This review of the cocoa market situation reports on cocoa price movements on international markets during the month of April 2018. It aims to highlight key insights on expected market developments and the effect of the United States dollar exchange rates on cocoa prices.

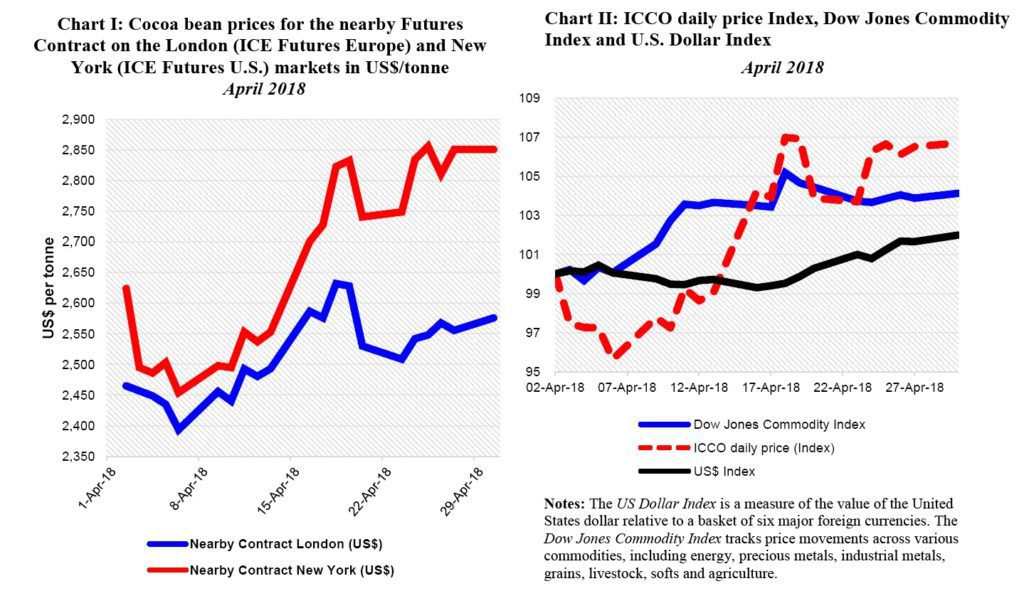

Chart I shows the historical developments in the prices of the nearby cocoa futures contracts on ICE U.S. (New York) and ICE Europe (London) at the London closing time. Both prices are expressed in US dollars.

The London market is pricing at par African origins, whereas the New York market prices at par Southeast Asian origins.

Thus, the London futures price is expected, under the same market conditions, to be higher than that of New York.

As a result, the relative price difference provides insights into the relative, expected availability of cocoa beans on these exchanges at the expiry of the futures contract.

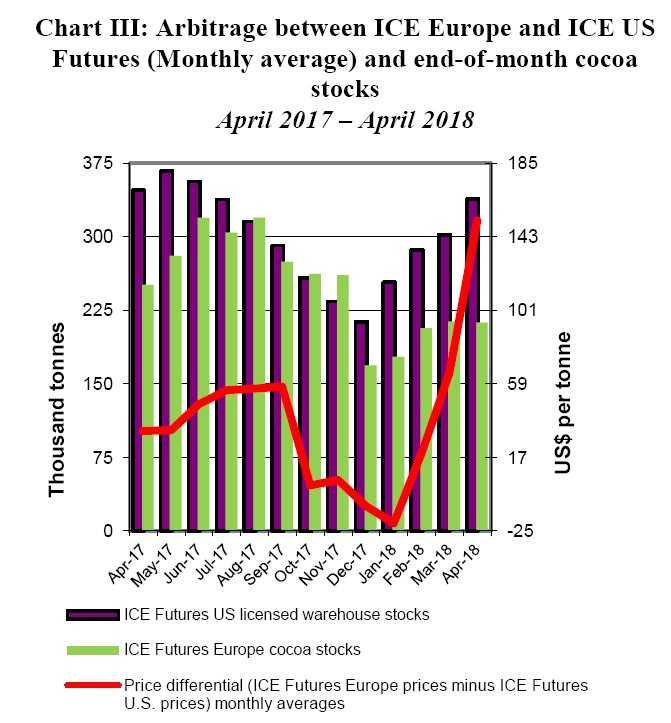

Chart II depicts the change in the ICCO daily price Index, the Dow Jones Commodity Index and the US Dollar Index in April.

Finally, Chart III illustrates the end-of-month cocoa bean stocks in licensed warehouses in Europe and in the United States and the arbitrage between ICE Futures Europe and ICE Futures U.S.

Price movements

In April, cocoa prices generally followed an upward trend despite an initial fall during the first five trading sessions of the month. They increased on average by 4% in London and 9% in New York.

The release of higher-than-expected grindings figures for the first quarter of 2018 in Europe, Asia and some cocoa origin countries supported the bullish stance on the nearby contract prices.

As shown in Chart I, during the first week of the month, the nearby futures contract prices retreated by nearly 3% and 6% in London and New York respectively. On 6 April, prices reached their lowest level of the month and stood at US$2,393 in London and US$2,454 in New York.

Expectations of a good mid-crop output in West African countries pressured down prices.

This bearish stance was however brief. Indeed, cocoa prices rallied during the second and third weeks of the month under review and settled at US$2,628 and US$2,833 in London and New York respectively.

The upbeat trend in prices resulted from news that grindings in Europe and Asia witnessed a year-on-year increase during the first quarter of 2018. Lower levels of arrival seen at Ivorian ports during this period also contributed to the increase in cocoa prices.

By the end of the third week of the month, prices halted their rally and reached US$2,530 in London and US$2,741 in New York following the release of surprisingly lower-than-expected grindings data for the first quarter of 2018 in the Americas.

Nevertheless, the halt in the price rally was short-lived and cocoa prices bounced back during the last week of the month.

The US dollar index and the broad commodity complex gained 2% and 4% respectively with respect to their values at the start of the month while the ICCO daily prices index rose by 7% compared to its value at the beginning of the month (Chart II).

Arbitrage opportunities widened during the month under review with an average differential in the front-month futures contract prices between London and New York seen at US$151/tonne (Chart I). The nearby contract traded on a higher note in New York compared to London.

As shown in Chart III, compared to last year’s data (April 2017), both markets reported a decrease in the volume of certified warehouse stocks during the month under review. In New York, volumes decreased from 347,502 tonnes to 338,458 tonnes and in London, from 250,910 tonnes to 212,290 tonnes.

Furthermore, the spread in the monthly average of futures prices had increased sharply since January 2018 and reached an average differential of US$152/tonne in April.

Increasing grindings in Asia is reported as causing a shortfall in the supply of cocoa beans from Asia to the Americas. Thus, good quality West African cocoa beans are entering the United States cocoa market at a price higher than in London.

Supply and demand situation

Cocoa arrivals at ports in Côte d’Ivoire remain behind last year’s level. As at 13 May, cumulative cocoa arrivals, since the start of the 2017/18 crop season, were seen at 1.601 million tonnes, down by 4% from the level reached during the same period in the previous season.

In Ghana, news indicated that the persistently low cocoa prices are inciting producers to invest in other crops and informal mining activities. As at the time of writing, there was no official news with regards to cocoa beans purchases.

Compared to the same period last year, grindings data released by regional cocoa associations showed an increase in demand in Africa, Europe and Asia.

Data published by the exporters’ association (GEPEX) showed that Côte d’Ivoire’s grindings had reached 254,000 tonnes since the start of 2017/18 crop season, up from 248,000 tonnes grinded over the same period last year.

European grindings data published by the European Cocoa Association showed a 5.5% increase to 358,432 tonnes. In addition, the Cocoa Association of Asia published an increase of 7.21% to 190,244 tonnes.

On the contrary, the National Confectioners Association published an unexpected 1.14% dip to 118,778 tonnes for North America.