were recorded in Côte d’Ivoire’s main cocoa producing regions.

Indeed, unusually low rainfall in most of the cocoa growing regions of the country were reported to likely reduce the bean size and further threaten to shorten the April to September mid-crop.

From 14 May onwards, with the expiry of the MAY-21 contract, prices of the JUL-21 contract witnessed a short-lived increase to reach their highest level of the month on 17 May 2021 settling at US$2,418 per tonne in London and US$2,526 per tonne in New York.

Thereafter, prices of the front month contract tumbled by 4% on both markets moving from US$2,394 to US$2,294 per tonne in London and from US$2,510 to US$2,419 per tonne in New York.

Meanwhile, cumulative arrivals of cocoa beans in Côte d’Ivoire were reported at levels topping those of the previous crop year. As at 23 May 2021, cumulative arrivals at Ivorian ports reached 1.960 million tonnes, up from 1.810 million tonnes recorded for the corresponding period of the previous season.

Commercial (or Hedger/Merchant & Producer) Net Short Futures Positioning

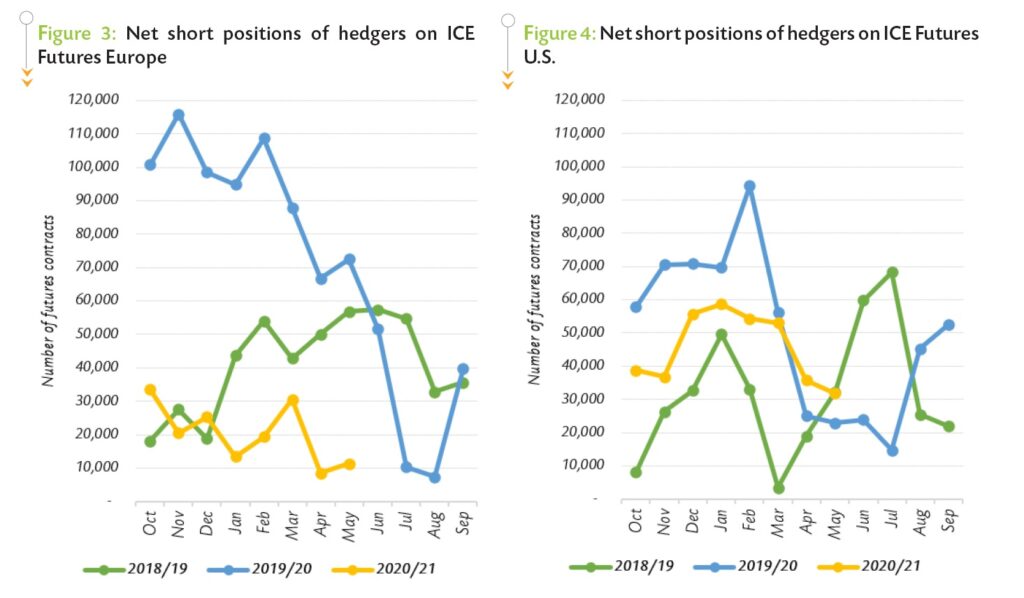

Figure 3 presents the net short positions for commercial traders in Europe over the period 2018/19 – 2020/21, while Figure 4 portrays the same information in the United States.

The size of net short positions can be thought of as a demand for an “insurance” against price drops; and its change over time assesses the evolution of the risk perception of the entire spectrum of merchants and producers in the cocoa futures markets.

The weekly report on the Commitments of Traders is the source of information.

During the period Oct-20 to May-21, the average net short positions in both London and New York were markedly lower than those recorded over the same period in 2019/20. In New York, they declined by 22% from an average of 58,449 contracts to 45,624 contracts. Meanwhile in London, they were down by 78% to an average 20,320 contracts compared to 2019/20 (Figure 3 and Figure 4).

During the period Oct-20 to May-21, the average net short positions in both London and New York were markedly lower than those recorded over the same period in 2019/20. In New York, they declined by 22% from an average of 58,449 contracts to 45,624 contracts. Meanwhile in London, they were down by 78% to an average 20,320 contracts compared to 2019/20 (Figure 3 and Figure 4).

The COVID 19 pandemic reducing the risk perception of a bearish market has in turn reduced the need for an “insurance”. The decline is more pronounced on the London futures market because the hedgers in this market preferred to reduce their risk exposure as a result of the introduction of the LID, which technically introduced a risk that cannot be hedged.

Focusing on the change in the net short positions in May 2021 versus April 2021, contrarian views emerged when comparing the commercial net short positions in New York and London.

In London, the net short position increased from 8,494 futures contracts to 11,294 futures contracts suggesting perhaps a slight increase in the perception of a price risk (i.e., bullish market).

On the contrary in New York, the aggregate net short position declined by 11% from 35,752 futures contracts in April 2021 to 31,866 futures contracts in May 2021.

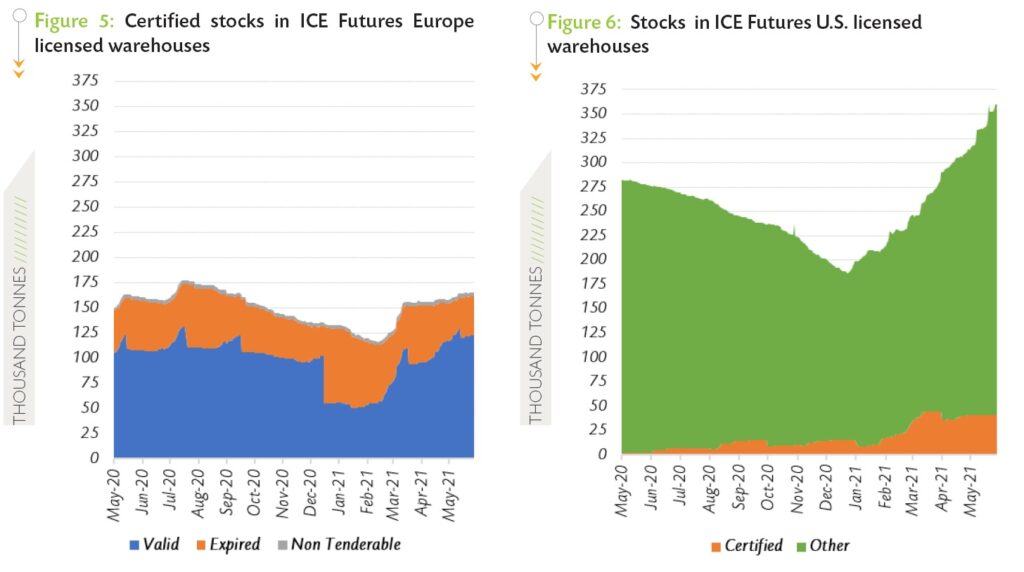

Certified stocks in exchange licensed warehouses

In May 2021, stocks of cocoa beans with valid certificates in European warehouses averaged 122,759 tonnes; representing approximately two-thirds (73%) of the total certified stocks. As illustrated in Figure 5, stocks with valid certificates increased by 11% as compared to their average level of 111,058 tonnes seen a year earlier. In the United States, total stocks increased by 21% year-on-year to reach an average of 339,824 tonnes in May 2021 (Figure 6).Over the same time span, certified stocks in the United States soared from 1,904 tonnes to 40,564 tonnes.

At its maturity, volumes of cocoa beans exchanged against the MAY-21 contract in Europe amounted to 72,230 tonnes; three times higher than 20,330 tonnes tendered against the MAY-20 futures contract one year ago.

At its maturity, volumes of cocoa beans exchanged against the MAY-21 contract in Europe amounted to 72,230 tonnes; three times higher than 20,330 tonnes tendered against the MAY-20 futures contract one year ago.

During the month under review, Cameroonian cocoa beans represented the highest share of the deliveries with 47% or 33,990 tonnes. The share of cocoa beans from Côte d’Ivoire in the physical deliveries in May 2021 stood at 28% or 20,330 tonnes, while 22% or 15,570 tonnes of the deliveries came from Nigeria. The remaining share (3% of the deliveries or 2,340 tonnes) originated from other cocoa origins.

Origin Differentials

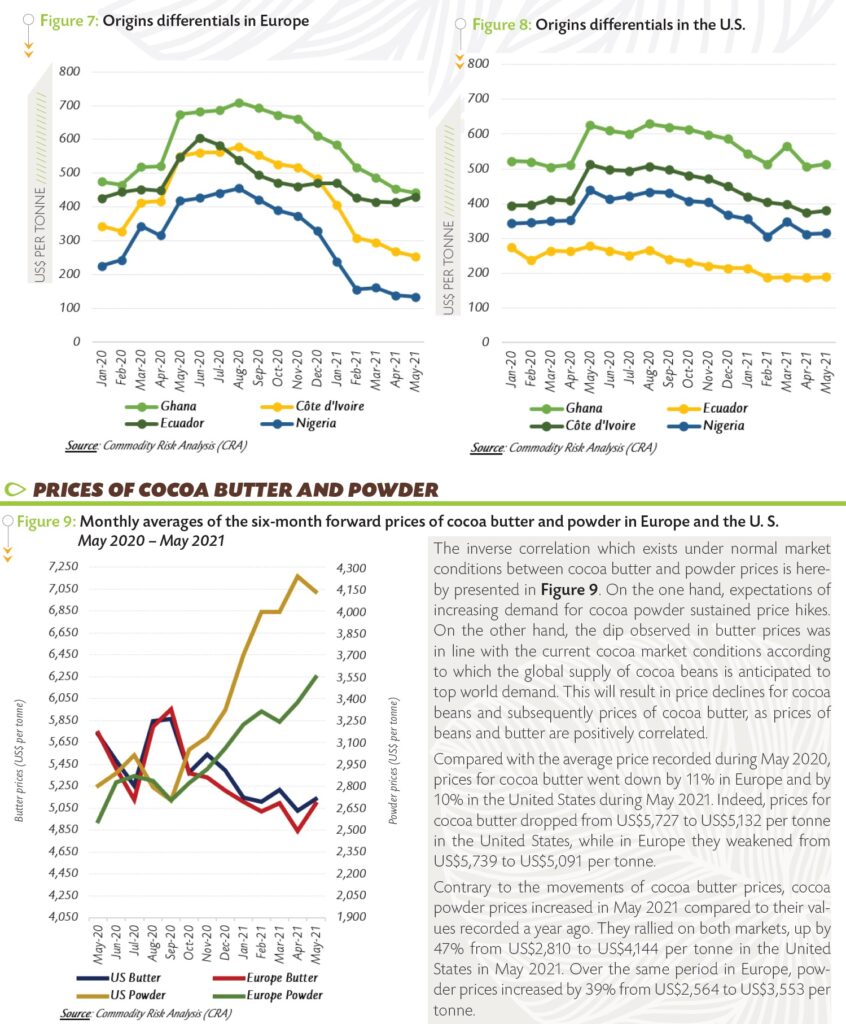

As seen in Figure 7 and Figure 8, origin differentials on prices of the six-month forward cocoa contract in Europe and the U.S. for Ghana, Côte d’Ivoire, Ecuador and Nigeria continued to decline in May as compared to their levels recorded at the beginning of the 2020/21 cocoa year.

In Europe, the differential for Ghanaian cocoa stood at US$442 per tonne in May 2021, 34% lower compared to US$672 per tonne recorded in October 2020. Similarly, the origin differential was discounted by 52% from US$527 to US$254 per tonne for Ivorian cocoa beans.

A 66% reduction from US$390 to US$133 per tonne was recorded for the Nigerian cocoa country differential, while Ecuador’s differential dwindled by 9% from US$472 to US$430 per tonne.

Turning to the U.S. market, cocoa beans from Ghana recorded a differential of US$514 per tonne in May 2021 against US$614 per tonne during October 2020. Over the same period, the premium applied to Ivorian cocoa beans plummeted by 21% from US$481 to US$380 per tonne. Premiums received for Ecuadorian beans in the U.S. dropped by 19% from US$231 to US$189 per tonne, while a 23% reduction from US$407 to US$315 per tonne was seen in the origin differential for Nigeria.

Production And Grindings

Production And Grindings

At the end of May 2021, cumulative arrivals of cocoa beans for the 2020/21 cocoa season in Côte d’Ivoire continued to beat all records. Indeed, as at 20 June 2021, cumulative arrivals at Ivorian ports were seen at 2.057 million tonnes, up by 6.3% compared to 1.936 million tonnes recorded a year earlier. Furthermore, cocoa processors in Côte d’Ivoire were reported to have ground 367,000 tonnes of cocoa beans at the end of May; representing a 2.7% drop compared to 377,000 tonnes processed over the corresponding period of the previous cocoa year.

The revised forecasts for the 2020/21 cocoa season published by the ICCO Secretariat in its latest issue of the Quarterly Bulletin of Cocoa Statistics suggest a production surplus of 165,000 tonnes. Increases in production and grindings are expected at 6.3% to 5.024 million tonnes and at 3.0% to 4.809 million tonnes, respectively.

Production is projected to increase by almost 9% to 3.871 million tonnes in Africa and by 2.2% to 278,000 tonnes in Asia and Oceania. A slight reduction of 1.7% to 875,000 tonnes is forecast for the Americas. Grindings are expected to expand to 4.809 million tonnes, up by 138,000 tonnes, representing a 3.0% increase compared to the revised estimate of 4.671 million tonnes for 2019/20.

It is anticipated that processing activities will grow by 5.4% to 1.156 million tonnes in Asia and Oceania, while a growth of 2.4% to 1.019 million tonnes is projected in Africa. In the Americas, processing activities are forecast to expand by 7.1% to 946,000 tonnes whereas a 0.5% drop to 1.688 million tonnes is envisaged in grindings activities for Europe compared to the level attained in the same period of the previous season.