ABIDJAN, Côte d’Ivoire — For the 2021/22 cocoa season, the demand for cocoa is envisaged to overtake supply. In addition, financial reports from major manufacturers depicted a strong growth in sales. Furthermore, data posted by the main regional cocoa associations indicated an increase in grindings in Q2.2022 in Europe and South-East Asia, whereas the inverse situation was observed in North America.

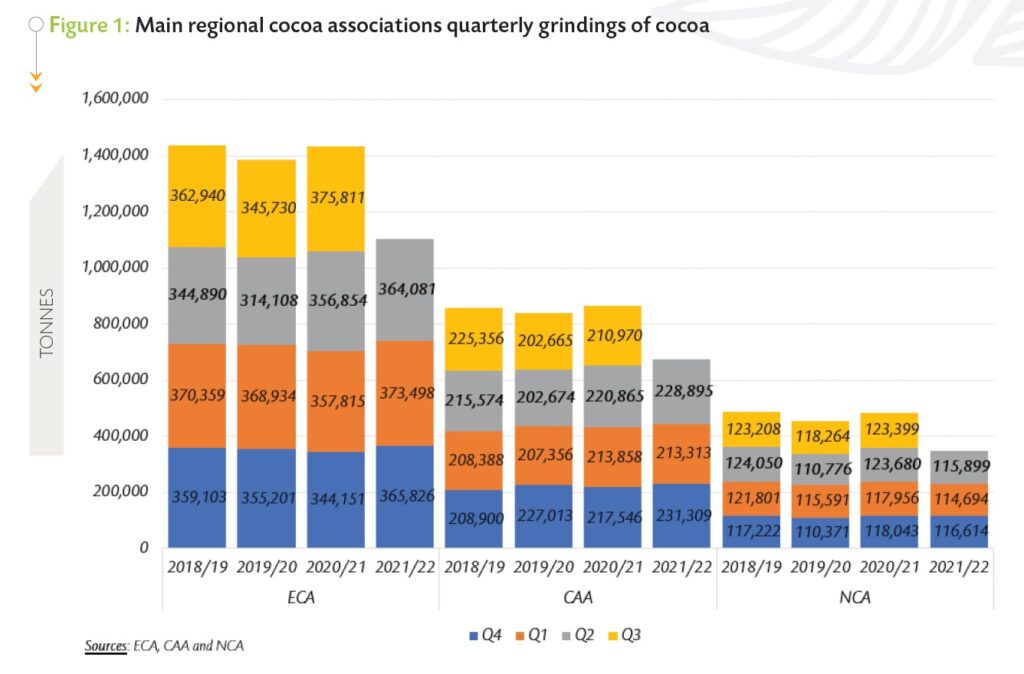

Figure 1 shows the quarterly grindings of three trade associations namely the European Cocoa Association (ECA), the National Confectioners’ Association (NCA), and the Cocoa Association of Asia (CAA).

For the latest quarterly data, the ECA posted that grindings increased in Europe by 2.03% year-on-year to reach 364,081 tonnes during Q2.2022. Nevertheless, these results should be interpreted with caution. The expectations of rising energy might have led grinders to process now and stockpile products for the future.

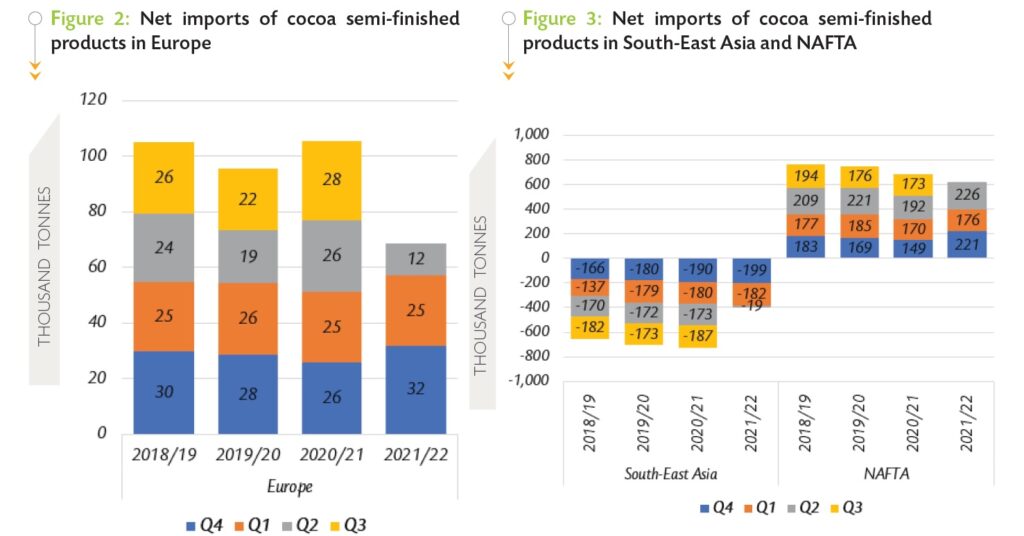

It is worth noting that the increase in grinding activities in Europe was accompanied by a reduction in the net imports of semi-finished products, hence indicating that the local market is stocked with an important share of domestically processed cocoa. As shown in Figure 2, the net imports of semi-finished products (in bean equivalent) stood at 68,805 tonnes at the end of Q2.2022, down by 11% year-on-year.

In South-East Asia, the CAA published data showing that cocoa processing activities in the region increased by 3.64% to 228,895 tonnes in Q2.2022 compared with 220,865 tonnes in Q2.2021. Net exports of semi-finished products in bean equivalent in South-East Asia as observed in Figure 3, shrank by 27% to 398,767 tonnes. Nevertheless, about 63% of the net exports of cocoa solids from Indonesia, Malaysia and Singapore are shipped to regions different from East Asia, South Asia – excluding intra-trade – and South-East Asia where important rates of growth of the population are recorded.

Inversely, the NCA reported a year-on-year quarterly decline of 6.29% in cocoa processing. This amounts to 115,899 tonnes against 123,680 tonnes recorded during the second quarter of 2021. As shown in Figure 3, in North America, net imports of semi-finished products in bean equivalent increased by 22% from 512,046 tonnes to 623,449 tonnes, hence suggesting that the drop observed in grindings in the region is somehow compensated by the importation of cocoa processed abroad.

On a cumulative basis, the trend in grindings is positive for Europe and South-East Asia, but negative for North America. Indeed, since the start of the 2021/22 crop year, grindings increased year on year in both Europe and South-East Asia while in the United States processing activities plunged. At the end of the third quarter of the 2021/22 season, processed cocoa amounted to 1.103 million tonnes, up by 4.21% compared to the level seen a year earlier. In South-East Asia, grindings increased by 3.26% year-on-year to reach 673,517 tonnes, while in North America a 3.47% tumble to 347,207 tonnes was recorded in grindings.

Furthermore, the international prices of cocoa beans as benchmarked by the ICCO indicator price averaged US$2,419 per tonne over October 2021 – July 2022, up by 1.7% compared to the US$2,379 per tonne seen a year back.

The slight, but existing, amelioration in cocoa prices corroborates the general improvement in the demand for cocoa

At this stage, one could argue that the global cocoa market has demonstrated resilience in facing the strong inflationary pressures worldwide. However, the increase in cocoa prices is far below the inflation rates in major economies.

This suggests that the overall increase in the demand for cocoa and the anticipated supply deficit for the 2021/22 season do not seem to be sufficient to counterbalance the effects of the current macroeconomic parameters.

Futures prices developments

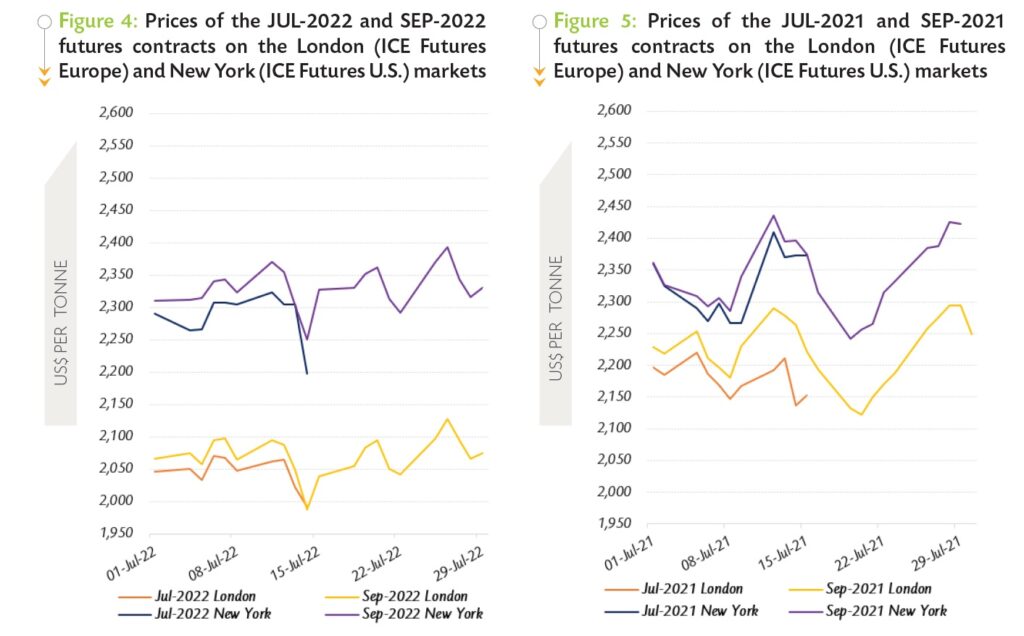

In July, prices of the front-month cocoa futures contract averaged US$2,061 per tonne and ranged between US$1,992 and US$2,227 per tonne in London, while in New York the nearby contract traded at an average price of US$2,315 per tonne and oscillated between US$2,198 and US$2,394 per tonne. Back in July 2021, the average price of the nearby contract stood at US$2,195 per tonne and ranged between US$2,122 and US$2,295 per tonne in London.

Meanwhile, prices of the first position of cocoa futures in New York averaged US$2,332 per tonne and oscillated between US$2,242 and US$2,425 per tonne. Figure 4 shows price movements of the first and second positions on the London and New York futures markets respectively at the London closing time in July 2022, while Figure 5 presents similar information for the previous year.

Closer to its maturity date on 14 July, prices of the JUL-22 contract developed downward (Figure 4) and plunged by 3% from US$2,046 to US$1,992 per tonne and by 4% from US$2,291 to US$2,198 per tonne in London and New York respectively. At the time, due to global inflationary pressure, the global cocoa market was bracing itself for less impressive grindings figures to be published by the main regional cocoa associations for the second quarter of 2021/22.

In addition, the adequate weather conditions reported in some producing regions of West Africa further contributed to pressure down cocoa prices. At the expiry of the JUL-22 contract, the nearby cocoa futures contract rolled over to the SEP-22 contract during the second half of the month under review. The SEP-22 contract which closes the 2021/22 cocoa season traded on a positive note.

Indeed, compared to their settlement values recorded on 15 July, prices of the SEP-22 contract increased on both markets. In London, the SEP-22 contract prices firmed by 2% moving from US$2,039 to US$2,075 per tonne while in New York, prices of the front-month contract moved from US$2,327 to US$2,330 per tonne.

During this period, the European Cocoa Association (ECA) and the Cocoa Association of Asia (CAA) posted data indicating increases in grindings in both regions, while in North America the National Confectioners’ Association (NCA) published data indicating a decline in processing activities on that side of the Atlantic.

Furthermore, arrivals of cocoa beans in Côte d’Ivoire and purchases of graded and sealed cocoa beans in Ghana were reported at lower levels compared to volumes recorded at the same period of the previous season.

Thus, the latest available data indicated that as at 31 July 2022, arrivals of cocoa beans in Côte d’Ivoire reached 2.028 million tonnes, down by 3.9% compared to the 2.110 million tonnes recorded a year ago.