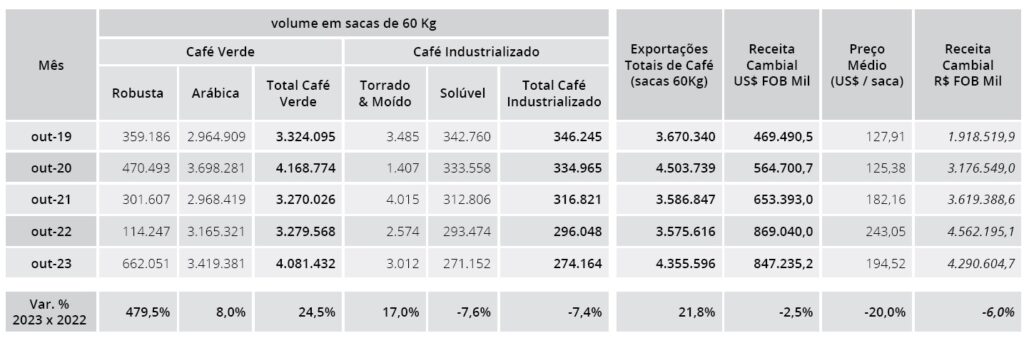

MILAN – Exports of all forms of coffee from Brazil grew 21.8% in October to 4,355,596 bags, close to a record high of 4.5 million set in 2020, Cecafé said on Monday. Green coffee exports rose 24.5% to 4.081.432 bags of which 3,419,381 bags of Arabica (+8%).

Robusta shipments soared 479.5% to 662,051 bags, the highest level on record for the month.

Conversely, sales of processed coffee (mostly soluble) were 7.4% down to 274,164 bags.

Exports of all forms of coffee for the first 10 months of calendar year 2023 are still below historical averages.

Exports of all forms of coffee for the first 10 months of calendar year 2023 are still below historical averages.

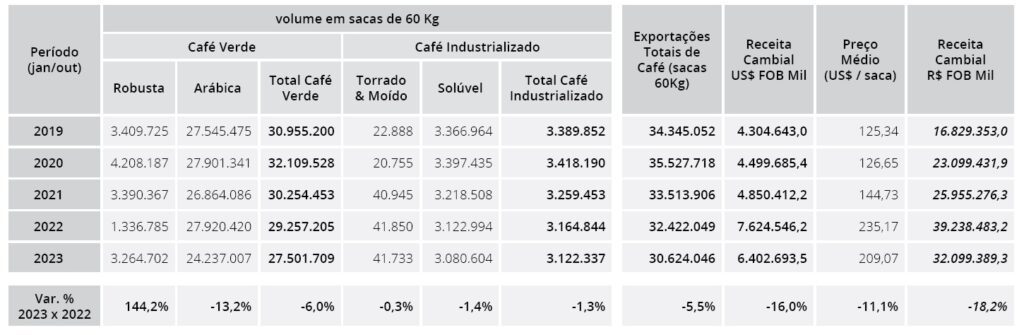

During the January-October period, Brazil exported 30,624,046 bags, down -5.5% compared to 2022. Green coffee volumes fell 6% to 27,501,709 bags.

While Arabica shipments saw a 13.2% decline to 27,501,709 bags, Robusta shipments more than doubled (+144.2%) to 3,264,702 bags.

While Arabica shipments saw a 13.2% decline to 27,501,709 bags, Robusta shipments more than doubled (+144.2%) to 3,264,702 bags.

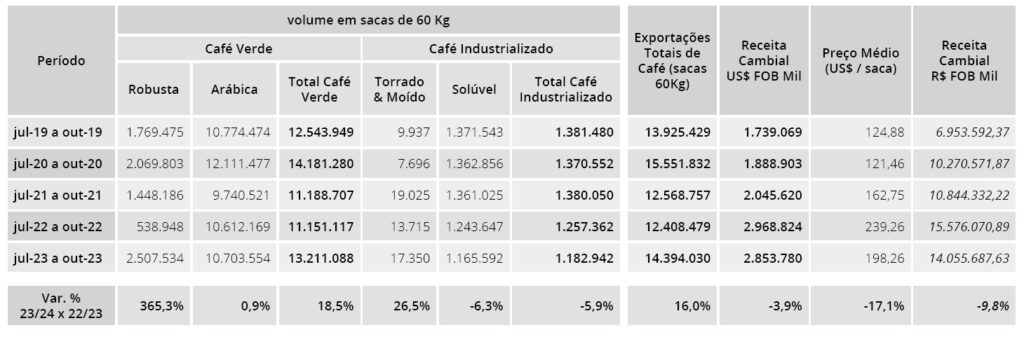

Overall exports for the first four months of crop year 2023/24 (July-October) were 16% up to 14,394,030 bags, of which 13,211,088 bags of green coffee.

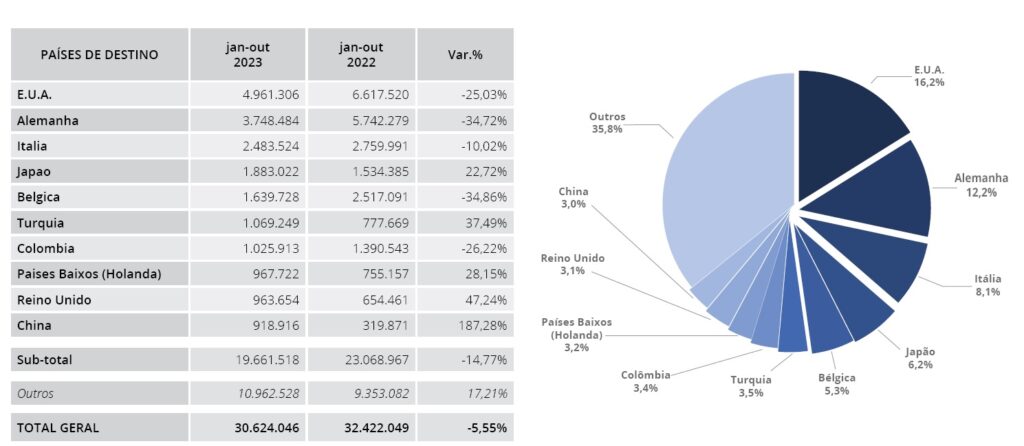

Sales to Brazil’s main markets were mostly down year-to-date, with the exception of Japan and Türkiye.

Sales to Brazil’s main markets were mostly down year-to-date, with the exception of Japan and Türkiye.

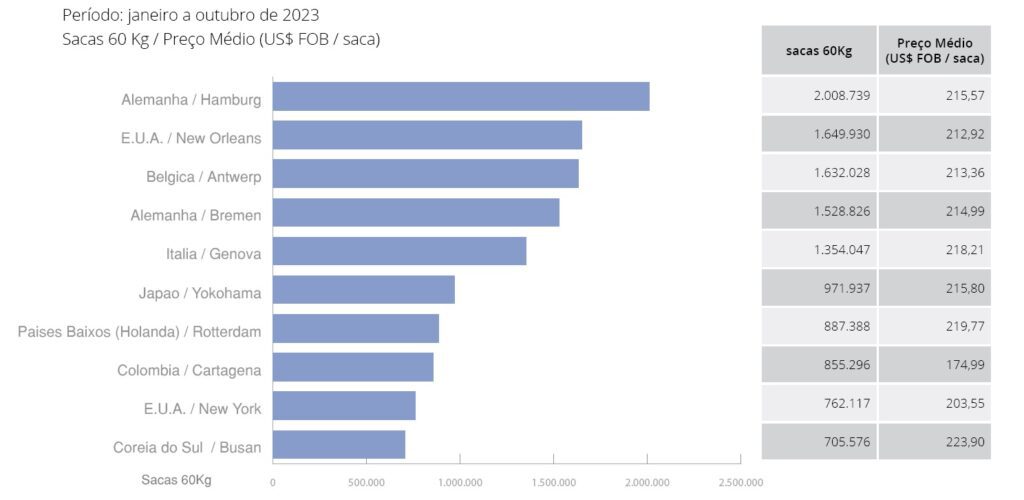

With a total of 2 million bags being exported, Hamburg emerged as the primary port of destination, followed by New Orleans, Antwerp, Bremen, and Genoa.

With a total of 2 million bags being exported, Hamburg emerged as the primary port of destination, followed by New Orleans, Antwerp, Bremen, and Genoa.

Concerns that excessive heat in Brazil could damage coffee trees triggered a rally in coffee prices Monday. The most-active Robusta futures rose as much as 2.8% in London to the highest in nearly three weeks.

Temperatures near 40C (104F) are expected for most producing regions in Brazil over this week, Climatempo meteorologist Nadiara Pereira said in a report.

Climatempo said temperatures are expected to be as high as 40 degrees Celsius (104 F) for most of Brazil’s coffee-producing regions this week, which could harm coffee trees and reduce yields.

The threat to Brazil is adding to an already tight supply from top exporters Vietnam and Indonesia.

For the Arabica variety, while most analysts expect Brazilian production to rise into next year following favorable rains, above-average heat is also driving concern, Marcelo Moreira from Archer Consulting told Bloomberg.