TREVISO, Italy – The Board of Directors of De’ Longhi S.p.A. has approved the consolidated results for the first nine months of 2024. In the third quarter, the Group achieved: revenues of €805.5 million, up by 14.0% (5.2% on a like-for-like2 basis);an adjusted Ebitda of €131.1 million, representing 16.3% of revenues and an increase of 25%; Ebit equal to € 97.0 million, representing 12.0% of revenues, increasing by 29.9%.

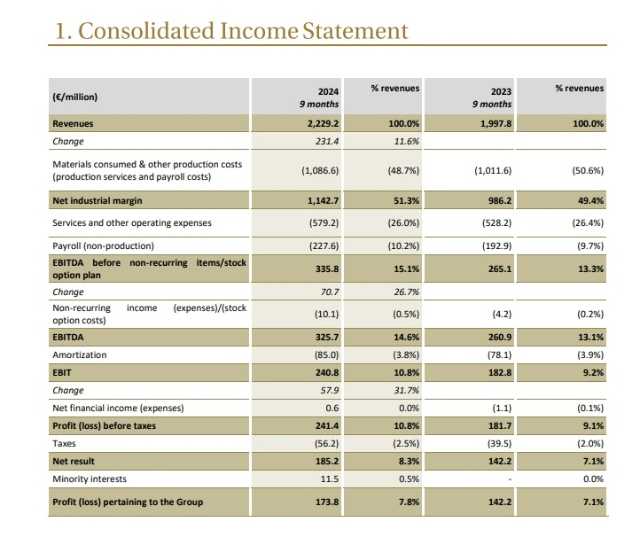

Over the nine months, the Group reported:

• revenues of €2,229.2 million, up by 11.6% (4.1% on a constant perimeter basis);

• an adjusted Ebitda of €335.8 million, representing 15.1% of revenues and an increase of 26.7%;

• Ebit equal to € 240.8 million, equal to 10.8% of revenues, increasing by 31.7%;

• a net profit4 of €173.8 million, representing 7.8% of revenues (up from 7.1%, a rise of 22.2%);

• positive cash flow before dividends and M&A of €35.6 million.

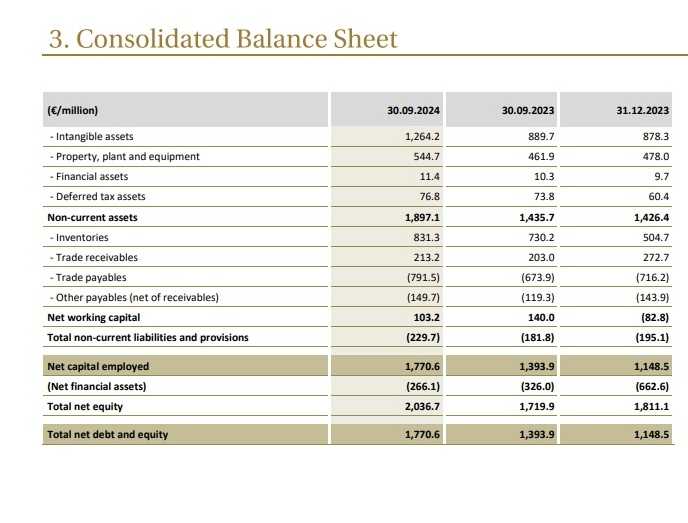

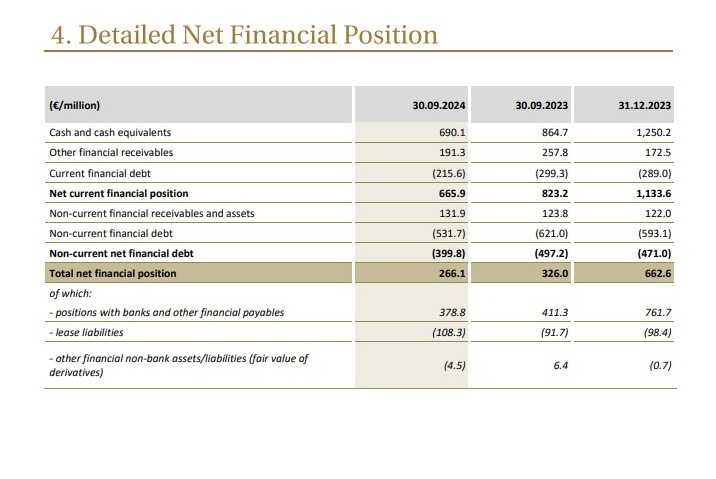

As of September 30, 2024, the Group’s net financial position was positive at €266.1 million.

CEO Fabio de’ Longhi commented:

“The Group improved the excellent performance of recent quarters, with a 14% increase in revenue, benefiting from both the consolidation of La Marzocco and acceleration in the household sectot. The past year and a half has shown stability and persistence in trends across our categories, thanks to a structurally expanding market, which we have supported through investments in innovation and communication.

Specifically, in addition to the renewed commitment to De’ Longhi’s global coffee campaign and Braun’s CareStyle ironing products, we supported the launch of new products in the quarter, such as Nutribullet’s Flip and Kenwood’s Go collection, with dedicated events and social media campaigns. Moreover, in the professional coffee sector, La Marzocco ha reaffirmed its market leadership, further developing its business and strengthening its presence in luxury household goods with targeted partenrship intiatives, including the creation of an exclusive Porsche X La Marzocco product line.

I am fully satisfied with the improvement in profitability, with EBIT growing at double the pace of revenue growth. In addition to the expanded scope, this improvement benefited from stabilized production costs and a favourable product mix effect, indicting the continued growth of our consumers’ interest in the premium segments of our product portfolio.

The acceleration seen in recent months, along with the current market development scenario, allows us to revise our guidance upwards for the year. We now estimante, for the new scope, revenuw growth in the range of 11%-12% for 2024 (previously 9%-11%), with adjusted EBITDA between euro 540-550 million (previously euro 500-530 million)”.

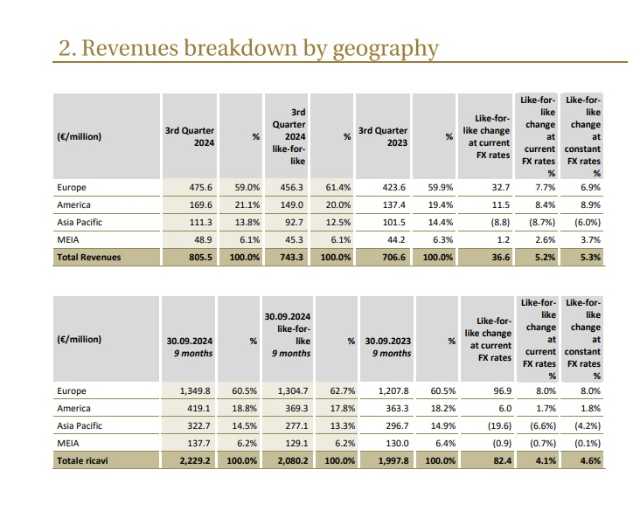

During the first nine months of 2024, the Group De’ Longhi achieved a revenue expansion of 11.6%, supported by like-for-like growth at constant exchange rates at a mid- single-digit rate, along with the seven-month consolidation of La Marzocco.

The like-for-like growth in the third quarter (+5.2%) accelerated compared to the first half of the year, thanks to the consolidation of growth trends in core categories, which have shown continuity and solidity of results since mid-last year.

The Group’s profitability experienced steady and significant improvement throughout the year, with a growth rate higher than revenue, marked by a 180- basis-point increase in Adjusted EBITDA over the nine months compared to 2023. This improvement is attributable, besides the consolidation of La Marzocco, to the stabilization of certain production costs compared to previous years and a favorable product mix effect, indicating the continued growth of our consumers’ interest in the premium segments of our product portfolio.

Throughout the year, the Group has supported brands’ growth with significant investments in media and communication (‘A&P’), with a percentage on revenues over the nine months higher than the previous year (at 12.5% like-for-like, up by about 50 basis points versus Q3-23), further increasing in the third quarter due to both different phasing within the year and activities supporting the launch of new product lines.

Notable initiatives include Kenwood’s campaign for the launch of the new ‘GO’ collection, Nutribullet’s events around the new portable blender Flip, activities for Braun-branded ironing systems, and the global coffee campaign featuring Brad Pitt as an ambassador, supporting the worldwide rollout of products like Rivelia and Eletta Explore.

It should be noted that revenues have benefited from the consolidation of La Marzocco by approximately €149.0 million over the nine months (since March 1, 2024) and €62.3 million in the third quarter.

In the first nine months of 2024, revenues increased by 11.6%, reaching

€2,229.2 million, with an accelerating third quarter compared to the previous ones, up 14.0% to €805.5 million.

The currency component, which had an essentially neutral effect in the third quarter, detracted approx. 0.5 percentage points of growth on a like-for-like basis in the nine months.

Generally speaking, the Group (including La Marzocco) recorded a positive quarterly performance in all areas, with the American market clearly accelerating compared to previous quarters also thanks to growth at a high single digit rate on a like-for-like basis.

In details, in the third quarter:

• South-Western Europe showed an expansion in turnover of 7.4%, which corresponds to low-single digit growth on a like-for-like basis. The area was supported by the expansion of the certain areas such as Switzerland, Austria and the Iberian Peninsula which benefited from the performance of fully automatic coffee machines and the return to growth of kitchen machines;

• North-Eastern Europe furtherly accelerated compared to previous quarters, supported by a like for like growth in turnover at mid-teens. In particular, we highlight the significant growth in Poland, thanks also to the recovery of the Kenwood-branded kitchen machines, as well as the positive dynamics of the United Kingdom and the Czech Republic & Slovakia & Hungary;

• Scope expansion also for MEIA region which achieved organic growth at a low-single digit rate in the quarter, despite the complexities of the geopolitical context;

• Americas area significantly accelerated its growth in the period, thanks to the consolidation of La Marzocco and like-for-like turnover expansion, which returns to being positive in the nine months. Specifically, the expansion of fully automatic machines and the partnership with Nespresso supported a mid-teens growth rate in home coffee in the quarter;

Finally, the Asia Pacific region showed an increase in turnover of approximately 10%, mainly thanks to the expansion of the scope of professional coffee, which more than offset the decline in turnover at constant scope, also deteriorated by a negative currency impact in several countries in the area (-2.7 points in the quarter). Australia and New Zealand enjoyed good results from the coffee and nutrition segments, while in Japan the particularly mild winter season penalized the quarterly result.

Regarding the product segments, the favorable development dynamics of the core categories continued through the year, with solid trends over the last 18 months for both the home coffee sector and the nutrition and food preparation segment.

The favorable performance of the business, together with the contribution of the integration of La Marzocco, led the coffee area (which includes both products for domestic and professional use) to represent, both in the nine months and in the third quarter, over 60% of the Group’s revenues.

Specifically, in this quarter, home coffee machines recorded an increase in turnover at a low-teens rate, thanks to the significant expansion of fully automatic machines and the acceleration of capsule systems.

The nutrition and food preparation segment confirmed the trend of the first half of the year, with a turnover growing at a low-mid single digit rate in the quarter. In particular, we note the return to growth of Kenwood brand kitchen machines, increasing at a mid-teens rate in the period, and the continuous expansion of the blenders sector, thanks to Nutribullet personal blenders and Braun hand blenders.

Comfort sector (portable heating and air conditioning) in negative territory also in the quarter under analysis, due to the postponement of the cold season in some relevant markets, but without significant effects on the overall performance of the Group.

Home care (house cleaning and ironing) recorded an increase in turnover at a mid-single digit rate, after four consecutive quarters of double-digit growth driven by Braun-branded ironing, which grew also in the reference period.

The first nine months of 2024 closed with a significant increase in margins, both due to the consolidation of La Marzocco and on a like-for-like basis thanks to the increase in volumes, the improvement of the product mix and the further easing of inflationary pressures on some industrial costs.

In the quarter:

• the net industrial margin stood at €415.8 million, equal to 51.6% of revenues (51.3% in the 9 months) compared to 49.0% in 2023, benefiting from the growth in volumes, the improvement in product mix and the recovery of some production costs;

• the adjusted Ebitda amounted to €131.1 million, or 16.3% of revenues (15.1% in the 9 months), improving compared to the 14.9% of the third quarter of 2023. It should be noted that the increase in profitability in the quarter was achieved in a context of greater investments on advertising and

communication (“A&P”), with a like for like percentage on turnover of 12.9% (equal to an increase of approximately 190bps vs Q3-23), to support the product launches planned in the period and for a different phasing.

• Ebitda amounted to €126.0 million, or 15.6% of revenues (14.4% in 2023) after €5.1 million of non-recurring expenses (which compare with 3.1 million non-recurring charges of the third quarter of 2023) mainly relating to the existing stock option plans;

• the operating result (Ebit) stood at €97.0 million, equal to 12.0% of revenues (10.6% in 2023), after a level of depreciation substantially aligned with the levels of the previous year;

• finally, the net profit attributable to the Group amounted to €67.6 million, (€173.8 million in the 9 months) equal to 8.4% of revenues.

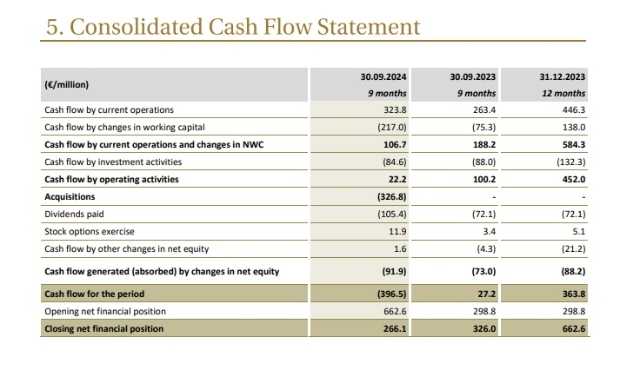

The Group closed the third quarter with an active Net Financial Position at 30 September of €266.1 million, down in the nine and twelve months due to the net absorption of €432.2 million in relation to the closing of the business combination of professional coffee and distributed dividends.

The cash flow, before dividends and M&A (“Free Cash Flow before dividends and M&A”) amounted to €372.3 million in the 12 months, while in the nine months it stood at €35.6 million for a temporary decline of net working capital aligned with the seasonality of the period.

In the nine months, operating working capital (equal to 7.6% of revenues in the rolling 12 months) increased compared to the position of December 2023, due to the effect of the consolidation of La Marzocco and the increase in inventory, due to of increasing production and inventories ahead of the fourth quarter.

Finally, Capex spending stood at €84.6 million in the nine months, in line with last year’s levels.

De’ Longhi Group results in detail