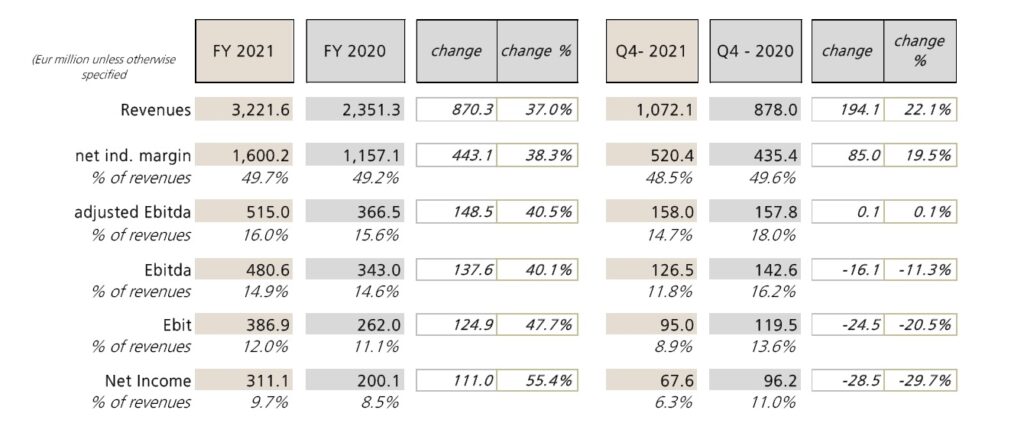

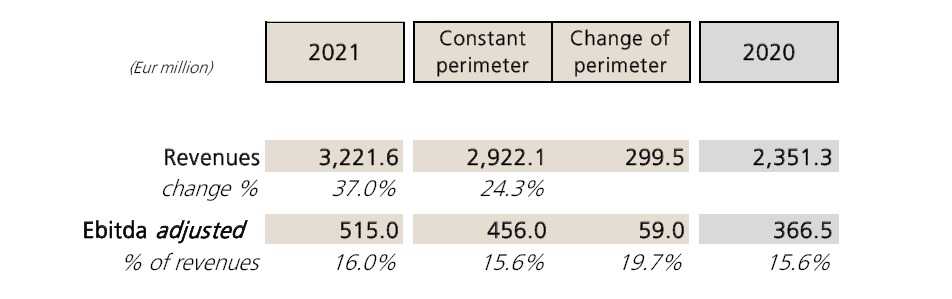

TREVISO, Italy – The Board of Directors of De’ Longhi SpA approved yesterday, 10 March, the consolidated¹ results of year 2021. In the 12 months revenues were up 37% to € 3,221.6 million (+ 24.3% on a like-for-like basis²). The adjusted Ebitda amounted to € 515 million, up 16% of revenues from 15.6% (€ 456 million on a like-for-like basis).

The company reported a net profit of € 311.1 million, up 55.4%, and equal to 9.7% of revenues (€ 258.7 million, up 29.2% on a like-for-like basis), as well as a positive net financial position of € 425.1 million, improving by € 197.1 million.

In the fourth quarter:

- revenues up 22.1% to € 1,072.1 million (+ 11.4% on a like-for-like basis);

- adjusted EBITDA of € 158 million, in line with the previous year, and equal to 14.7% of revenues (€ 141.1 million on a like-for-like basis);

- net profit of € 67.6 million, equal to 6.3% of revenues (€ 69.7 million, equal to 7.1% of revenues, on a like-for-like basis).

The BoD proposed the distribution of a dividend of € 0.83 per share, equal to a pay-out ratio of 40%, in line with the Group’s dividend policy.

In addition, today’s BoD also approved a donation of € 1 million, in favour of NGO partners, in support of the populations affected by the conflict in Ukraine.

De’ Longhi SpA: Results summary and business review³

General Outlook

2021 has been a year still characterized by the complexities associated with a pandemic that on a global level continued to affect the dynamics of consumption and above all the structure of trade flows, with serious impacts on the cost of raw materials, on the availability of components and finished products and on transport costs.

However, never before has the Group achieved such flattering results as in 2021, crossing the threshold of 3 billion Euros in turnover and 500 million Euros of adjusted Ebitda, with a net financial position that, leaving behind the acquisitions of Capital Brands and Eversys, reached € 425 million, thus providing a fundamental basis for continuing with the investment strategy by internal lines and, if necessary, also by external lines.

The dynamics of the structural trends of the Group’s main core segments, in coffee and food, were solid and responsive to investments in communication and marketing, which grew by over 100 million Euros in the year, and culminated in the first global campaign with Brad Pitt in role of Ambassador of the De’ Longhi brand in the coffee segment.

Furthermore, the price management strategy, launched in 2019, contributed, together with the mix, to the protection of the industrial margin, with a positive effect of € 121.4 million (considering only the constant perimeter).

Revenues

In 2021, revenues grew by 37%, reaching € 3,221.6 million. The fourth quarter contributed to this performance which, from the point of view of the underlying trends, was in line with the rest of the year, closing with growth of 22.1%.

On a like-for-like basis, growth stood at a double digit rate both in the year and in the quarter, with revenues of € 2,922.1 million (+ 24.3%) in the 12 months and of € 978.3 million (+11.4 %) in the quarter.

The acquired Capital Brands and Eversys contributed to the growth by bringing revenues of € 299.5 million in the year and of € 93.8 million in the quarter, in line with management expectations.

Finally, the currency component (including hedging management) subtracted approximately 1.4 percentage points of growth from revenues during the year (with a negative exchange rate and hedging effect of approximately € 31million), but with a limited impact on adjusted EBITDA (negative effect of € 2.3million).

Market

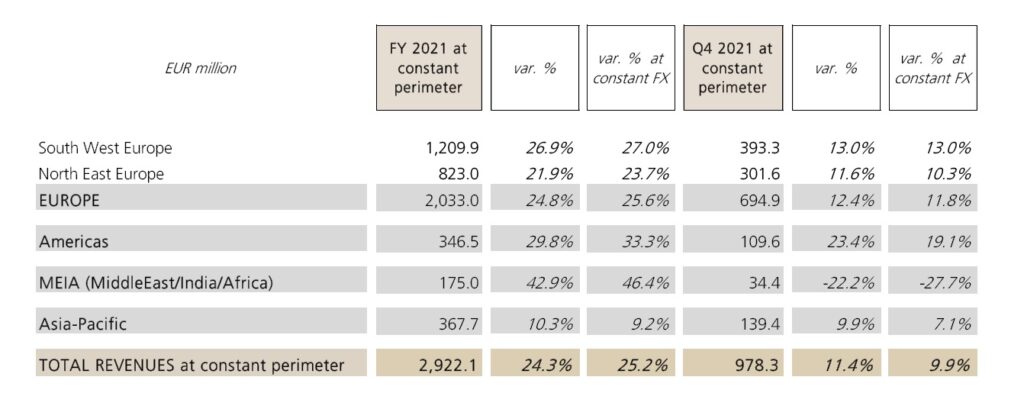

In the twelve months all the geographical macro-regions showed double-digit growth.

At a constant perimeter level:

- South-western Europe achieved double-digit performance in both the twelve months and the fourth quarter, thanks to an important contribution from the main countries in the area, such as Germany, France, Italy and the Iberian region;

- similarly the area of north-eastern Europe grew double-digit in the year and in the quarter. More specifically, almost all the countries in the region achieved double-digit growth in the twelve months, maintaining a significant pace of expansion even in the final quarter of the year. In the 12 months, the weight of Russia and Ukraine on total revenues was 4.9%, equal to € 159.1 million;

- the MEIA region recorded a growth trend in the twelve months of 42.9%, higher than the Group average, thanks to the positive contribution of all the countries in the area, but declining in the fourth quarter;

- the America region continued to expand, achieving significant double-digit growth – also confirmed by the growth in the fourth quarter – supported by a significant acceleration in the coffee segment;

- finally, the Asia Pacific region achieved growth of 10.3% in the 12 months, thanks to a double digit rate expansion in the main markets such as China and Hong Kong, Australia and New Zealand and South Korea. It’s worth noting how the double digit growth rate of China and Hong Kong accelerated in the fourth quarter, thus supporting the expansion of the entire region (up 9.9% in the quarter).

Product Segments

As regards the product segments, on a like-for-like basis, 2021 saw sustained, double-digit growth in both coffee and food preparation, driven by the main product families: from super-automatic espresso coffee machines to manual machines, from Kenwood’s kitchen machines to Braun’s blenders. Overall, the two aforementioned segments accounted for 82% of revenues on a like-for-like basis.

The coffee segment, in particular, once again confirmed the strength of the underlying structural trend, also thanks to the launch of new products and the success of the global communication campaign, launched in early September, which sees Brad Pitt as the De’ Longhi brand’s ambassador.

The food preparation sector also confirmed a good performance, especially in the most representative categories of kitchen machines and handblenders, while some minor categories showed signs of decline in the last quarter.

Less pronounced were the segments of comfort (portable air conditioning and heating), which grew mid-single-digit over the year, and home care (cleaning and ironing), stable over the year, both declining in the fourth quarter.

Operating Margins

Looking now at the evolution of operating margins over the 12 months:

- the net industrial margin, equal to € 1,600.2 million, improved from 49.2% to 49.7% of revenues, despite the inflationary pressure on some important cost items, the impact of which was offset by production efficiencies and the positive contribution of price-mix (equal to € 121.4 million on a like-for-like basis);

- adjusted Ebitda amounted to € 515 million (+ 40.5%), equal to 16% of revenues (compared to 15.6% in 2020), a result even more eloquent considering the increase in investments in communication and marketing which, on a like-for-like basis, went from € 292.8 to € 395.1 million (from 12.5% of revenues to 13.5%);

- Ebitda was € 480.6 million (+ 40.1%), or 14.9% of revenues (14.6% in the previous year);

- Ebit was € 386.9 million, up by 47.7%;

- finally, net income was € 311.1 million, equal to 9.7% of revenues and up by 55.4%.

In the fourth quarter, margins, supported by double-digit growth in revenues, had to absorb an acceleration in the rise of transport costs and a greater push in communication and marketing activities, typical of the fourth quarter and also due to the launch of the global Ambassador campaign (16.6% of revenues, from 14.6% in 2020, on a like-for-like basis). In the quarter, adjusted EBITDA was in line with the previous year in value, but down as a percentage of revenues from 18% to 14.7%.

Non recurring items

We report the presence, among non-recurring charges, of the amount of € 11.2million paid to Group employees as an extraordinary bonus for the commitment and extraordinary dedication shown in a year of great complexity. In addition, non-recurring charges include a review, in relation to the recent geopolitical

crisis in Ukraine, of the valuation of some current assets of the working capital held at the balance sheet date, for a negative amount of approximately € 10 million

De’ Longhi SpA: Balance Sheet

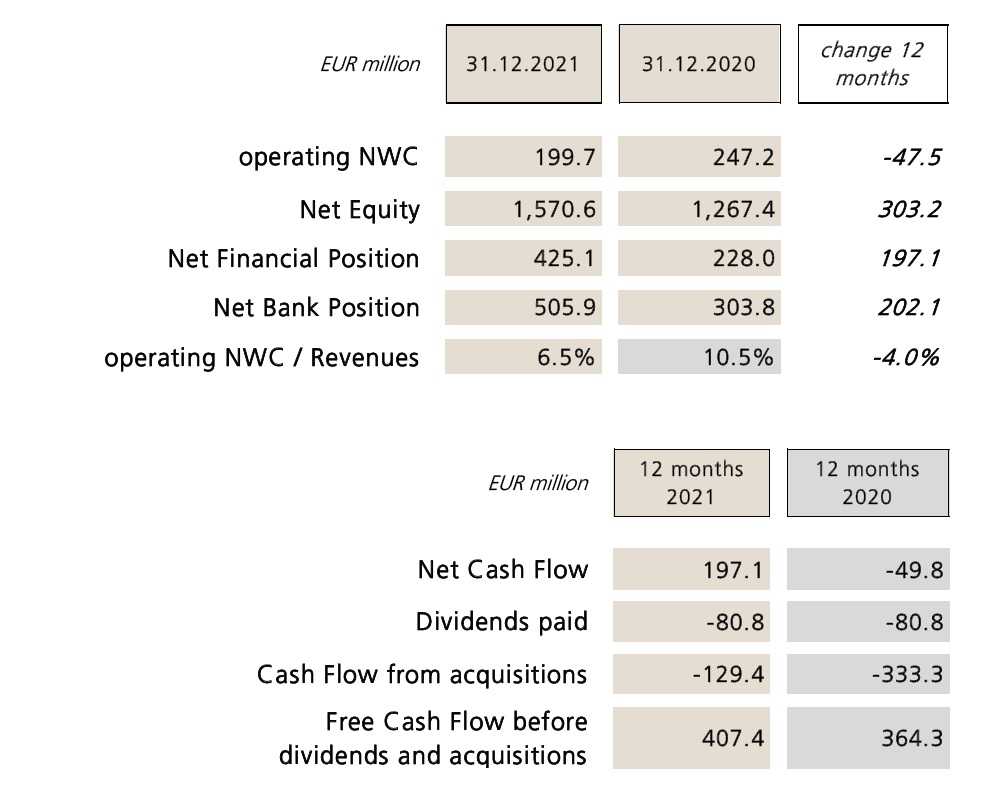

The balance sheet of the De’ Longhi Group as at 31 December 2021 also includes the full consolidation of Eversys, whose total control was acquired during the year. The Group closed year 2021 with an improvement of € 197.1 million in the Net Financial Position, which at Dec.31st was positive for € 425.1 million.

The balance sheet of the De’ Longhi Group as at 31 December 2021 also includes the full consolidation of Eversys, whose total control was acquired during the year. The Group closed year 2021 with an improvement of € 197.1 million in the Net Financial Position, which at Dec.31st was positive for € 425.1 million.

The Net Position towards banks and other lenders was positive for € 505.9 million (+ € 202.1 million compared to the end of 2020).

Excluding dividend payment (€ 80.8 million) and acquisitions (€ 129.4 million), the Free Cash Flow was particularly strong, amounting to € 407.4 million.

It should also be noted that the aforementioned Free Cash Flow figure includes:

- investments (mostly relating to tangible assets) for € 132.3 million (+42.8 million compared to 2020);

- an impact of net working capital on the generation of cash which is essentially neutral (€ 5.8 million), in which the absorption effect of the increased final inventories (due to the dynamics of the growth and partly also to the precautionary procurement activity) was offset by the management of the other items of receivables and payables.

In particular, the turnover rate of net operating working capital on revenues improved from 10.5% at the end of 2020 to 6.2% at 31.12.2021

Dividends

The Board of Directors resolved to propose to the Shareholders’ Meeting (to be held on 20 April 2022) a dividend of € 0.83 per share, payable starting from May 25, 2022, with coupon detachment on May 23 and with the record date pursuant to art. 83-terdecies of Legislative Decree no. 58/98 on May 24, equal to a pay-out ratio of 40% of the consolidated net profit of the Group.

Purchase of a new production plant in Romania

In February, the De’ Longhi Group acquired, through the subsidiary De’ Longhi Romania srl, a production plant in Romania, in the city of Satu Mare, which joins the other two Romanian production sites of Cluji and Madaras. The site occupies a covered area of approximately 48,000 square meters, which will house production lines, plastic molding machines and a warehouse dedicated to full-automatic espresso makers.

Such investment is part of the production capacity expansion plans intended to support the organic growth of the Group.

The purchase price is approximately € 21 million.

The Ukrainian crisis

In February, we witnessed the outbreak of an armed conflict, of increasing intensity, on the Ukrainian territory, the evolution of which is subject to constant monitoring by the management.

In relation to this event, today’s Board of Directors approved a total donation of € 1 million in favour of NGO partners, in support of the populations affected by the conflict in Ukraine.

Foreseeable business development and guidance

At present, the main elements that will affect the macro-economic scenario in the coming months are on the one hand the progressive improvement of the pandemic outlook in developed countries and on the other hand the cost inflationary trend of some production factors and the tragic events of the Ukrainian conflict, whose developments make the business evolution in an important part of the Eastern European region difficult to read.

Compared to the initial guidance on 2022 sales growth shared at the end of January, there are now risks that the ongoing conflict, in the absence of a peaceful resolution and normalization in the short term, will have material repercussions on the Russian and Ukrainian markets, for whose assessment we believe it is necessary to use great caution.

Nonetheless, the Group’s core business can count on structural trends, particularly in coffee, on geographic diversification and on the strength of leading brands which, on the whole, exert a positive balance with respect to the aforementioned critical factors.

¹ The results for the year 2021 include the consolidation for the full year of the Capital Brands group and, only starting from 1st April, of the Eversys group.

² “Adjusted” stands for excluding non-recurring income / charges and the notional cost of stock option plans. In some cases, data “on a like-for-like basis” are also presented, ie excluding Capital Brands and Eversys from the scope of consolidation.

³ The draft financial statements for the year 2021 and the consolidated financial statements for the year 2021 were drawn in the electronic format XHTML in accordance with the Delegated Regulation (EU) 2019/815 (the so-called ESEF Regulation); with the approval of the consolidated financial statements, the related markings in XBRL were also approved.