MILAN – Yesterday, Tuesday 28 January, the Brazil’s National Supply Company (Conab)released its first report for this year’s harvest. The field survey was carried out in December. It was supplemented, as always, by data provided by producers, associations and local institutions, as well as satellite imagery. It is important to stress that this is a preliminary estimate, drawn up months before the start of the harvest.

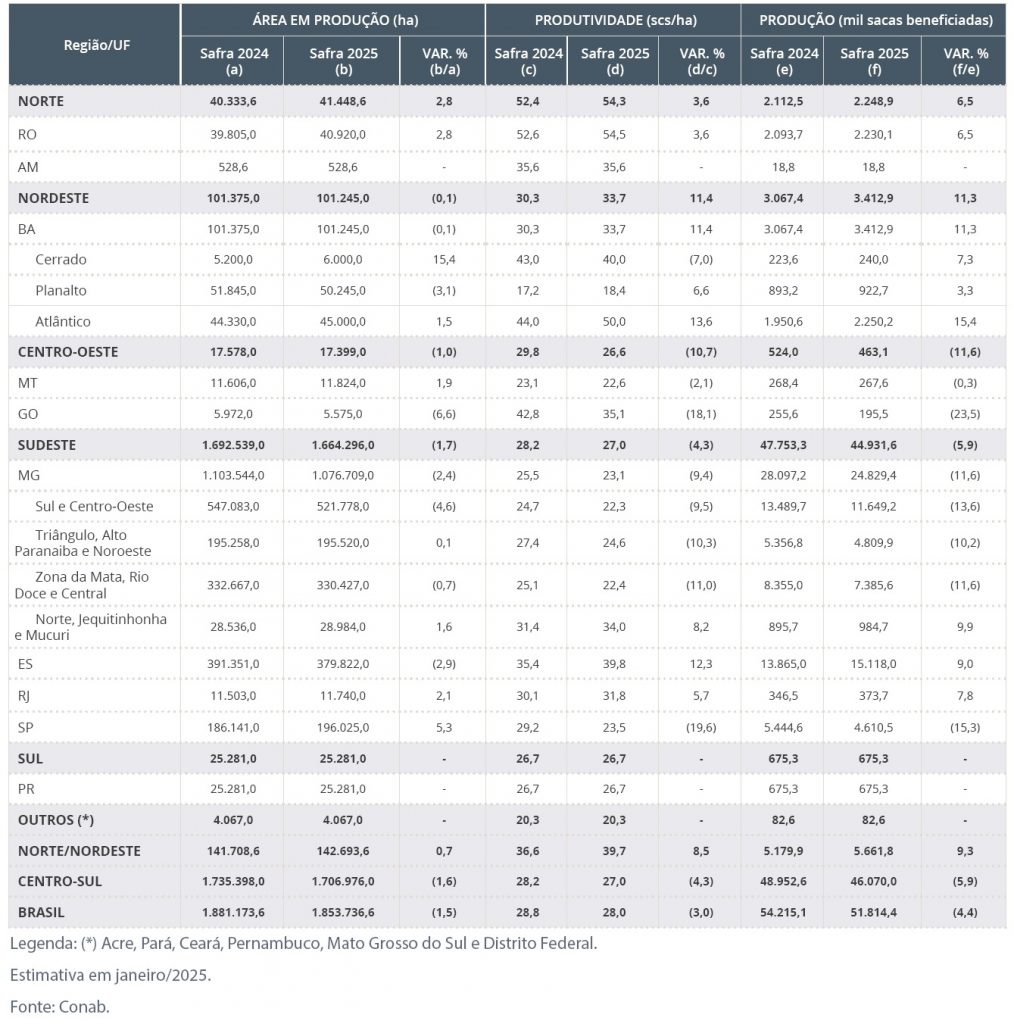

Conab forecasts 2025/26 production at 51.81 million bags, down 4.4 % compared to 2024/25. This is the lowest production level recorded since 2022/23, when production reached 50.9 million.

In a season marked by an off-year in the Arabica cycle, the effects of drought and high temperatures further impacted overall productivity, which fell to 28 bags/ha nationwide: 3% less than in 2024.

The area under cultivation increased slightly (+0.5%), to 2.25 million hectares, with a little contraction, while the area in production fell slightly (-1.5%) to 1.85 million hectares.

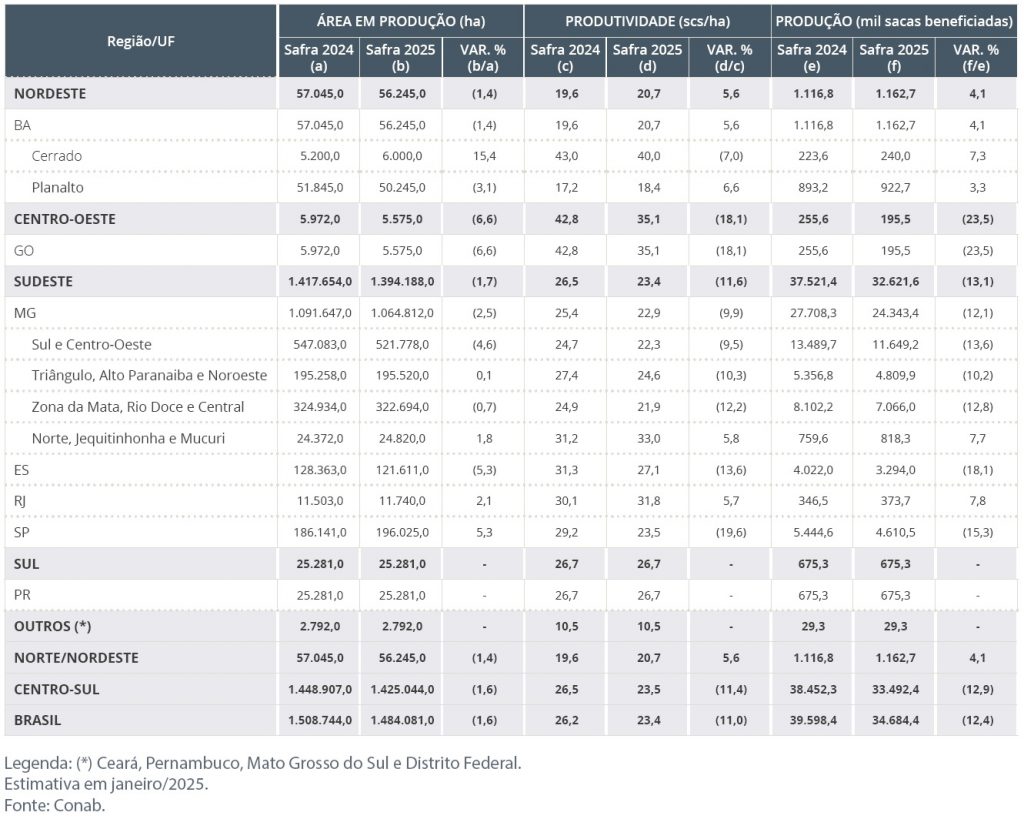

The painful notes come precisely from the Arabicas, whose production is seen down 12.4% to 34.7 million due to the aforementioned climatic and cyclical factors. Productivity should drop from 26.2 to 23.4 bags/ha (-11%). Added to this is a contraction of the production areas by 1.6%.

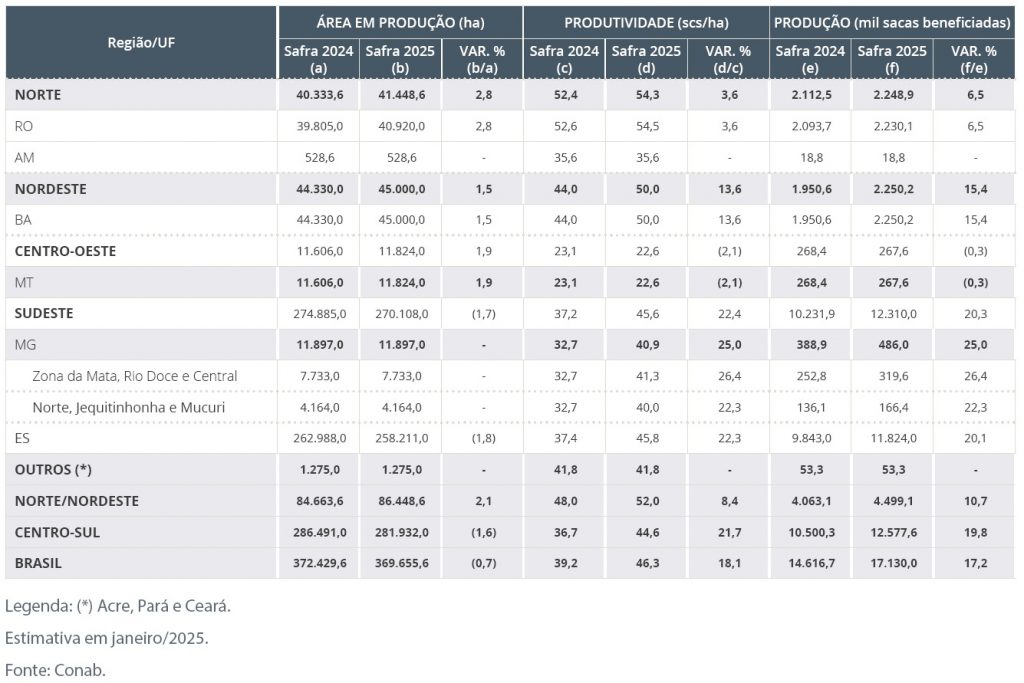

The Robusta crop, on the other hand, will soar to new highs, up 17.2% to 17.1 million, despite a slight reduction in the area in production, offset by an 18.1% increase in productivity to 46.3 bags/ha.

Below is a summary of the Conab estimate, followed by tables with estimates for Arabicas and Robustas

It will be a negative year especially for Minas Gerais, Brazil’s largest producing state and the world’s largest Arabica-producing area. According to Conab, the state production will fall by 11.6% to 24.8 million.

It will be a negative year especially for Minas Gerais, Brazil’s largest producing state and the world’s largest Arabica-producing area. According to Conab, the state production will fall by 11.6% to 24.8 million.

With the return of the rains, starting in September/October 2024, crops regained vigour and developed well.

However, the damaging effects of the long drought period have had an irreversible impact on the trees’ potential.

In particular, heavy defoliation has reduced the trees’ ability to carry out photosynthesis and thus provide the energy and nutrients needed to adequately support the vegetative phases after flowering. This already unfavourable picture has been exacerbated by the occurrence of a negative year in the two-year Arabica cycle in most areas.

All the main regions therefore seem destined to produce less than last year.

Starting with Sul and Centro-Oeste, where Conab forecasts a 13.6% drop in the crop to 11.65 million. Triângulo, Alto Paranaiba and Noroeste will also be down 10.2% to 4.8 million. In Zona da Mata, Rio Doce and Central, the harvest will be just under 7.4 million (-11.6%). Only the Norte, Jequitinhonha and Mucuri regions (+7.7%) will buck the trend.

In Espírito Santo, on the other hand, production will rise by 9% to 15.1 million bags, thanks to a Robusta crop of over 11.8 million bags (+20.1%), boosted by a 22.3% increase in productivity.

Arabica production will remain at just under 3.3 million bags (-18.1%), reflecting the negative cycle and the unfavourable weather conditions. Productivity will fall to 27.1 bags/ha (-13.6%), still above the national average.

Weather and cyclical factors will also affect the state of São Paulo (Arabica), where production will fall by 15.3% to 4.61 million. The sharp fall in productivity (-19.6%) was offset by a partial increase in the area under cultivation (+5.3%).

Positive outlook for the State of Bahia: production is expected to surge by 11.3% to 3.41 million, with increases in all areas. Robusta production will rise by 15.4% to 2.25 million, with a productivity of 50 bags/ha. Arabica production is estimated at 1.16 million (+4.1%), with productivity reaching 40 bags/ha in the Cerrado.

A slight increase both in acreage and productivity will bring production in the state of Rondônia to 2.23 million bags (+6.5%). Yields per hectare will reach a new record-high of 54.5 bags/ha.

Finally, production in Paraná is expected to be unchanged from last year at 675,300 bags.

Conab’s figures sent coffee futures prices sharply higher. In New York, the main contract gained 2.4% to close at a new all-time high of 357.50 cents. London rose 1.8% to settle at $5,560, just below the day’s high. The strength of the Real, at two-month highs against the Dollar, also contributed to the rally.