BANGKOK, Thailand – In the summer of 2023, Thailand experienced record-breaking temperatures, soaring to an unprecedented high of 45.5°C, as reported. During times of extreme heat, consumers naturally turn to hydration to relieve thirst. Latest research from Mintel reveals that 70% of Thais have actively pursued adequate water consumption as part of their commitment to maintaining a healthy lifestyle, showcasing their conscientious efforts to stay hydrated amid the challenging weather conditions.

Thailand’s unprecedented heatwave this year has also sparked a surge in discussions about refreshments, including 780k impressions since March 2023, as indicated by the social listening tool Infegy Atlas. This uptick coincided with the onset of the hot summer and escalating temperatures, indicating that Thai consumers actively seek ways to cool down and express positive sentiments around refreshments.

Rashmika Khanijou, Senior Food and Drink Analyst, Mintel Reports Thailand, said:

“Mintel’s 2023 Global Food and Drink Trend Weatherproofed Provisions highlights how brands can help consumers endure more extreme weather events. Consequently, non-alcoholic beverages are expected to play a pivotal role in providing refreshment and rejuvenation. Some added-value ingredients to watch include electrolytes and cooling herbs, which can counter the effects of heat on the body.

“Poor air quality is also becoming a matter of concern due to extreme temperatures such as those faced in Thailand. Ingredients to watch here include antioxidant-rich inclusions, which can help the body cope.”

In 2023, carbonated drinks (70%), bottled water (67%) and ready-to-drink coffee (60%) are the top choices among consumers for non-alcoholic drinks. The research also identifies a potential opportunity for hybrid drinks, with 47% of consumers expressing interest in trying them.

“Brands have an opportunity to maximise appeal with coffee and juice hybrids (‘joffee’), this being the winning hybrid combination among Thai consumers. Our research indicates that 58% of Bangkok residents (compared to 47% of the total sample) are aware of and interested in trying hybrid drinks. For brands, this presents an opportunity to develop innovative juice and coffee hybrid beverages with flavours that resonate strongly with consumers,” Khanijou added.

Looking at health benefits

When purchasing drinks, Thai consumers prioritise the health value of a beverage over flavour (35% vs 22%).

“Currently, no one flavour group is strongly perceived as being ‘functional’. With health benefits growing to become more important than flavour, the synergy of flavour and function becomes crucial for beverages to entice consumers and establish a unique identity.”

Older Thais (Gen X) exhibit a stronger inclination toward health-conscious choices compared to other generations, such as Gen Z. For example, 43% of consumers aged 45 and above prefer non-alcoholic beverages with low/no/reduced sugar, compared to 33% of Gen Z. Khanijou suggests that brands can appeal to the Gen X demographic by offering health-focused options with permissible and functional attributes.

In general, nearly half of Thais prefer beverages with ingredients known for their health benefits, such as collagen and probiotics. Rashmika added, “This highlights that Thai consumers scrutinize beverage ingredient lists, actively seeking options that contribute to their health.”

Gen Z as a key target market

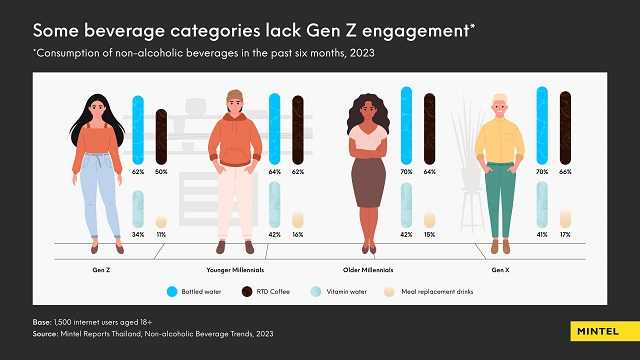

Although Gen Z represents the largest consumer segment for non-alcoholic beverages in Thailand, their consumption lags behind other age groups in certain categories such as bottled water, ready-to-drink (RTD) coffee, vitamin water and meal replacement drinks (e.g. protein-rich shakes). Mintel research indicates a significant untapped potential for brands in the Gen Z market.

Khanijou noted, “Beverage brands have an opportunity to innovate with sweet flavour profiles to target Gen Zs. Mintel research shows that over a third (37%) of Thai Gen Zs prefer non-alcoholic beverages with a sweet flavour (e.g. chocolate) over others (vs 30% of the total sample). Therefore, Gen Zs can be categorised as ‘Emotional Indulgers’, leaning towards indulgent flavour profiles.

“However, sweet beverage flavours are highly associated with being ‘unhealthy’. Brands can overcome this perception by incorporating added functional ingredients, offering a balanced and appealing beverage choice for Gen Z consumers.”