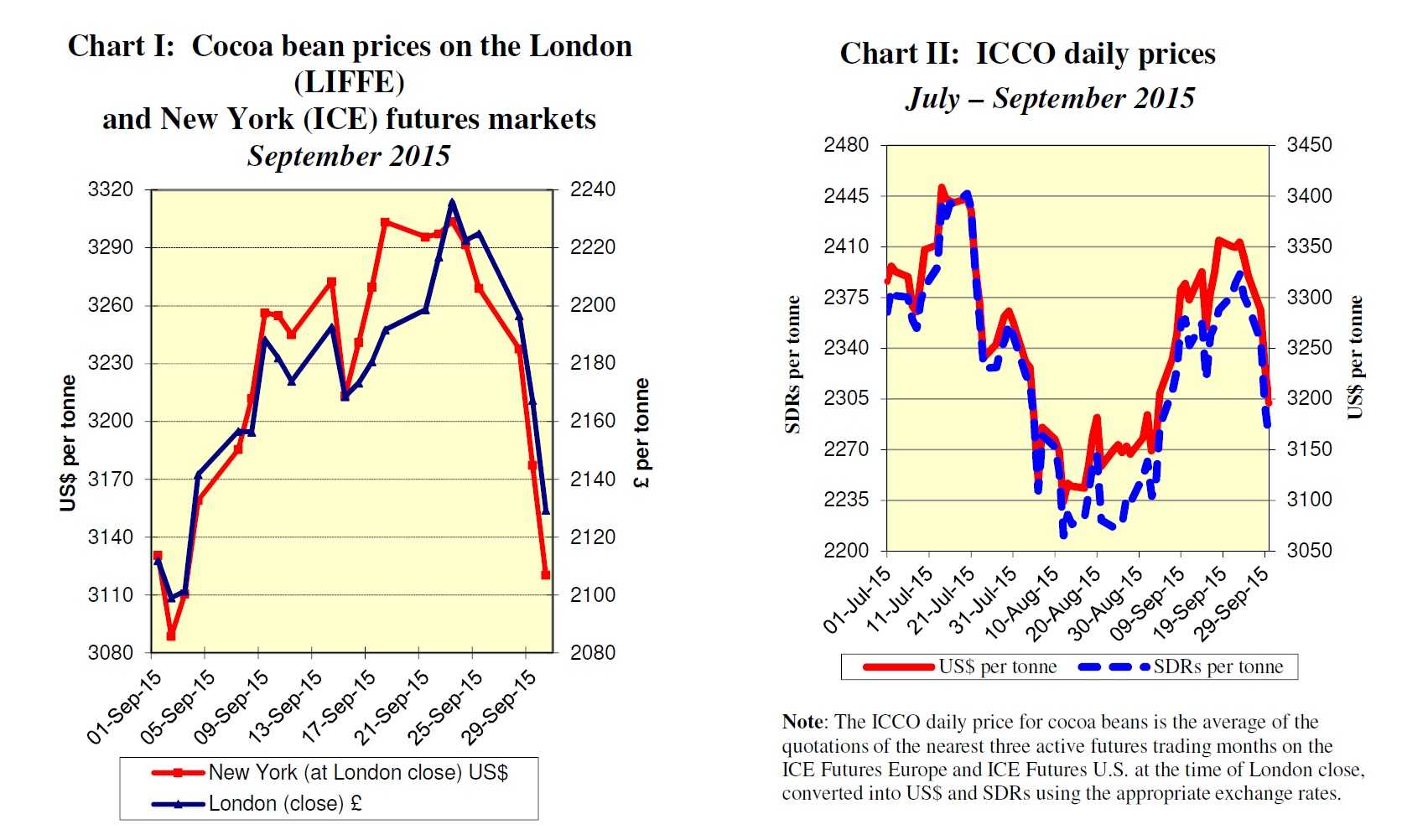

The current review reports on cocoa price movements on the international markets during the month of September 2015. Chart I illustrates price movements on the London (ICE Futures Europe) and New York (ICE Futures US) markets for the month under review.

Chart II shows the evolution of the ICCO daily price, quoted in US dollars and in SDRs, from July to September 2015.

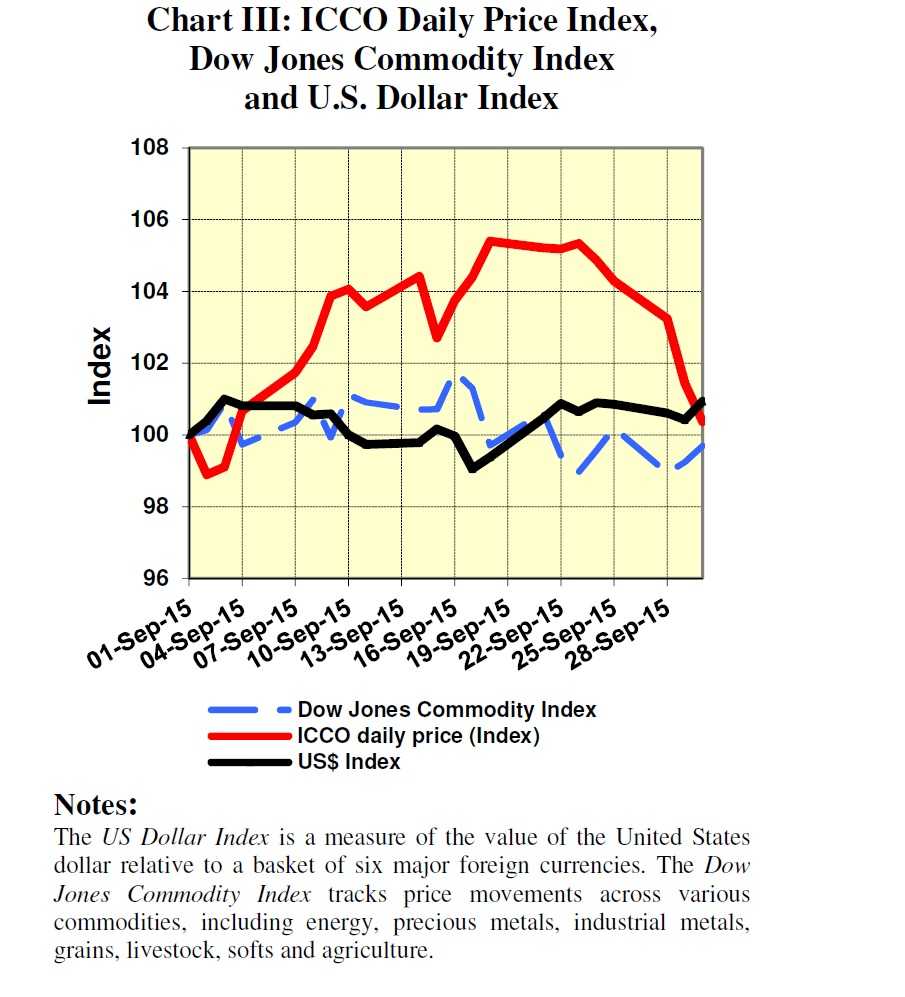

Chart III depicts the change in the ICCO daily price index, the Dow Jones Commodity Index and the US dollar Index during the month under review, while Table 1 illustrates prices for cocoa beans on the futures markets, as well as record levels and variations during the 2014/2015 season.

Price movements

In September, the ICCO daily price averaged US$3,278 per tonne, up by US$125 compared to the average price recorded in the previous month (US$3,153), and ranged between US$3,148 and US$3,357 per tonne.

As seen in Chart I, cocoa prices in both terminal markets moved downwards at the beginning of the month.

Cocoa futures fell to their lowest level for the month under review, at £2,099 per tonne in London and at US$3,089 per tonne in New York. They changed direction in the later part of the first week as a result of a weakening dollar, as seen in Chart III.

In addition, the ongoing dry weather conditions in West Africa, potentially affecting the 2015/2016 cocoa season, contributed to the upward trend in prices.

Compared to the above mentioned lows recorded at the start of the month, in the middle of the fourth week, prices rose by almost seven per cent in both markets to a more than four-month high, at £2,236 per tonne in London and to a two-month high, at US$ 3,304 per tonne in New York.

However, moving towards the end of the month, the five remaining trading sessions experienced a sharp fall in cocoa prices in both London and New York markets.

Indeed, reports of higher than expected figures for 2014/2015 total crops in both Côte d’Ivoire and Ghana, of 1,794 million tonnes and 735,000 tonnes respectively, outweighed the general market expectations of yet another deficit for the 2015/2016 season.

Thus, by the end of the month, the expected increase in farm-gate prices in both top producing countries for the forthcoming 2015/2016 season led cocoa prices to shed their early gains and to settle at £2,129 per tonne in London and at US$ 3,120 per tonne in New York.

As shown in Table 1, at the end of the 2014/2015 cocoa year, the London market recorded a two per cent increase over the previous year, whereas the New York market recorded a decrease of four per cent. This mixed variation in cocoa prices occurred in the context of a small production surplus estimated for the 2014/2015 cocoa year.

Supply and demand situation

Cocoa bean arrivals at ports in Côte d’Ivoire hit another all-time record of 1.794 million tonnes for the 2014/2015 cocoa season, compared with 1.741 million tonnes for the previous season.

For the 2015/2016 season, the Government has set a farm-gate price of 1,000 CFA francs (US$ 1.67) per kilogramme, representing an 18% increase, compared with 850 CFA francs per kilogramme set for the 2014/2015 crop season.

Conversely, Ghana, the world’s second largest cocoa producing country, surprised most cocoa analysts by experiencing a sharp fall in its cocoa production, from 896,917 tonnes in the 2013/2014 season, to 735,000 tonnes following a very poor main crop, according to data released by officials in the country.

The farm-gate price was increased by 22% to 6,720 cedis per tonne (US$1,759 per tonne) for the 2015/2016 season, from 5,600 cedis per tonne (US$1,465) paid in the just-ended 2014/2015 season.

On the demand side, market analysts are looking forward to the publication of grindings data for the July to September 2015 period for Asia, Europe and North America, expected in the middle of October.

However, given the ongoing challenging economic outlook for the global economy, and in particular for emerging markets, a significant recovery from the setbacks experienced in the 2014/2015 season for global cocoa demand is not expected.