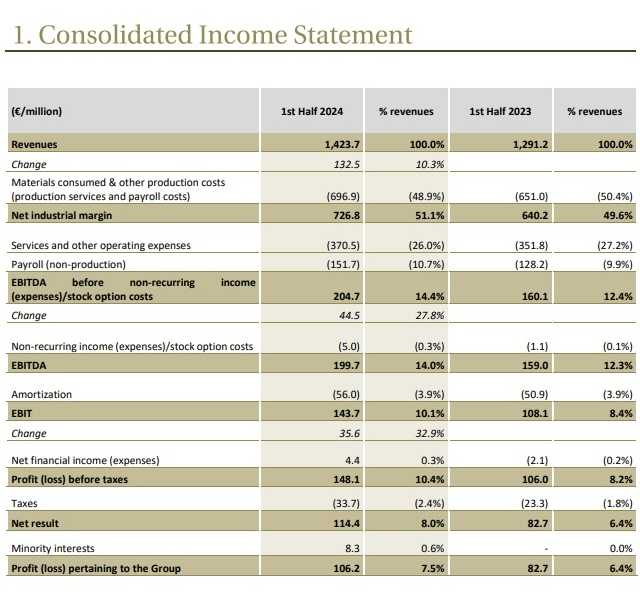

TREVISO, Italy – The consolidated results for the first half of 2024 have been approved by the Board of Directors of De’ Longhi SpA. In the first half: revenues of € 1,423.7 million, up by 10.3% (+3.5% on a like-for-like basis and +4.2% on a like for like basis and constant currencies); adjusted Ebitda at € 204.7 million, equal to 14.4% of revenues (compared to 12.4% achieved in the first half of 2023); net income pertaining to the Group of € 106.2 million, up by 28.4%; free cash flow before dividends and acquisitions of € 74.3 million.

In the second quarter: revenues of € 764.9 million, up by 11.0% (+1.5% on a like-for-like basis, with the household business excluding comfort segment growing by +6.9%); Ebitda adjusted at €110.9 million, equal to 14.5% of revenues (marked improvement from 12.5% in 2023); Net financial position as of June 30, 2024 was positive by € 305.3 million, after the net absorption of € 326.8 million in relation to the closing of the business combination between La Marzocco and Eversys.

The Board of Directors approved the Group’s Sustainability Report relating to 2023 financial year.

In the words of the ceo Fabio De’ Longhi:

“The Group achieved an expansion in turnover of more than 10% also in the second quarter, benefiting both from the consolidation of the professional coffee area and from the continuation of development in the core categories, despite the marked weakness of the comfort segment, net of which the household growth in the quarter was 6.9%. In the home coffee machine segment, we were able to further increase our market share, taking advantage of a structrully expanding reference sector. Furthermore, the nutrition and food preparation area has consolidated the positive trend witnessed in recent quarters, also thanks to the recent launches of new products that are increasingly focused on a consumer approach to a healthy diet.

The evolution of turnover, an improvement in the product mix and careful cost management have allowed us to significantly improve the margin profile at costant perimeter, further increasing the Group’s profitability with the consolidation of La Marzocco. The current context of business evolution allow us to reaffirm the guidance for the year, albeit aware of the variability of the current macroeconomic and geopolitical scenario.

We therefore confirm revenue growth in the 9%-11% range, including the expansion of the perimeter. In terms of margins, the quarterlu results reinforce the expectation of reaching the upper end of the guidance, which foresees an adjusted Ebitda in the range of euros 500-530 million for the new perimeter”.

The first half of 2024 highlighted a significant growth both in terms of turnover and profitability compared to the previous year. Specifically, the consolidation of four months of La Marzocco coupled with the growth of the organic perimeter and constant exchange rates at a mid-single digit rate allowed the Group to achieve an expansion in revenues of more than 10%.

The core product categories experienced a growth trend consistent with recent quarters, with coffee maintaining a strong momentum and the nutrition and food preparation area in positive territory.

In the second quarter, organic growth was impacted by a significant slowdown in the comfort segment, due to an unfavorable weather season and the aftermath of the discontinuity of mobile air conditioning in the Americas area (which occurred in the first half of 2023).

Net of this effect, the household segment’s turnover would have achieved growth of 6.9%, strengthening the trends highlighted in the last twelve months.

In the first part of the year, the De’ Longhi Group achieved a significant improvement in profitability compared to the same period of 2023, thanks to the consolidation of La Marzocco, a positive mix effect and the stabilization of certain production costs compared to previous years.

These favorable dynamics allowed the Group to quickly return to its historical profitability range, reaffirming a significantly improved margin guidance for the year.

The overall picture continues to be characterized by growth dynamics, despite the variability of the current macroeconomic and geopolitical scenario at international level.

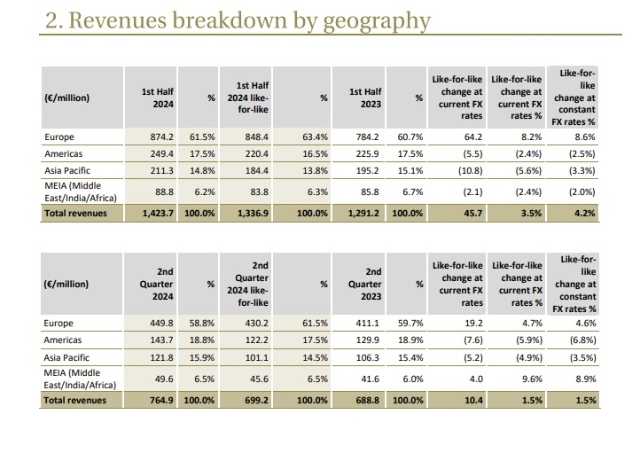

Please note that revenues benefitted from the consolidation of La Marzocco for approximately €86.8 million in the half-year (since March 1st, 2024) and €65.7 million in the second quarter.

In the first half of the year, the Group’s revenues stood at €1,423.7 million, up 10.3% compared to the previous year, thanks to a growth on a like-for-like basis of 3.5%, which equals to 4.2% at constant changes.

The currency component, which had a neutral effect in the second quarter, detracted approximately 0.6 percentage points of organic growth in the half- year, due to the impacts deriving from the devaluation of the main currencies.

All geographical areas achieved growth in the second quarter, with the European area showing progression on a like-for-like basis at a mid-single digit rate.

De’ Longhi: the second quarter in detail

• South-Western Europe achieved an expansion of 6.5%, with a low single digit like-for-like growth rate, partially deteriorated by the slowdown in mobile air conditioning, during the most seasonally important quarter for this category. Notably, Switzerland, Austria, and the Iberian Peninsula showed strong organic growth, continuing the significant development trend observed over the past twelve months;

• North-Eastern Europe grew in the quarter at low-teens rate, benefiting from a like-for-like at constant exchange rates progression of approximately 10%. The area achieved a significant expansion in turnover for the fifth consecutive quarter, specifically driven by the development of the coffee and ironing sectors;

• the MEIA area experienced a recovery in turnover trends in organic terms, returning to positive territory after a declining first quarter strongly influenced by a complex macroeconomic and geopolitical context. The growth in the second quarter was driven above all by the increase in the coffee area and by some nutrition and food preparation segments;

• Americas area benefited from the consolidation of the professional business, recording an increase in turnover of 10.6%. Like-for-like revenues slowed down in the quarter, due to the aftermath of the mobile air conditioning discontinuity in the area (realized in the first half of 2023). Concerning core categories, the area has experienced an expansion of fully automatic coffee machines and Nespresso branded capsule systems, as well as growth in the nutrition and food preparation segment led by Nutribullet products;

• the Asia Pacific region completes the picture, with an expansion in turnover at a mid-teens rate, mainly thanks to the consolidation of La Marzocco which offset a slight decline at an organic level at constant exchange rates.

Concerning the evolution of the product segments, all macro categories showed a positive trend in the quarter, with the exception of comfort (mobile air conditioning and heating), allowing the Group to confirm the positive trend experienced in the last twelve months.

The home coffee sector continued its positive trend from the first quarter, driven by strong growth in fully automatic machines and capsule systems.

This, along with the integration of La Marzocco, contributed to a substantial increase in turnover for the coffee division (encompassing both domestic and professional products), which now accounts for over 60% of the Group’s revenues.

In continuity with the first quarter, the positive trend recorded in the area of nutrition and food preparation was supported by the continuous development of the blenders’ category (personal blenders, hand blenders and blenders).

Noteworthy is the significant expansion of the homecare segment (floor care and ironing), thanks to Braun brand ironing products, which achieved double-digit growth in many countries in the European area, as already experienced in the last twelve months.

Finally, in the comfort segment (portable air conditioning and heating), the business experienced a significant contraction due to an unfavorable weather season and the aftermath of the discontinuity in mobile air conditioning in America (realized in the first half of 2023). Given the seasonality of the products, with a greater weight in the second quarter of the year, the reduction in turnover had a temporary impact on the Group’s organic growth.

During the first half of the year, the Group was able to significantly increase its profit margins, benefiting from perimeter expansion and operating leverage resulting from volume growth and a partial improvement in industrial costs.

In the second quarter:

• the net industrial margin stood at €391.5 million, equal to 51.2% of revenues, compared to 48.8% in 2023, benefiting from a positive mix effect and lower production costs inflationary pressures;

• adjusted Ebitda amounted to €110.9 million, or 14.5% of revenues compared to 12.5% the previous year. The expansion of volumes, a further partial easing of inflationary pressures on certain industrial costs and the improvement of the product mix, supported a boost in margins, despite the increase in labor costs and in certain logistics expenses;

• Ebitda amounted to €108.5 million, or 14.2% of revenues, after €2.4 million of non-recurring expenses and expenses relating to the stock option plan;

• the operating result (Ebit) stood at €79.0 million, equal to 10.3% of revenues, equal to an improvement of approximately 190bps;

• finally, the net profit attributable to the Group amounted to €54.8 million, equal to 7.2% of revenues (6.4% in the second quarter of 2023). Financial income stood at €0.3 million, compared to financial charges of €1.5 million in 2023, thanks to a careful liquidity investment policy.

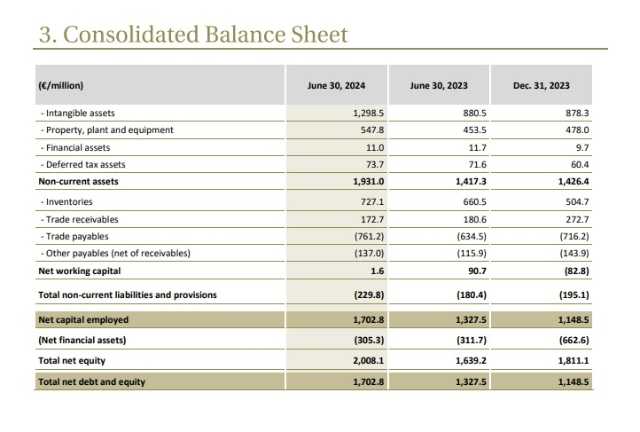

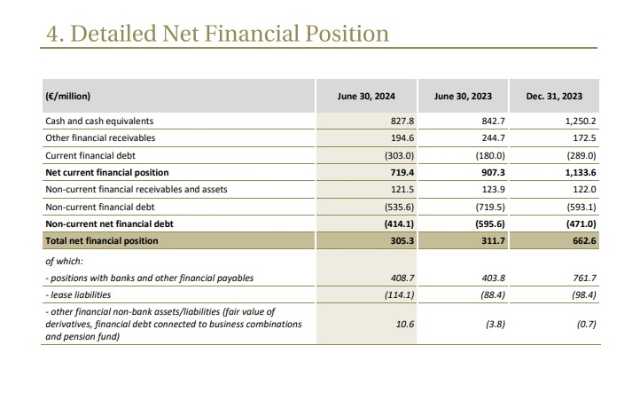

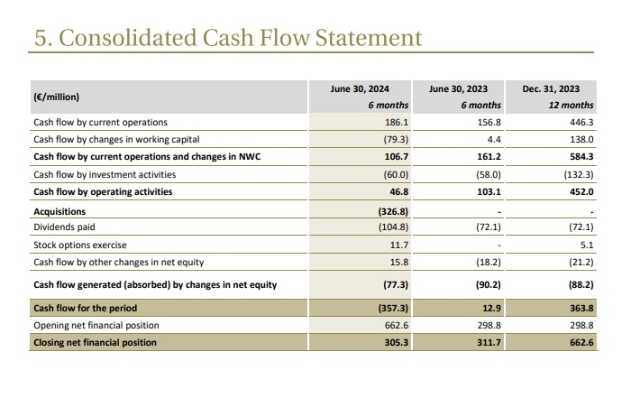

The De’ Longhi Group closed the half-year with a positive Net Financial Position of €305.3 million, after €326.8 million of net absorption in relation to the closing of the business combination between La Marzocco and Eversys.

Similarly, the Net Position towards banks and other lenders also showed a significant change compared to that recorded at 31 December 2023, standing at

€408.7 million.

The cash flow, before dividends and acquisitions (“Free Cash Flow before dividends and acquisitions”) amounted to € 425.2 million in the twelve months, thanks to a significant contribution from operating activities.

In the half-year, Free Cash Flow before dividends and acquisitions was positive at

€ 74.3 million, in line with the previous year (€ 85 million) despite the partial deterioration of net working capital.

Operating working capital (equal to 4.3% of revenues) slightly increased compared to the position at the end of the year due to the effect of the consolidation of La Marzocco and the seasonality relating to the inventories, while it recorded a marked improvement compared to 30 June 2023 (equal to 6.9% of revenues).

Investment spending (including the professional segment) absorbed €60 million in the half-year, in line with €58 million last year.

The De’ Longhi Group results in detail