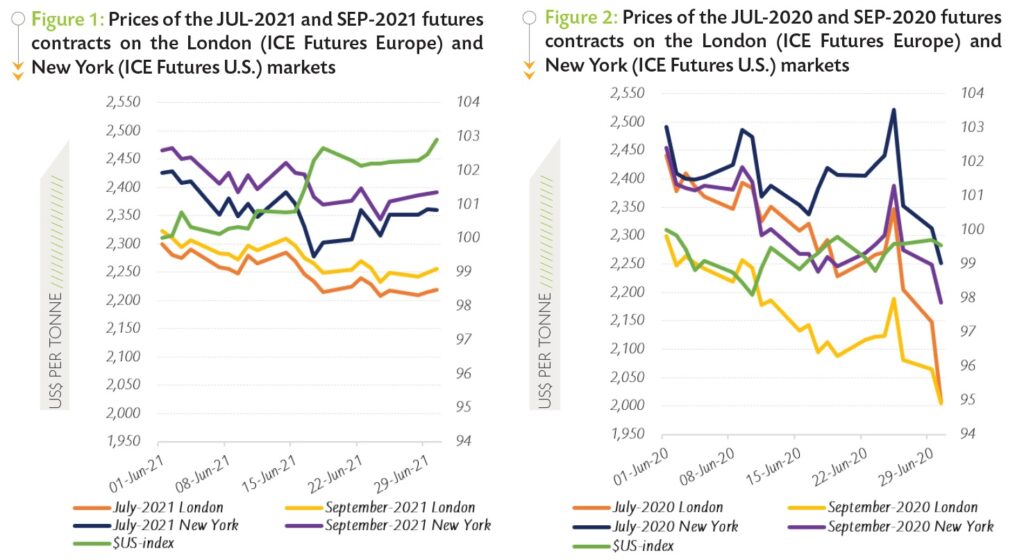

ABIDJAN, Côte d’Ivoire – This report on the movements of cocoa futures prices sheds some light on the July-2021 (JUL-21) and September-2021 (SEP-21) futures contracts as listed on ICE Futures Europe (London) and ICE Futures U.S. (New York). It aims to provide insights into the price developments for these two specific futures contracts.

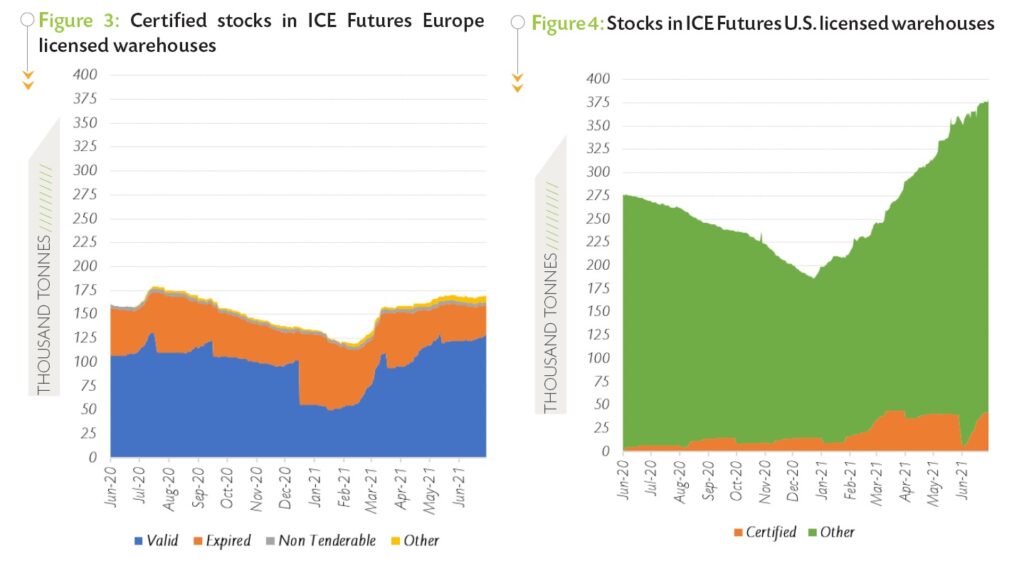

Figure 1 shows price movements on the London and New York futures markets respectively at the London closing time in June 2021, while Figure 2 presents similar information for the previous year.

Both figures include the US dollar index to extricate the influence of the strength of the currency on prices.

As seen in Figure 1, the contango situation which was observed in May 2021 continued throughout June 2021. This is directly related to the increase in the volumes of exchange-certified stocks on both sides of the Atlantic.

As seen in Figure 1, the contango situation which was observed in May 2021 continued throughout June 2021. This is directly related to the increase in the volumes of exchange-certified stocks on both sides of the Atlantic.

The JUL-21 contract priced with an average discount of US$27 per tonne over SEP-21 in London, while in New York an average discount of US$48 per tonne was recorded on JUL-21 prices compared to SEP-21. It is recalled that a contango is the normal price configuration in futures markets.

Contracts expiring at a later date are more expensive as a result of (i) storage and insurance costs; (ii) interest rates and (iii) the time value of the certification issued by the exchange.

Figure 2 shows that both the London and New York markets were bearish, and a backwardation was observed. On the one hand, the declining trend in cocoa prices a year ago was due to lower-than-expected grindings volumes in the midst the COVID-19 pandemic outbreak

On the other hand, the backwardation which occurred resulted from the drastic reduction in exchange-certified stocks fuelled by the low rate of re-grading of expired certified stocks, and the removal of certified stocks from the pool of warrants available to exchange.

Focusing on the JUL-21 contract price trend in June 2021, Figure 1 outlines that both the London and New York markets were bearish. In London, prices of the JUL-21 contract plummeted by 4% from US$2,299 to US$2,219 per tonne while in New York, they tumbled by 3% from US$2,425 to US$2,360 per tonne.

Various fundamental factors contributed to the overall decline observed in prices of the JUL-21 contract during the month under investigation. Indeed, massive supplies of cocoa beans from Côte d’Ivoire and Ghana, amidst uncertainties on demand, were detrimental to prices.

In addition, the announcement of the postponement of the reopening of some economies in the Eurozone because of the propagation of new and deadly variants of the COVID-19 contributed to further pressure down futures prices. Furthermore, the weakening in cocoa prices was also triggered by the appreciation of the US dollar.

In particular, over 11-18 June 2021, the US dollar firmed by 3% and thereby played a predominant role in the plunge in prices observed during that time span

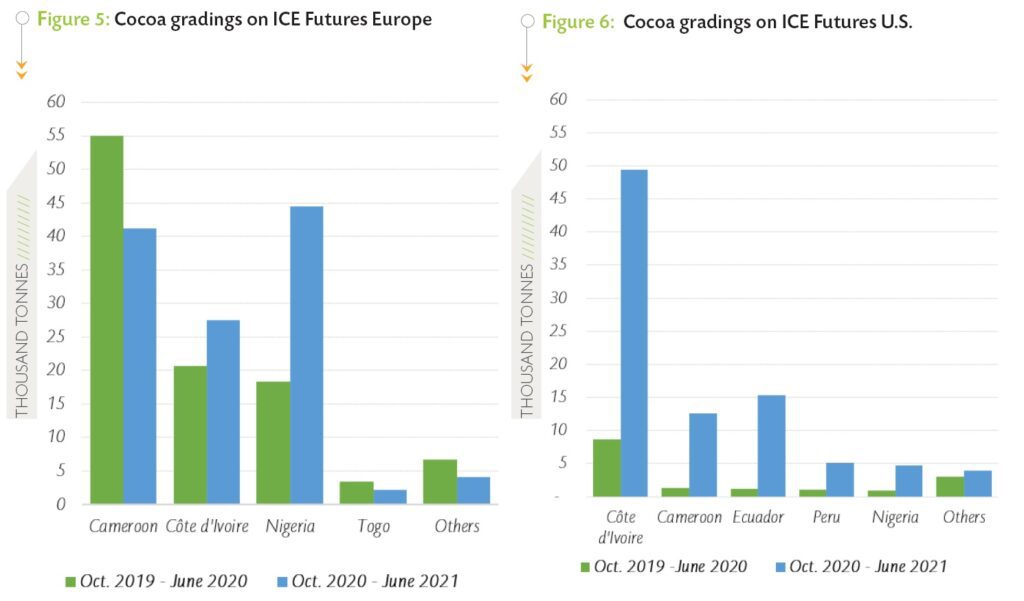

Cocoa gradings and stocks in exchange licensed warehouses

In the course of June 2021, stocks of cocoa beans with valid certificates in European warehouses averaged 124,368 tonnes; representing almost three-quarters of the total certified stocks. As illustrated in Figure 3, stocks with valid certificates increased by 15% as compared to their average level of 108,085 tonnes seen a year earlier. In the United States, total stocks climbed by 34% year-on-year to reach an average of 366,489 tonnes in June 2021 (Figure 4).

Over the same timeframe, certified stocks in the United States rose from 5,366 tonnes to 25,673 tonnes. This development is suggesting that the industry is now increasing the share of exchange-certified stocks so as to use them as collateral.

More cash will be needed to finance the higher working capital which is expected as a result of the ease of the COVID-19 pandemic restrictions.

Figure 5 presents the main origins of cocoa graded on the ICE Futures Europe market during the periods October 2019 – June 2020 and October 2020 – June 2021, while Figure 6 shows the same information for the cocoa graded on the U.S. Exchange.

Figure 5 presents the main origins of cocoa graded on the ICE Futures Europe market during the periods October 2019 – June 2020 and October 2020 – June 2021, while Figure 6 shows the same information for the cocoa graded on the U.S. Exchange.

Over October 2020 – June 2021, cocoa graded by the ICE Futures Europe reached 119,380 tonnes, up by 14% from 104,270 tonnes of cocoa graded over the same period in the previous season. During the above-mentioned time spans, the volume of Cameroonian cocoa beans at exchange gradings decreased from 54,960 tonnes to 41,160 tonnes.

Similarly, the volume of Togolese cocoa beans graded at the exchange was reduced from 3,490 tonnes to 2,150 tonnes while cocoa beans from other origins dropped from 6,740 tonnes to 4,100 tonnes. On the contrary, cocoa beans from Côte d’Ivoire and Nigeria increased from 20,690 tonnes to 27,540 tonnes and 18,390 tonnes to 44,430 tonnes respectively.

In the United States, the ICE Futures U.S. graded 91,191 tonnes of cocoa beans during October 2020 – June 2021, up from 16,354 tonnes graded during the same period of the preceding cocoa year. On a year-on-year basis, the volumes of cocoa beans from Côte d’Ivoire and Ecuador in ICE Futures U.S. gradings increased from 8,699 tonnes to 49,467 tonnes and from 1,169 tonnes to 15,311 tonnes respectively.

In the same vein, volumes of Cameroonian and Peruvian cocoa beans at exchange gradings increased from 1,340 tonnes to 12,531 tonnes and from 1,099 tonnes to 5,112 tonnes respectively. It should be noted that volumes of Nigerian cocoa beans in ICE Futures U.S. licensed warehouses increased from 954 tonnes to 4,794 tonnes. Additionally, the volumes of cocoa beans graded on the ICE Futures U.S. for other origins went up from 3,092 tonnes to 3,976 tonnes.

Origin differentials

Origin differentials

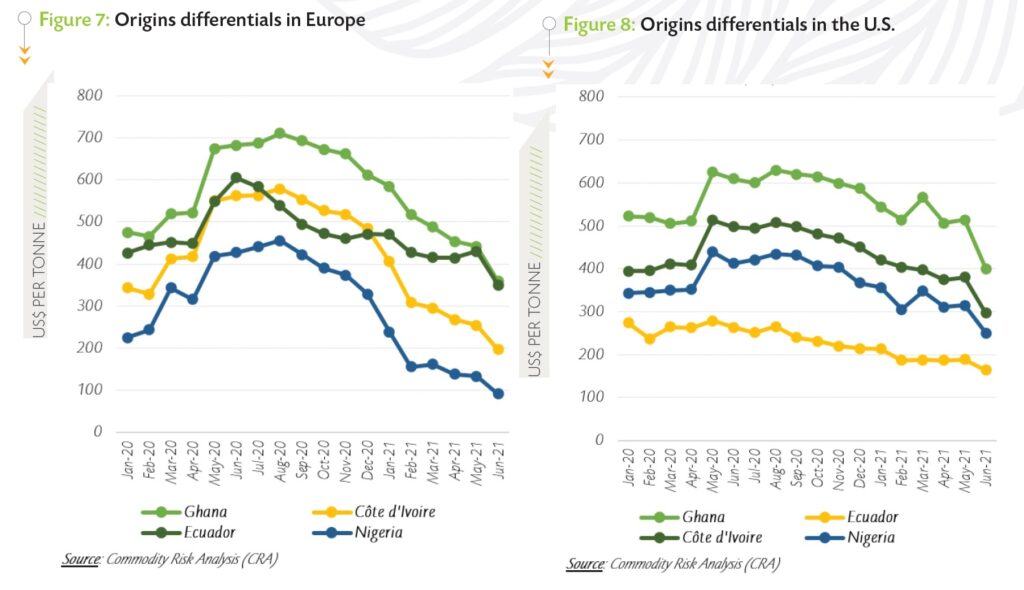

As presented in Figure 7 and Figure 8, origin differentials on prices of the six-month forward cocoa contract in Europe and the U.S. for Ghana, Côte d’Ivoire, Ecuador and Nigeria continued to decline in June as compared to their levels recorded at the beginning of the 2020/21 cocoa year.

The anticipated market surplus of over 150,000 tonnes because of the persisting weaker demand pressured down origins differentials. In Europe, the differential for Ghanaian cocoa was seen at US$358 per tonne in June 2021, 47% lower compared to US$672 per tonne recorded in October 2020.

Similarly, the origin differential was slashed by 63% from US$527 to US$197 per tonne for Ivorian cocoa beans. A 77% reduction from US$390 to US$91 per tonne was recorded for the Nigerian cocoa country differential, while Ecuador’s differential dwindled by 26% from US$472 to US$350 per tonne.

Turning to the U.S. market, cocoa beans from Ghana recorded a differential of US$400 per tonne in June 2021 against US$614 per tonne during October 2020. Over the same period, the premium applied to Ivorian cocoa beans plummeted by 38% from US$481 to US$296 per tonne. Premiums received for Ecuadorian beans in the U.S. dropped by 29% from US$231 to US$164 per tonne, while a 39% reduction from US$407 to US$250 per tonne was seen in the origin differential for Nigeria.

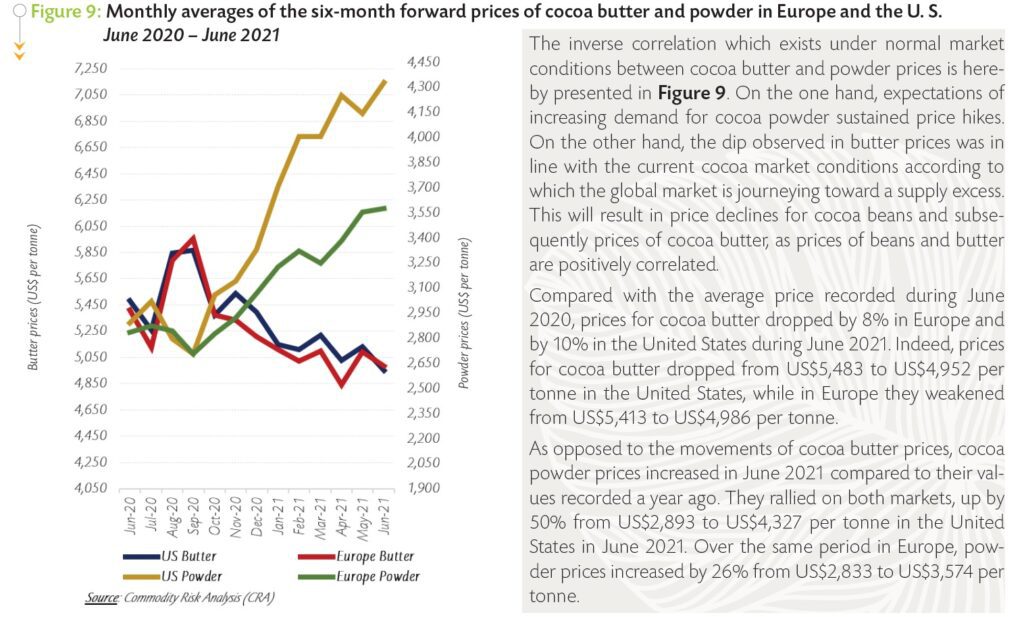

Prices of cocoa butter and powder

Prices of cocoa butter and powder

Production and grindings

Production and grindings

At the end of June, cumulative arrivals of cocoa beans for the 2020/21 cocoa season in Côte d’Ivoire and Ghana remained higher than levels recorded at the same period of 2019/20. As at 30 June 2021, cumulative arrivals at Ivorian ports were seen at 2.093 million tonnes, up by 5.2% compared to 1.989 million tonnes recorded a year earlier.

Turning to grindings, processors in Côte d’Ivoire were reported to have ground 402,000 tonnes of cocoa beans in June, down from 422,000 tonnes processed at the same period of the previous cocoa season.

In Ghana, graded and sealed cocoa purchases for the 2020/21 crop year were reported to have reached 981,222 tonnes by 17 June 2021, up from 754,800 tonnes recorded at the corresponding period of the previous season.

In June 2021, the Conseil du Café-Cacao announced that Côte d’Ivoire was on track to reach its sales target for export contracts.

Indeed, the country was reported to have sold 74% or 1.18 million tonnes of the target set for export contracts for the 2021/22 cocoa season. In neighbouring Ghana, forward sales of contracts amounted to 350,000 tonnes in June 2021; representing 58% of 600,000 tonnes to be sold by the country.