DEERFIELD, Ill., US – Mondelez International, Inc. yesterday (December 18th 2013) announced the final results for its previously announced cash tender offer (the “Tender Offer”) for its 6.500% Notes due 2017 (the “Priority 1 Notes”), 6.125% Notes due 2018 (the “Priority 2 Notes”), 6.125% Notes due 2018 (the “Priority 3 Notes”) and 5.375% Notes due 2020 (the “Priority 4 Notes” and, together with the Priority 1 Notes, the Priority 2 Notes and the Priority 3 Notes, the “Notes”).

The company had previously accepted for purchase $908,215,000 of the Priority 1 Notes, $727,027,000 of the Priority 2 Notes, $329,771,000 of the Priority 3 Notes and $1,465,807,000 of the Priority 4 Notes, which had been validly tendered and not validly withdrawn as of 5:00 p.m., Eastern time, on December 3, 2013 (the “Early Tender Deadline”). Payment for all notes accepted for purchase thereby was made on December 11, 2013.

The Tender Offer was made pursuant to an Offer to Purchase, dated November 19, 2013 (the “Offer to Purchase”) and related Letter of Transmittal, also dated November 19, 2013 (the “Letter of Transmittal”), which set forth a description of the terms and conditions of the Tender Offer.

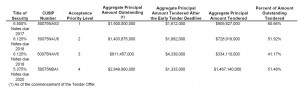

The principal amount of each series of Notes that were validly tendered and not validly withdrawn in the Tender Offer as of the expiration of the Tender Offer at 11:59 p.m., Eastern time, on December 17, 2013 (the “Expiration Time”) are outlined in the table below (click to enlarge).

Subject to the terms and conditions of the Tender Offer, the company expects that it will accept for purchase all Notes validly tendered and not validly withdrawn prior to the Expiration Time. The settlement for the Notes tendered after the Early Tender Deadline and accepted by the company is currently expected to take place on December 18, 2013.

This press release is neither an offer to purchase nor a solicitation of an offer to sell securities. No offer, solicitation, purchase or sale will be made in any jurisdiction in which such offer, solicitation, or sale would be unlawful. The Tender Offer is being made solely pursuant to terms and conditions set forth in the Offer to Purchase and the Letter of Transmittal.

BofA Merrill Lynch, Credit Suisse Securities (USA) LLC, BNP Paribas Securities Corp. and Deutsche Bank Securities Inc. served as Lead Dealer Managers for the Tender Offer.

Questions regarding the Tender Offer may be directed to BofA Merrill Lynch at 888-292-0070 (toll free) or 980-387-3907 (collect), to Credit Suisse Securities (USA) LLC at 800-820-1653 (toll free) or 212-538-2147 (collect), to BNP Paribas Securities Corp. at 888-210-4358 (toll free) or 212-841-3059 (collect) or to Deutsche Bank Securities Inc. at 866-627-0391 (toll free) or 212-250-2955 (collect).

Requests for the Offer to Purchase or the Letter of Transmittal or the documents incorporated by reference therein may be directed to Global Bondholder Services Corporation, which acted as Tender and Information Agent for the Tender Offer, at the following telephone numbers: banks and brokers, 212-430-3774; all others toll free at 866-924-2200.