ABIDJAN, Côte d’Ivoire – This review of the cocoa market situation provides a brief on the September-2020 (SEP-20) and December-2020 (DEC-20) futures contracts prices listed on ICE Futures Europe (London) and ICE Futures U.S. (New York) during the month of August 2020. It aims to highlight key insights on expected market developments and the effect of the exchange rate on the US-denominated prices of the said contracts.

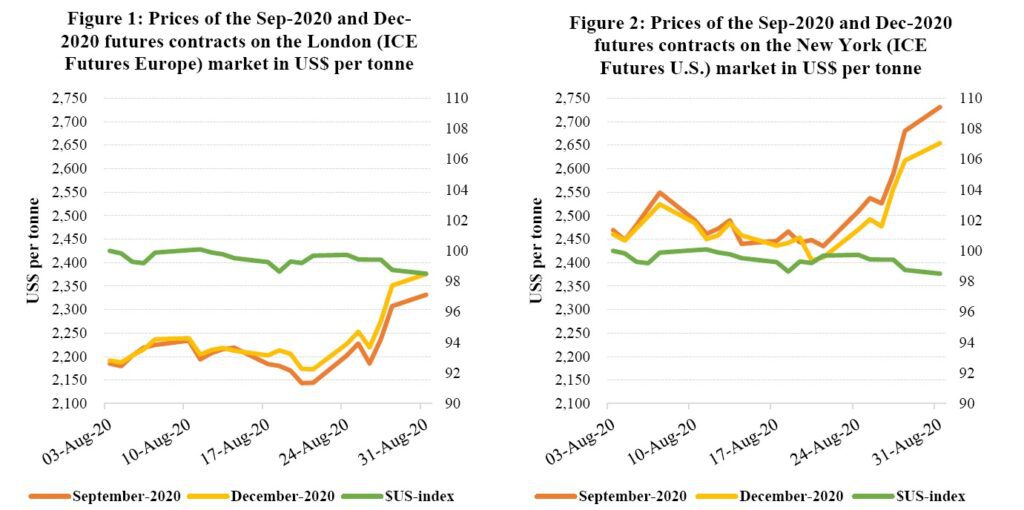

Figure 1 shows the development of the futures contracts prices on the London market while Figure 2 depicts the evolution of prices for the same futures contracts on the New York market at the London closing time.

Hence, by monitoring the development of the US dollar index in August, one can extricate the impact of the US dollar exchange rate on the development of the futures prices – denominated in US dollar – during the period under review.

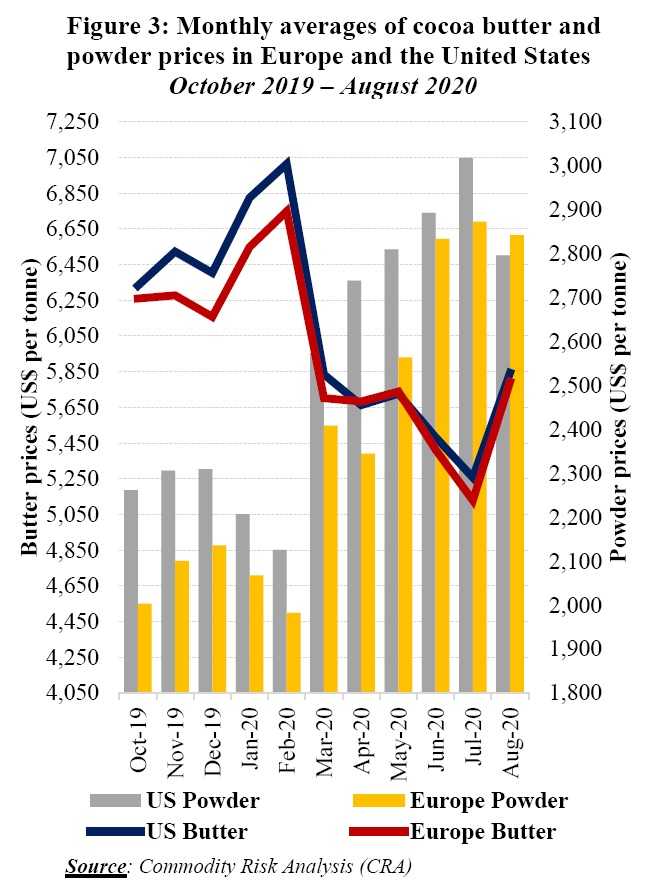

Finally, Figure 3 presents monthly averages of cocoa butter and powder prices in Europe and the United States since the start of the 2019/20 crop year.

Price movements

Price movements

The London market was in contango during July and remained in this price configuration in August, but in a lesser form. As shown in Figure 1, the front-month cocoa futures contract (SEP-20) priced with an average discount of US$19 per tonne over the DEC-20 futures contract.

Similar to July, the New York market remained in backwardation but in a more narrowed form (Figure 2). Compared to the DEC-20 futures contract, the SEP-20 contract traded with an average premium of US$23 per tonne. Furthermore, compared to the start of the month, prices on both markets rallied by the end of the month. Prices soared by 7% from US$2,185 to US$2,331 per tonne in London, and by 11% from US$2,469 to US$2,731 per tonne in New York.

For the first three weeks of August, the SEP-20 futures contract prices remained in a range on both markets. While adverse meteorological conditions observed in the cocoa regions in West Africa resulted in a bullish stance, the coronavirus (COVID-19) pandemic which is stifling demand led to bearish prices.

During this period, the London front-month contract prices moved between US$2,143 and US$2,234 per tonne and in New York, prices oscillated between US$2,435 and US$2,549 per tonne. Moving on to the last trading week of the month under review, cocoa prices rallied as recurrent below-average rainfalls which could curb production levels for the upcoming main crop were recorded in the main cocoa areas of West Africa. As a result, the SEP-20 futures contract prices stretched to an almost ten-week high at US$2,331 per tonne in London whilst in New York, prices climbed to a six-month high at US$2,731 per tonne.

In addition, a reduction in the sizes of certified stocks also contributed to price rallies. In Europe, certified stocks declined by 15% year-on-year from 130,014 tonnes to 111,025 tonnes in August. Similarly, in the United States, certified stocks contracted tremendously – down by 69% – from 32,100 tonnes to 9,859 tonnes

Movements of cocoa futures and cocoa butter prices are positively correlated, whereas the inverse occurs with cocoa powder prices. Figure 3 shows that compared with the average prices recorded at the start of the 2019/20 cocoa year, prices for cocoa butter were down during August in both Europe and the United States. Indeed, prices for cocoa butter shrank by 8% from US$6,331 to US$5,844 per tonne in the United States, while in Europe they plunged by 7%, moving from US$6,260 to US$5,792 per tonne.

Conversely, compared to the levels reached in October 2019, cocoa powder prices rocketed on both markets, up by 24% from US$2,261 to US$2,796 per tonne in the United States.

During the same time frame in Europe, powder prices soared by 42% from US$2,003 to US$2,842 per tonne.

Furthermore, compared to their average values recorded at the start of the 2019/20 cocoa year, the front-month cocoa futures contract prices contracted by 9% from US$2,423 to US$2,209 in London at the end of August 2020.

Conversely in New York, prices of the first position cocoa contract improved by 2% from US$2,467 to US$2,506 per tonne over the same period.

Cocoa supply and demand situation

At the end of August, cocoa arrivals in Côte d’Ivoire and Ghana remained lower compared to the levels attained one year ago. Indeed, as at 30 August 2020, cumulative cocoa arrivals at Ivorian ports, since the 2019/20 season started, were established at 2.043 million tonnes, down by 6.5% from 2.185 million tonnes reached during the same period in the previous season.

The recent forecasts for the 2019/20 cocoa season published by the ICCO Secretariat in its latest issue of the Quarterly Bulletin of Cocoa Statistics (QBCS) reveal anticipations of a reduction in grindings compared to the previous cocoa season. Grindings are expected to be reduced to 4.635 million tonnes, down by 150,000 tonnes.

This lower forecast reflects that the coronavirus pandemic is undermining demand in the usual mature markets (Europe and North America) as well as Asia. It is projected that processing activities will tumble by 2.5% to 1.117 million tonnes in Asia and Oceania, whereas a 1% drop to 1.007 million tonnes is anticipated in Africa.

Similarly, in the Americas, processing activities are forecast to contract by 3.2% to 874,000 tonnes while a 4.7% decline to 1.637 million tonnes is envisaged in grindings activities for Europe.