ABIDJAN, Côte d’Ivoire – The current review of the cocoa market situation reports on cocoa price movements on the international markets during the month of June 2017.

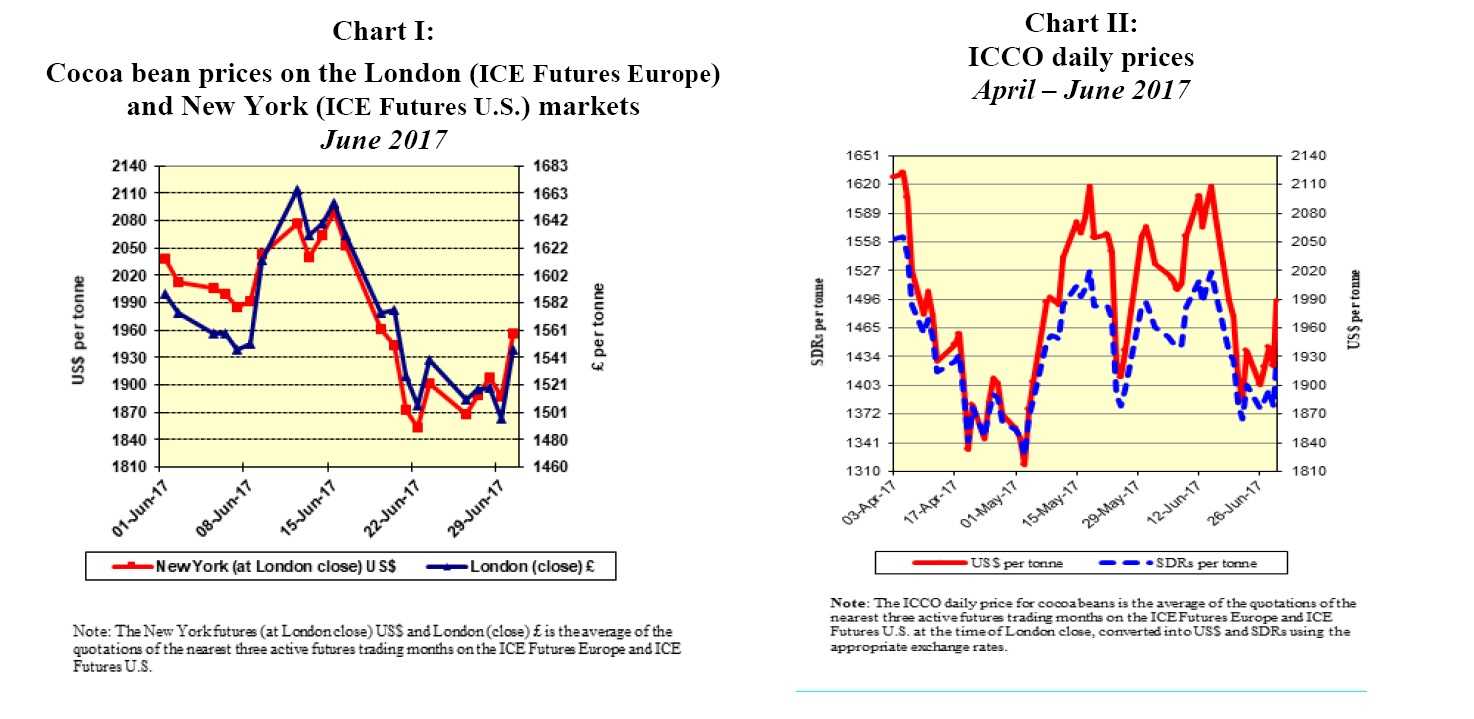

Chart I illustrate price developments of the average of the nearest three active futures trading months on the London (ICE Futures Europe) and New York (ICE Futures U.S.) markets for the month under review.

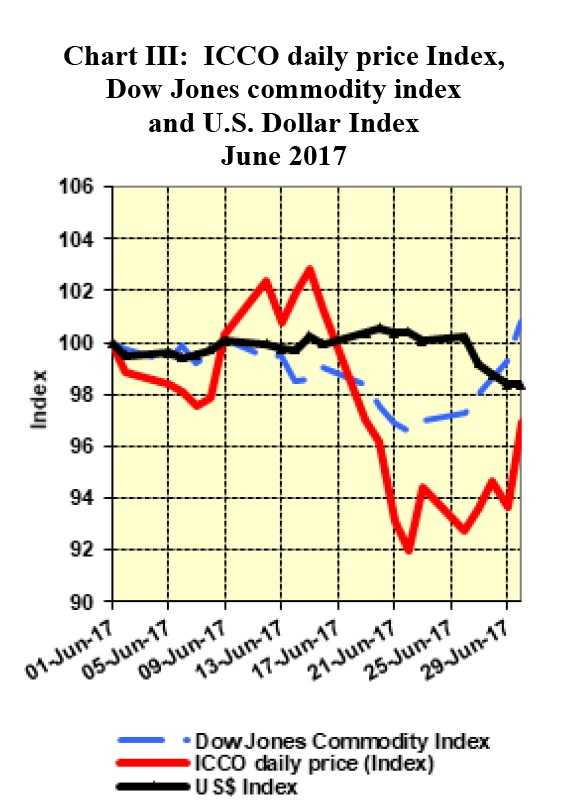

Chart II shows the evolution of the ICCO daily price, quoted in US dollars and in SDRs, from April to June 2017.

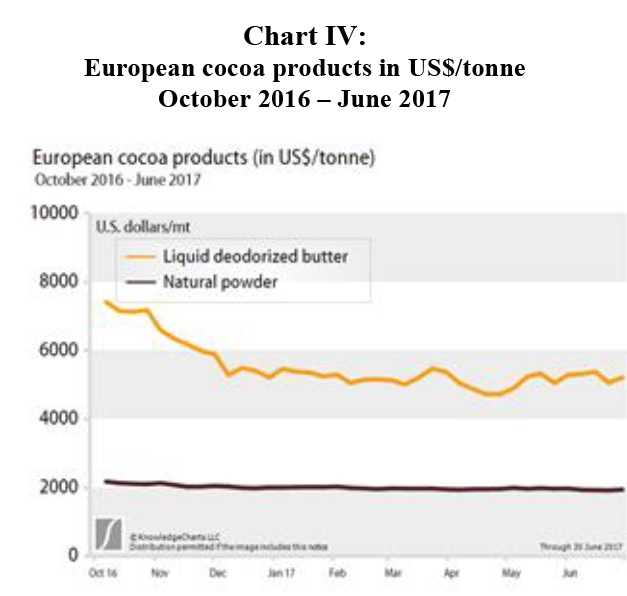

Chart III depicts the change in the ICCO daily price Index, the Dow Jones Commodity Index and the US Dollar Index in June while Chart IV presents the prices of European cocoa products since the beginning of the 2016/2017 cocoa year.

Price movements

Price movements

In June, the ICCO daily price averaged US$1,998 per tonne, up by US$15 compared to the average of the previous month (US$1,983), and ranged between US$1,885 and US$2,108 per tonne.

As shown in Chart I, at the beginning of June, cocoa futures prices followed a downward trend as expectations of a more than higher global production made the headlines.

In London and New York, compared to prices at the start of the month, cocoa futures prices dropped by three percent in both markets to £1,547 and US$1,985 per tonne respectively.

However, cocoa futures reverted from the downward trend during the second week of the month and recovered the losses made.

Adverse weather conditions were the major bullish fundamentals that contributed to the price rise.

This was indicated by reports of limited supplies to ports in Côte d’Ivoire due to heavy rains in major growing regions in the country. In addition, currency movements also played a role in the price rise.

Indeed, the greater increase in the London market reflected how the British pound sterling depreciated strongly against the US dollar as a result of the political uncertainty that pertained after the United Kingdom election that denied any party a majority in parliament.

Thus, in London, cocoa prices increased to £1,665 per tonne and to US$2,090 per tonne in New York. However, the price rise was short-lived and cocoa futures prices reverted to a downward trend against the backdrop of excess global supplies with reports from the Ghana Cocoa Board indicating that the country’s main crop production had reached a six-year high of 882,175 tonnes.

Thereafter, amid larger-than-expected cocoa beans supplies and lacklustre growth in demand, cocoa futures ranged within the lows of £1,496 and £1,547 per tonne in London and between US$1,853 and US$1,956 per tonne in New York.

As shown in Chart III, influenced by the movements of the US$ against other major currencies, most commodities were generally lower although cocoa prices fell more sharply, against the backdrop of ongoing concerns related to excess supplies.

Supply and demand situation

Supply and demand situation

Although reports indicated that the harvested mid-crop beans in Côte d’Ivoire may have been affected by the adverse weather conditions, supply from the country has continued to be larger than expected.

Cocoa arrivals since the start of the season are reported to have reached around 1,902,000 tonnes by July 16 compared to 1,422,000 tonnes for the same period of the previous season.

With Ghana maintaining its farmgate price at 7,600 Ghana cedis (US$1,914) per tonne for the mid-crop, news agencies reports indicate that the price gap is fuelling the activities of cocoa beans smuggling from Côte d’Ivoire to Ghana and this is reported to be inflating the cocoa production levels in the country.

On the demand side, the second quarter European grindings, published by the European Cocoa Association was in line with market expectations and indicated an increase of 2.1 percent from the same period last year to 331,850 tonnes.

As at the time of writing, grindings data from other regional cocoa associations had not been published.

As seen in Chart IV, while cocoa butter prices remained high at levels above US$4,000 per tonne during the month under review, on the other hand, ample stocks of cocoa powder have led the price of the product to be virtually flat.

As seen in Chart IV, while cocoa butter prices remained high at levels above US$4,000 per tonne during the month under review, on the other hand, ample stocks of cocoa powder have led the price of the product to be virtually flat.

Indeed, an increase in consumers’ preference of a confectionery with higher cocoa content have supported cocoa butter prices.