TREVISO – De’ Longhi S.p.A. Results of the 9 months 2021: a trend still in strong growth; the targets for the year are confirmed. The ceo Massimo Garavaglia has commented: “The third quarter showed a robust growth trend at a high single digit rate, despite the challenging comparison with the same quarter of last year, which recorded a tremendous growth of +26% versus 2019.

The exceptional results obtained in this macroeconomic environment were accompanied by the planned acceleration of investments in communication and marketing, which found maximum expression in the launch of the Group’s first global campaign starring Brad Pitt, the Group’s new Ambassador and perfect icon to represent the path we are making towards the affirmation of our brands in the “Life style” space. For this 2021 we believe we can continue to look positively at the evolution of the business, in face of the growing global difficulties in the distribution and production areas, and therefore we confirm the targets and guidance for this 2021 previously communicated.”

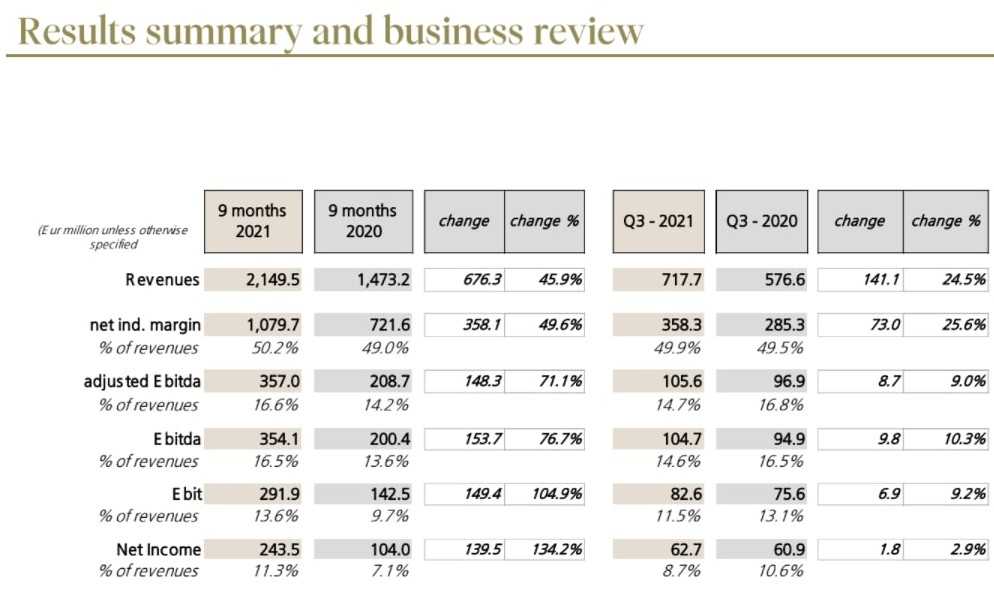

De’ Longhi: Results summary and business review

General outlook

The last few months have been characterized by a macroeconomic scenario of increasing complexity on a global level, especially for whatever is related to the production and supply chain, as unanimously highlighted by all players in our industry and beyond. In this context, the Group has been able to give continuity to growth in almost all segments, without compromising on its strategy in terms of prices and industrial and product investments as well as in communication and marketing. In particular, in the latter area, the third quarter saw a marked acceleration of activities and investments, culminating in the launch of the new global communication campaign on coffee which sees Brad Pitt – a perfect icon for everything that today identifies Life-style – as the Group’s Ambassador.

Once again the Group has demonstrated resilience and flexibility in addressing the difficulties that have emerged in the markets, thanks above all to the exceptional dedication and competences of its employees and the extraordinary efficiency of its production platform. Confirming the above, the robust high single digit growth of revenues at constant perimeter in the quarter is even more noteworthy considering the difficult comparison with last year, whose quarterly revenue grew by 26%, so reflecting the inherent strength of the core segments.

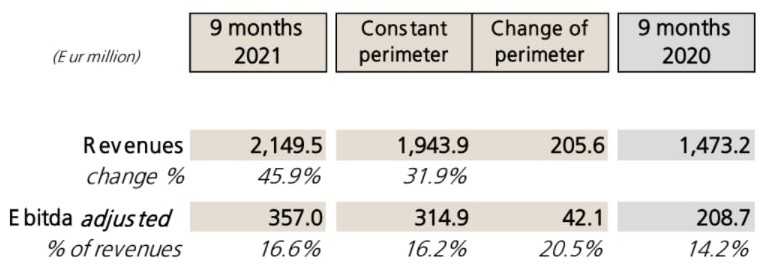

The De’ Longhi Group’s scope of consolidation in the nine months of 2021 saw the inclusion, for the entire period, of the American group Capital Brands

And, starting from April 1st , of the Swiss group Eversys, active in the coffee machines segment and whose entire share capital was acquired by De’ Longhi on May 3, 2021. The acquired companies contributed € 205.6 million in revenues and € 42.1 million in adjusted Ebitda in the nine months.

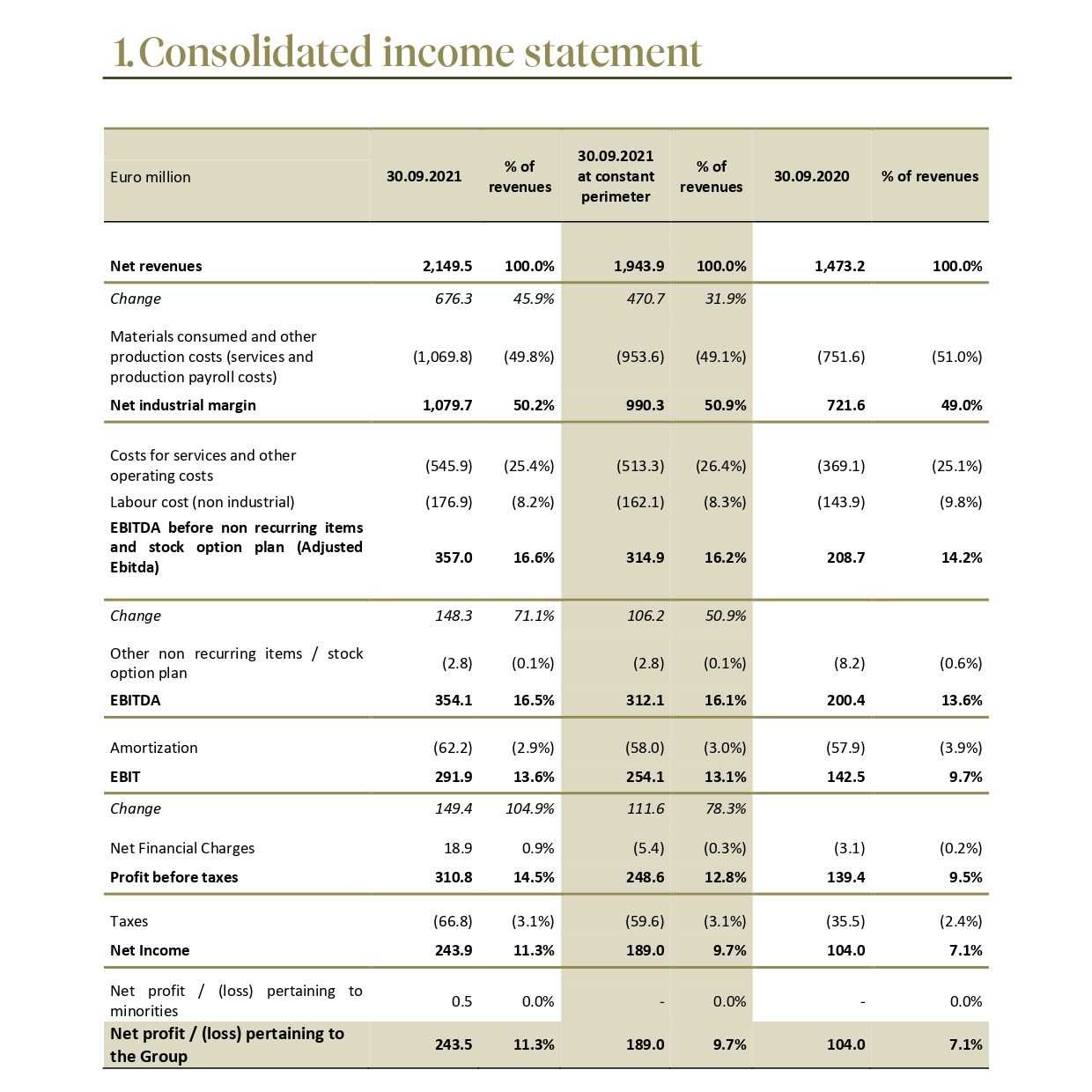

For the purpose of comparison with 2020, in some cases we present the data on a “like-for-like basis”,i.e. excluding the two above-mentioned acquired companies from the scope of consolidation. Consolidated revenues in the first nine months amounted to € 2,149.5 million, with an increase of 45.9%. The expansion of the Group on a like-for-like basis was 31.9% with a turnover of € 1,943.9 million.

For the purpose of comparison with 2020, in some cases we present the data on a “like-for-like basis”,i.e. excluding the two above-mentioned acquired companies from the scope of consolidation. Consolidated revenues in the first nine months amounted to € 2,149.5 million, with an increase of 45.9%. The expansion of the Group on a like-for-like basis was 31.9% with a turnover of € 1,943.9 million.

The currency effect in the 9 months was negative on revenues for approx. 3.3 percentage points of growth (49% growth at constant exchange rates), but with a positive impact on the adjusted EBITDA which led to a margin of 16.6% in the period, instead of 16.1% at constant exchange rates.

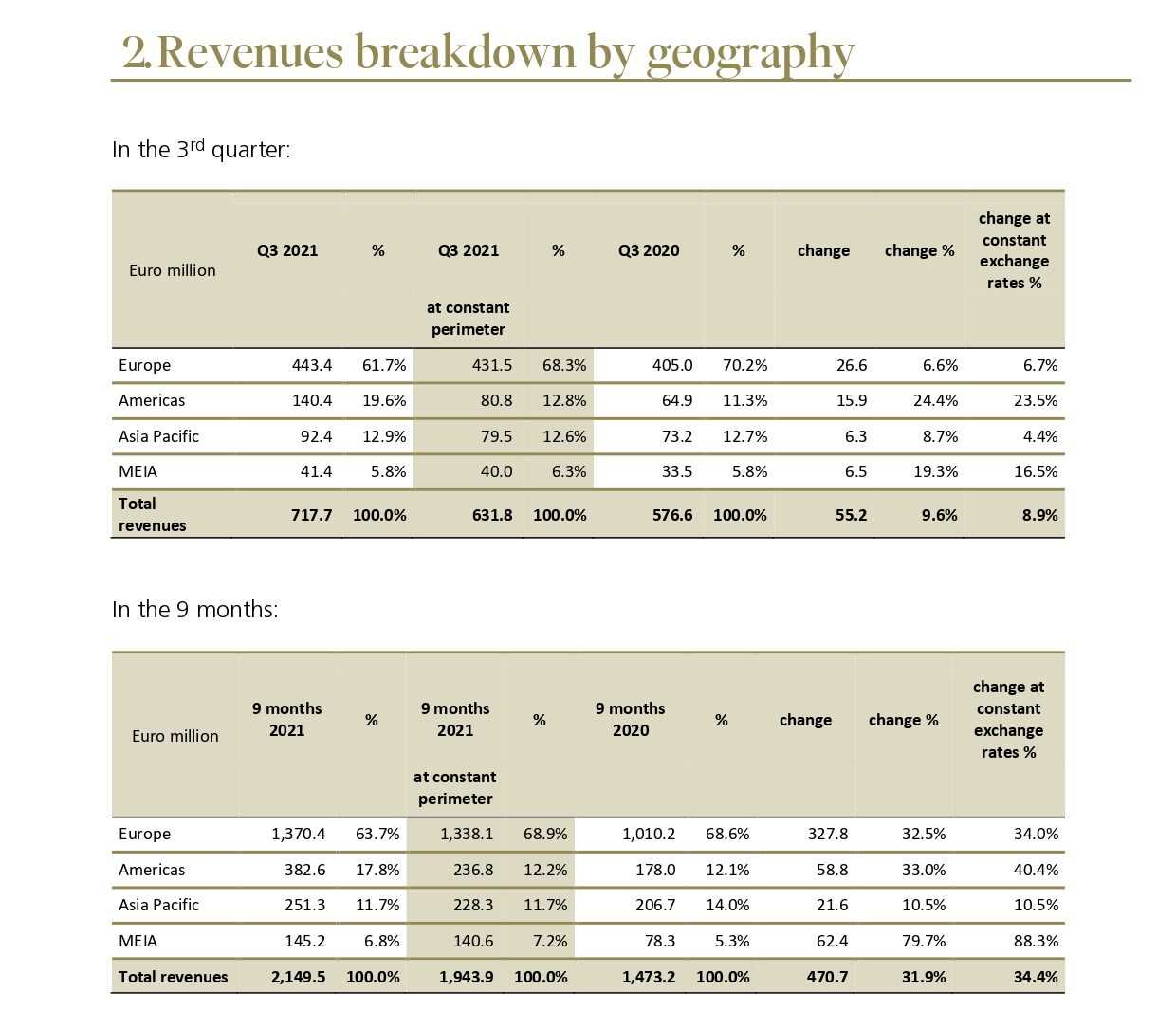

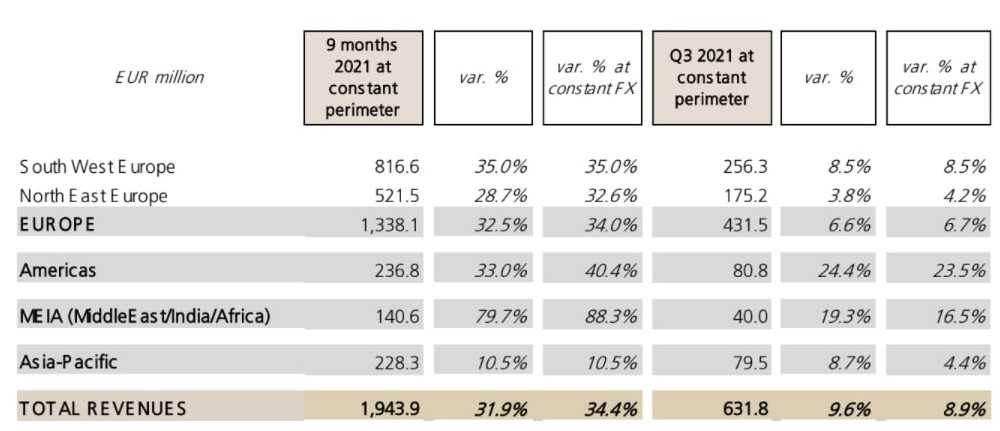

All the main geographies have achieved growth in revenues both in the nine months and in the third quarter

At a constant perimeter:

At a constant perimeter:

- South-Western Europe achieved high single digit growth in the quarter, confirming the positive trend already highlighted in the first half of the year; in continuity with the previous months, Germany and France achieved double digit growth, together with other countries such as Austria and Greece;

- North-Eastern Europe grew by 3.8% in the quarter (4.2% at constant exchange rates), thanks to the strong expansion of Russia and the Scandinavian region;

- the Americas region confirmed a double digit growth rate (+ 24.4%) in the quarter, in line with the strong trend highlighted since the beginning of the year;

- in the quarter the MEIA region (Middle East, India, Africa) achieved a robust double digit growth, maintaining solid expansion in the nine months, with a growth rate at constant exchange rates of 88.3%, to which all main markets contributed;

- finally, the Asia Pacific region grew at a high single digit rate in the quarter, thanks in particular to the development of Australia, New Zealand and South Korea. During the first nine months of 2021, on a like-for-like basis, all product segments went up and more specifically those segments considered “core” grew very strongly.

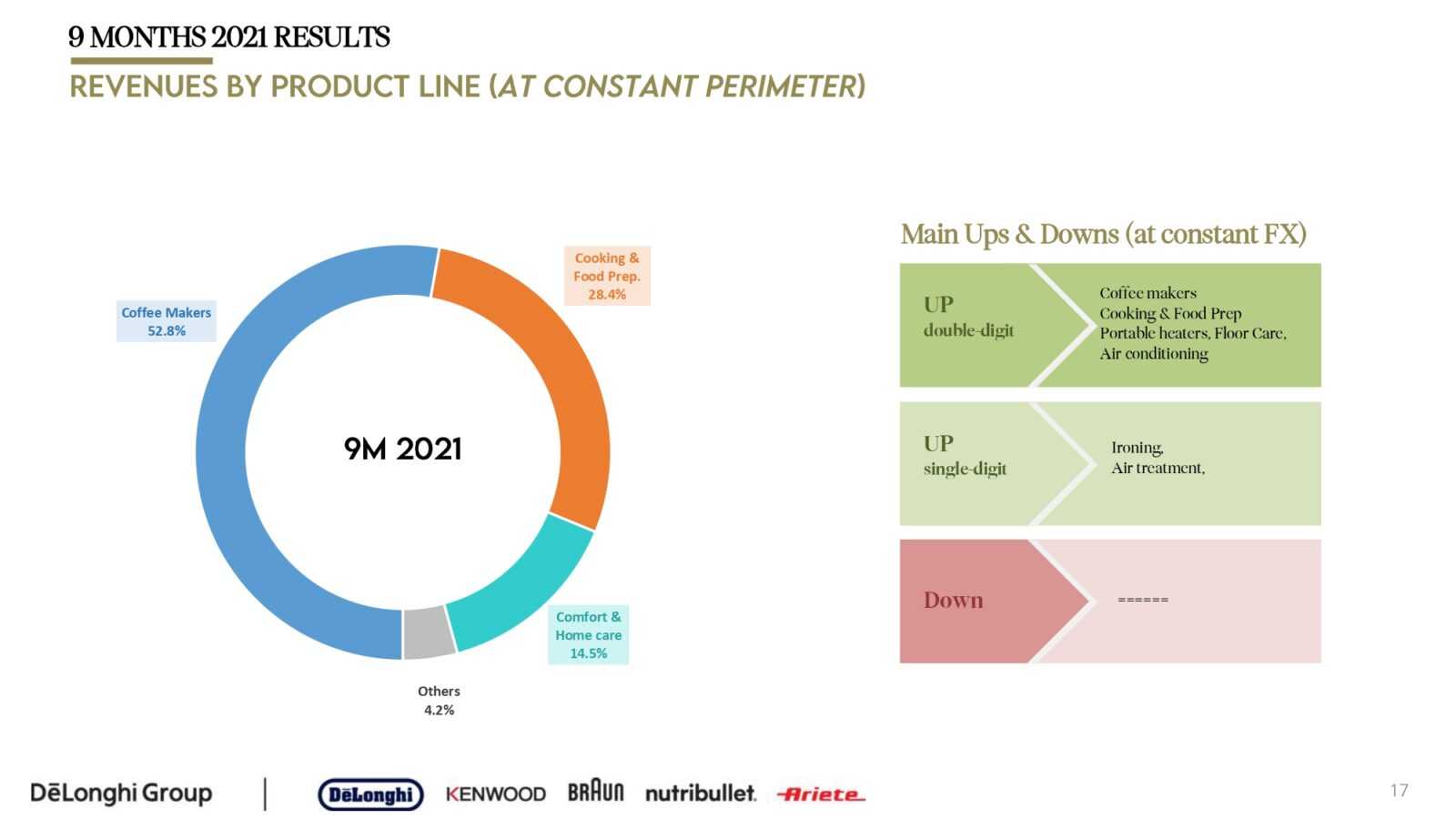

During the first nine months of 2021, on a like-for-like basis, all product segments went up and more specifically those segments considered “core” grew very strongly.In general, even in the third quarter, the latter achieved good high single digit growth, a very comforting figure considering the tough comparison with the same period of last year.

This performance was made possible by the intrinsic strength of the structural trends in the coffee and food segments

Reinforced by the support provided by investments in communication and marketing (€ 238.9 million in 9 months), which resulted in many activities supporting the product portfolio. In particular, the quarter saw an acceleration in communication and marketing spending, which rose to 13.7% of revenues from 11.2% in the first half, in line with the plans for this second part of the year.

The world of coffee has experienced an expansion since the beginning of the year above the Group average, on a like-for-like basis, thanks to a strong trend highlighted in particular in fully automatic and manual machines. The latter recorded double-digit growth also in the third quarter, thanks to the widening of the product range, which took place in the last few quarters.

Cooking and food preparation confirmed a significant organic growth in the nine months, with a trend supported by a greater attention of consumers towards products linked to the “home experience”. In particular, in the third quarter, the high single digit organic growth rate was supported by continuation of the development trend of kitchen machines and hand blenders, which maintained a double-digit growth rate.

Cooking and food preparation confirmed a significant organic growth in the nine months, with a trend supported by a greater attention of consumers towards products linked to the “home experience”. In particular, in the third quarter, the high single digit organic growth rate was supported by continuation of the development trend of kitchen machines and hand blenders, which maintained a double-digit growth rate.

As to the remaining segments, floor care and ironing recorded a mid-single digit growth in the nine months (however penalized by a negative quarter), while the domestic air conditioning and heating segment (comfort) recorded a growth in the quarter at a double-digit rate, as a result of the summer trend of mobile air conditioning.

With regard to the evolution of margins in the first nine months:

- the net industrial margin, equal to € 1,079.7 million, improved in terms of incidence on revenues from 49% to 50.2% (+ 49.6%), thanks in particular to higher volumes and the positive contribution of price-mix;

- adjusted Ebitda amounted to € 357 million, equal to 16.6% of revenues; on a like-for-like basis, it stood at € 314.9 million, with a sharp improvement in terms of margin on revenues from 14.2% to 16.2%;

- EBITDA was equal to € 354.1 million, or 16.5% of revenues; on a like-for- like basis, the margin went up from 13.6% of revenues to 16.1%, amounting to € 312.1 million;

- EBIT was € 291.9 million, equal to 13.6% of revenues, improving on a like- for-like basis from 9.7% to 13.1% of revenues, reaching € 254.1 million;

- finally, the net profit attributable to the Group amounted to € 243.5 million, equal to 11.3% of revenues (€ 189 million, equal to 9.7% of revenues, on a like-for-like basis).

As regards the third quarter, we point out that in the face of a slightly improved industrial margin on revenues – thanks to measures aimed to compensate for the negative impact of the cost increases of raw materials and transportation – the aforementioned increase in investments in communication and marketing activities, together with some increases in overhead costs due to the growth of the Group, led to a decrease in margins as a percentage of revenues: the adjusted Ebitda went down from 16.8% to 14.7% and EBIT went down from 13.1% to 11.5%.

This trend in margins is also consistent with the indications of the company and the guidance provided for the current year, which envisage a significant increase in communication and marketing activities in a period of the year typically full of commercial activities.

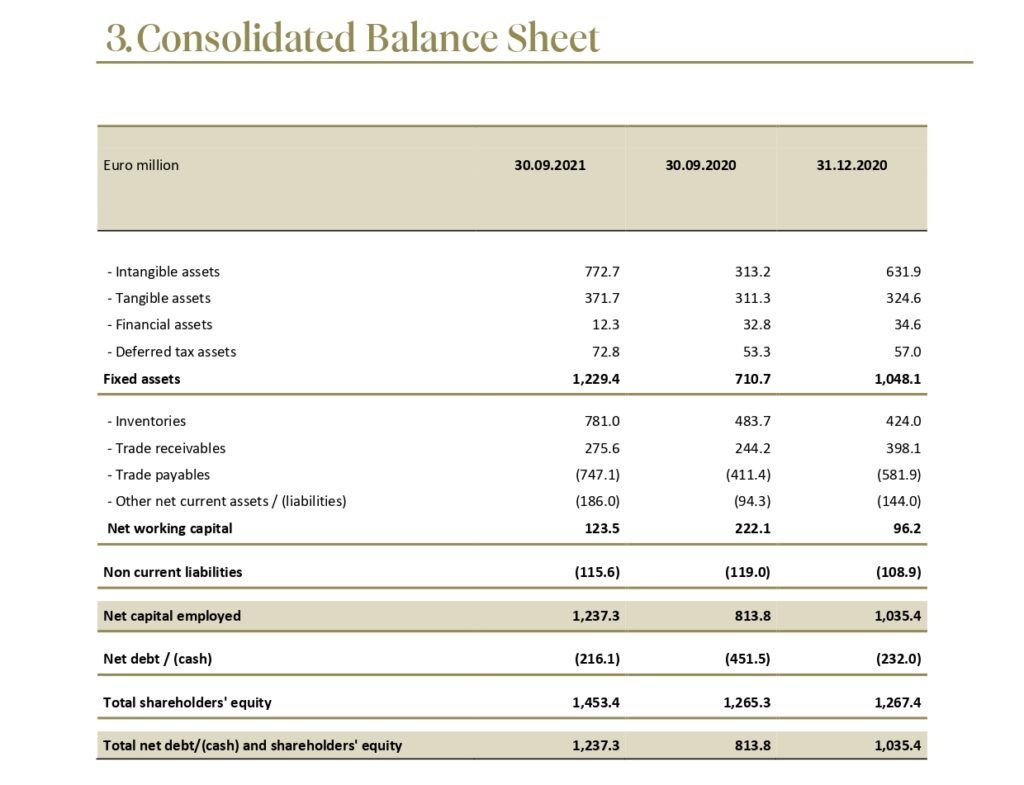

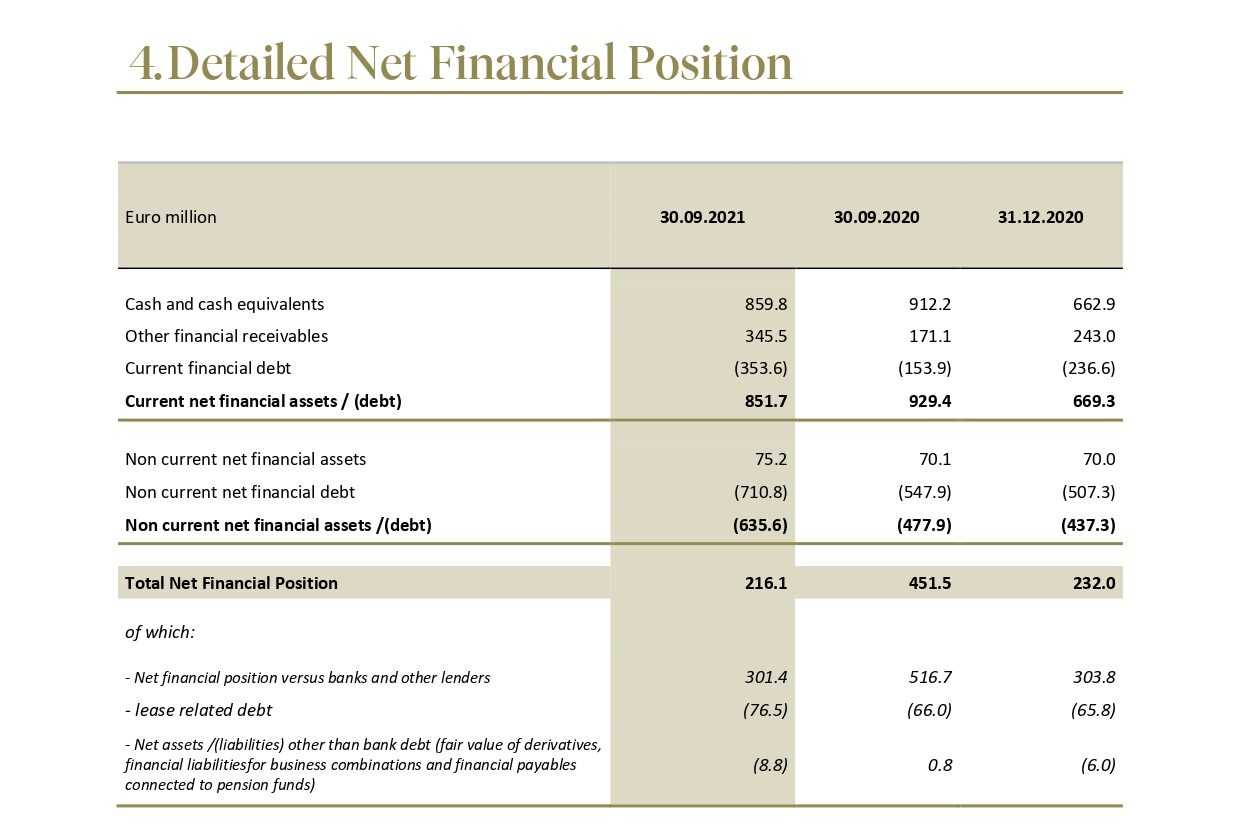

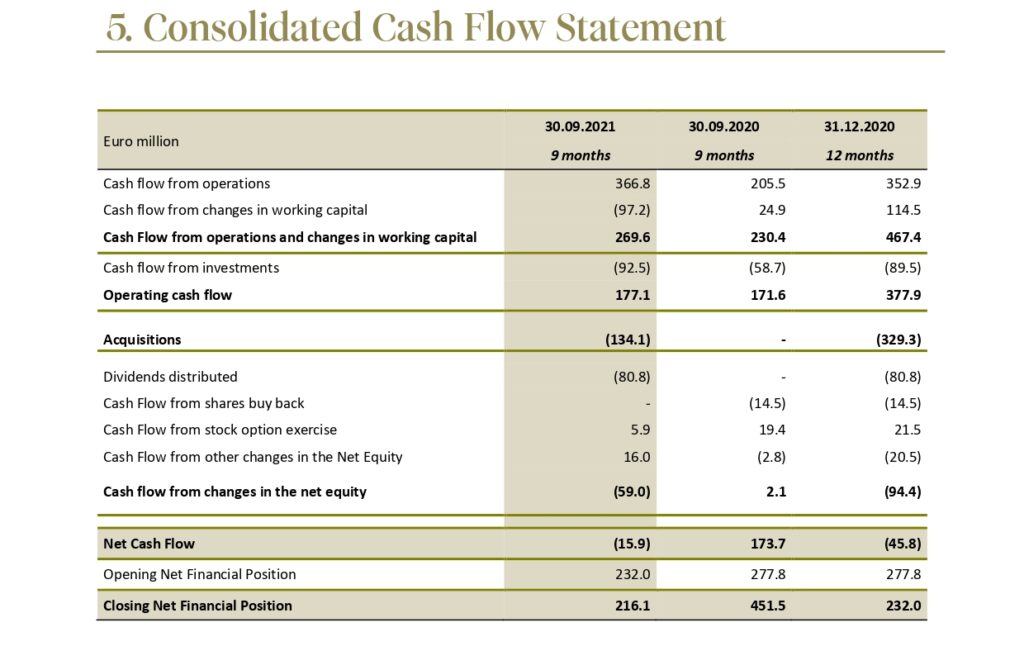

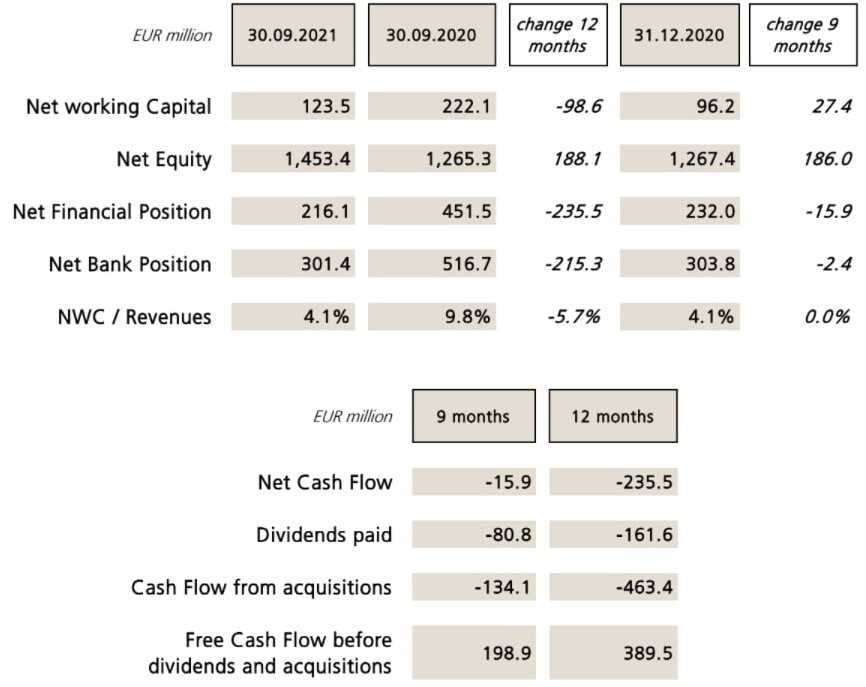

Looking at the balance sheet, the positive net financial position as at 30.09.2021 amounted to € 216.1 million (€ 451.5 million as at 30.09.2020). We remind you that over the last 12 months the Group has finalized two acquisitions, i.e. the American Capital Brands in December 2020 and the Swiss Eversys group in May 2021, for a total financial commitment of € 463.4 million.

Excluding the flows relating to acquisitions and the payment of dividends (€ 161.6 million in the 12 months), the Group generated a net cash flow of € 389.5 million in the 12 months

And of € 198.9 million in the 9 months of 2021.

As already highlighted in the first half of the year, net working capital shows a significant improvement compared to last year’s values. Thanks to a careful management of trade receivables and the dynamics of trade payables, the ratio of net working capital on revenues fell to 4.1%, a marked reduction compared to the figure of last year (9.8%), but in line with the values reached at the end of 2020.

As already highlighted in the first half of the year, net working capital shows a significant improvement compared to last year’s values. Thanks to a careful management of trade receivables and the dynamics of trade payables, the ratio of net working capital on revenues fell to 4.1%, a marked reduction compared to the figure of last year (9.8%), but in line with the values reached at the end of 2020.

The ratio of net operating working capital on revenues also improved, declining from 13.9% to 10.2% in the 12 months. In the period under analysis, inventories were increasing compared to both September 2020 and the beginning of the year, in view of the business development in the coming months and of a greater activity of procurement of products and components in light of the tensions experienced on the supply chain side.

Finally, on the investment front, capital expenditures were equal to € 92.5 million that is an increase of approximately € 33.8 million compared to last year, confirming the Group’s commitment to strengthening its industrial platform, which is a key factor in improving production efficiency and time-to-market.

Events occurred after the end of the period

There are no significant events following the end of the nine months.

Foreseeable business development and guidance

For the year 2021, management confirms the guidance previously provided, i.e. growth of Group’s revenues at constant exchange rates (including Capital Brands) at a rate in the upper end of the range 28% – 33% and an adjusted Ebitda improving vs. last year, both in value and as a percentage of revenues. The consolidation of Eversys is expected to bring about an additional 2 percentage points of revenue growth and an adjusted EBITDA, as a percentage of revenues, in line with the rest of the Group.