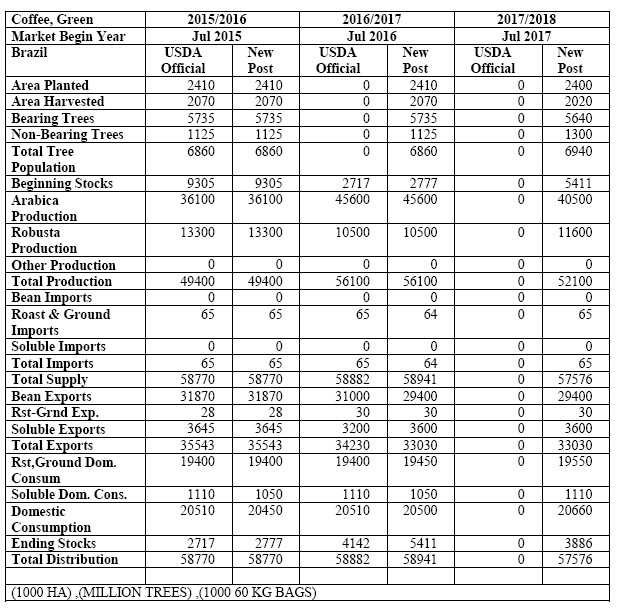

SAO PAULO, Brazil – ATO/Sao Paulo forecasts Brazil’s coffee production for Marketing Year (MY) 2017/18 (July-June) at 52.1 million 60-kg bags, a decrease of four million bags compared to MY 2016/17, due to the off-year of the biennial production cycle of trees in the majority of Arabica growing regions.

Robusta/conilon trees are likely to partially recover from the previous year’s smaller crop. Coffee exports for MY 2017/18 are projected stable at 33.03 million bags, compared to the revised estimate for MY 2016/17, due to supply constraints.

Production

The Agricultural Trade Office in Sao Paulo (ATO) forecasts Brazil’s marketing year (MY) 2017/2018 (July-June) coffee production at 52.10 million bags (60 kilograms per bag), green equivalent, a decrease of four million bags relative to the unchanged estimate for MY 2016/17.

Harvest in the Robusta/conilon producing regions started in March/April, whereas the Arabica coffee harvest started in May.

Arabica production for MY 2017/18 is forecast at 40.5 million bags, a decrease of 11 percent relative to the previous crop, given that the majority of producing areas are in the off-year of the biennial production cycle.

However, adequate blossoming and good weather conditions in the majority of the producing regions are likely to contribute to expected good agricultural yields.

Indeed, production numbers could even improve throughout the harvest, due to expected above average dehusking yields and quality of the beans. ATO contacts report a larger screen size of beans this year.

Robusta/Conilon production for MY 2017/18 is projected at 11.6 million bags, up 1.1 million bags from MY 2016/17 (10.5 million bags).

Higher production is expected in Espirito Santo, Rondonia, and Bahia. Note that due to continued water deficits, coffee trees in Espirito Santo have not fully recovered the production potential from previous years yet.

Post conducted field trips to the major coffee producing areas (Minas Gerais, Espirito Santo, Sao Paulo, Rondonia and Parana) to observe vegetative development, cherry set, and fruit formation to assess the 2017 crop. Information was also collected from government sources, state secretariats of agriculture, grower associations, cooperatives, and traders.

Coffee trees in southern Minas Gerais and Sao Paulo (Alta and Baixa Mogiana) show excellent vegetative development and vigor. Growers have taken advantage of the excellent production in last year’s crop and have intensified crop management, particularly pruning.

Adequate rainfall has fully supported fruit development and filling. However, production potential is expected to drop compared to the previous season given that the majority of trees are in the off-year of the biennial production cycle.

Overall, conilon/Robusta coffee trees show regular to fair vegetative development and that production potential will be somehow affected by the water deficit experienced the past three years.

Rainfall volumes have improved in Espirito Santo recently, but not in levels sufficient to fully recover plant vigor and production potential. The water deficit is still an important issue for the state and several restrictions, such as limits on irrigation, have been enforced.

Arabica coffee trees in Espirito Santo are expected to result in lower production for the 2017 crop, given that they are in the off-year of the biennial production cycle. On the contrary, eastern Minas Gerais shows overall good to excellent crop development and production potential should exceed last year’s production. Rainfall patterns in the region are reportedly good.

Weather has contributed to above average coffee bean development and filling in, both in the State of Parana and the Marilia/Presidente Prudente growing areas in the state of Sao Paulo.

Production in Parana is expected to increase due to the on-year of the biennial production cycle of the coffee trees whereas the opposite is likely to occur in the state of Sao Paulo (due to the off-year of the biennial production cycle).

Coffee trees in the “Cerrado Mineiro” (western Minas Gerais) show good vegetative development, however production potential will be limited by the off-year of the biennial production cycle of the trees.

As reported in southern Minas Gerais, growers have taken advantage of the excellent production in last year’s crop and have intensified crop management, particularly pruning. Weather patterns have supported the filling and development of the beans.

Coffee production in Rondonia is expected to improve from last year’s crop as a result of increased use of clonal coffee seedlings and the revitalization of old coffee areas.

In addition, a growing number of farmers have adopted technologies and cultural practices such as the use of improved cultivars, phytosanitary control, fertilization, irrigation, good harvesting and post harvesting practices, which have enabled higher yields and resulted in a better quality product.

The table below shows coffee forecast production by state and variety for MY 2017/18 as well as production estimates from MY 2013/14 to MY 2016/17.

In January 2017, the Brazilian Government (GOB), through the Ministry of Agriculture, Livestock and Food Supply’s (MAPA) National Supply Company (CONAB), released its first survey projecting Brazilian coffee production in MY 2017/18.

In January 2017, the Brazilian Government (GOB), through the Ministry of Agriculture, Livestock and Food Supply’s (MAPA) National Supply Company (CONAB), released its first survey projecting Brazilian coffee production in MY 2017/18.

It forecasts between 43.65 and 47.5 million 60-kg bags, a 3.87 to 7.72 million bag decrease compared to the final estimate for MY 2016/17 (51.37 million bags – 43.38 and 7.99 million bags of Arabica and Robusta/conilon coffee, respectively).

CONAB projects Arabica production between 35.01 and 37.88 million bags, whereas the Robusta/conilon crop is estimated between 8.63 and 9.62 million bags. CONAB is expected to release the second coffee survey for the 2016 crop on May 18.

The Brazilian coffee yield for MY 2017/18 is projected at 25.79 bags/hectare, a five percent decrease vis-à-vis the previous crop (27.10 bags/hectare). The graph bellows illustrates the evolution of Brazilian coffee yields since 2006.

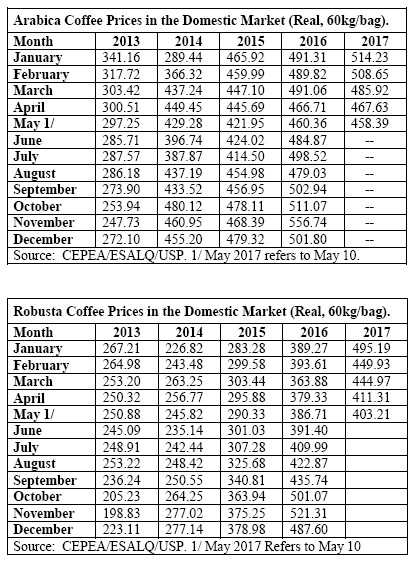

Coffee Prices in the Domestic Market

The tables below show the Coffee Index price series for both Arabica and Robusta coffee released by the University of Sao Paulo’s Luiz de Queiroz College of Agriculture (ESALQ). The series tracks coffee prices in the domestic spot market since September 1996.

Robusta coffee prices in the domestic market have steadily increased as a consequence of a persistent drought in the state of Espirito Santo since 2014.

Robusta coffee prices in the domestic market have steadily increased as a consequence of a persistent drought in the state of Espirito Santo since 2014.

Espirito Santo is the major Brazilian growing area for this coffee variety coffee. ATO/Sao Paulo estimates production in the state dropped nearly 50 percent from 2014 (13.1 million 60-kg bags) to 2016 (6.7 million 60-kg bags).

Consumption

ATO/Sao Paulo projects Brazil’s domestic coffee consumption for MY 2017/18 virtually stable at 20.66 million coffee bags (19.55 million bags of roast/ground and 1.11 million bags of soluble coffee, respectively), vis-à-vis MY 2015/16, reflecting the slowdown of the Brazilian economy and changing of consumer patterns, in spite the high penetration of coffee in Brazilian households.

The Brazilian Coffee Industry Association (ABIC) reports that the coffee industry processed 21.2 million bags, green equivalent, from November 2015 to October 2016, up three percent compared to the same period the year before (20.5 million bags).

Per capita consumption for 2016 is estimated slightly up from 2015, at 5.03 kg of roasted coffee per person.

Exports

Total Brazilian coffee exports for MY 2017/18 are projected stable at 33.03 60-kg million bags. Green bean exports are forecast to account for 29.4 million bags, while soluble coffee exports are projected at 3.6 million bags.

ATO/Sao Paulo estimates coffee exports for MY 2016/17 at 33.03 million 60-kg bags, green beans, a decrease of seven percent from MY 2015/16 (35.54 million bags), based on year-to-date export volumes and anticipated May-June loadings.

Green bean (Arabica and Robusta/conilon) exports are estimated at 29.4 million bags, whereas soluble coffee exports are estimated at 3.6 million bags.

According to the April 2017 coffee trade statistics released by the International Coffee Organization (ICO), total world coffee consumption for 2015/16 is estimated at 155.71 million bags, up 3.89 million bags relative to 2014/15. Brazil represents over one third of total world exports.

Stocks

ATO/Sao Paulo forecasts total ending stocks in MY 2017/18 at 3.88 million bags, a 1.53 million bag decrease relative to the previous season (5.41 million bags), due to expected lower production.

CONAB has promoted auctions to sell 720,000 bags of coffee in the domestic market and government stocks are virtually zero.

CONAB’s 2017 CONAB’s privately-owned stocks survey has not been released yet.

The survey includes coffee stocks held by growers, coffee cooperatives, exporters, roasters, and the soluble industry as of March 31, 2017.