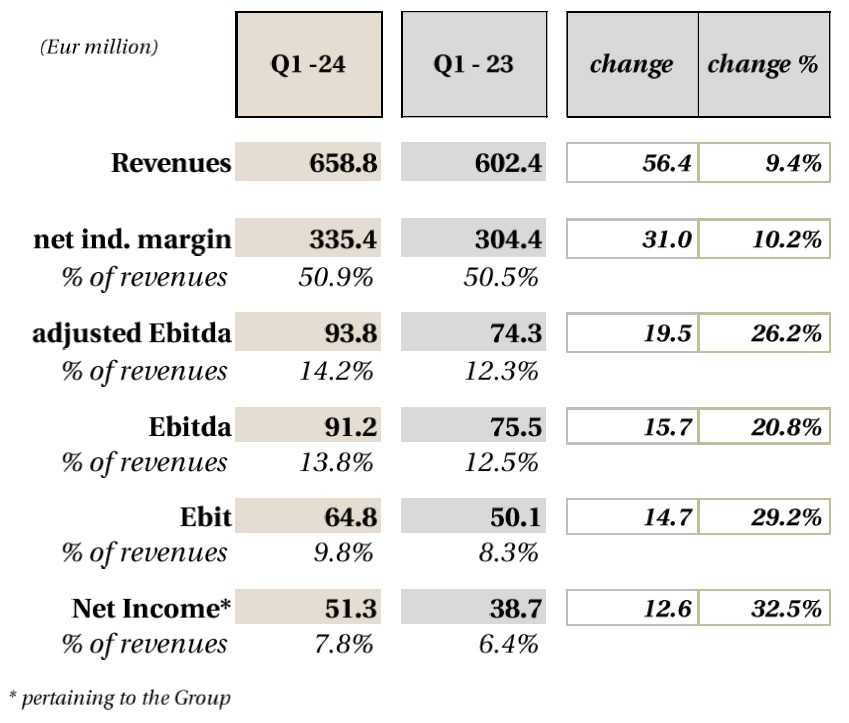

MILAN, Italy – The Board of Directors of De’ Longhi SpA approved on May 10th, 2024, the consolidated results¹ of the first quarter of 2024. Revenues of € 658.8 million, up 9.4% (+5.9% on a like-for-like basis and +7.3% on a like for like basis and constant currencies). Adjusted² Ebitda of € 93.8 million, equal to 14.2% of revenues (compared to 12.3% achieved in the first quarter of 2023).

A net income pertaining to the Group of € 51.3 million, equal to 7.8% of revenues (vs. 6.4% of first quarter of 2023). A positive net financial position amounting to € 307.6 million, after the net absorption in relation to the closing of the business combination between La Marzocco and Eversys³.

In the words of the C.E.O. of De’ Longhi Spa, Fabio de’ Longhi: “The persistent growth of the coffee business, as well as the recovery of the nutrition and food preparation category, led to an organic increase in turnover at constant currencies in the high single digits for the third consecutive quarter. The consistency of trends, combined with the one – month consolidation of the business combination between La Marzocco and Eversys, enabled the Group to increase turnover by about 10%.

Those growth dynamics, coupled with careful cost management and targeted investment expansion, have reinforced the improvement in the level of profitability, in a scenario of clear consolidation of results following the phase of progressive post – pandemic normalisation.

In this context of favourable evolution of the core categories, although aware of the variability of the current macroeconomic and geopolitical scenario, we confirm the guidance3 for 2024, which includes the perimeter expansion with the business combination in the professional coffee, with a revenues growth in the region of 9% – 11%.

In terms of margins, the quarterly results reinforce the expectation of an adjusted Ebitda of around €500 – 530 million for the new perimeter.”

De’ Longhi: General Outlook

The first quarter of 2024 highlighted a trend continuity with the second part of last year, achieving an increase in organic turnover at constant currencies at a high single digit rate for the third consecutive quarter.

The first quarter of 2024 highlighted a trend continuity with the second part of last year, achieving an increase in organic turnover at constant currencies at a high single digit rate for the third consecutive quarter.

The normalisation of the post-pandemic effects on consumption, combined with a restored level of normality of stocks at the distribution level, have favoured a significant comeback in growth dynamics over the last few quarters, both in the coffee sector and in the nutrition and preparation area of foods.

These dynamics of increase in volumes, together with the stabilization of some production costs compared to previous years, have allowed the Group to obtain a further margin improvement, quickly bringing it within the historical profitability range.

The overall picture indicates a consolidation and strengthening of results following the gradual post-pandemic normalisation phase in recent years, despite being aware that the current macroeconomic and geopolitical scenario remains uncertain and variable.

It should be noted that the revenues in the quarter were impacted by around €21 million as a result of the one-month consolidation of La Marzocco.

Revenues

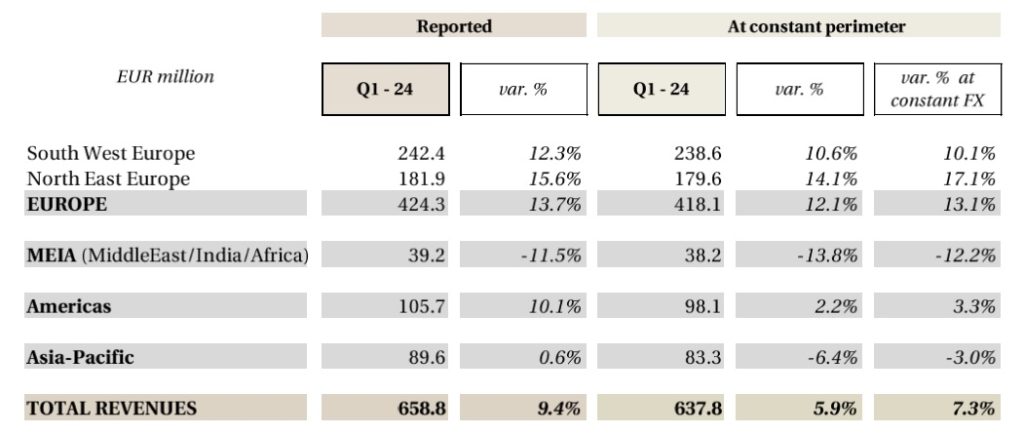

In the first quarter, the Group’s revenues reached €658.8 million, showing a 9.4% increase compared to the previous year, thanks to a like-for-like growth of 5.9%, which was 7.3% at constant exchange rates.

The currency component thus had a negative impact of around 1.4 percentage points on organic growth, primarily because of the devaluation of certain currencies, such as the US dollar and the Yen.

Markets

The geographical expansion, in line with previous quarters, displayed a steady growth trend in the European area, achieving organic growth at a low-teens rate.

In details:

- South-Western Europe experienced organic growth of roughly 10%, in line with the main trends identified in the second half of 2023. Within this context, the main markets witnessed significant growth in turnover across all major product categories, with certain countries like the Iberian Peninsula and Switzerland showing accelerated growth in the double digits;

- North-Eastern Europe witnessed significant organic revenue growth for the fourth consecutive quarter, reinforced by the high-teens performance in the early months of 2024. We observe the continuation of the favourable trend of the UK and Poland, with an acceleration in the Czech Republic, Slovakia, and Hungary area;

- the MEIA area has gone through a decline in turnover, which has been heavily influenced by a complex macroeconomic and geopolitical context;

- the Americas area achieved an increase in turnover of around 10%, thanks to the consolidation of La Marzocco and mid-single digit organic growth, supported mainly by the performance of the nutrition and food preparation sector driven by the expansion of Nutribullet’s products;

- finally, the Asia Pacific region, which was the only one to show growth in the first quarter of last year, maintains a turnover in line with 2023, showing a partial decline at an organic and constant currency level, however growth accelerated in countries like Australia and New Zealand.

De’ Longhi: Product segments

Regarding product segments, it is worth highlighting that there has been positive momentum across all macro categories, allowing the Group to achieve organic growth at constant exchange rates in the high single digits.

Specifically, the coffee machine sector (area including both domestic and professional products), which currently accounts for approximately 60% of total revenue, grew significantly in the quarter at a low teens rate, driven by an acceleration in the expansion of the household fully automatic machines and the contribution from La Marzocco consolidation of 1 month. In the nutrition and food preparation category, personal blenders and hand blenders supported the sector’s performance in the quarter, which recorded low to mid-single digit increase. Lastly, in the quarter, there was a worth noting expansion of Braun branded ironing products, with significant growth in many countries in the European area.

Operating margins

Over the last quarters, the Group has been able to significantly enhance its margin profile in comparison to the complexities faced in 2022. Volume growth, together with partial improvements in industrial costs, allowed a further improvement in margins in the first quarter of this year.

In details:

- the net industrial margin stood at €335.4 million, equal to 50.9% of revenues, compared to 50.5% in 2023, benefiting from a positive effect of the mix and an easing of inflationary pressures on product costs;

- the Ebitda adjusted was €93.8 million, or 14.2% of revenues compared to 12.3% the previous year. The expansion of volumes, a further partial easing of inflationary pressures on some industrial costs and an investment in media and communication in line respect to 2023 (A&P on revenues at 11.2%), have supported an improvement in margins, despite an increase in labour costs and organizational structures;

- the Ebitda amounted to €91.2 million, or 13.8% of revenues, after €2.1 million of non-recurring expenses compared to 1.4 million of non-recurring income in 2023;

- the operating result (Ebit) stood at €64.8 million, equal to 9.8% of revenues, with a level of depreciation substantially in line with the previous year;

- finally, the Group’s net profit rose to €51.3 million, representing 7.8% of revenues (6.4% in Q1 2023). Financial income was €4.1 million, compared to financial expenses of €0.6 million in 2023, reflecting a careful liquidity investment strategy and an effective currency management.

De’ Longhi: Balance sheet

The Group ended the quarter with a positive Net Financial Position of €307.6 million, after €326.8 million of net absorption in relation to the closing of the business combination between La Marzocco and Eversys.

Similarly, the net position towards banks and other financiers showed a large change, amounting to €409.9 million.

Free Cash Flow before dividends and acquisitions amounted to €389.2 million in the twelve months, thanks to a significant contribution from current operations.

In the first quarter of the year, Free Cash Flow before dividends and acquisitions was negative by €28.2 million, due to an increase in net working capital compared to the year-end value.

Operating working capital (equal to 5.9% of revenues) showed a partial increase compared to the position at the end of the year due to the effect of the consolidation of La Marzocco and the seasonality relating to the warehouse.

Capital Expenditures absorbed €25.7 million, up from €19.2 million last year.

¹ Unaudited data.

² “Adjusted” stands for before non recurring income/expenses and the notional cost of the stock option plan.

³ Guidance on revenues and adj ebitda estimated consolidating the business combination between La Marzocco and Eversys from March 1, 2024.