AMSTERDAM, The Netherlands – Dutch coffee and tea company D.E Master Blenders 1753 reported 12-month results for Fiscal Year 2013[1] in line with guidance.

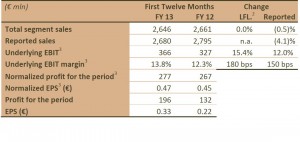

Key Highlights First Twelve Months Fiscal Year 2013:

- Total segment sales stable on like-for-like [2] basis; reported segment sales down (0.5)%

- Gross margin improved 270 bps to 40.4%

- A&P investments up 26%

- Underlying [3] EBIT margin up 180 bps to 13.8%

- Normalized [3] earnings per share at € 0.47

- Operating working capital improved 590 bps to 8.6% of sales

Total segment sales remained stable at € 2,646 mln, on a like-for-like basis, in the first twelve months of FY 13. This performance was driven by an improvement of mix/other of 2.2%, while price contributed 0.1%.Volumes were down 2.3%. Total reported sales decreased by 0.5%, with acquisitions contributing 0.6% while currency translation effects had a negative impact of 1.1%.The gross margin increased 270 bps to 40.4%, excluding green coffee export sales.

This increase was largely driven by the substantial drop in green coffee Arabica prices and mix. A&P spend went up by 26% to support our brands and product introductions across the entire portfolio. SG&A costs went down by 3% driven by “Fit for Growth”, the cost optimization program that was launched in 2012, delivering € 27 mln of cost savings in the first twelve months of FY 13. The resulting underlying EBIT margin significantly improved by 180 bps to 13.8%, on a like-for-like basis.

Normalized profit and normalized earnings per share amounted to € 227 mln and € 0.47, respectively. Reported profit, including the unusual items, and reported earnings per share amounted to € 196 mln and € 0.33, respectively.

Operating working capital[7] as a percentage of total sales improved by 590 bps to 8.6% freeing up € 154 mln in cash. The improvement of 590 bps was largely driven by a reduction in inventories with good progress made in trade payables and trade receivables.

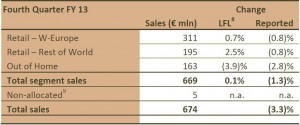

Total segment sales increased 0.1% to € 669 mln, on a like-for-like basis, in the fourth quarter of FY 13. This strong rebound, compared to the decline of (3.2)% in the preceding quarter, can be attributed to the performance of Retail Western Europe returning to growth. The Company’s sales performance had a strong mix/other development of 3.7%, reflecting the success of our focus on premiumization.

Volume performance improved to a decrease of only (1.4)%, versus (4.6)% in the third quarter. Price, however, had a negative effect of (2.2)%, reflecting the increased pressure to lower consumer prices, as the result of the substantially lower green coffee prices. Reported total segment sales decreased by (1.3)% driven by a negative currency translation of (1.5)%, with acquisitions adding 0.1%.

[1] The Company’s current accounting period runs from July 1, 2012 until December 31, 2013 to allow the Company to report on a calendar year basis from calendar year 2014 onwards. [2] Like-for-like (LFL) growth is at constant scope of consolidation and constant exchange rates [3] This represents a non-IFRS measure.

The reason for the inclusion of the measure along with the definition and reconciliation to the comparable IFRS measure can be found in appendix 1 of this release [4] Like-for-like (LFL) growth is at constant scope of consolidation and constant exchange rates [5] This represents a non-IFRS measure.

The reason for the inclusion of the measure along with the definition and reconciliation to the comparable IFRS measure can be found in appendix 1 of this release. [6] Non-allocated sales represent green coffee export sales. The Company announced in CY 12 to reduce these sales to around € 45 mln from FY 13 onwards. Non- allocated EBIT mainly represents corporate overhead costs and EBIT contribution from green coffee export sales, the latter being negligible in FY 13. [7] Operating working capital is explained and reconciled to the closest IFRS measure in appendix 1.

[8] Like-for-like (LFL) growth is at constant scope of consolidation and constant exchange rates [9] Non-allocated sales represent green coffee export sales. The Company announced in CY 12 to reduce these sales to around € 45 mln from FY 13 onwards.