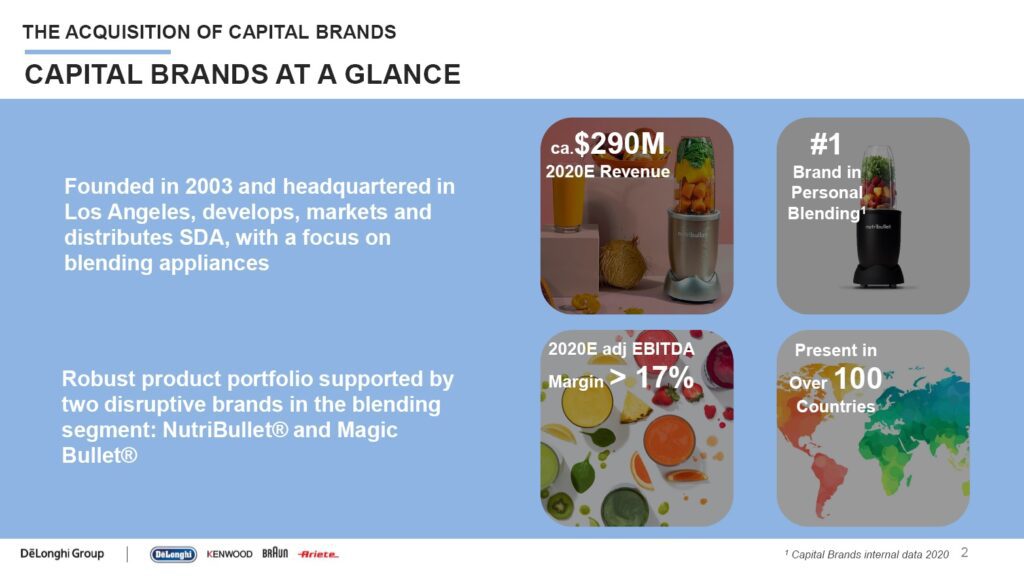

TREVISO, Italy – De’ Longhi has reached a definitive agreement with affiliates of Centre Lane Partners to acquire Capital Brands Holdings, Inc., a leader in the personal blenders segment with the Nutribullet and Magic Bullet brands. Founded in 2003 and headquartered in Los Angeles, California, Capital Brands develops and sells domestic appliances with a focus on wellness nutrition to households in over 100 markets worldwide under the Nutribullet® and Magic Bullet® brands.

The company has successfully created the personal blenders segment, within the broader blenders category – which is estimated to be worth ca. $ 1.1 billion in the USA – and has become the category leader in North America and in other key markets around the world such as Australia, New Zealand and the UK.

Capital Brands forecasts net revenues of approximately $ 290 million for year 2020, ahead of last year sales. With this transaction, the United States become the largest market for the De’ Longhi Group, with aggregate turnover in excess of $ 500 million.

Massimo Garavaglia, CEO of De’ Longhi, comments: “This acquisition is a perfect fit for the De’ Longhi Group and is consistent with our objectives of geographical expansion and growth by external lines. Moreover, it represents a strategic value from several viewpoints: we add a young and dynamic brand to our portfolio; we enlarge our range of iconic products with an important presence in the blender segment; we increase our penetration in an expanding and strategically important market like the USA; and last, but not least, we strengthen the De’ Longhi Group’s leadership in the sector of food preparation.”

Rich Krause, CEO of Capital Brands, said: “We are very pleased to be joining the De’ Longhi Group and to have the opportunity to align our strong brands with theirs. We are excited about the future growth opportunities that we will be able to exploit in the US and internationally with the support of our new shareholder.”

Rich Krause, CEO of Capital Brands, said: “We are very pleased to be joining the De’ Longhi Group and to have the opportunity to align our strong brands with theirs. We are excited about the future growth opportunities that we will be able to exploit in the US and internationally with the support of our new shareholder.”

With its research and development centers in Boston and in Connecticut, Capital Brands brings innovative technologies to the development of products that cater to an evolved concept of nutrition. Nutribullet® and Magic Bullet® are highly recognizable brands that have earned a strong reputation among consumers in a short period of time. Capital Brands’ strengths and expertise will contribute to accelerate De’Longhi Group’s growth in the world of healthy foods, which is currently experiencing an expanding trend.

The price payable by De’ Longhi for Capital Brands is approximately $ 420 million, for an implied forecast adjusted Ebitda multiple for year 2020 just above 8 times. The transaction consideration will be paid by drawing on De’ Longhi Group’s existing liquidity reserves and is expected to be accretive to De’ Longhi from next year. The closing of the transaction is expected to take place before the end of 2020.

The De’ Longhi Group was assisted by BofA Securities, White & Case and Ernst & Young, while Centre Lane Partners were assisted by Goldman Sachs and PJ Solomon.