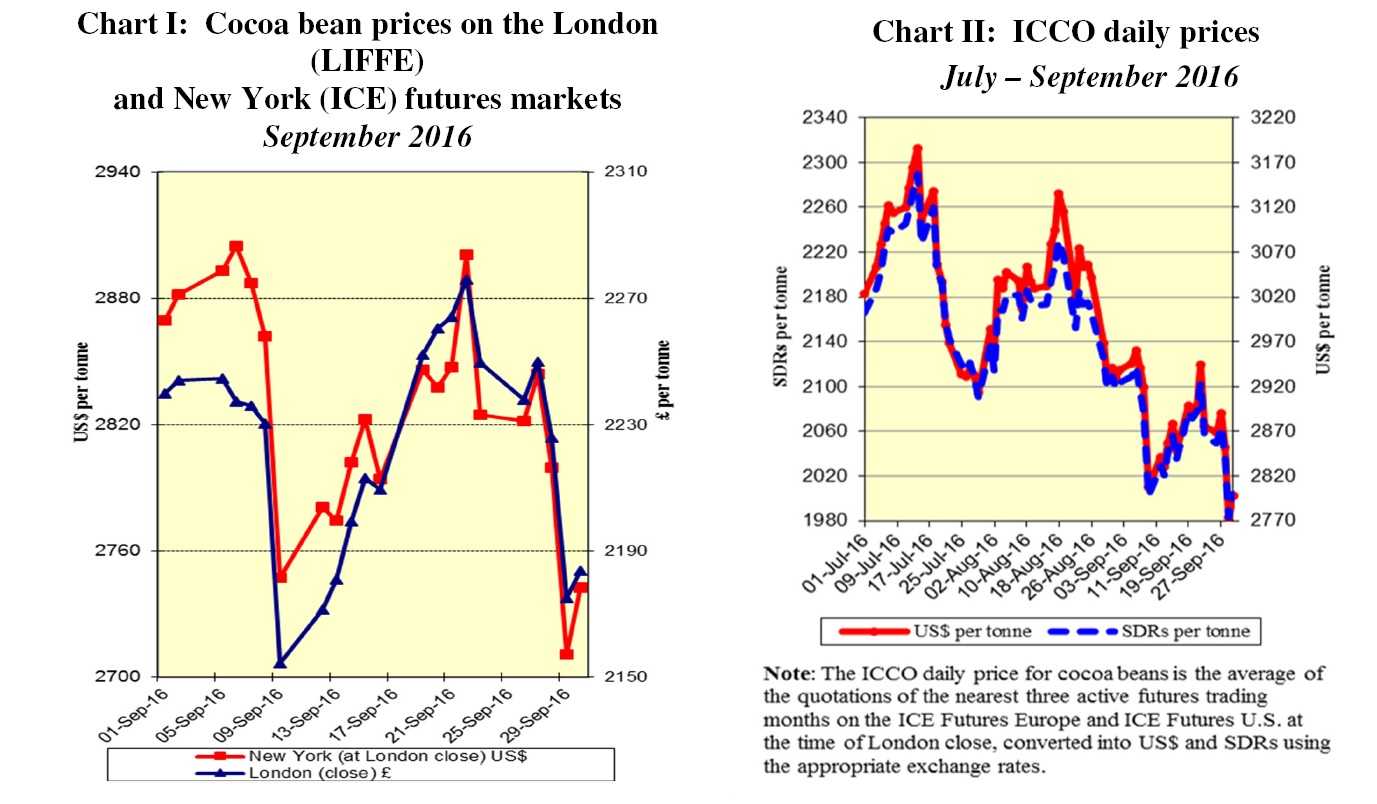

The current review reports on cocoa price movements on the international markets during the month of September 2016. Chart I illustrates price movements on the London (ICE Futures Europe) and New York (ICE Futures US) markets for the month under review.

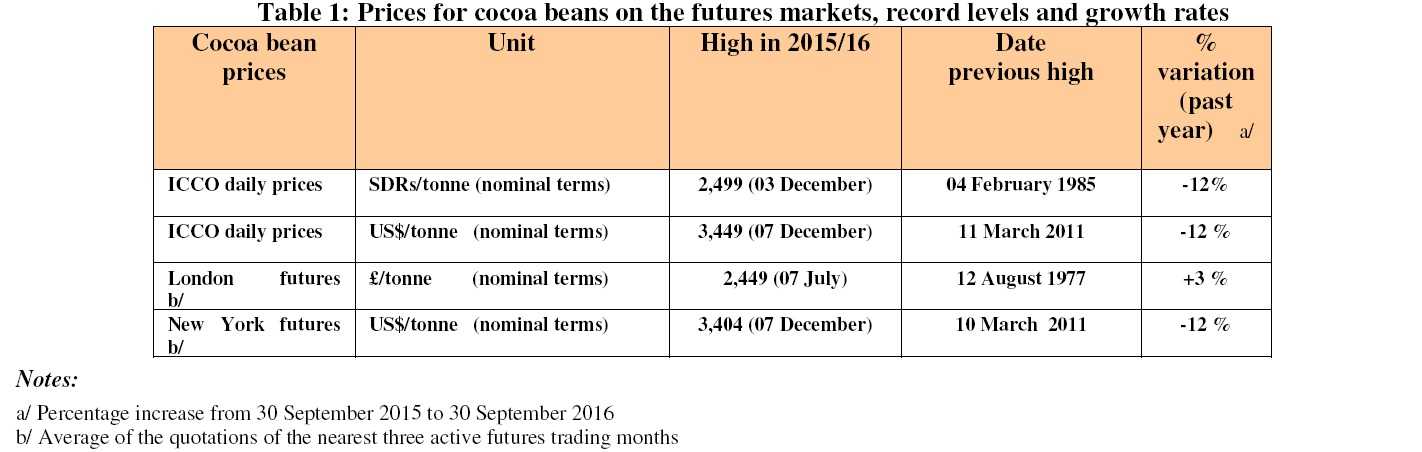

Chart II shows the evolution of the ICCO daily price, quoted in US dollars and

in SDRs, from July to September 2016.

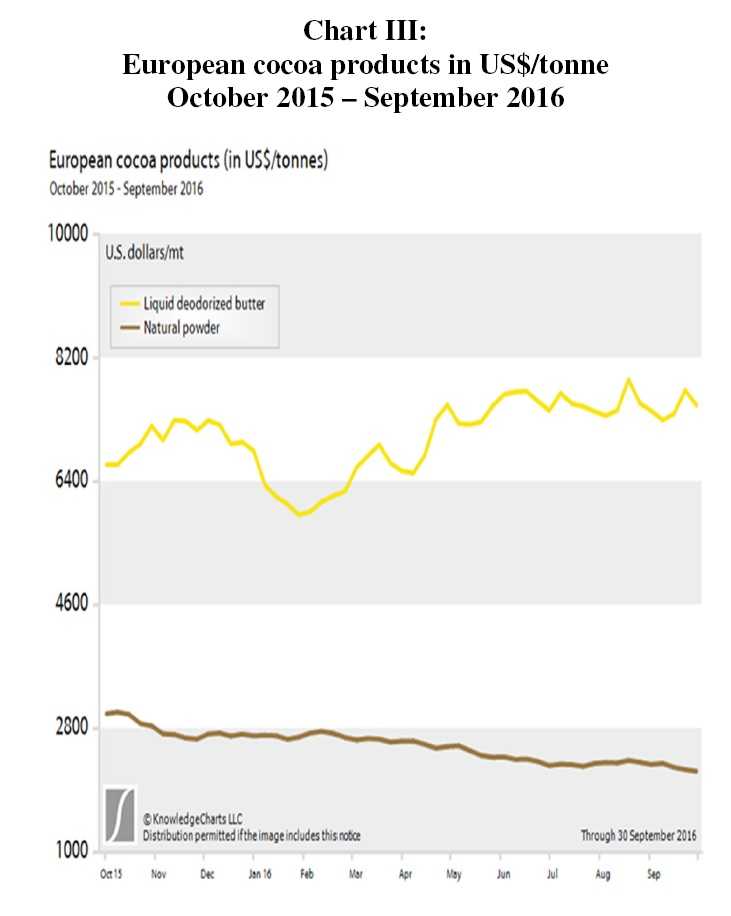

Chart III depicts the change in the ICCO daily price index, the Dow Jones Commodity Index and the US dollar Index during the month under review, while Table 1 illustrates prices for cocoa beans on the futures markets, as well as record levels and variations during the 2015/2016 season.

Price movements

In September, the ICCO daily price averaged US$2,881 per tonne, down by US$152 compared to the average price recorded in the previous month (US$3,033), and ranged between US$2,773 and US$2,960 per tonne.

After the decline experienced in the second half of the previous month, prices on the two cocoa futures markets recovered in the early part of September, reaching their highest level of the month at US$ 2,905 per tonne in New York.

After the decline experienced in the second half of the previous month, prices on the two cocoa futures markets recovered in the early part of September, reaching their highest level of the month at US$ 2,905 per tonne in New York.

Nevertheless, despite the cocoa supply deficit in the just-ended cocoa season 2015/16 turning out to be larger than expected at the beginning of the season, cocoa futures prices in September were mostly affected by expectations of a production surplus in the new 2016/2017 season, resulting from improving weather conditions in West Africa towards the end of August.

Thus, by the end of the second week of the month, cocoa futures prices tumbled to a three-month low, at £2,154 per tonne in London.

Furthermore, the strengthening of the Pound Sterling by 3% against the US Dollar by that period, following the release of weak US and better UK macroeconomic data, also contributed to setting a bearish tone to the London market.

Moving onwards, cocoa futures prices changed course amid reports from officials at the Conseil du Café Cacao in Côte d’Ivoire.

Despite previous reports by some news agencies, the Conseil said that there would not be any re-auctioning of acquired exports rights for the ongoing 2016/17 cocoa season by local exporters who had so far been unable to provide the required documentation and deposits.

This lent support to cocoa futures prices and pushed them to their highest level of the month at £2,276 per tonne in London by the end of the fourth week of the month.

However, at the end of the month, persisting reports of improving West African crop prospects contributed to setting a bearish tone on both terminal markets; cocoa prices followed a downward trend and as a result, reached a morethan one-year low at US$ 2,711 per tonne in New York.

As shown in Table 1, at the end of the 2015/2016 cocoa year, the London market recorded a three per cent increase over the previous year, while the New York market recorded a substantial decline of twelve per cent.

This mixed variation in cocoa prices occurred in the context of a larger-than-expected production deficit estimated for the 2015/2016 cocoa year, and a strong depreciation of the Pound Sterling.

Supply and demand situation

Supply and demand situation

The official figures for cocoa production for the 2015/2016 cocoa year for the two largest

cocoa producing countries are expected to be released shortly.

It should be noted that some uncertainty remains, in particular for Côte d’Ivoire, as large discrepancies persist in cumulative arrivals figures released by various news agencies.

The ICCO Secretariat’s forecast for the 2015/16 indicated a production of 1.570 million tonnes.

For the 2016/2017 season, the Government of Côte d’Ivoire has set a farm-gate price of 1,100 CFA francs (US$1.88) per kilogram, representing a 10% increase, compared with 1,000 CFA francs set for the 2015/2016 crop season.

In Ghana, the world’s second largest cocoa producing country, Cocobod purchases are

expected to have reached 780,000 tonnes, below the government’s initial target of 850,000 tonnes.

However, this represents approximately a 6% increase from the 740,000 tonnes recorded in the previous cocoa season.

The farm-gate price was increased by almost 12% to 7,600 cedis per tonne (US$1,914 per tonne) for the 2016/2017 season, from 6,720 cedis per tonne (US$1,759) paid in the just-ended 2015/2016 season.

On the demand side, the third quarter European grindings data published by ECA showed an almost three per cent increase compared with the same period for the previous year, rising to 343,935 tonnes.

Market analysts are looking forward to the publication of grindings data for the July to September 2016 period for Asia and North America, expected in the middle of October.

As seen in Chart III, the European processors benefited from rising cocoa butter prices in 2016.