TREVISO, Italy – The Board of Directors of De’ Longhi SpA approved the consolidated results of the first quarter of 2023: revenues of € 602.4 million, down by 18.1% (-18.7% at constant exchange rates); an adjusted Ebitda of € 74.3 million, equal to 12.3% of revenues (vs. 13.6% of first quarter of 2022); a net income of € 7 million, equal to 6.4% of revenues (vs. 6.9% of first quarter of 2022); a positive net financial position amounting to € 2 million, improving vs. both year end of 2022 (+ € 18.5 million) and end of Q1-20223 (+€ 42.6 million).

In the words of the Chief Executive Officer Fabio de’ Longhi

“Looking at the start of 2023, despite results impacted by an unfavorable macroeconomic context, with prudent behavior by consumers and distributors, we are satisfied with how the Group has been able to react to the many challenges and difficulties. To date, our Group can count on revenues and margins that remain well above pre-pandemic levels, thanks to organic growth, investments and acquisitions finalized in recent years: revenues for the quarter are now 60% above those of 2019 (€ 376 million in Q1-2019) and adjusted Ebitda doubled compared to € 37 million in 2019.”

“Let me also underline how the satisfactory trend in margins in the first quarter, compared to 2022, was made possible by all measures of cost efficiency and containment put in place in recent months and despite all the communication and marketing activities carried on, following the success of the global coffee campaign.”

“Looking at the following quarters, it is reasonable to assume that the comparison with the past year will gradually become less challenging, thus keeping the growth rate at sustained levels compared to the pre- pandemic years.”

“In this context, therefore, we confirm the guidance for the full year of revenues slightly declining vs. 2022 and an adjusted Ebitda in the range of 370-390 million euros.”

The first quarter of 2023 was characterized by an unfavorable and difficult to interpret geopolitical and macroeconomic situation, in continuity with the scenario encountered in the second half of 2022. Furthermore, the start of the year was impacted by some already anticipated factors, which influenced the trend of sales in this initial phase.

Specifically, De’ Longhi points out three main effects:

- a challenging comparison with the extraordinary growth in the first months of the previous two years (respectively +59% in 2021 and +5.5% in 2022 on a constant perimeter basis);

- a more cautious approach of some distributors, which have used these months to reduce the level of inventories (de-stocking effect);

- the Group’s strategic decision to exit the portable air conditioning market in the United States, which had an impact of € 23.4 million in the quarter.

Despite the complexity of the scenario, the Group has continued to invest in marketing and communication activities – in particular as regards the global coffee campaign – in innovation – with the launch on the North American market of the premium “drip coffee” machine True Brew – and in margin recovery – with a focus on costs and price stability.

With regard to the profitability trend, it should be noted that in the quarter the impact of the increase in production costs was limited and offset by cost efficiency and containment measures.

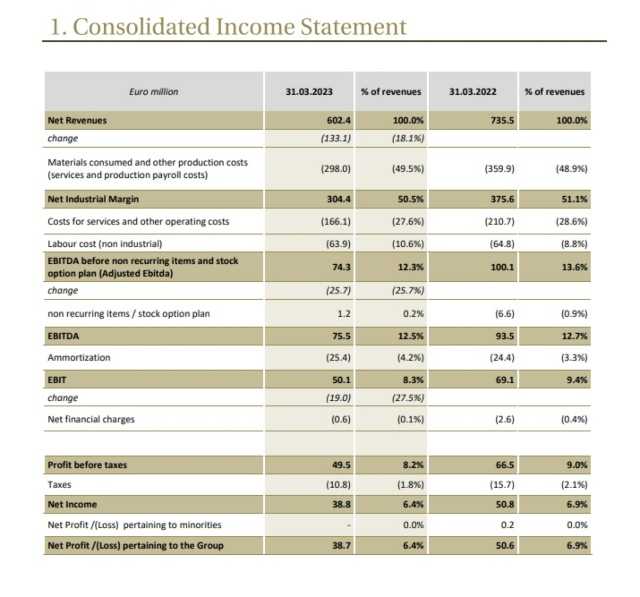

In the first quarter of 2023, revenues were down by 18.1%, reaching € 602.4 million.

The currency component (including hedging management) made a positive contribution of 0.6 percentage points of revenue growth.

As already highlighted in the past months, the European area has been affected, more than other areas, by the effects of the Russian-Ukrainian conflict and the weakening of consumers’ purchasing power caused by inflation.

In terms of product segments, the difficult comparison with the extraordinary performance of the quarters of the previous two years led to a decline for all of the macro categories of the “consumer” business, including coffee as well.

The company points out that the decision to exit the American market of portable air conditioners, determined by the purpose of protecting the average profitability of the product portfolio, amounting to € 23.4 million, however bringing a benefit in terms of mix. Excluding portable air conditioning for the US market, the rest of the perimeter showed a decrease of 15.4%.

On the contrary, professional coffee, branded Eversys, showed a strong positive trend, which continued its growth trajectory at a high-double-digit rate.

Looking at the evolution of operating margins, we point out that in general they stood at improved levels compared to the first quarters of the pre- pandemic years (2019 and 2020), thanks also to price defense actions and the positive contribution of the mix, which offset the negative effect of the decline in sales volumes and the tail of cost increases of the past quarters, mainly with regard to raw materials:

• the net industrial margin amounted to € 304.4 million, equal to 50.5% of revenues (51.1% in 2022); together with the positive contributions of the price-mix and the recovery of transport prices, there was still a residual negative effect from raw materials and production inefficiencies which will have to find a full recovery in the coming months;

• adjusted Ebitda amounted to € 74.3 million, or 12.3% of revenues (13.6% in 2022), following investments in advertisement and promotions which, while remaining constant with 2022 as a percentage of revenues (at 12.1%), decreased in value by € 15.7 million, down to € 73.1 million;

• Ebitda amounted to € 75.5 million, or 12.5% of revenues (12.7% in 2022);

• Ebit stood at € 50.1 million, equal to 8.3% of revenues (9.4% in 2022), after depreciation and amortization up by € 1 million;

• finally, the net profit attributable to the Group amounted to € 38.7 million, or 6.4% of revenues (6.9% in 2022).

The Group closed the first quarter of 2023 with a positive Net Financial Position improving against the end of 2022 figure.

The position as at March 31st amounted to € 317.2 million, i.e. an increase of €

18.5 million in the quarter and € 42.6 million in the 12 months.

The Net Position towards banks and other lenders as at 31.3.2023 was active for € 399.2 million, improving by € 9.7 million compared to the end of 2022.

In the quarter, the Group was able to generate € 41.4 million in cash from current operations and working capital movements (compared to the first quarter of 2022 in which there was an absorption of € 103.8 million).

In terms of operating working capital (8.5% of 12-month rolling revenues), the negative change in inventories (up from the record value of € 551 million at the end of 2022, as expected by the normal economic-financial cycle) was more than counterbalanced by the positive cash generation of trade receivables and payables’ management.

It should also be noted that capital expenditures absorbed € 19.2 million in the quarter, a clear decrease compared to last year, which recorded the disbursement for the acquisition of the new production plant in Romania.

The Free Cash Flow before dividends and M&A was equal to € 18.5 million in the quarter and € 167.1 million in the 12 months.