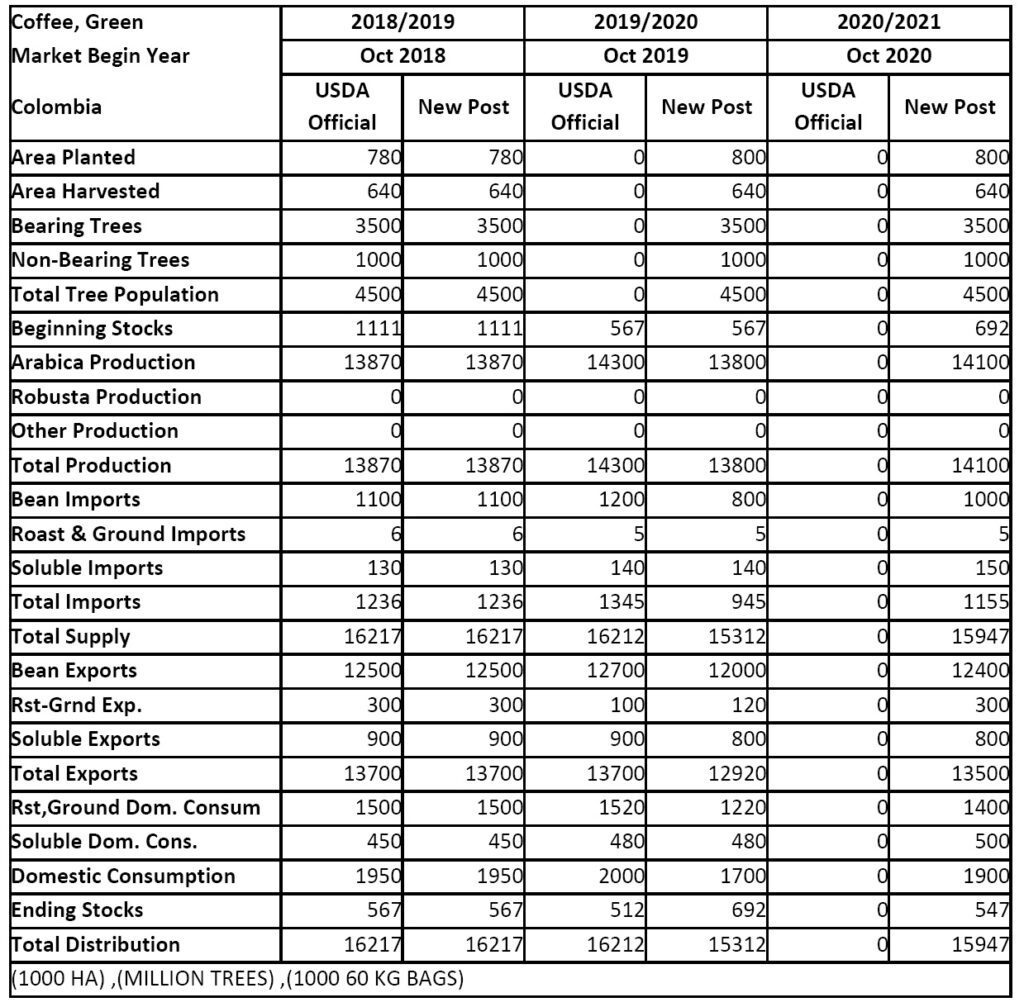

BOGOTA, Colombia – In MY 2020/21, Colombian coffee production is forecast to reach 14.1 million bags GBE, if weather conditions are favorable for crop development and challenges from the covid-19 pandemic are overcome, says the latest Gain Report from USDA’s Foreign Agricultural Service. Production estimates for MY 2019/20 are revised downward from 14.3 to 13.8 million bags GBE. This decrease is a result of climate effects and containment measures to stop the Covid-19 spread.

In early 2020, the rainy season was delayed affecting fruit ripening and increasing the risk of borer that benefits from extended drought. In fact, in April 2020, borer infestation reached 6.2 percent, higher than the 2 percent goal. Usually rain starts in March, but this year it started in the third week of April. The Colombian Coffee Growers Federation (Fedecafe) estimates production in May through July will partly compensate the low production levels of March and April, as coffee trees in the field indicate normal production levels.

In addition to climate change challenges, on March 25, 2020, the Government of Colombia ordered all people within the country to quarantine in response to the growing Covid-19 outbreak. The food and agricultural sectors were authorized to continue operating, however, some challenges have arisen. In the coffee sector, the main concerns are a shortage of labor and the effect of lockdown restrictions on transportation and logistics.

During the first part of the year, 135,000 seasonal workers are required to collect the estimated 6.5 million bags harvest. Medium and large scale growers usually hire seasonal workers from other areas, and in recent years, Venezuelan immigrants that supported labor in the main producing regions.

Due to the quarantine measures, people are restricted to travel and the main concern is to have enough workers. Fedecafe and the Colombian government developed a sanitary protocol to prevent the spread of Covid-19 in the coffee sector while growers gather the crop. In addition to the sanitary measures, Fedecafe has conducted a campaign to motivate unemployed local people in other sectors to work in the coffee farms. Small farmers, with less than 3 hectares, are encouraged to work only with family members older than 16-years old, while medium and large farmers are recommended to employ mostly people from the region.

The supply chain has also been affected by the lockdown restrictions on traveling and cargo transportation. Suppliers, traders and intermediaries have faced delays delivering and collecting coffee to and from the distribution centers or cooperativas, and limited schedules for banks and other institutions have slowed down coffee operations.

Colombian coffee production costs

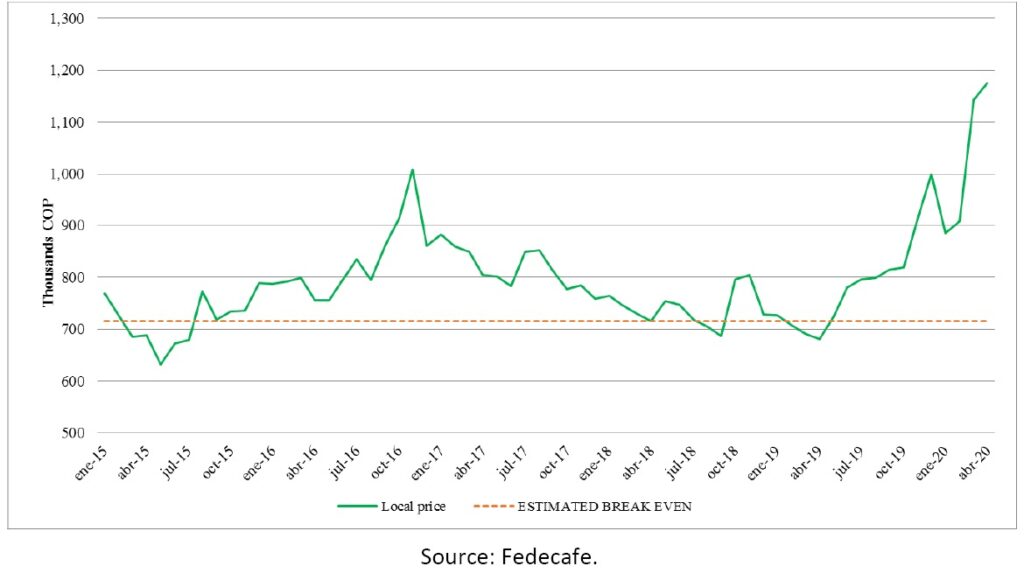

Colombian domestic prices depend on the New York international price and the Colombian peso (COP) to U.S. dollar currency exchange rate. The decrease in international prices severely affected internal prices in 2018 and part of 2019. Since May 2019, the recovery of international prices and the devaluation of Colombian peso against dollar have slowly increased and maintained internal prices above estimated average productions costs ($715,000 COP/125Kg bag, approximately $208 USD). However, since the first case of Covid-19 was confirmed in Colombia, local prices have jumped to high historical levels. In March 2020, local price increased by 25.7 percent compared to the previous month, and by 65.5 percent compared to March, 2019.

This increase is motivated by higher international prices driven by stockpiling among major players that anticipate supply disruptions, and the over 20 percent Colombian peso depreciation against U.S. dollar. The graph below illustrates the monthly internal price paid to growers per 125 kilogram bag.

As reference, the estimated average production cost is illustrated by the red dotted line. Colombian coffee farmers have claimed that production costs may increase as a result of the implementation of sanitary measures and higher salaries due to shortage of labor.

In 2019, Fedecafe estimates there are 540,000 coffee growing families in 21 out of 32 Colombian departments, where small farmers with less than five hectares of land are responsible for approximately 69 percent of coffee production in Colombia.

There are approximately 860,000 hectares of coffee planted in the country. Nearly 800,000 correspond to technified crops, meaning they are partially planted with improved coffee varieties, such as rust resistant trees, dense plantations and are younger than 12 years old.

As a result of a successful replanting program and the implementation of agronomic best practices, the planting density increased to 5,232 trees per hectare, the area planted with rust resistant varieties reached 82.4 percent, with productivity at historically high levels of 20.5 bags GBE per hectare, and the average age of coffee plantations was reduced to 6.7 years. If the number of renovated hectares is at least 80,000 per year, the Colombian productivity potential will remain around 14.7 million bags GBE.

Consumption

In MY 2019/20, Colombian coffee consumption levels are revised downward from 2.0 million bags GBE to 1.7 million bags GBE as out-of-home demand decreases due to lockdown measures that ordered restaurants and coffee stores to remain closed to the public and only operate through deliveries. In recent years, increasing number of coffee stores boosted Colombians coffee consumption.

While roasted and ground coffee consumption may decrease driven by restaurants and coffee stores closures and social distancing measures, soluble coffee consumption may increase as a result of panic buying and stockpiling by households. In addition, reduced household incomes can lead to some consumers to substitute higher priced coffee by lower value brands.

In MY 2020/21, Colombian coffee consumption is forecast to recover to 1.9 million bags GBE, a 12 percent increase from the previous year, in response of resumed operations of restaurants, coffee stores and workplaces in general.

Trade

In MY 2019/20, revised Colombia coffee exports are estimated at 12.9 million bags GBE, because of decreasing production and logistical challenges due to the Covid-19 containment measures that have slowed down the flow of coffee through the supply chain. Coffee bean exports represent over 90 percent of total exports followed by soluble coffee and roasted coffee.

From October 2019 to February 2020, overall coffee exports decreased by 2 percent, driven by lower exports of coffee beans (-1%) and roasted coffee (-57%).

In MY 2020/21, coffee exports are forecast to reach 13.5 million bags GBE, a 4.5 percent increase from the previous year. This growth is motivated by increasing production and more normal conditions in the supply chain operation.

If global coffee demand is affected by the effects of the Covid-19 pandemic, a recovery may be expected in MY 2020/21.

The United States continue to be the major destination for Colombian coffee. In MY 2018/19, the United States imported approximately 43% of the total Colombian exports, followed by the European Union (26%), Japan (9%), and Canada (8%).

Colombia’s coffee import estimate for MY 2019/20 decreases to 945,000 bags GBE driven by lower domestic demand. In MY 2020/21, coffee imports are forecast to increase to 1.1 million bags GBE to satisfy the recovery of domestic demand along with exports. The coffee imports have been traditionally from Peru, Honduras and Ecuador. However, since 2019, Brazil became the top coffee supplier, accounting for 60 percent of total imports, followed by Peru (20.7%) and Honduras (5.6%). Imports are primarily used to meet the lower end of the domestic market.

Stocks

There exists no government or Fedecafe policy to support large scale carry-over stocks of coffee. In MY 2019/20 ending stocks are estimated to increase to 692,000 bags GBE given delayed harvest and slowdown operations in the supply chain due to the Covid-19 pandemic measures. In MY 2020/21 ending stocks are forecast to fall to 547,000 bags GBE, as a result of recovering exports and domestic demand.

Policy

Fedecafe represents Colombia’s coffee sector and manages its programs under a legal agreement with the Colombian government. Most of the policies and programs for the coffee sector are sponsored by the National Coffee Fund, which is a checkoff program that collects six cents per pound of coffee from producers.

Most coffee growers are members of Fedecafe and take advantage of the organization’s educational programs, technical training, and sales support. Fedecafe provides technical support to coffee producers through the extension service that assists growers on good practices for planting, harvest and post-harvest, as well as processing that have an impact on the final quality of coffee. In addition, Fedecafe manages low interest loan programs for the costs of replanting.

The Colombian government also offers financial assistance to coffee producers supported by the Financing Fund for the Agricultural Sector (FINAGRO). It provides loans with discounted payback terms and a special loan category that offers funds to small growers in replanting their coffee fields. Under the current emergency, Finagro created four special loan categories for all coffee farmers to support replanting activities, purchasing of machinery, coffee crop maintenance and alternative crops planting.

Colombian coffee production, consumption and trade