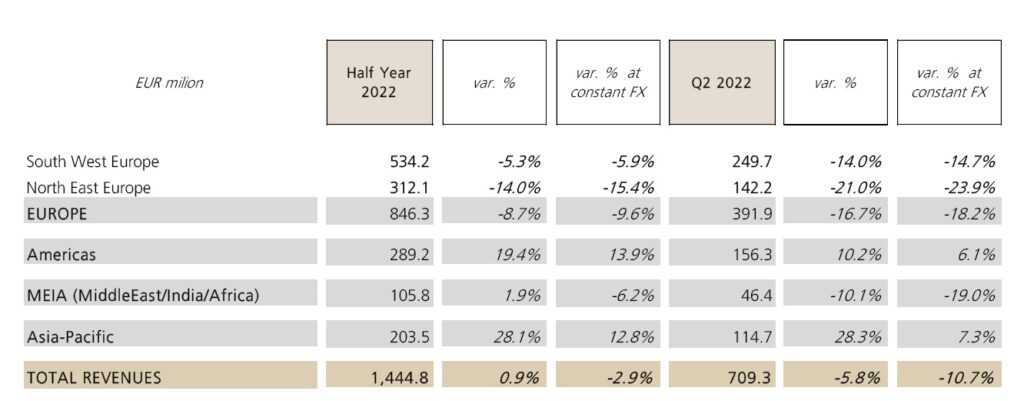

TREVISO, Italy – The Board of Directors of DēLonghi SpA approved the consolidated results of the first 6 months of 2022¹. Revenues reached € 1,444.8 million, increasing by 0.9% (-2.9% at constant exchange rates). The Company reported an adjusted² Ebitda of € 149.1 million, equal to 10.3% of revenues (down from 17.6% in 2021) and an Ebit of € 103 million, equal to 6.9% of revenues (from 13.8% in 2021).

Net profit amounted to € 71.7 million, equal to 5% of revenues (it was € 171.9 million in the first half of 2021).

The Company reported a positive net financial position of € 55.4 million (which increases to € 132.7 million excluding non-banking components), as a result of a free-cash-flow before dividends and acquisitions negative in the half year for € 245.2 millions.

The second quarter saw revenues down by 5.8% (-10.7% at constant exchange rates) and an adjusted Ebitda of € 49 million (to 6.9% of revenues, from 16.3% in the second quarter of 2021).

The Board of Directors has also:

- as part of the Succession Plan Policy, adopted by the Company in compliance with the recommendations of the Corporate Governance Code, appointed the Vice-Chairman Fabio de’ Longhi as Chief Executive Officer with effect from 1st September 2022, pending the identification of the new Chief Executive Officer;

- approved the Group Sustainability Report for the year 2021;

- approved the sustainability plan and the related ESG targets.

The CEO Massimo Garavaglia stated:

“We are experiencing a historical moment of great uncertainty that tests the structure of the whole macro-economic system. The positive signs highlighted in the first months of the year gradually diluted in coincidence with the evolution of the Russian-Ukrainian conflict and the consequent impacts on consumer sentiment, already undermined by recent inflationary pressures in consumer good of primary necessity.”

Garaviglia continues: “Despite the unsatisfactory performance of the last quarter, we believe that the strategy underlying the actions implemented by the Group DēLonghi in recent months Is still correct in a medium-long term perspective.”

Garavaglia adds: “We therefore intend to continue to defend prices and push investments in innovation and communication; as the main levers that can guarantee sustainable development. In this 2022, we expect a persistent weakness of the markets and demand also in the second half of the year with revenues down mid-single-digit and an adjusted Ebitda in the range of 320-340 million euros”.

DēLonghi: a major growth of coffee

The first half of 2022 ended with sales substantially in line with the first half of last year, even if this result declined differently in the two quarters, showing clear signs of weakening demand in Europe in the second. Specifically, the weakness shown by some product families in the second quarter is attributable to various elements, including:

- a challenging comparison with the extraordinary expansion of turnover last year (46% in the half year and 36% in the quarter on a like-for-like basis);

- a complex and dramatic international geopolitical situation, which inevitably worsened consumer confidence;

- a particularly adverse inflationary dynamic, which has eroded the purchasing power of consumers, as never happened in the last twenty

This scenario inevitably temporarily worsened the demand for goods in European markets, while in the main non-European areas the DēLonghi Group was able to maintain the sales trend in positive territory thanks to greater penetration and growth of coffee.

The DēLonghi strategy in communication

Furthermore, the continuation of the investment strategy in communication on the main brands of the Group led to a significant increase in spending, especially in relation to the activities related to the global campaign on coffee launched in the autumn of last year, therefore with a particularly difficult comparison in the first semester.

In fact, investments in media and communication increased from € 150.6 million (10.5% of revenues) to € 184.8 (12.8% of revenues ), in connection with the activities related to the coffee campaign starring Brad Pitt, Ambassador of the De’ Longhi brand.

Markets

The broad geographical diversification of the Group was able to mitigate the negative performance of the European region in the half year, thanks to the growth achieved in other geographies.

South-West Europe in the second quarter of the year recorded a decline in turnover of 14%, taking the half-year, that began with a growing trend, into negative territory; in particular, we highlight the weakness in the quarter of some core markets, such as France, Germany, Austria and Switzerland – which in recent years had particularly benefited from the favorable context of consumption – while Italy was substantially flattish and the markets of Spain and Portugal continued growth trend;

South-West Europe in the second quarter of the year recorded a decline in turnover of 14%, taking the half-year, that began with a growing trend, into negative territory; in particular, we highlight the weakness in the quarter of some core markets, such as France, Germany, Austria and Switzerland – which in recent years had particularly benefited from the favorable context of consumption – while Italy was substantially flattish and the markets of Spain and Portugal continued growth trend;

In North-East Europe the negative trend continued, with an understandable impact of the effects of the Russian-Ukrainian conflict: in general, the slowdown affected all the main countries of northern Europe, with the exception of Poland, which grew double-digit in the quarter;

The MEIA region has seen varied situations in the main markets, which however resulted in a decline in the second quarter, only partially mitigated by the appreciation of the US dollar;

The market in America

Sustained growth in America, which also maintained a positive trend in the second quarter (+ 10.2%), thanks to expansion in the coffee and comfort categories; in particular, United States and Canada are confirmed as the Group’s first market, accounting for 19.1% of total revenues in the half year compared to 15.8% in the first half of 2021.

With regard to the evolution of the product segments, the semester saw a marked weakness in the food preparation sector materialize, while the other categories were confirmed in positive territory, although in the second quarter there was a generalized weakening in almost all of the categories.

Finally, in the Asia Pacific region the double-digit growth already seen in the first part of the year continued in the quarter

led by almost all the main countries in the region (Australia and New Zealand, Greater China and South Korea) as well as by significant contribution of the currency effect.

The sector of coffee machines

Specifically, the sector of coffee machines for households, which grew in the half-year, slowed down in the quarter attenuated by the strong trend of expansion of manual machines, supported by recent launches relating to the expansion of the La Specialista range.

Finally, the contribution of the professional coffee machines sector, represented by the newly acquired Eversys – which showed a very strong growth trend – was largely positive.

¹ The economic and financial data commented refer to the new perimeter of the De’ Longhi Group resulting from the recent acquisitions of Capital Brands and Eversys. The comparative data as at 30 June 2021 have been restated, as required by IFRS 3 as a result of the definitive accounting of the two business combinations mentioned above.

It should also be noted that the audit of the half-year financial report is still in progress.

² “Adjusted” stands for gross of non-recurring income / charges and the notional cost of stock option plans.