CANTON, Mass., U.S. – Dunkin’ Brands Group, Inc., the parent company of Dunkin’ and Baskin-Robbins (BR), on May 2, 2019, reported results for the first quarter ended March 30, 2019. First quarter highlights include Dunkin’ U.S. comparable store sales growth of 2.4% and Baskin-Robbins U.S. comparable store sales decline of 2.8%. 34 net new Dunkin’ locations were added in the U.S., for a total of 8 net new Dunkin’ and Baskin-Robbins locations globally.

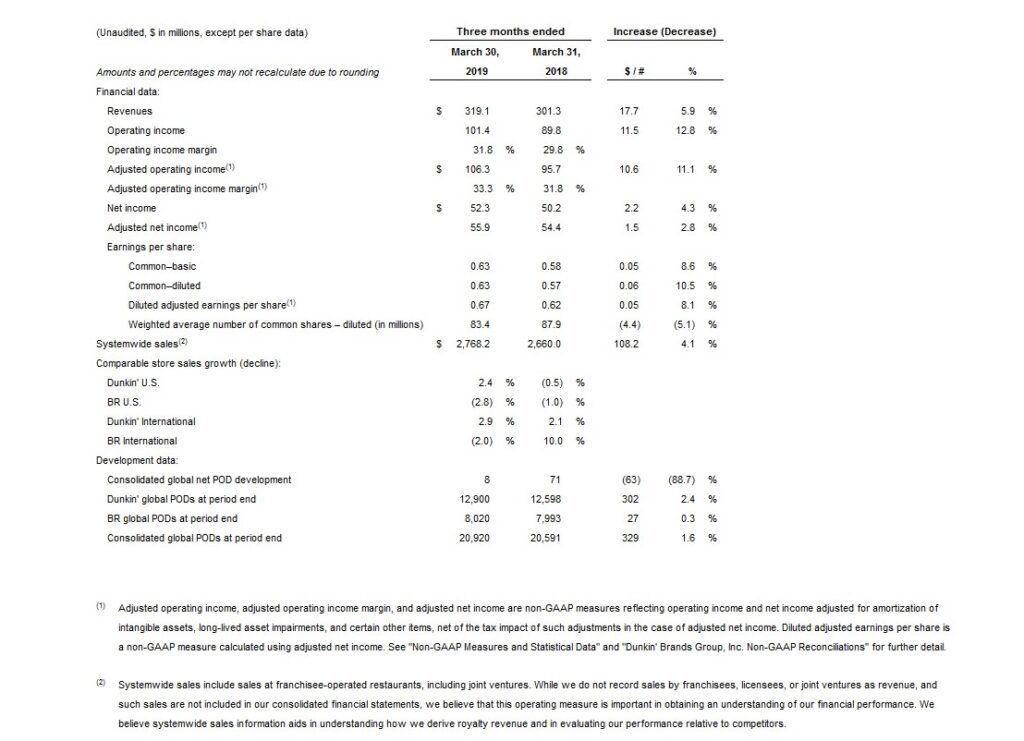

Revenues increased 5.9% and diluted EPS increased by 10.5% to $0.63. Diluted adjusted EPS increased by 8.1% to $0.67

“While we are still in the early innings of the implementation of our Blueprint for Growth, Dunkin’ U.S. delivered a strong first quarter, including 5.5 percent systemwide sales growth and a 2.4 percent increase in comparable store sales, which was the largest quarterly comparable store sales increase in four years.

This solid performance, across both morning and afternoon, was driven by consistent, compelling national value promotions and continued beverage sales momentum.

In particular, the relaunch of our highly successful handcrafted espresso platform, without impacting our trademark speed of service, has demonstrated our ability to deliver on the commitment of ‘great coffee fast,'” said David Hoffmann, Dunkin’ Brands Chief Executive Officer and President of Dunkin’ U.S. “Going forward, the collaboration we have with our franchisees and licensees will remain our number one asset, and we will continue to work together to modernize our brands and deliver healthy growth.”

“Our first quarter financial performance included approximately 6 percent revenue growth and double-digit operating income growth,” said Kate Jaspon, Chief Financial Officer, Dunkin’ Brands Group, Inc. “We completed a $1.7 billion placement of securitized debt on April 30 that replaced our 2015 notes and were pleased to maintain our overall blended fixed interest rate across all of the outstanding securitized debt under four percent. The refinancing provides strong fixed rates as well as flexibility to navigate future market environments.”

First Quarter 2019 Key Financial Highlights

Global systemwide sales growth of 4.1% in the first quarter was primarily attributable to global store development, Dunkin’ U.S. comparable store sales growth, and Dunkin’ International comparable store sales growth.

Global systemwide sales growth of 4.1% in the first quarter was primarily attributable to global store development, Dunkin’ U.S. comparable store sales growth, and Dunkin’ International comparable store sales growth.

Dunkin’ U.S. comparable store sales grew 2.4% in the first quarter as an increase in average ticket was partially offset by a decrease in traffic. The increase in average ticket was driven by strategic pricing increases coupled with favorable mix shift to premium priced espresso and frozen beverages, as well as our Go2s value breakfast sandwich platform.

Baskin-Robbins U.S. comparable store sales declined 2.8% in the first quarter as a decrease in traffic was partially offset by an increase in average ticket. Unfavorable weather impact of more than 300 basis points significantly affected all product categories in the first quarter. The increase in average ticket was driven by strategic pricing increases coupled with favorable mix shift to beverages, take home quarts, and desserts.

In the first quarter, Dunkin’ Brands franchisees and licensees opened 8 net new restaurants globally. This included 34 net new Dunkin’ U.S. locations, offset by net closures of 18 Baskin-Robbins International locations, 5 Dunkin’ International locations, and 3 Baskin-Robbins U.S. locations. Additionally, Dunkin’ U.S. franchisees remodeled 33 restaurants and Baskin-Robbins U.S. franchisees remodeled 8 restaurants during the quarter.

Revenues for the first quarter increased $17.7 million, or 5.9%, compared to the prior year period due primarily to increases in royalty income and advertising fees as a result of systemwide sales growth, as well as an increase in rental income. The increase in rental income resulted from the adoption of a new lease accounting standard in the first quarter of fiscal year 2019, which requires gross presentation of certain lease costs that the Company passes through to franchisees. See “Adoption of New Accounting Standard” for further detail.

Operating income and adjusted operating income for the first quarter increased $11.5 million, or 12.8%, and $10.6 million, or 11.1%, respectively, from the prior year period primarily as a result of the increase in royalty income and a reduction in general and administrative expenses due primarily to a decrease in personnel costs.

Net income and adjusted net income for the first quarter increased by $2.2 million, or 4.3%, and $1.5 million, or 2.8%, respectively, compared to the prior year period primarily as a result of the increases in operating income and adjusted operating income, respectively, offset by an increase in income tax expense primarily driven by excess tax benefits from share-based compensation of $1.2 million compared to $7.6 million in the prior year period and the increase in income in the current period.

Diluted earnings per share and diluted adjusted earnings per share for the first quarter increased by 10.5% to $0.63 and 8.1% to $0.67, respectively, compared to the prior year period as a result of the increases in net income and adjusted net income, respectively, as well as a decrease in shares outstanding. The decrease in shares outstanding from the prior year period was due primarily to the repurchase of shares since the beginning of the first quarter of fiscal year 2018, offset by the exercise of stock options.

Excluding the impact of recognized excess tax benefits, both diluted earnings per share and diluted adjusted earnings per share would have been lower by approximately $0.01 and $0.09 for the first quarter of fiscal years 2019 and 2018, respectively.