ABIDJAN, Côte d’Ivoire – This review of the cocoa market situation reports on the prices of the nearby futures contracts listed on ICE Europe (London) and U.S. (New York) during the month of June 2019. It aims to highlight key insights on expected market developments and the effect of the exchange rates on the US-denominated prices.

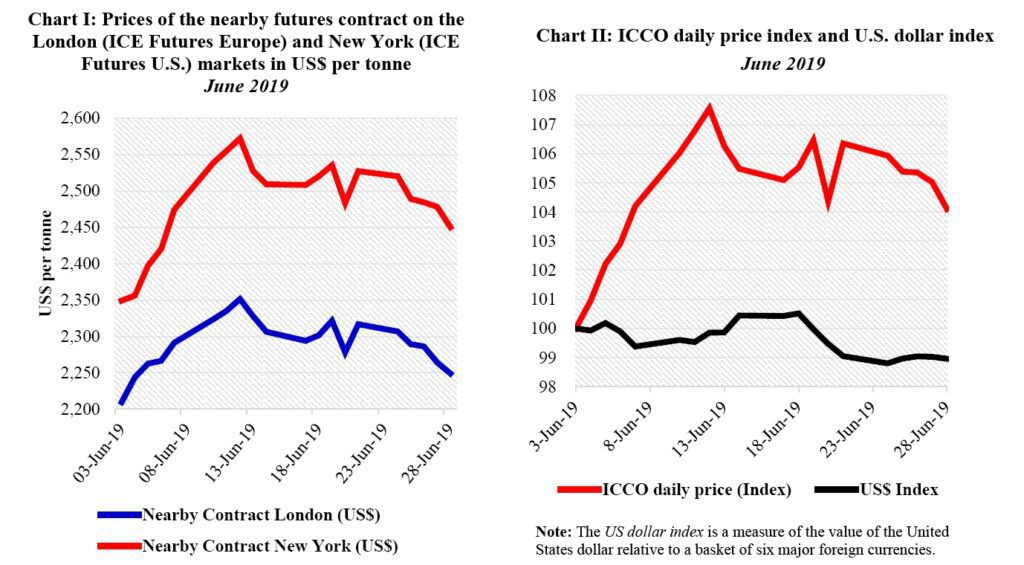

Chart I shows the development of the nearby futures prices on the London and New York markets at the London closing time. Both prices are expressed in US dollars. Chart II depicts the change in the ICCO daily price index and the US dollar index in June.

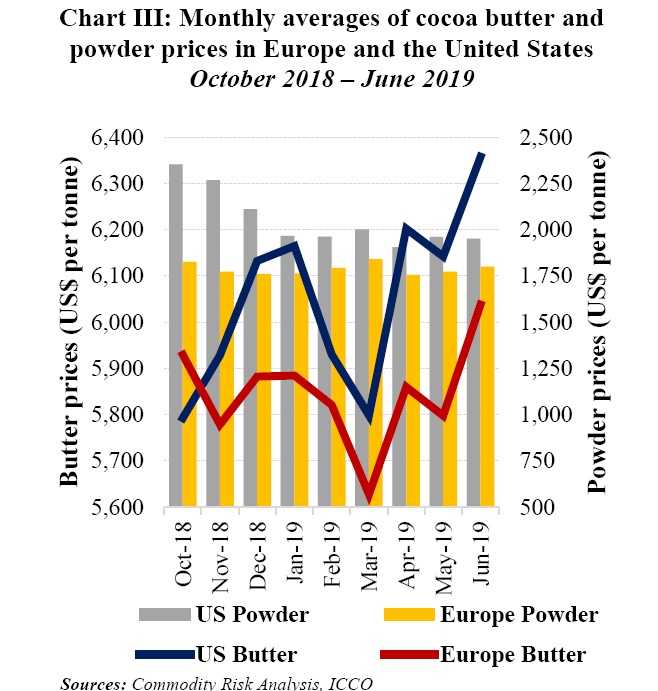

By comparing these two developments, one can disentangle the impact of the US dollar exchange rate on the development of the US dollar denominated ICCO daily price index. Finally, Chart III illustrates monthly averages of cocoa butter and powder prices in Europe and the United States since the beginning of the 2018/19 cocoa year.

Price movements

As presented in Chart I the front month cocoa futures contract prices increased on both the London and New York markets during June. Indeed, in London, compared to the beginning of the month, prices ascended by 2% to US$2,249 per tonne while in New York, they escalated by 4% to US$2,450 per tonne by the end of the month.

The continuous increase in processing activities worldwide, together with the less conducive meteorological conditions that prevailed in most West African countries stimulated prices. In addition, the Cocoa Swollen Shoot Virus Disease (CSSVD) outbreak in Ghana’s cocoa growing areas also contributed to support the bullish stance seen in prices.

The development in the nearby cocoa futures contract prices exhibited two major stages on both the London and New York markets during the month under review. Over the period 3 12 June, prices moved up by 6% to US$2,351 per tonne, and by 9% to US$2,572 per tonne, in London and New York respectively.

This rally was an implication of, on the one hand, the prospect of strong demand mainly from North America and Asia and, on the other hand, of the potential reduction in the size of the Ghanaian crop due to the CSSVD outbreak. During the same period, weather issues reported from Nigeria and Cameroon led market participants to envisage a downward revision to the crop sizes of these two countries.

However, from 12 June onwards, prices halted from their upward trend and dropped by 4% to US$2,249 per tonne in London and 5% to US$2,450 per tonne in New York. During this period, information on cocoa beans arrivals indicated ample supplies from West Africa.

The US dollar index weakened by only 1% during the month under review and consequently did not have a significant influence on the increase seen in the US denominated cocoa prices Chart II.

As depicted in Chart III since the commencement of the 2018/19 crop year, cocoa butter and powder traded higher in the United States compared to Europe. Butter prices increased by 10% from US$5,792 to US$6,358 per tonne in the United States, while in Europe these prices gained 2% moving from US$5,929 to US$6,038 per tonne.

Regarding cocoa powder, compared to the levels reached at the start of the current crop year, prices declined by 17% from US$2,353 to US$1,952 per tonne in the United States. At the same time in Europe, powder prices reduced by 1% from US$1,826 to US$1,801 per tonne.

Additionally, since October 2018, the monthly average for the front month cocoa futures contract prices increased in both London and New York. Thus, futures contract prices increased by 10% from US$2,092 to US$2,291 in London, while in New York they expanded by 16%, moving from US$2,140 to US$2,485 per tonne.

Cocoa supply and demand situation

To protect cocoa farmers’ incomes, the governments of the two top cocoa supplier s met with industry players in June to discuss a proposed floor price of US$2,600 per tonne for cocoa beans produced in Côte d’Ivoire and Ghana.

As at the time of writing, discussion of the implementation details of the floor price is underway in a technic al meeting. Moreover, forward sales for the 2020/21 cocoa crop have been suspended by the two top producers until the floor price is reached.

While the 2018/19 cocoa year is drawing to a close, cocoa production in Côte d’Ivoire continues to top the all time record. Indeed, as at 30 June 2019, cumulative cocoa arrivals at Ivorian ports, since the current season started, reached 2.0 61 million tonnes, up by 1 0 from the 1.8 69 million tonnes reached during the same period in the previous season.

Also, the Ivorian mid crop is expected to hit 600,000 tonnes, which, if realised, will be another record. Between the start of the mid crop on 1 April and 30 June 2019, cocoa beans at Ivorian ports amounted to 459,000 tonnes, up from the 391,000 tonnes recorded during the same period last year. As a measure to control production, the government of Côte d’Ivoire plans to eradicate irregular cocoa farming in protected areas over the next five years.

Regarding cocoa grinding activity, data released by the Association of Coffee and Cocoa Exporters of Côte d’Ivoire (GEPEX) showed that since the beginning of the 2018/19 cocoa year to the end of June 2019, cocoa beans grindings in Côte d’Ivoire had increased by 7.4 year on year, from 3 79,000 tonnes to 407,000 tonnes.

In Ghana the mid crop is anticipated to fall by half and range between 120,000 and 130,000 tonnes, as compared to the level of about 250,000 tonnes attained last season.

Data published by COCOBOD in the course of the month showed that cocoa bean sales for the 2018/19 crop year were estimated at 842,835 tonnes. Over the same period, cocoa processors had grindings of 180,065 tonnes, up by 6% from the 169,522 tonnes of cocoa beans pro cessed the same period last year.

Considering the reduction of the mid crop production, it is possible to process outsourced cocoa beans from neighbouring Côte d’Ivoire in order to cater for the increase in the country’s processing activities.