DEERFIELD, Ill., USA – Mondelez International, Inc. reported its 2014 results on February 11th 2015, reflecting strong Adjusted Operating Income1 margin expansion and Adjusted EPS1 growth.

“In 2014, we delivered strong earnings growth, margin expansion and cash flow in a challenging consumer and retail environment by driving record net productivity and aggressively reducing overheads,” said Irene Rosenfeld, Chairman and CEO.

“At the same time, we delivered organic net revenue growth in line with our expectations as we raised prices to recover higher input costs, protect profitability and ensure the health of our franchises.

“As we execute our transformation agenda in 2015, we expect to deliver modest organic revenue growth as well as solid margin expansion and strong constant-currency earnings growth.

We remain on a clear path to achieve our 2016 margin target and to drive sustainable earnings and revenue growth over the long term.

We’re continuing to execute our cost-reduction initiatives to expand margins and to make the necessary foundational investments in our brands, innovation platforms, routes to market and supply chain, so we’re well-positioned to accelerate revenue growth as consumer demand improves.”

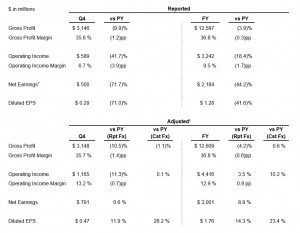

Full Year GAAP Results

On a reported basis, net revenues were $34.2 billion, down 3.0 percent, including a negative 5.1 percentage point impact from currency. Operating income was $3.2 billion, down 18.4 percent, including a negative 12.4 percentage point impact from restructuring costs2 and a negative 8.7 percentage point impact from cycling the prior-year reversal of an indemnity accrual related to the 2010 acquisition of Cadbury3. Diluted EPS was $1.28, down 41.6 percent, due almost entirely to the negative 90-cent impact of cycling the prior year’s arbitration award4.

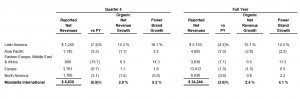

Organic Net Revenue1 (click to enlarge)

Full Year Commentary

Organic Net Revenue increased 2.4 percent, driven by strong pricing performance (up 4.5 percentage points), which more than offset unfavorable volume/mix (down 2.1 percentage points).

The decline in volume/mix was largely due to price elasticity, a slow response by competitors to higher input costs and the impact of significant price-related customer disruptions that are largely resolved.

Organic Net Revenue from emerging markets5 was up 7.0 percent, while developed markets6 decreased 0.5 percent. Overall, Power Brands grew 4.1 percent.

Operating Income and Diluted EPS

Full Year Commentary

Adjusted Gross Profit1 increased 0.6 percent on a constant-currency basis. Adjusted Gross Profit margin was 36.8 percent, down 0.6 percentage points, including a negative 0.5 percentage point impact from the mark-to-market adjustments associated with commodities and currency hedging.

Excluding this impact, Adjusted Gross Profit margin was essentially flat as higher prices and a strong contribution from supply chain productivity offset input cost inflation.

Adjusted Operating Income grew 10.2 percent on a constant-currency basis. Adjusted Operating Income margin expanded 0.8 percentage points to 12.9 percent, driven primarily by strong gains in Europe and North America.

The company continued to reduce overheads in all regions. In addition, the company maintained working media support while lowering overall advertising and consumer expense by driving efficiencies through consolidating providers, reducing non-working costs and shifting spending to lower-cost, digital outlets.

Adjusted EPS grew 23.4 percent on a constant-currency basis, driven by operating gains, lower interest expense and share repurchases.

Free Cash Flow, Share Repurchases and Dividends

For the full year, Free Cash Flow excluding items1 was $2.5 billion, driven by earnings growth and working capital improvement. The company returned $2.9 billion to shareholders through $1.9 billion of share repurchases and $1 billion in dividends.

Outlook

In 2015, the company expects Organic Net Revenue growth of at least 2 percent, after accounting for the company’s strategic decision to exit certain lower-margin revenue.

Adjusted Operating Income margin is expected to be approximately 14 percent for the year, with margin expansion accelerating in the second half, driven by the timing of cost-reduction programs. Adjusted EPS is expected to increase at a double-digit rate on a constant-currency basis.

With approximately 80 percent of revenues in currencies not tied to the strengthening U.S. dollar, the company estimates foreign exchange translation to reduce 2015 net revenue growth by approximately 11 percentage points and Adjusted EPS by approximately $0.308.

Conference Call

Mondelez International will host a conference call for investors with accompanying slides to review its results at 10 a.m. ET today. Investors and analysts may participate via phone by calling

1-800-322-9079 from the United States and 1-973-582-2717 from other locations. Access to a live audio webcast with accompanying slides and a replay of the event will be available at www.mondelezinternational.com/Investor.

The company will be live tweeting from the event at www.twitter.com/MDLZ.

End Notes

1.Organic Net Revenue, Adjusted Operating Income, Adjusted EPS, Adjusted Gross Profit and Free Cash Flow excluding items are non-GAAP financial measures. Please see discussion of non-GAAP financial measures at the end of this press release for more information.

2.Includes both the 2012-2014 Restructuring Program and the 2014-2018 Restructuring Program. Please see discussion of non-GAAP financial measures at the end of this press release for more details about both programs.

3.In August 2013, the company recorded a $363 million favorable impact related to the resolution of a Cadbury acquisition tax indemnification, including $336 million in selling, general and administrative expenses and $49 million in interest and other expense, net partially offset by $22 million of tax expense.

4.On December 13, 2013, the independent arbitrator in the dispute between Kraft Foods Group and Starbucks Coffee Company issued a decision and Final Award that Starbucks must pay $2.8 billion in total cash compensation for its unilateral termination of the companies’ license and supply agreement. The company recorded a gain, net of taxes, of $1.6 billion during the fourth quarter of 2013.

5.Emerging markets consist of the Latin America and Eastern Europe, Middle East and Africa regions in their entirety; the Asia Pacific region, excluding Australia, New Zealand and Japan; and the following countries from the Europe region: Poland, Czech & Slovak Republics, Hungary, Bulgaria, Romania, the Baltics and the East Adriatic countries.

6.Developed markets include the entire North America region, the Europe region excluding the countries included in the emerging markets definition, and Australia, New Zealand and Japan from the Asia Pacific region.

7.Net earnings attributable to Mondelez International.

8.Currency estimate is based on spot rates as of the close of business on January 30, 2015.