TREVISO, Italy – In 2020 the De’ Longhi Group achieved revenues of about € 2,353.1 million, above expectations and equal to a growth of 12% (13.9% in organic terms¹) and of 12.5% normalized², after a fourth quarter growing by 10.3% (13.8% in organic terms¹). Looking at the product segments, we highlight the strong double-digit expansion of coffee machines, driven in particular by both the fully-automatic and manual machines, which have grown steadily over the twelve months.

The C.E.O. Massimo Garavaglia commented: “A challenging and complex year from many points of view, which required an extraordinary effort from De’ Longhi’s employees and business partners, has just ended.

During 2020, we witnessed an acceleration of some processes that will lead to structural changes both in distribution, with a greater relevance of the digital world, and in consumption and consumers’ behaviour, with more focus on the home experience.

The significant growth achieved by the Group in 2020, reaffirming our leadership in the core markets and product segments, and the extraordinary work done by everyone, are the basis for a continuation of this expansion path also in 2021, which will be driven also by the continuation of investments in marketing and communication and the strengthening of our organizational and commercial structure, in support of product innovation and a sustainable growth.

Therefore, despite a macroeconomic scenario of great complexity and instability, we believe there is ground to confirm the positive trend of the last 12 months and to expand Group’s sales in 2021 at an organic¹ rate in the mid-single digit area, not including the contribution provided by the investment in Capital Brands, whose revenues will be consolidated starting from 2021″.

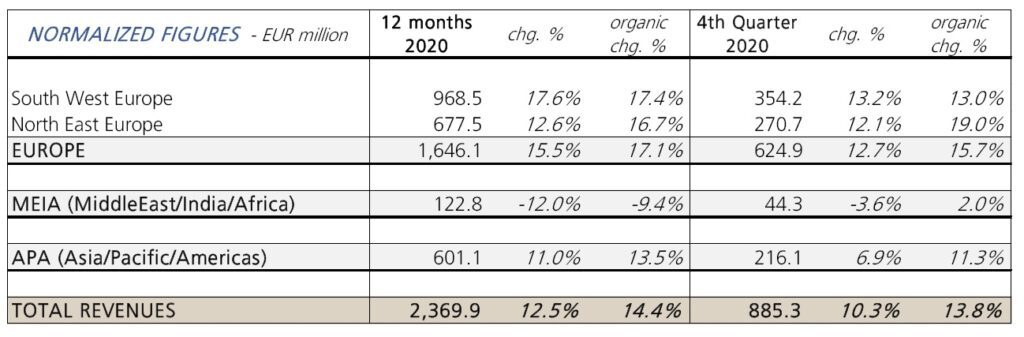

De’ Longhi Group: 2020 revenues by geography and product line

In 2020 the De’ Longhi Group witnessed a double-digit growth in revenues in almost all macro areas, with the exception of MEIA region (Middle-East, India and Africa), which returned to growth in the last two quarters of the year. Both in the twelve months and in the fourth quarter, the main geographies benefited from a solid increase in major product categories, pushing the Group’s turnover to a strong progression.

In the twelve months, revenues in South-Western Europe grew significantly, thanks to a double digit expansion of some reference markets such as Germany, France, Austria, Spain and Portugal, which benefited from a significant development in the main product categories both in the year and in the fourth quarter.

In the twelve months, revenues in South-Western Europe grew significantly, thanks to a double digit expansion of some reference markets such as Germany, France, Austria, Spain and Portugal, which benefited from a significant development in the main product categories both in the year and in the fourth quarter.

We highlight the strong growth of North-Eastern Europe region, with a double-digit expansion both in the year and in the fourth quarter. In particular, in the year, there was a sustained acceleration of the United Kingdom, Benelux, Poland, Scandinavian countries and Russia, the latter with growth diluted by the exchange rate effect.

The MEIA region recorded a revenues’ contraction in the twelve months mainly due to a rationalization of the distribution network and the difficult macroeconomic environment, which had a negative impact on the growth in the year, but with the third and fourth quarters turning positive in organic terms.

Finally, the APA region (Asia-Pacific-Americas) recorded a double-digit organic growth both in the twelve months and in the final part of the year. Despite the volatility of some currencies, the main countries showed significant growth in the reference period, with a robust double digit expansion of Australia and New Zealand, China and Hong Kong. It’s also worth noting the high single digit organic growth achieved by USA and Canada in the year.

Looking at the product segments, we highlight the strong double-digit expansion of coffee machines, driven in particular by both the fully-automatic and manual machines, which have grown steadily over the twelve months. We reported a solid progress also in the other categories of the coffee segment, such as the capsule systems and filter coffee machines (drip coffee).

The cooking and food preparation sector closed the year with a high single digit expansion, supported by a renewed interest from consumers for the food preparation and for our brands.

In particular, the segment was sustained by the robust double-digit growth of the kitchen machines main category, which remained in positive territory in each quarter of the year.

As to the remaining segments, the Group delivered a double-digit growth of the domestic climatization products (comfort) and a significant growth of home cleaning products (floor care), while the ironing segment remained in negative territory.

1 “organic” stands for at constant exchange rates and excluding the derivative effect.

2 For comparative purposes, we may present so called “normalized” values, that is, comparable with those of the previous year, excluding the effects deriving from the reclassification of financial discounts (previously classified among financial charges and now included among commercial premiums and therefore netting the revenues).