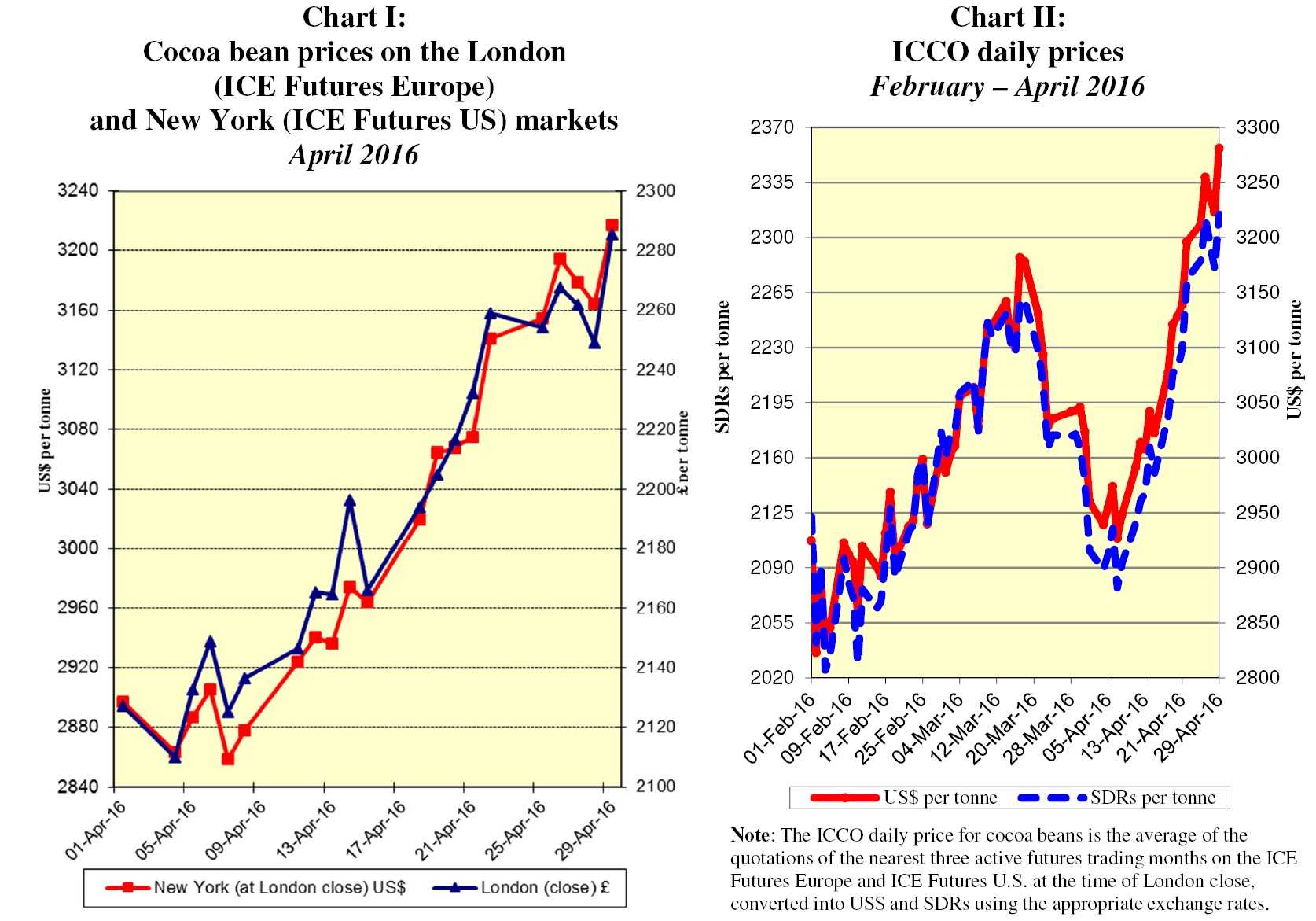

The current review focuses on cocoa price movements on the international markets during May 2016. Chart I illustrates price movements on the London (ICE Futures Europe) and New York (ICE Futures U.S.) markets for the month under review.

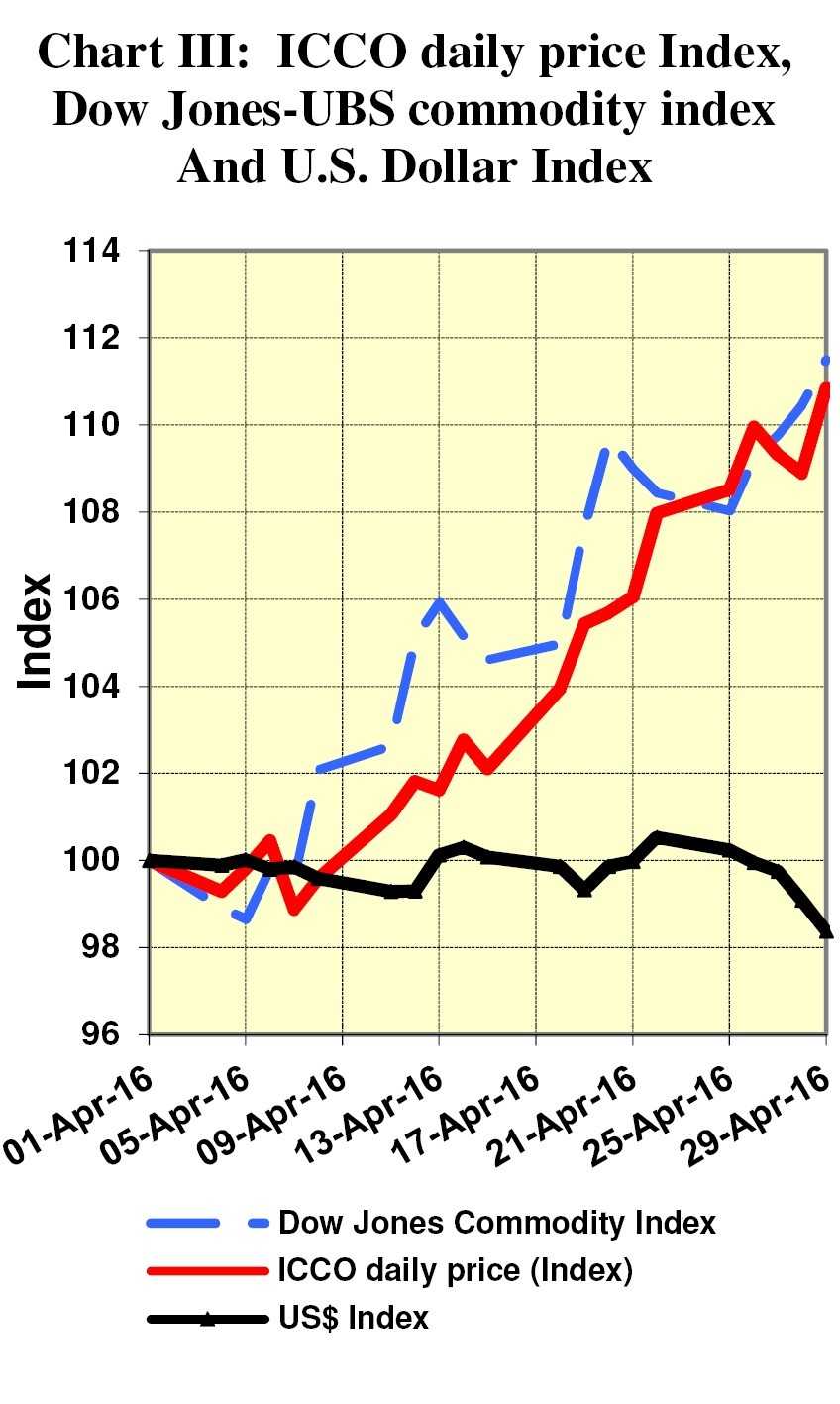

Chart II shows the evolution of the ICCO daily price, quoted in US dollars and in SDRs, from March to May 2016.

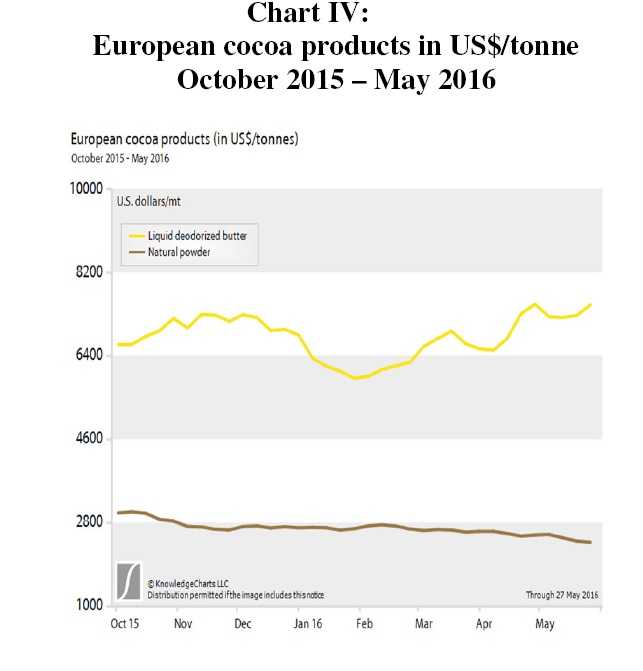

Chart III depicts the change in the ICCO daily price index, the Dow Jones-UBS Commodity Index and the US Dollar Index during the month under review, while Chart IV presents the prices of European cocoa products from the beginning of the current cocoa year to the present.

Price movements

In May 2016, the ICCO daily price averaged US$3,099 per tonne, up by US$21 compared to the average price recorded in the previous month (US$3,078), and ranged between US$2,978 and US$3,280 per tonne.

After reaching their highest levels of the year during the very last trading session of the previous month, cocoa futures prices followed a gradual downward slope at the beginning of May.

By the end of the third week of the month, cocoa futures fell to a four-month low, at £2,099 per tonne in London and at US$ 2,894 per tonne in New York; thus shredding nine per cent and eight per cent respectively from their peak values reached at the very end of the previous month.

Bearish factors that led to the fall in cocoa futures included reports of improved rainfall across West Africa in March, thus lowering the possibility of a widening supply deficit for the ongoing cocoa season.

In addition, the strengthening of the US dollar, coupled with weak demand growth also contributed to the bearish tone on both markets.

However, from the early part of the fourth week towards the end of the month, cocoa futures prices reverted from their downward trend and followed a gradual upward movement, mainly due to the presentation by the ICCO of revised supply and demand statistics at the third edition of the World Cocoa Conference (WCC3) held in The Dominican Republic, showing in particular an almost five per cent decrease in global production for the current season compared to the previous one, and a wider supply deficit than previously expected.

As illustrated in Chart III, under the influence of the strengthening of the U.S. dollar in May against other major currencies, cocoa prices followed a downward trend during the first half of the month, before recovering gradually afterwards.

By contrast, the broad commodity complex remained quite firm throughout the month under review.

Supply and demand situation

According to the ICCO’s latest issue of the Quarterly Bulletin of Cocoa Statistics, based on information available at the beginning of May, world cocoa production for the current season is expected to decrease by 4.6% to 4.039 million tonnes, as compared with the previous season’s estimate of 4.233 million tonnes.

With demand anticipated to grow modestly by less than one per cent to 4.179 million tonnes, the current season is expected to experience a supply deficit of 180,000 tonnes.

As reported by Reuters, port arrivals in Côte d’Ivoire since the start of the cocoa season were estimated at 1,326,000 tonnes by 5 June 2016, compared to 1,469,000 tonnes for the same period of the previous season.

Overall, the ICCO Secretariat expects the total reduction in production to reach about 150,000 tonnes for the current cocoa season, mainly due to the effects of the Harmattan winds which were reported to be the strongest in three decades.

In Ghana, total production for the 2015/2016 season is anticipated to reach 800,000 tonnes in 2015/2016.

Although the adverse weather conditions have reduced the production potential significantly, reports indicate that the distribution of free cocoa seedlings, fertilizers and pesticides are on course, thereby contributing to the recovery from the low level recorded in the previous season.

As seen in Chart IV, cocoa butter prices remain at relatively high levels, above US$6,000 per tonne. On the other hand, the price of cocoa powder which is used in baked goods, chocolate drinks and ice cream, has been continuously weak over the past few months.