CANTON, Mass. – Dunkin’ Brands Group, Inc. (Nasdaq: DNKN), the parent company of Dunkin’ Donuts (DD) and Baskin-Robbins (BR), on Thursday reported results for the fourth quarter ended December 27, 2014.

“Highlights from our performance in 2014 included: strong domestic restaurant level unit economics; robust U.S. restaurant development for both brands, including the opening of our first traditional Dunkin’ Donuts restaurants in California; growing transactions in the Dunkin’ Donuts U.S. business in the face of macroeconomic and competitive headwinds; the launch of both the DD Perks loyalty program, which now has more than 2.5 million members, and Baskin-Robbins online cake ordering; and progress with the retooling of our international businesses as demonstrated by the signing of significant international development agreements in Sweden, Austria, and China,” said Nigel Travis, Chairman & CEO, Dunkin’ Brands Group, Inc.

“Our nearly 100-percent franchised business model delivered another year of double-digit adjusted earnings per share growth, and most notably, more than 50 percent free cash flow growth. While our earnings growth expectations for 2015 are below our longer-term targets, we are committed to returning to double-digit growth in subsequent years.”

“We are very pleased with our recently completed debt refinancing which increases our financial flexibility and provides us with the stability of fixed rate interest over the next several years,” said Paul Carbone, Chief Financial Officer, Dunkin’ Brands Group, Inc.

“As a demonstration of our commitment to returning capital to our shareholders, our Board of Directors authorized a new share repurchase program of up to an aggregate of $700 million and increased our quarterly dividend by 15 percent over the prior quarter.”

FISCAL YEAR 2014 KEY FINANCIAL HIGHLIGHTS

1 Adjusted operating income, adjusted operating income margin, and adjusted net income are non-GAAP measures reflecting operating income and net income adjusted for amortization of intangible assets, long-lived asset impairments, and other non-recurring, infrequent, or unusual charges, net of the tax impact of such adjustments in the case of adjusted net income. Diluted adjusted earnings per share is a non-GAAP measure calculated using adjusted net income. Please refer to “Non-GAAP Measures and Statistical Data” and “Dunkin’ Brands Group, Inc. Non-GAAP Reconciliations” for further detail.

FOURTH QUARTER 2014 KEY FINANCIAL HIGHLIGHTS

Global systemwide sales growth in the fourth quarter was primarily attributable to global store development and Dunkin’ Donuts U.S. comparable store sales growth (which includes stores open 54 weeks or more).

Dunkin’ Donuts U.S. comparable store sales growth in the fourth quarter was driven by increased average ticket and higher traffic resulting from our focus on operational excellence and product and marketing innovation.

Ticket and traffic growth were balanced in the fourth quarter.

Product and marketing innovations resulted in strong beverage growth, led by Iced Coffee, the launch of Dark Roast Coffee, Hot and Iced Espresso, and record seasonal results from Frozen Beverages and Iced Tea; continued breakfast sandwich momentum across core and limited time offer sandwiches including the national return of Spicy Smoked Sausage and the Breakfast Burrito and Chicken Biscuit in select markets; and donut category growth driven by the launch of the Croissant Donut.

The K-Cup and packaged coffee categories had a significant negative impact on fourth quarter comparable store sales. There are now more than 2.5 million members in the DD Perks Rewards program, which will be discussed in greater detail on the Company’s earnings call.

Baskin-Robbins U.S. comparable store sales growth was driven by sales of Cups & Cones, Beverages, Desserts and Take-Home as a result of news on flavors, increased sales of cakes, driven by online cake ordering, and take-home ice cream quarts.

In the fourth quarter, Dunkin’ Brands franchisees and licensees opened 260 net new restaurants around the globe. This includes 141 net new Dunkin’ Donuts U.S. locations, 75 net new Baskin-Robbins International locations, 46 net new Dunkin’ Donuts International locations, and two net closures for Baskin-Robbins U.S. Additionally, Dunkin’ Donuts U.S. franchisees remodeled 172 restaurants during the quarter.

Revenues for the fourth quarter increased 5.5 percent compared to the prior year period due primarily to increased royalty income as a result of systemwide sales growth, as well as increased sales of ice cream products.

Operating income and adjusted operating income for the fourth quarter increased $7.5 million, or 9.1 percent, and $7.5 million, or 8.4 percent, respectively, from the prior year period primarily as a result of increases in royalty income and margin on sales of ice cream products.

Net income for the fourth quarter increased by $10.4 million, or 24.8 percent, compared to the prior year period primarily as a result of the $7.5 millionincrease in operating income and a $3.1 million decrease in interest expense.

Income tax expense for the fourth quarter remained consistent with the prior year period despite the increase in income before income taxes, as the effective tax rate for the fourth quarter of 2014 was favorably impacted by tax benefits resulting from a restructuring of our Canadian subsidiaries.

Adjusted net income for the fourth quarter increased by $1.9 million, or 4.1 percent, compared to the fourth quarter of 2013 primarily as a result of the$7.5 million increase in adjusted operating income and a $3.1 million decrease in interest expense, offset by an $8.3 million increase in income tax expense.

Diluted adjusted earnings per share increased by 7.0 percent to $0.46 for the fourth quarter of 2014 compared to the prior year period as a result of the increase in adjusted net income and a decrease in shares outstanding.

The decrease in shares outstanding from the prior year period is due primarily to the repurchase of shares, offset by the exercise of stock options.

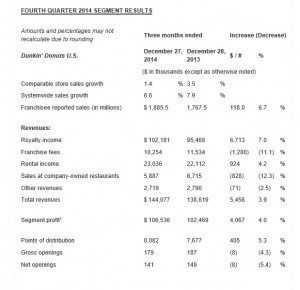

FOURTH QUARTER 2014 SEGMENT RESULTS

1 Prior year amounts reflect change in segment profit measure. Please refer to “Segment Profit Comparability” for further detail.

Dunkin’ Donuts U.S. fourth quarter revenues of $144.1 million represented an increase of 3.9 percent year-over-year. The increase was primarily a result of increased royalty income, offset by a decrease in franchise fees due primarily to the timing of franchise renewals.

Dunkin’ Donuts U.S. segment profit in the fourth quarter increased $4.1 million over the prior year period to $106.5 million, which was driven primarily by revenue growth, offset by the impact of reserves, including the reversal of reserves in the prior year period.

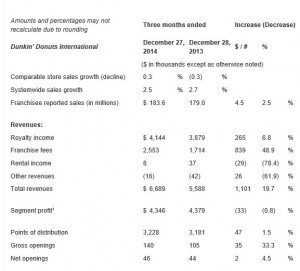

Dunkin’ Donuts International fourth quarter systemwide sales increased 2.5 percent from the prior year period, driven by sales growth in the Middle Eastand Europe, offset by a decline in South Korea. On a constant currency basis, systemwide sales increased by approximately 6 percent.

Dunkin’ Donuts International fourth quarter revenues of $6.7 million represented an increase of 19.7% year-over-year.

The increase in revenue was primarily a result of an increase in franchise fees due to openings in existing and new international markets and additional franchise renewals, offset by income recognized in connection with the termination of development agreements in Asia in the prior year period. Also contributing to the increase in revenues was an increase in royalty income.

Segment profit for Dunkin’ Donuts International of $4.3 million in the fourth quarter remained consistent with the prior year period, as revenue growth was offset by increases in general and administrative expenses and a decrease in income from our South Korea joint venture.

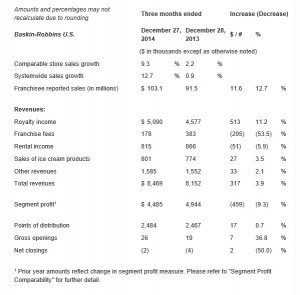

Baskin-Robbins U.S. fourth quarter revenue increased 3.9 percent from the prior year period to $8.5 million due primarily to increased royalty income, offset by a decrease in franchise fees driven primarily by timing of franchise renewals.

Segment profit for Baskin-Robbins U.S. decreased $0.5 million in the fourth quarter, or 9.3 percent, year-over-year primarily as a result of increases in general and administrative expenses, including investments in advertising and other brand-building activities and an increase in personnel costs, offset by the increase in revenues.

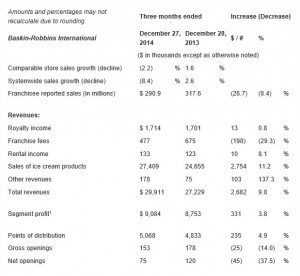

Baskin-Robbins International systemwide sales decreased 8.4 percent in the fourth quarter compared to the prior year period driven by a sales decline in Japan, primarily as a result of unfavorable exchange rates, as well as a sales decline in the Middle East. On a constant currency basis, systemwide sales decreased by approximately 3 percent.

Baskin-Robbins International fourth quarter revenues increased 9.8 percent year-over-year to $29.9 million due primarily to increases in sales of ice cream products in the Middle East and Asia, offset by a decline in franchise fees.

Fourth quarter segment profit increased 3.8 percent year-over-year to $9.1 million, resulting from an increase in net margin on ice cream driven by the increase in sales, as well as an increase in income from our South Korea joint venture, offset by a $0.5 million decrease in income from our Japan joint venture and increases in advertising and personnel costs.

COMPANY UPDATES

- The Company announced on January 26, 2015 that it completed a refinancing of its senior secured credit facility with the placement by its subsidiary of a $2.6 billion securitized debt facility. The securitized debt facility includes $2.5 billion Class A-2 Senior Secured Notes (“Notes”), which consist of two tranches with anticipated repayment dates of four years ($750 million) and seven years ($1.75 billion), respectively. The Notes will bear interest at a rate of 3.262 percent per annum for the four year tranche and 3.980 percent per annum for the seven year tranche, resulting in a weighted-average effective interest rate of 3.765 percent per annum, payable quarterly. As a result, the Company expects its 2015 annual interest expense to be approximately $96.5 million.

- The Company announced on January 26, 2015 that the Board of Directors authorized a new program to repurchase up to an aggregate of $700 million of its outstanding common stock over the next two years.

- The Company today announced that the Board of Directors declared a first quarter cash dividend of $0.265 per share, payable on March 18, 2015 to shareholders of record as of the close of business on March 9, 2015. This represents a 15 percent increase over the Company’s fourth quarter 2014 dividend.

FISCAL YEAR 2015 TARGETS

As described below, the Company is reiterating certain targets regarding its 2015 expectations.

- The Company expects Dunkin’ Donuts U.S. comparable store sales growth of 1 to 3 percent and Baskin-Robbins U.S. comparable store sales growth of 1 to 3 percent.

- The Company expects that Dunkin’ Donuts U.S. will add between 410 and 440 net new restaurants, for greater than 5 percent net unit growth, and expects Baskin-Robbins U.S. will add between 5 and 10 net new restaurants.

- Internationally, the Company is targeting opening 200 to 300 net new restaurants across the two brands. It expects net income of equity method investments to be approximately $13 million.

- Globally, the Company expects to open between 615 and 750 net new units.

- The Company expects revenue growth of between 5 and 7 percent and adjusted operating income growth of between 6 and 8 percent.

- The Company expects adjusted earnings per share of $1.83 to $1.87.

Conference Call

As previously announced, Dunkin’ Brands will be holding a conference call today at 8:00 am ET hosted by Nigel Travis, Chairman & Chief Executive Officer, and Paul Carbone, Chief Financial Officer.

The dial-in number is (866) 393-1607 or (914) 495-8556, conference number 63732202. Dunkin’ Brands will broadcast the conference call live over the Internet at http://investor.dunkinbrands.com. A replay of the conference call will be available on the Company’s website at http://investor.dunkinbrands.com.