ATLANTA, US – Intercontinental Exchange (NYSE:ICE), the leading global network of exchanges and clearing houses, completed on June 1st the transition of Liffe U.S. futures and options contracts to the ICE futures exchanges, trading platform and clearing infrastructure.

The Liffe U.S. MSCI equity index and precious metal contracts were successfully transitioned to ICE Futures U.S. and ICE Clear U.S. on June 30, 2014, where they trade and clear alongside ICE’s agricultural commodity and Russell index futures and options contracts.

The transition of Liffe U.S. MSCI equity index and precious metal contracts involved our global customer base with 500,000 contracts being transferred to ICE Clear U.S. and an additional U.S. $1.9 billion margin transferred to the clearing house for these positions on June 30, 2014.

The following Liffe U.S. interest rate futures were previously transitioned to ICE Futures Europe and ICE Clear Europe on June, 9, 2014:

- Three-Month Eurodollar Futures

- US Agency DTCC GCF Repo Index® Futures

- US Mortgage-Backed Securities DTCC GCF Repo Index® Futures

- US Treasury DTCC GCF Repo Index® Futures

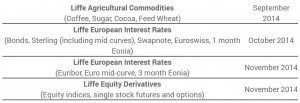

The transition of Liffe’s European interest rate, agriculture and equity derivatives markets remains on track to migrate to ICE Futures Europe by the end of 2014 based on the schedule below.

This will centralize ICE’s global interest rate portfolio on one exchange and clearing platform, maximizing operational and capital efficiencies for customers. Clearing for the contracts transitioned to ICE Clear Europe one year ago (click to enlarge).

The ICE trading platform features state-of-the art technology and functionality, including trading applications such as the WebICE trading front end, ICE mobile, ICE Chat and WhenTech Options Analytics. The transition of Liffe contracts to the ICE platform involves further expanding the ICE trading platform to provide:

- A pro-rata, allocation based matching model, an important feature for the interest rate futures markets

- Enhanced wash trade prevention protections, including ICE’s self-trade prevention functionality

- Improved pre-trade risk management technology, interval price limit circuit breakers and sophisticated messaging policies to maintain highly efficient, orderly and reliable markets