ABIDJAN, Ivory Coast – The current review of the cocoa market situation reports on cocoa price movements on the international markets during the month of July 2017.

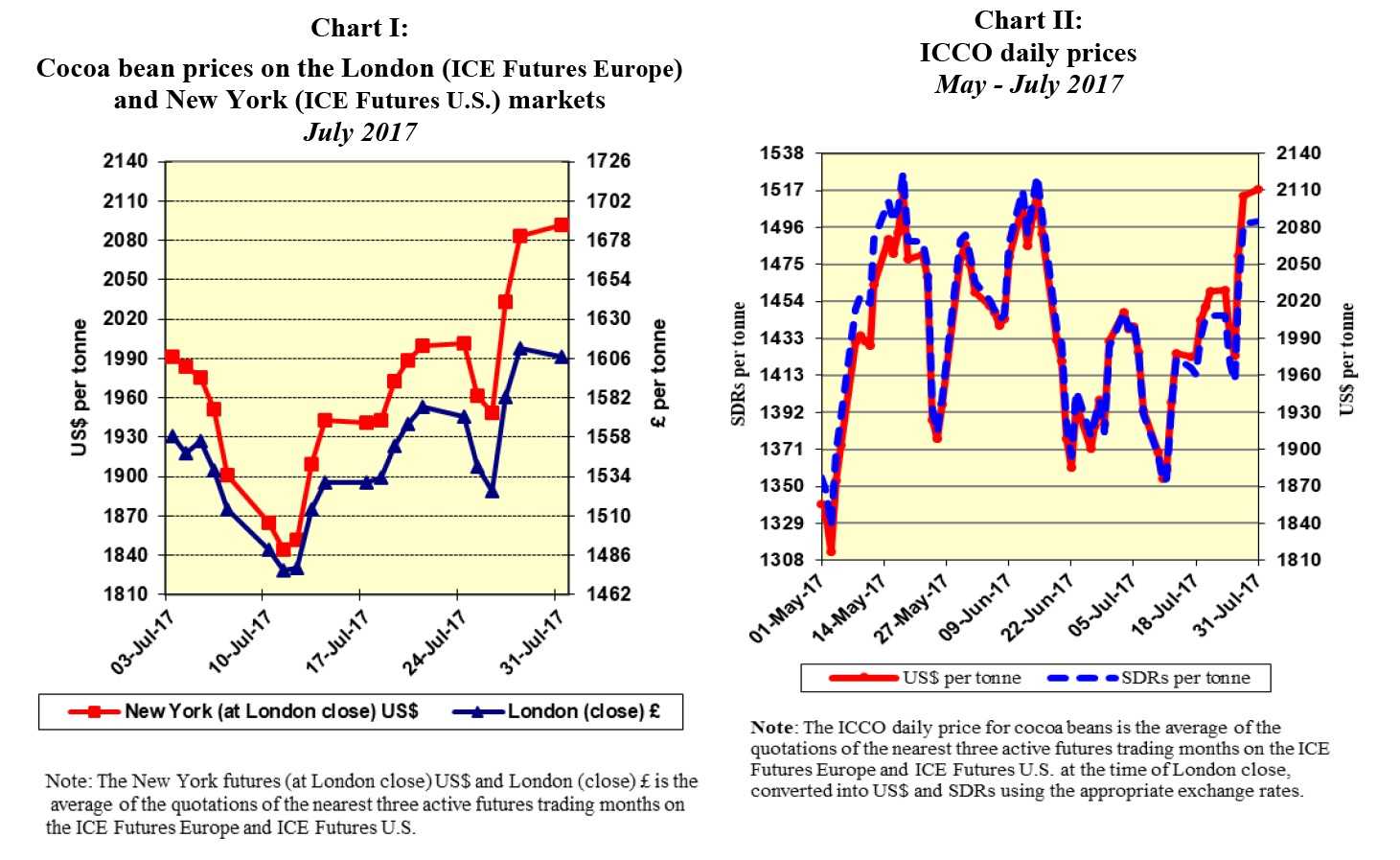

Chart I illustrate price movements of the average of the nearest three active futures trading months on the London (ICE Futures Europe) and New York (ICE Futures U.S.) markets for the month under review.

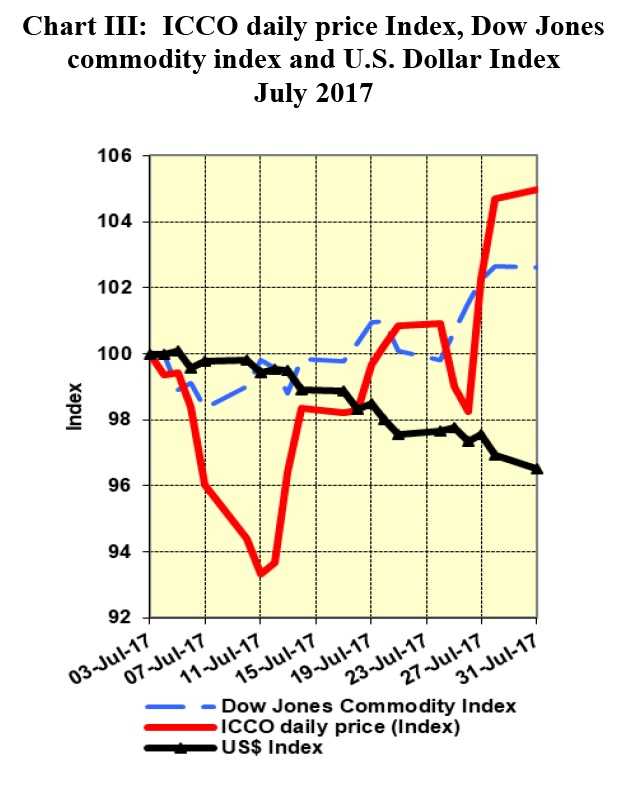

Chart II shows the evolution of the ICCO daily price, quoted in US dollars and in SDRs, from May to July 2017.

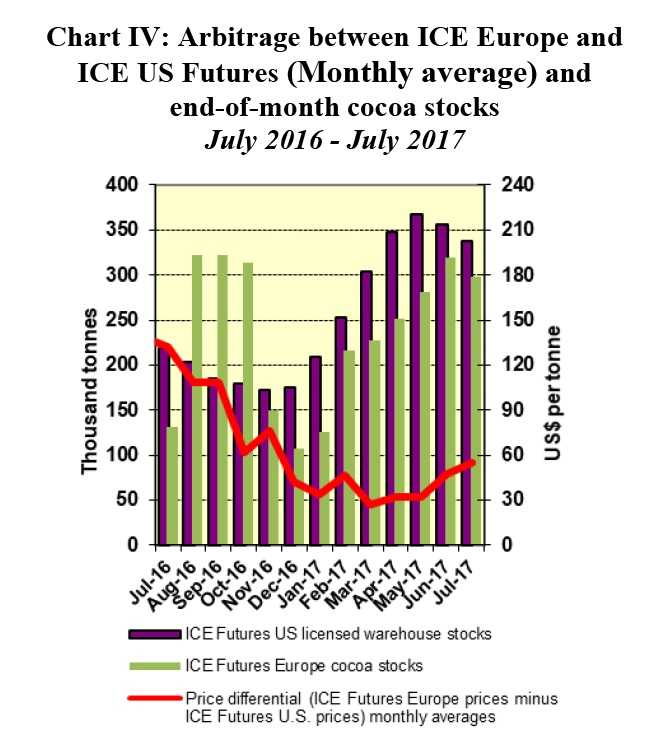

Chart III depicts the change in the ICCO daily price Index, the Dow Jones Commodity Index and the US Dollar Index in July, while Chart IV illustrates the end-of-month stocks in licensed warehouses in Europe and in the United States and the arbitrage between ICE Futures Europe and ICE Futures U.S.

Price movements

Price movements

In July, the ICCO daily price averaged US$1,989 per tonne, down by US$10 compared to the average of the previous month (US$1,998), and ranged between US$1,876 and US$2,111 per tonne.

As shown in Chart I, underpinned by the expectations of a more than higher global production for the current cocoa year, cocoa futures prices generally followed a gradual downward trend during the first seven trading sessions of the month under review.

In London and New York, compared to prices at the start of the month, cocoa futures prices dropped by five percent in London to £1,477 per tonne and by seven percent to US$1,844 per tonne in New York.

Thereafter, the release of improved grindings data from Europe and Asia as well as news of expectations of a slump in the upcoming main crop for top producer Côte d’Ivoire due to unfavourable weather conditions propelled the markets into positive territory.

Compared to the aforementioned low prices recorded by the end of the third trading week of July, cocoa futures rose by seven and eight percent to £1,576 per tonne and US$2,000 per tonne in London and New York respectively.

The rise in cocoa futures prices were however short-lived as the release of North America’s second quarter grindings data indicated a drop of 1.05%.

Consequently, compared to previous highs attained, cocoa futures dropped by 3% in both markets to £1,525 per tonne and US$1,949 per tonne in London and New York respectively.

As illustrated in Chart III, apart from the first half of July when larger than expected cocoa production from top producers resulted in cocoa prices plummeting, improved grindings data and the weakening of the US dollar mainly led cocoa futures prices to generally move higher from the middle of the month onwards.

Supply and demand situation

Supply and demand situation

On the supply side, news agency data showed that, as at 30 July 2017, cumulative cocoa bean arrivals at ports in Côte d’Ivoire reached almost 1.900 million tonnes, compared with 1.435 million tonnes recorded for the corresponding period of the previous season.

As at the time of writing, in Ghana, there was, as yet, no update report of cumulative data. At the end of August, the ICCO Secretariat will release its revised crop and grindings forecasts for the current cocoa year in its Quarterly Bulletin of Cocoa Statistics.

On the demand side, the dismal North America second quarter grindings (down by 1.05% year-on-year) reported by the National Confectioners Association (NCA) were offset by the positive figures from the European Cocoa Association for Europe (up by 2.1% compared with the corresponding period for the previous year) and the Cocoa Association of Asia (up by 9.9% year-on-year). Indeed, world grindings are expected to grow during the current cocoa season.

Certified warehouse stocks of cocoa beans

Certified warehouse stocks of cocoa beans

As shown in Chart IV, compared to last year’s data (July 2016), both markets reported an increase in the volume of certified warehouse stocks during the month under review.

In New York, volumes rose from 218,340 tonnes to 338,281 tonnes and in London, from 131,990 tonnes to 298,560 tonnes. The arbitrage spread (difference in prices) has gradually widened to an average of US$55 in July.