Share your coffee stories with us by writing to info@comunicaffe.com.

LONDON – Intercontinental Exchange (NYSE: ICE), the leading global network of exchanges and clearing houses, today provided an update in relation to the transition of the Liffe futures and options contracts to the ICE futures exchanges, trading platform and clearing infrastructure.

On June 9, 2014, the following Liffe U.S. interest rate futures were successfully transitioned to ICE Futures Europe and ICE Clear Europe.

- Three-Month Eurodollar Futures

- US Agency DTCC GCF Repo Index® Futures

- US Mortgage-Backed Securities DTCC GCF Repo Index® Futures

- US Treasury DTCC GCF Repo Index® Futures

The transition of DTCC GCF Repo Index futures and Eurodollar futures involved our global customer base with 261k contracts being transferred to ICE Clear Europe and US $61 million margin held at the clearing house on the morning of June 9, 2014.

Separately, the Liffe U.S. MSCI equity index and precious metal futures contracts will transition to ICE Futures U.S. and ICE Clear U.S. on June 30, 2014, where they will trade alongside ICE’s Russell index futures and agricultural commodity contracts.

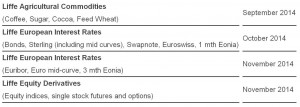

Following the successful separation of the Liffe and Euronext businesses earlier this year, the transition of Liffe’s European interest rate, agriculture and equity derivatives markets remains on track to migrate to ICE Futures Europe by the end of 2014 and based on the schedule below.

This will centralise ICE’s global interest rate portfolio on one exchange and trading platform, maximising operational and capital efficiencies for customers (click to enlarge).

The ICE trading platform features state-of-the art technology and functionality, including trading applications such as the WebICE trading front end, ICE Mobile, ICE Chat and WhenTech Options Analytics. The transition of Liffe contracts to the ICE platform involves further expanding the ICE trading platform to provide:

- A pro-rata, allocation based matching model, an important feature for the interest rate markets

- Enhanced wash trade prevention protections, including ICE’s Self-Trade prevention Functionality

- Improved pre-trade risk management technology, interval price limit circuit breakers and sophisticated messaging policies to maintain highly efficient, orderly and reliable markets

About Intercontinental Exchange

Intercontinental Exchange (NYSE: ICE) is the leading network of regulated exchanges and clearing houses for financial and commodity markets. ICE delivers transparent, reliable and accessible data, technology and risk management services to markets around the world through its portfolio of exchanges, including the New York Stock Exchange, ICE Futures, Liffe and Euronext.

Trademarks of ICE and/or its affiliates include Intercontinental Exchange, ICE, ICE block design, NYSE Euronext, NYSE, New York Stock Exchange, LIFFE and Euronext.

Source: IntercontinentalExchange