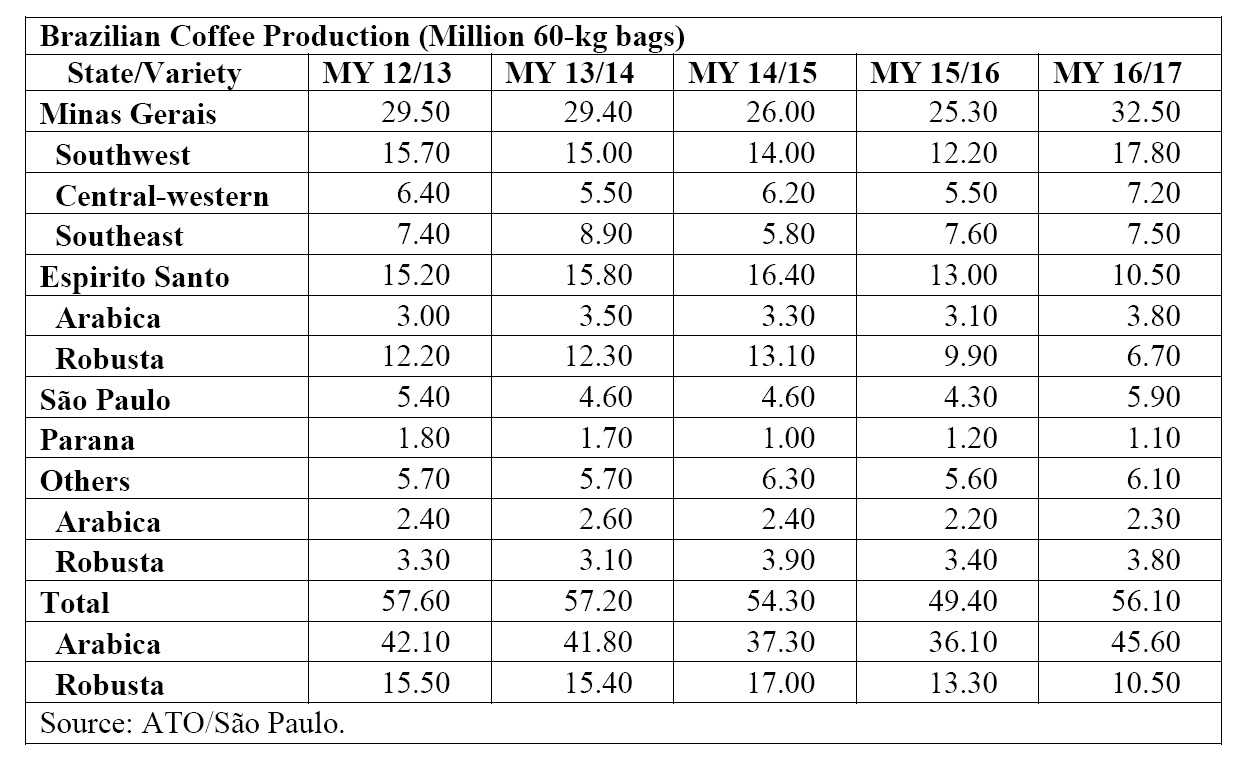

The Agricultural Trade Office (ATO) in São Paulo revised the Brazilian coffee production estimate for marketing year (MY) 2016/17 (July-June) up to 56.1 million 60-kg bags, green equivalent, an increase of 6.7 million bags relative to MY 2015/16 (49.4 million bags).

Arabica production is estimated at 45.6 million bags, up four percent compared to the previous estimate, due to better than expected dehusking yields in the majority of the growing areas.

On the other hand, Robusta production was revised down to 10.5 million bags, a 13 percent decrease from the May 2016 estimate, due to lower than expected yields, especially in the state of Espirito Santo, which has been steadily and severely affected by a deficit in water supply due to irregular rainfall since 2014. The harvest ended in October.

The overall quality of the Arabica beans has improved from the previous crop and the size pattern of the beans is normal compared to historical averages. However, the quality of Robusta beans is significantly below average.

Area harvested and tree inventory estimates remain unchanged. The table below shows production estimates by state from MY 2012/13 to MY 2016/17.

In September 2016, the Brazilian government (GOB), through the National Supply Company (CONAB) of the Ministry of Agriculture, Livestock and Supply (MAPA), released the third official coffee production estimate for MY 2016/17.

In September 2016, the Brazilian government (GOB), through the National Supply Company (CONAB) of the Ministry of Agriculture, Livestock and Supply (MAPA), released the third official coffee production estimate for MY 2016/17.

As reported by CONAB, coffee production is estimated at 49.64 million bags (41.29 million bags for Arabica and 8.35 million for Robusta coffee), up 6.41 million bags compared to MY 2015/16 (43.24 million bags).

The September 2016 coffee production estimate for MY 2016/17 released by the Brazilian Institute of Geography and Statistics (IBGE) shows the production of 2.9 million metric tons of coffee, or 48.9 million 60-kg bags (41.1 million bags for Arabica and 7.8 million for Robusta coffee), up 4.8 million bags relative to MY 2015/16 (44.1 million bags).

No official forecast has been announced for MY 2017/18.

Coffee Prices in the Domestic Market

According to the Arabica Coffee Index price series released by the University of São Paulo’s Luiz de Queiroz College of Agriculture (ESALQ), Arabica coffee prices in local currency have reacted positively in 2016 compared to 2015, driven by expectations of a smaller crop in MY 2017/18.

Note that trees will be mostly on the off-year of the biennial production cycle, and traders have already anticipated an expected reduction in production for 2017.

Coffee prices in U.S. dollars for July-October 2016 increased by 27 percent (US$ 154.33/bag) compared to US$ 121.40/bag during the same period in 2015, mainly due to the sharp devaluation of the Brazilian Real.

On the other hand, Robusta prices have abruptly increased since 2015.

The Robusta Coffee Index price series released by ESALQ increased by 38 percent from October 2015 (R$ 363,94/bag) to October 2016 (R$ 501,08/bag) due to the sharp drop in production from 17 million bags for MY 2014/15 to 13.3 million bags in MY 2015/16 and to 10.5 million bags during the current crop.

Therefore, the price differential between Arabica and Robusta varieties has narrowed in the last year.

Consumption

The estimate for domestic coffee consumption for MY 2016/17 remains unchanged at 20.51 million coffee bags (19.4 million bags of roast/ground coffee and 1.11 million bags of soluble coffee, respectively), equivalent to MY 2015/16, reflecting stable consumption.

The Brazilian Coffee Industry Association (ABIC) has not released yet the November 2015-October 2016 coffee consumption survey.

Trade

ATO/São Paulo’s estimate for Brazilian coffee exports in MY 2016/17 has been revised down to 34.23 million bags, a decrease of 1.31 million bags from the previous marketing year, reflecting the export pace for the initial months of the current marketing year.

Green bean exports are expected to contribute 31 million bags, while soluble coffee exports are estimated at 3.2 million bags. Brazil remains the largest world coffee exporter representing over one third of world trade.

Coffee exports for MY 2015/16 were revised downward to 35.54 million 60-kg bags, green beans, a decrease of 1 million bags from the previous season, but still the second highest export volume ever, based on updated information from the industry.

Green bean (arabica and robusta) exports are estimated at 31.87 million bags, whereas soluble coffee exports are estimated at 3.65 million bags.

Stocks

ATO/São Paulo estimates ending stocks in MY 2016/17 at 4.14 million bags, up 1.42 million bags relative to MY 2015/16, as a result of updated figures for exports and production.

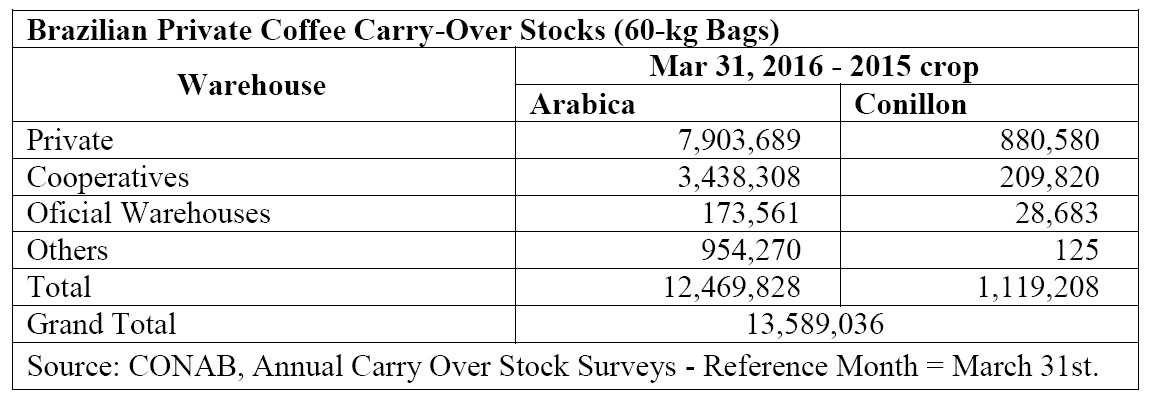

On March 31, CONAB released the 2016 private stocks survey, including stocks held by growers, coffee cooperatives, exporters, roasters, and the soluble industry.

Private stocks are estimated at 13.59 million bags, down five percent compared to the previous year (14.37 million bags).

CONAB has changed the methodology on how it reports the different industry agents. The table below shows the results of the last private stock survey released by CONAB.

Government owned stocks held by CONAB on October 31, 2016 are reported at 1 million bags. CONAB has held coffee auctions to sell public stocks, and stocks are expected to be zeroed by the end of the MY.

Government owned stocks held by CONAB on October 31, 2016 are reported at 1 million bags. CONAB has held coffee auctions to sell public stocks, and stocks are expected to be zeroed by the end of the MY.