Matteo Borea, Coffee Master and third-generation owner of La Genovese, a renowned roasting company in Albenga (Savona), provides an in-depth and interesting analysis about how to decode the world behind coffee futures exploring the two main markets: New York (ICE) – for Arabica and London (LIFFE) – for Robusta. Below, we share his analysis.

Decoding coffee futures

by Matteo Borea

MILAN – “Coffee is much more than just a morning beverage; it is one of the most traded commodities in the world. Recently, coffee prices have surged significantly, with Robusta reaching its historical high multiple times and Arabica seeing an increase of over 50% in the past year. But what lies behind these numbers? Let’s dive into the world of coffee futures.

First, let’s understand what a coffee future is. A coffee future is a standardized contract to buy or sell a specific amount of coffee at a predetermined price on a future date. These contracts are essential for producers, roasters, and investors to manage risk and plan for the future. Essentially, a coffee producer can sell futures to lock in a fixed price, while a roaster can buy futures to secure the cost of the coffee they will use.

What are the reference markets? There are two main markets for coffee futures:

1. New York (ICE) – for Arabica

The New York Intercontinental Exchange (ICE) is the primary reference market for Arabica futures, the most premium and commonly used type of coffee. The global production of Arabica coffee typically hovers around 60%.

2. London (LIFFE) – for Robusta

The London International Financial Futures and Options Exchange (LIFFE) is the main market for Robusta futures, a type of green coffee often used in espresso blends and instant coffee.

Pay attention to the units of measurement used. Let’s understand them well to avoid confusion.

In New York, Arabica is quoted in US cents per pound. In London, Robusta is quoted in US dollars per metric ton. This can indeed create confusion, so it might be useful to immediately convert these prices into a more common measure, dollars per kilogram.

Here’s how to create the two formulas that we can use, for example, in our Excel sheet to monitor price trends:

- Robusta price conversion formula: Divide the price per ton by 1000

Example: $4185 / 1000 = $4.185 per kg (rounded)

- Arabica price conversion formula: First convert pounds to kg (1 kg = 20462 pounds) by multiplying the price by 2.20462 and then dividing the result by 100 (to convert from cents to dollars)

Example: If the price is 230.30 cents = (230.30 x 2.20462) / 100 = $5.08 per kg

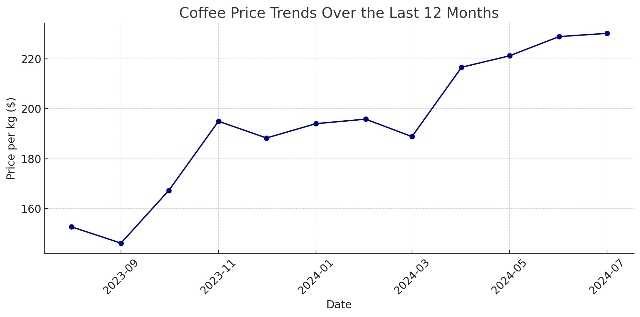

If you want to create a quick chart to get an immediate idea of coffee price trends per kg over the past year, here’s how you can do it:

- Go to Investing.com and in the search bar type “Arabica” (KCU4)

- Click on “Historical Data” and select a time range, for example, “monthly”

- Select the time period, for instance, the last 12 months, indicating the two dates in the appropriate field

- Click “Download Data” to download the file that you will find on your computer in .CSV format (no need to open it)

- Now go to ChatGpt.com and if you haven’t, create a free account

- Open a new chat, upload the file, and provide the following instructions: “Create a simple chart with the attached data to show me the price trends per kg of coffee over the last 12 months.”

- Wait a few seconds and you will magically see the chart

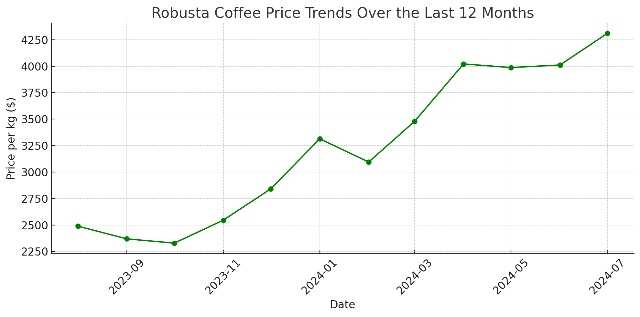

- Repeat the procedure from step 1 for “Robusta” (RCU4)

The results I obtained are as follows (data as of 07/28/2024) and are quite impressive:

Price of Arabica has increased by 50.79%

Price of Robusta has increased by 73.16%

Now that you have your charts in front of you, let’s understand what factors influence coffee futures prices:

- Weather conditions and climate changes: Events like frosts, droughts, or excessive rains can damage coffee crops, reducing supply and driving up prices.

- Global production and stocks: If major producing countries like Brazil, Vietnam, and Colombia have good harvests, supply increases and prices tend to fall. Conversely, poor harvests or logistical problems can reduce supply and increase prices.

- Consumer demand: The growing global demand for coffee, especially in emerging markets, can influence prices. Increased demand for high-quality coffee (specialty coffee) can push up Arabica prices.

- Global economic situation: Economic stability affects consumers’ purchasing power and producers’ operations. Economic crises or changes in trade policies can significantly impact coffee prices.

How can we interpret futures prices?

When futures prices rise, it indicates an expectation of future scarcity or increased demand. Conversely, falling prices suggest abundant supply or decreased demand. However, it is important to note that futures prices do not immediately translate into changes in retail prices.

Roasters often have stocks purchased at previous prices and long-term contracts that cushion the immediate impact of futures fluctuations.

What is the impact of futures on retail coffee prices?

While there is a correlation between futures prices and retail prices, the relationship is not direct or immediate. Roasters and retailers consider many factors beyond the cost of the raw material.

Here are the most important ones:

- Transportation costs: The cost of transporting coffee from producing countries to consumer markets can vary based on fuel prices and logistics.

- Roasting costs: Coffee roasting requires energy and labor, and these costs, along with production costs, significantly impact the final price.

- Packaging: Materials and packaging design can add significant costs.

- Marketing: Advertising and promotional expenses are also an important part of the total cost.

Let’s finish with a quick look at the risks and opportunities for investors and roasters. For investors, coffee futures offer profit opportunities but also carry significant risks due to their volatility. Prices can change drastically in response to unforeseen events.

For producers and roasters, the situation is entirely different. Futures are an essential tool for managing business risk because they allow prices to be “locked in” and protect against market fluctuations, ensuring greater stability in costs and revenues. The logical consequence of this is that liquidity is indeed vital for roasters.

Understanding coffee futures is essential, but all this knowledge is useless if it is not put into practice and turned into skills. The goal of this guide, especially at a critical moment like the current one, is to highlight the importance of these skills for those working in the coffee world. From roasters to baristas, this information provides a broad view of what’s behind the cup and can help make better decisions while enhancing professionalism.

Knowing the factors that influence coffee prices is extremely useful for educating customers and collaborators, explaining why the price of their favorite espresso should not be “political” but vary according to the raw material, processing, and the skills of roasters and baristas. This not only improves professionals’ credibility but also elevates the customer experience.

Implementing this knowledge in your daily work can make the difference between simply knowing something and using that knowledge to gain a competitive edge”.

Matteo Borea