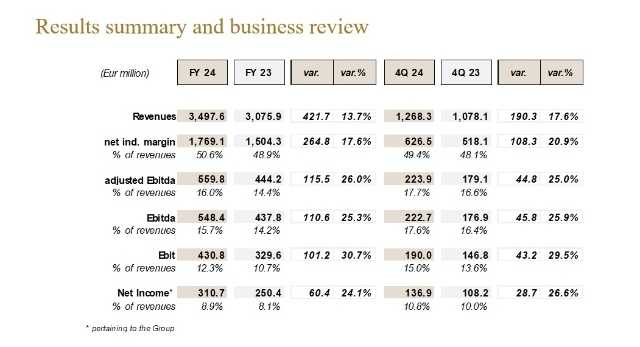

TREVISO – Approved by the Board of Directors of De’ Longhi S.p.A. the consolidated financial results for 2024. In the fourth quarter the Group achieved: revenues at €1,268.3 million, up 17.6% (+11.1% on a like-for-like basis); an adjusted Ebitda of € 223.9 million, equal to 17.7% of revenues (strongly improving from 16.6% recorded in 2023).

In the twelve months the De’ Longhi Group reached:

• revenues at € 3,497.6 million, growing by 13.7% (+6.6% on a like-for-like basis).

• adjusted Ebitda at € 559.8 million, equal to 16.0% of revenues (14.4% in 2023);

• net income (pertaining to the Group) at € 310.7 million, up by 24.1% vs 2023;

• free cash flow before dividends and acquisition at € 416.1 million;

• cash-positive net financial position at year-end 2024 for € 643.2 million, substantially aligned to 2023 levels.

The Board of Directors has proposed the distribution of a total dividend of €1.25 per share, an increase of 87% compared to the previous year, corresponding to a pay-out ratio of around 60% (compared to the ordinary 40% envisaged by the dividend policy). The payment of the ordinary part of the dividend equal to €0.83 will take place with record date 20 May 2025, while the additional component of €0.42 will be credited with record date 23 September 2025.

In the words of the C.E.O. Fabio de’ Longhi:

“Throughout the year, the Group highlighted continuity and solidity of results, with a robust organic growth trend for the sixth quarter in a row, thanks to the structural development in coffee and the renewed attention for nutrition. This trend, together with the consolidation of La Marzocco and the brand’s favourable momentum, resulted in a 14% increase in turnover, which accelerated to 18% in the last quarter.

I am extremely pleased with the achievement of a record Ebitda, with a margin of 16% that benefitted from volume growth, industrial cost stabilisation, and mix improvement, as well as the expansion of the perimeter into professional coffee, further strengthening the Group’s profitability.

These results enabled us to achieve once again a significant cash generation, allowing the Group to maintain full flexibility in terms of capital allocation towards potential external growth opportunities, as well as towards greater shareholder return. In particular, we have proposed to return to shareholders an overall dividend of € 1.25 per share, an increase of 87% compared to last year.

The recent growth trends, confirmed also in the first months of the year, lead us to estimate for the new perimeter a turnover for 2025 expanding between 5% and 7%, also supported by the launch of new products and investments in communication. In terms of margins, we expect an adjusted Ebitda of around €580-600 million (new perimeter), considering the current scenario with tariffs on products meant for the American market.”

De’ Longhi: general outlook

The Group De’ Longhi closed 2024 with a significant increase in revenues compared to the previous year, driven by a robust acceleration in organic growth across key categories in the household sector, as well as the consolidation of La Marzocco starting in March 2024.

The Group’s positive momentum persists, marking the sixth consecutive quarter of like-for-like turnover growth, further confirming and consolidating favourable medium- and long-term market prospects.

Specifically, both the coffee machine and nutrition and food preparation sectors experienced growth in all quarters of 2024, thanks especially to fully automatic coffee machines and the blender segment, a product category that fully meets consumers’ new eating habits.

In the first half of 2024, the Group achieved growth of more than 10%, despite the marked weakness of the comfort sector, affected by a particularly unfavourable season in the most significant quarter for the category and by the tail end of the discontinuity of mobile air conditioning in the American market.

In the second half of the year, the Group showed continuity of results, with the household sector growing in the third quarter at a mid-single digit rate followed by a further acceleration of the business in the last part of the year. These results were obtained after an excellent performance achieved in the second half of 2023, confirming the solidity of the structural trends and the effectiveness of the investments in communication and innovation made by the Group.

During 2024, the Group achieved a record adjusted Ebitda in absolute terms, with a considerable margins expansion obtained thanks to the increase in profitability of the household business, as well as the ten-month consolidation of La Marzocco. In particular, the improvement in organic terms was favoured by the further easing of inflationary pressures on certain cost components and by the increase in volumes together with a better product mix in the core categories, supported by continuous investments in innovation, media and communication.

The macroeconomic and geopolitical environment remains characterized by volatility and uncertainty, however the consolidation of the organic growth trends recorded in recent quarters confirms the favourable medium and long-term market outlook. This outlook seems supported by the structural trend of coffee and by the growing attention of consumers towards healthier and more balanced food preparation approach, as well as by the development opportunities present in the professional world thanks to the premium positioning of the Group’s brand portfolio.

De’ Longhi: revenues

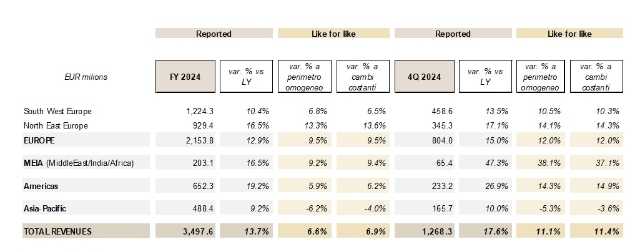

In 2024 the Group De’ Longhi recorded revenues of €3,497.6 million, strongly expanding compared to the previous year (+13.7%), thanks to the consolidation of La Marzocco from March 2024 and a growth on a like-for-like basis of 6.6%. In the fourth quarter, revenue growth was 17.6%, with an organic growth accelerating to 11.1%.

The forex component was almost neutral in both periods analysed, subtracting approx. 0.3 percentage points of growth in the 12 months and approx. 0.3 percentage points in the quarter.

La Marzocco’s contribution was equal to €71 million in the fourth quarter (€220 million in the 10 months).

Revenues by geography

The Group recorded a positive trend in all geographical areas, with Europe experiencing significant growth in all the quarters under analysis and the Americas accelerating in the second part of the year.

In more details:

• Western Europe achieved turnover growth of 10.4% over the twelve months, or 6.8% on a like-for-like basis, with countries such as the Iberian Peninsula, Austria, and Switzerland leading the growth in the area. In terms of product categories, the region’s expansion was driven by the internationalization of Nutribullet, the premiumization trend in coffee favouring De’ Longhi-branded automatic machines, and the success of Braun-branded ironing systems;

• the solid expansion of north-eastern Europe persists in the fourth quarter, recording an annual increase of 16.5%, equal to 13.3% on a like-for-like basis, thanks to the significant contribution of all the main markets in both periods analysed. Specifically, countries such as the United Kingdom and the Czech Republic – Slovakia – Hungary area experienced a like-for-like growth at around mid-teens rate in the fourth quarter. Referring to product categories, the coffee sector, driven by automatic machines, and Kenwood brand food preparation stood out;

• MEIA area achieved a significant recovery in the fourth quarter, with a performance of 47.3% (38.1% at constant perimeter), reversing the negative trend recorded at the beginning of the year in the last quarters. This brought the growth at constant perimeter in the twelve months to 9.2%, despite the difficulties linked to geopolitical tensions and the uncertainty of the macroeconomic scenario;

• the Americas recorded growth of 19.2% in the twelve months, equal to 5.9% at constant perimeter, accelerating to 14.3% in the fourth quarter. After a first part of the year influenced by the tail end of the discontinuity in mobile air conditioning, the area significantly increased the pace of growth in the second part, benefiting from the double-digit progression of fully-automatic coffee machines and Nutribullet’s personal blenders;

• finally, the Asia-Pacific region benefited from the consolidation of the La Marzocco, achieving a 9.2% increase in turnover compared to 2023. However, like-for-like revenues showed a partial decline in both periods analysed. Specifically, we highlight the positive mid-single digit performance of Australia and New Zealand over the twelve months, accelerating in the quarter at a high single digit rate, and the decline of the Japanese market impacted by a slowdown in the comfort sector due to unfavourable weather conditions.

Revenues by product category: De’ Longhi

As regards the evolution of the product segments, all the key macro categories achieved a positive trend in both of the periods under analysis, with the exception of comfort (mobile air conditioning and heating), with a significant acceleration of the nutrition and food preparation sector in the second part of the year.

• At the end of 2024, the overall incidence of the coffee area on the Group’s turnover is approximately 62%, also thanks to the consolidation of La Marzocco from March 1st, 2024. Specifically, the significant expansion of home coffee was supported, in both periods under analysis, by a persistent growth of fully-automatic machines at mid-teens rate, supported by investments in communication and the continuous launch of innovative products with distinctive design, which meet the needs of a consumer who is increasingly attentive to the quality of the outcome and versatility of the product. As regards the professional sector, we note the continuous progression of La Marzocco that consolidates the strength of its brand, both in the semi-automatic professional machines market and in the home premium segment;

• the nutrition & food preparation segment recorded a high single digit growth in the twelve months, with a major acceleration in the fourth quarter at a rate higher than high teens. We emphasize the evolution of the blenders’ category (personal blenders, hand blenders and blenders) through the year, together with the return to growth of more traditional products, such as kitchen machines in the second part of the year;

• we highlight a significant expansion of Braun brand ironing products, which experienced a double-digit growth during the year, thanks to design and product innovation. The new launches were supported by targeted investments in media and communication in various markets;

• the trend in comfort (portable air conditioning and heating) in 2024 was strongly affected by an unfavourable weather conditions, both in the summer (air conditioning) and winter (heating) seasons, as well as by the tail end of the discontinuity of mobile air conditioning in the American market.

Operating margins: De’ Longhi

During 2024, the De’ Longhi Group further strengthened its margin profile, benefiting from an improvement in the product mix and an attenuation of inflationary pressures on certain production costs, as well as the consolidation of La Marzocco for 10 months.

In the twelve months:

• the net industrial margin stood at €1,769.1 million, equal to 50.6% of revenues, compared to 48.9% in 2023, thanks to the positive contribution of the mix and the reduction in inflationary pressures on some production costs, which more than offset the temporary limited rise in some logistics costs;

• the adjusted Ebitda amounted to €559.8 million, or 16.0% of revenues, a marked increase compared to 14.4% the previous year. The improvement in margins was achieved despite the increase in investments in media and communications (A&P), which accelerated in the second half of the year to support the launch of new products and the geographical expansion of Nutribullet in Europe. In 2024 the investment in A&P for the Group amounted to approx. €436 million (increasing by approximately €42 million), with an impact on revenues of the new perimeter of 12.5%;

• the Ebitda was equal to €548.4 million, or 15.7% of revenues after €0.4 million of non-recurring charges, as well as €10.9 million of costs related to existing stock-option plans, compared to €6.4 million of non-recurring items and stock-options in 2023;

• the Ebit stood at a € 430.8 million, or 12.3% of revenues, with a level of D&A slightly above 2023 levels;

• finally, the net income attributable to the Group was equal to € 310.7 million, corresponding to 8.9% of revenues (8.1% in 2023). Financial charges totalled to € 1.4 million, compared to € 2.3 million in 2023.

In the fourth quarter:

• the net industrial margin was equal to € 626.5 million, or 49.4% of revenues vs. 48.1% in 2023, thanks to the volume effect and the better product mix, among others fully automatic coffee machines and personal blenders;

• the adjusted Ebitda amounted to €223.9 million, or 17.7% of revenues, growing by 1.1 percentage points with respect to last year, thanks to the excellent performance of the household business in terms of volume growth and improving product mix, as well as La Marzocco contribution.

De’ Longhi: balance sheet and cash flow

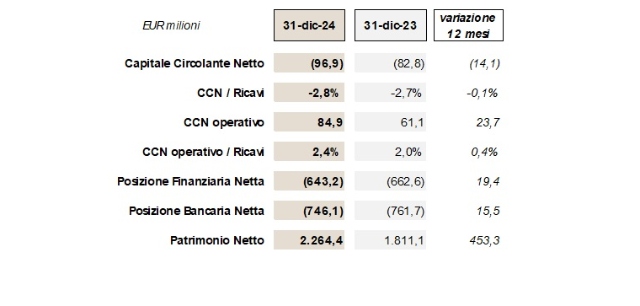

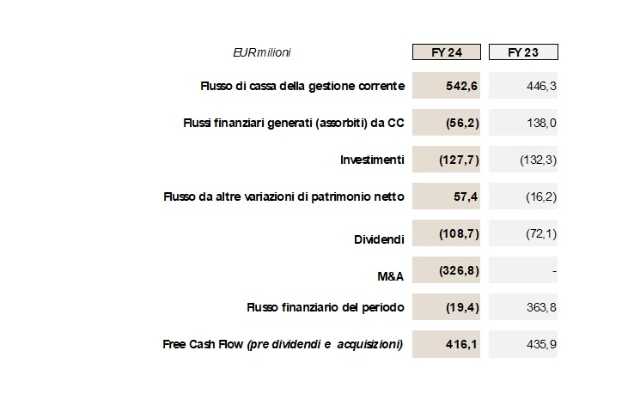

The Net Financial Position of the Group De’ Longhi was positive for € 643.2 million at the end of 2024, thanks to significant cash generation in the fourth quarter, which allowed us to close 2024 substantially in line with the end-2023 figure, despite the absorption related to the closing of the business combination in professional coffee and to the distributed dividends.

The net financial position towards banks and other lenders was €746.1 million (€15.5 million less than in 2023).

Concerning cash generation, the free cash flow before dividends and acquisitions was equal to €416.1 million in the 12 months, corresponding to a cash conversion rate on the adjusted Ebitda of 74%, confirming also for 2024 the group’s ability to consistently generate solid cash flows from operating activities.

Operating working capital amounted to € 84.9 million, or 2.4% on revenues, a modest increase of up € 23.7 million compared to 2023 (+0.4% on revenues). We would like to point out the increase in the warehouse for approx. €117 million, partly due to the expansion of the scope with the inclusion of La Marzocco.

Investment spending committed financial resources of €127.7 million, down by approx. €4.6 million compared to 2023.

Dividend

The De’ Longhi Board of Directors has resolved to propose to the Shareholders’ Meeting (to be held on 30 April 2025) a total dividend per share of €1.25, equal to a pay-out ratio of around 60% of net profit (compared to the ordinary 40% envisaged by the dividend policy).

The Board of Directors also confirmed the guidelines relating to the Group’s dividend policy, that provides for a pay-out ratio equal to 40% of net profit, modifiable in the event of excess liquidity or financial needs for extraordinary transactions, with the aim of linking the distribution of dividends to the financial cycle, at the same time maintaining a priority focus on external growth opportunities.

The resolution provides that the payment of the aforementioned amount is to be made as a gross ordinary dividend of € 0.83 per share, equal to the portion of the 2024 profit due to each entitled share and, for the difference, taken from the “extraordinary reserve”, on 21 May 2025, with the coupon detachment date being 19 May 2025, in accordance with the Italian Stock Exchange calendar, and the legitimacy to pay pursuant to art. 83-terdecies of Legislative Decree no. 58/98 (record date), 20 May 2025.

The additional gross dividend (therefore, extraordinary from a stock market perspective) of Euro 0.42 per share, withdrawn entirely from the “extraordinary reserve”, will be paid on 24 September 2025, with the ex-dividend date of 22 September 2025, in accordance with the Borsa Italiana calendar, and the date of legitimacy for payment pursuant to art. 83-terdecies of Legislative Decree no. 58/98 (record date), 23 September 2025.