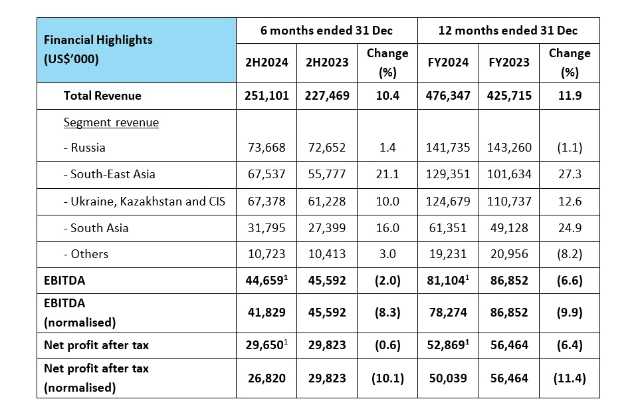

SINGAPORE – Food Empire Holdings Limited (“Food Empire”, and together with its subsidiaries, the “Group”) has achieved the fourth consecutive year of topline growth with revenue reaching a new record of US$476.3 million for the financial year ended 31 December 2024 (“FY2024”).

This is a 11.9% year-on-year (“yoy”) increase from the previous high of US$425.7 million achieved in 2023 (“FY2023”).

The stellar topline performance was a result of Food Empire’s diversification strategy as well as its increasing focus on the fast-growing Asia region. Additionally, the Group’s investments in brand building, distribution channels and product development have enabled its branded consumer products to continue to enjoy leadership position across all key markets.

In FY2024, the Group’s revenue was boosted mainly by strong double-digit growth from its South-East Asia (up 27.3% to US$129.4 million), South Asia (up 24.9% to US$61.4 million) and Ukraine, Kazakhstan and CIS (up 12.6% to US$124.7 million) segments, and partially offset by a slight dip from its Russia segment (down 1.1% to US$141.7 million) due to the depreciation of the Russian Ruble against the US dollar. For the purpose of comparing underlying performance, Russia had achieved a 7.3% increase in revenue in local currency terms.

Excluding the fair value gain on redeemable exchangeable notes of US$2.8 million, Food Empire’s normalised net profit after tax declined 11.4% to US$50.0 million in FY2024, reflecting the impact of record high coffee prices during the year, and also higher overall expenses. Sales and marketing expenses was up 14.2% due to an increase in consumer engagement activities, particularly in Vietnam, while general and administrative expenses were up 15.6% mainly due to higher legal and professional expenses in relation to the issuance of the redeemable exchangeable notes.

The Group remained in a healthy financial position with cash and cash equivalents of US$130.9 million as at 31 December 2024 (US$131.3 million as at 31 December 2023).

In view of the good results despite difficult market conditions, the Board of Directors has proposed a first and final dividend of 6.0 Singapore cents per ordinary share and a special dividend of 2.0 Singapore cents per ordinary share, bringing the total dividend for FY2024 to 8.0 Singapore cents per ordinary share. This is the third consecutive year of increase in dividends (excluding special dividends).

FY2024 market highlights

Vietnam was Food Empire’s fastest growing market in FY2024, contributing more than 50% to revenue from the Group’s South-East Asian segment. This was a result of investments in targeted consumer marketing campaigns that have strengthened the visibility of the Group’s branded consumer products and garnered strong consumer loyalty and robust sales during the year.

In Malaysia, the Group achieved higher revenue due to higher sales volumes of non-dairy creamer to customers in key markets, supported by the expanded production capacity and capability in its non- dairy creamer factory. The snack business also recorded higher sales volumes in key markets and secured new customers during the year.

In India, Food Empire’s manufacturing facilities for freeze-dried and spray-dried soluble coffee are running at close to full capacity with higher revenue from increased sales of instant coffee products and price adjustments to reflect the higher cost of coffee beans.

In Russia, the Group achieved higher revenue in local currency terms supported by effective price positioning.

The Group’s Ukraine, Kazakhstan and CIS segment also achieved revenue growth due to price adjustments, new product launches and new contribution from Tea House LLP (“Tea House”), which became a subsidiary in FY2024. Tea House is one of the leading producers of tea in Kazakhstan.

Food Empire, Group Chief Executive Officer, Mr Sudeep Nair, said: “This is our fourth consecutive year of revenue growth amidst all the geopolitical challenges. We continue to reap the results of investments that were made over the past decade. We will build on this momentum by ongoing investments in our flagship brands and support our efforts with new expansion projects that will continue to strengthen our business and bring us sustainable growth.”

Outlook

The Group expects its growth momentum to continue due to its past and ongoing investments in its brands. In particular, it sees stronger growth from Asia and has put in place various commercial and strategic initiatives to tap on opportunities around the region.

To sustain the strong growth in Vietnam, the Group will continue to invest in strengthening its brand presence and increase the rate of consumer acquisition.

In Malaysia, the Group completed the expansion of its non-dairy creamer manufacturing facility in 2Q2024 with newly added capacity that is expected to ramp up to full utilisation over the next two to three years. In addition, the expansion of the snack manufacturing facility in Malaysia is expected to be completed by the first quarter of 2025 with commercial production to commence by the second quarter of the year.

As part of its regional expansion strategy, the Group has invested in new production facilities in Asia. It expects to complete the construction of a new coffee-mix production facility in Kazakhstan by the end of 2025. This will be Food Empire’s first coffee-mix production facility in Central Asia and it will enable the Group to serve markets in that region more efficiently.

The Group has committed to invest in a freeze-dried soluble coffee manufacturing facility in Vietnam, which is expected to be completed by 2028. This new facility will position Food Empire as one of Asia’s leading manufacturers of freeze-dried soluble coffee.

Food Empire is cautiously optimistic of sustained business growth, but it is mindful of macro factors that may impact its business. These include geopolitical challenges and the potential of heightened trade tensions that may cause volatility in local currencies and bring economic uncertainties. Climate change has also driven up the cost of the Group’s main raw material – coffee beans. The Group remains vigilant of any potential impact that these events may have on its business and will continue to conduct periodic reviews and manage its business strategies to mitigate these challenges.

Notes

From the charts: (1) Includes a fair value gain of derivatives of US$2.8 million from the redeemable exchangeable notes. In FY2024, the Group’s wholly owned subsidiary, Empire APAC Pte. Ltd. issued 5.5% redeemable exchangeable notes to Merit Genesis Pte Ltd and Apex Genesis Pte Ltd at an aggregate value of US$40.0 million, that are convertible into new ordinary shares in the capital of the Company.

About Food Empire Holdings Limited (Bloomberg Code: FEH SP)

SGX Mainboard-listed Food Empire Holdings (“Food Empire” or together with its subsidiaries, the “Group”) is a multinational food and beverage manufacturing and distribution group headquartered in Singapore. With a portfolio spanning instant beverages, snack foods, and a growing presence in food ingredients, Food Empire’s products are sold in over 60 countries across North Asia, Eastern Europe, South-East Asia, South Asia, Central Asia, Middle East, and North America.

Supported by 9 manufacturing facilities in 6 countries and 23 offices worldwide, Food Empire offers an enticing range of branded beverages and snacks, including classic and flavoured coffee mixes and cappuccinos, chocolate drinks, flavoured fruity teas, bubble tea, instant cereal blends, and potato chips. Its food ingredients business features the finest freeze-dried and spray-dried instant coffee, as well as non- dairy creamer.

Food Empire owns a family of proprietary brands – including MacCoffee, CaféPHỐ, Petrovskaya Sloboda, Klassno, Hillway, and Kracks. MacCoffee – the Group’s flagship brand – has been consistently ranked as the leading 3-in-1 instant coffee brand in the Group’s core markets. The Group employs innovative brand-building activities, localised to match the flavour of the local markets in which its products are sold.

Since its public listing in 2000, Food Empire has won numerous accolades and awards including being recognised as one of the “Most Valuable Singapore Brands” by IE Singapore (now known as Enterprise Singapore), while MacCoffee has been ranked as one of “The Strongest Singapore Brands” and CaféPhố received “Top Brand” Award by Influential Brands. Forbes Magazine has thrice named Food Empire as one of the “Best Under A Billion” companies in Asia and the company has also been awarded as one of Asia’s “Top Brands” by Influential Brands.

Food Empire is dedicated to sustainability, as evidenced by the receipt of the Sustainability Award at the Securities Investors Association (Singapore) 20th Investors’ Choice Award – and it also emerged as the winner of The Enterprise Award at the Singapore Business Awards 2020/2021.

For more information, please click here.