ABIDJAN, Côte d’Ivoire — This review of the cocoa market situation reports on the prices of the nearby futures contracts listed on ICE Europe (London) and U.S. (New York) during the month of March 2019. It aims to highlight key insights on expected market developments and the effect of the exchange rates on the US-denominated prices.

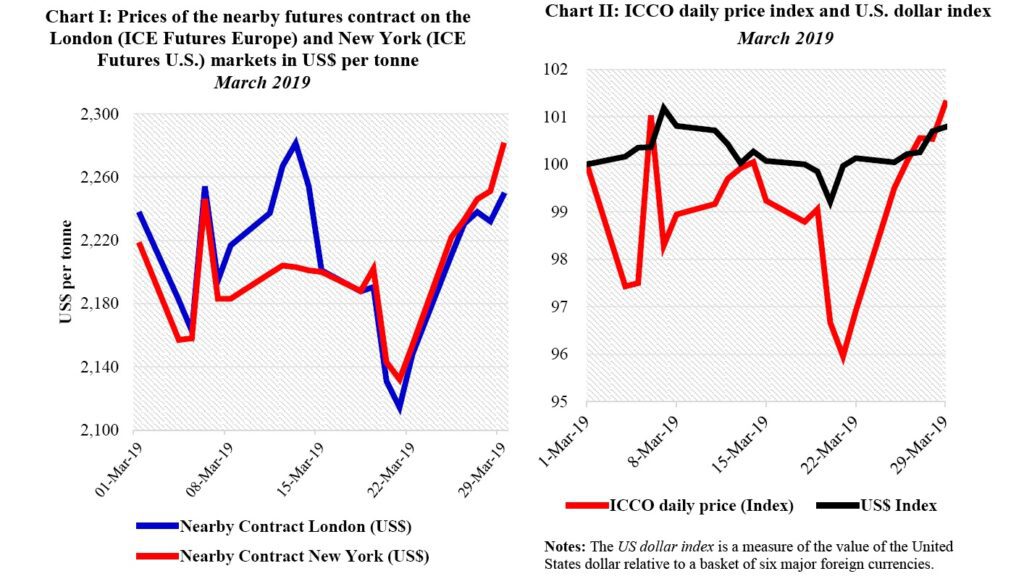

Chart I shows the development of the futures prices on the London and New York markets at the London closing time. Both prices are expressed in US dollars. African origins are priced at par with the London market, whereas they receive a premium of US$160 per tonne over the New York price.

Any departure from this expected price equilibrium is due to the differences in the size and composition of tenderable cocoa stocks in London and New York as well as their certifications rules. Chart II depicts the change in the ICCO daily price index and the US dollar index in March.

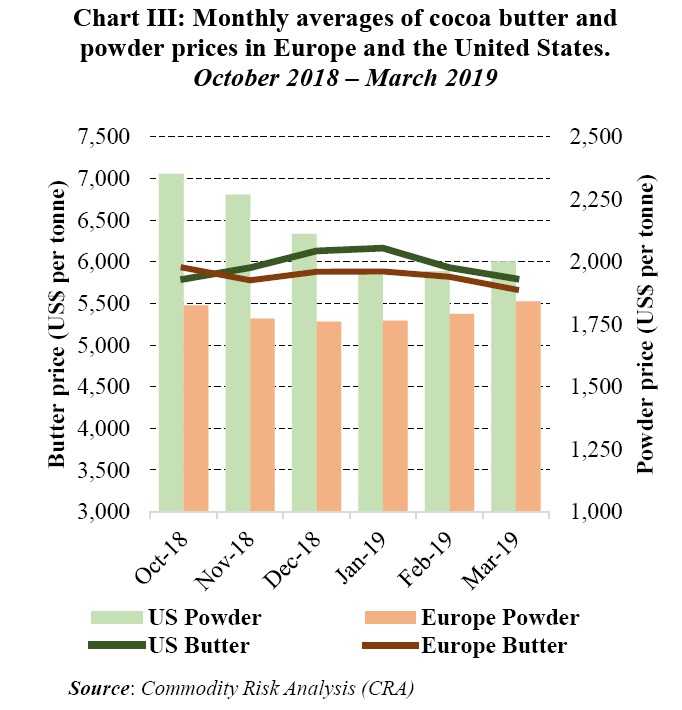

By comparing these two developments, one can extricate the impact of the US dollar exchange rate on the development of the US dollar-denominated ICCO daily price index. Finally, Chart III illustrates monthly averages of cocoa butter and powder prices in Europe and the United States since the beginning of the 2018/19 cocoa year.

Price movements

In the course of March, the prices of the front-month contract increased from US$2,236 to US$2,248 per tonne, or about 1%, in London and from US$2,217 to US$2,280 per tonne, or about 3%, in New York. (Chart I). This trend was fuelled by adverse meteorological conditions that occurred in the West African cocoa growing regions.

During the first two trading weeks of the month, prices generally followed a bullish stance despite the initial fall recorded at the beginning of the considered period. The short-lived fall in prices was a reaction to the publication of data showing ample supplies of cocoa beans from Côte d’Ivoire. Warmer and drier climate conditions prevailing later on in West Africa led to a spike of 2% in prices in both London and New York.

Thus, prices were reinvigorated from US$2,163 to US$2,201 per tonne and from US$2,158 to US$2,200 per tonne in London and New York respectively.

The isolated rise in London prices during the period 7-13 March was due to the immediate unavailability of tenderable cocoa beans to be delivered against the March contract set to expire on 14 March.

Throughout the third trading week of the month under review, prices reverted from their increase and plummeted sharply to US$2,114 per tonne in London and US$2,132 per tonne in New York. The bearish stance on prices was due to views of a strong main crop output from top West African cocoa suppliers.

However, this bearish stance was not sustained for long and from 22 March onwards, signs of unfavourable weather conditions that could harm the development of the mid-crop fuelled an increase in prices on both markets. Subsequently, the nearby cocoa contract prices rose by 5% from US$2,148 to US$2,248 per tonne in London and by 6% from US$2,154 to US$2,280 per tonne in New York.

Ultimately, the strengthening of the US dollar – by nearly 1% – during the month of March had a weak impact on the boost observed in the US-denominated cocoa price (Chart II).

As shown in Chart III, although cocoa butter prices in Europe and the United States moved in opposite ways during October and November 2018, they declined starting from December 2018 onwards. In particular, cocoa butter prices retreated by 4% from US$5,929 to US$5,667 per tonne in Europe, while in the United States the contraction rate stood at 0.1%, moving prices from US$5,792 to US$5,798 per tonne.

On the other hand, compared to the level reached at the start of the crop year, cocoa powder prices plunged by 15% from US$2,353 to US$2,001 per tonne in the United States whereas in Europe, powder prices increased by 0.9% from US$1,826 to US$1,841 per tonne.

Moreover, since the 2018/19 crop year started, the monthly average for the nearby cocoa futures contract prices increased on both London and New York. Indeed, futures contract prices increased by 6% to US$2,210 in London, while in New York they expanded by 3% to US$2,200 per tonne

Cocoa supply and demand situation

In Côte d’Ivoire, the mid-crop started in April with the Government’s decision to maintain the farm gate price at CFA750 (US$1.29) per kilogram of cocoa beans; the same price as the main crop. As at 21 April 2019, cumulative cocoa arrivals at Ivorian ports for the 2018/19 crop year were estimated at 1.803 million tonnes, up by 14% from 1.580 million tonnes recorded over the same period last season.

According to the Ghana Cocoa Board, the country’s cocoa beans production for 2018/19 is expected to weaken compared to the level reached the previous season because of cocoa-related diseases and dry weather. However, cocoa purchases were seen at 698,553 tonnes over the period 1 October 2018-4 April 2019, up from 657,604 tonnes recorded over the period 1 October 2017-12 April 2018.

Despite the strong tensions in Cameroon’s Anglophone regions; which represent the main cocoa belt in the country, cumulative arrivals of cocoa beans at the port of Douala attained 250,000 tonnes by 28 February 2019, up by 19% from the 210,000 tonnes seen for the same period of the previous season.

Grindings data released for the first quarter of 2019 by regional cocoa associations showed an increase in the year-on-year demand worldwide. Indeed, in Africa, data published by the exporters’ association (GEPEX) showed that Côte d’Ivoire’s grindings had reached 268,000 tonnes since the start of the 2018/19 crop season, up from 254,000 tonnes recorded over the same period last year.

European grindings data issued by the European Cocoa Association showed a 3.3% increase to 370,359 tonnes. In addition, the Cocoa Association of Asia posted an increase of 9.5% to 190,244 tonnes. The National Confectioners Association reported an increase of 1.98% to 121,129 tonnes for North America.