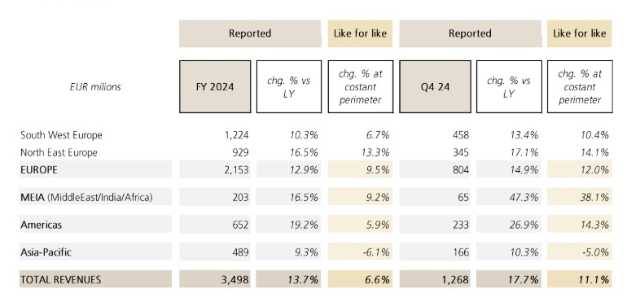

TREVISO, Italy – Highlighted below the 2024 preliminary revenues for De’ Longhi S.p.A. Group.: fourth quarter, revenues at € 1,268.4 millions, growing at 17.7% (+11.1% at constant perimeter); 12 months revenues equal to € 3,497.6 millions, increasing by 13.7% (+6.6% at constant perimeter).

In the words of the CEO Fabio de’ Longhi: “In 2024 the Group achieved a robust increase in turnover of 14%, accelerating to 18% in the last quarter due to considerable growth on a like-for-like basis, as well as the consolidation of La Marzocco which confirms the positive momentum seen in the year”.

Fabio de’ Longhi continues: “The evolution of revenues reaffirmed the structural growth trend in coffee and the renewed interest in the nutrition area for the sixth consecutive quarter, and highlighted growth in the household sector of around 12% over the last three months. These results once again demonstrate the Group’s ability to seize the opportunities of a structurally expanding market, also thanks to the effectiveness of investments dedicated to innovation and brand communication. As anticipated throughout the year, we expect to achieve an improvement in margins and a solid cash generation, further strengthening the resources available to seize any potential external growth opportunities, in line with the diversification of the brand portfolio that has occurred strategically in recent years”.

Fabio de’ Longhi concludes: “The consolidation of growth dynamics, coupled with the launch of new products and the recently announced media campaigns, lead us to estimate a turnover for 2025 expanding between 5% and 7% for the new perimeter.

As regards the 2024 margins, given the growth trend and considering the investments in media and communication made in the quarter to support the recent product launches, we estimate an adjusted Ebitda of around 555 million euros.”

Finally, it should be noted that the preliminary revenue data set out in this press release have not been audited. The complete consolidated results for the year 2024 will be submitted to the Board of Directors for approval at the meeting scheduled for March 14, 2025

2024 Revenues by geography and product line

The Group closed 2024 with a significant increase in revenues compared to the previous year, driven by a robust acceleration in organic growth across key categories in the household sector and the consolidation of La Marzocco starting in March 2024.

The Group’s positive momentum persists, marking the sixth consecutive quarter of like-for-like turnover growth, further confirming and consolidating favorable medium- and long-term market prospects. Specifically, both the coffee machine and nutrition and food preparation sectors experienced growth in all quarters of 2024, thanks especially to fully automatic coffee machines and the blender segment, a product category that fully meets consumers’ new eating habits.

In the first half of 2024, the Group achieved growth of more than 10%, despite the marked weakness of the comfort sector, affected by a particularly unfavorable season in the most significant quarter for the category and by the tail end of the discontinuity of mobile air conditioning in the American market.

In the second half of the year, the Group showed continuity of results, with the household sector growing in the third quarter at a mid-single digit rate followed by a further acceleration of the business in the last part of the year. These results were obtained after an excellent performance achieved in the second half of 2023, confirming the solidity of the structural trends and the effectiveness of the investments in communication and innovation made by the Group.

Revenues by geography

The Group recorded a positive trend in all geographical areas, with Europe experiencing significant growth in all the quarters under analysis and the Americas accelerating in the second part of the year.

In more details:

• Western Europe achieved turnover growth of 10.3% over the twelve months, or 6.7% on a like-for-like basis, with countries such as the Iberian Peninsula, Austria, and Switzerland reporting above-average growth rates. In terms of product categories, the region’s expansion was driven by the internationalization of Nutribullet, the premiumization trend in coffee favoring De’ Longhi-branded automatic machines, and the success of Braun-branded ironing systems;

• the solid expansion of north-eastern Europe persists in the fourth quarter, recording an annual increase of 16.5%, equal to 13.3% on a like-for-like basis, thanks to the significant contribution of all the main markets in both periods analyzed. Specifically, countries such as the United Kingdom and the Czech Republic – Slovakia – Hungary area experienced a like-for-like growth at around mid-teens rate in the fourth quarter. Referring to product categories, the coffee sector, driven by automatic machines, and Kenwood brand food preparation stood out;

• MEIA area achieved a significant recovery in the fourth quarter, with a performance of 47.3% (38.1% at constant perimeter), reversing the negative trend recorded at the beginning of the year in the last quarters. This brought the growth at constant perimeter in the twelve months to 9.2%, despite the difficulties linked to geopolitical tensions and the uncertainty of the macroeconomic scenario;

• the Americas recorded growth of 19.2% in the twelve months, equal to 5.9% at constant perimeter, accelerating to 14.3% in the fourth quarter. After a first part of the year influenced by the tail end of the discontinuity in mobile air conditioning, the area significantly increased the pace of growth in the second part, benefiting from the double-digit progression of fully-automatic coffee machines and Nutribullet’s personal blenders;

• finally, the Asia-Pacific region benefited from the consolidation of the La Marzocco, achieving a 9.3% increase in turnover compared to 2023. However, like-for-like revenues showed a partial decline in both periods analyzed. Specifically, we highlight the positive mid-single digit performance of Australia and New Zealand over the twelve months, accelerating in the quarter at a high single digit rate, and the decline of the Japanese market impacted by a slowdown in the comfort sector due to unfavorable weather conditions.

Revenues by product category

As regards the evolution of the product segments, all the key macro categories achieved a positive trend in both of the periods under analysis, with the exception of comfort (mobile air conditioning and heating), with a significant acceleration of the nutrition and food preparation sector in the second part of the year.

• At the end of 2024, the overall incidence of the coffee area on the Group’s turnover is approximately 62%, also thanks to the consolidation of La Marzocco from March 1st, 2024. Specifically, the significant expansion of home coffee was supported, in both periods under analysis, by a persistent growth of fully-automatic machines at mid-teens rate, supported by investments in communication and the continuous launch of innovative products with distinctive design, which meet the needs of a consumer who is increasingly attentive to the quality and versatility of the product.

As regards the professional sector, we note the continuous progression of La Marzocco that consolidates the strength of its brand, both in the semi-automatic professional machines market and in the home premium segment.

• the nutrition & food preparation segment recorded a high single digit growth in the twelve months, with a major acceleration in the fourth quarter at a rate higher than high teens. We emphasize the evolution of the blenders category (personal blenders, hand blenders and blenders) through the year, together with the return to growth of more traditional products, such as kitchen machines in the second part of the year.

• De’ Longhi highlights a significant expansion of Braun brand ironing products, which experienced a double-digit growth during the year, thanks to design and product innovation. The new launches were supported by targeted investments in media and communication in various markets;

• the trend in comfort (portable air conditioning and heating) in 2024 was strongly affected by an unfavorable weather conditions, both in the summer (air conditioning) and winter (heating) seasons, as well as by the tail end of the discontinuity of mobile air conditioning in the American market.