ECULLY, France – Groupe Seb issued on January 30, 2023, unaudited figures for 2022. The French giant generated 2022 sales of €7,960m, almost stable as reported (-1.2%) vs. 2021 and down 4.7% LFL. The difference between these two figures can be attributed to a strong positive currency effect (+3.3%), stemming very largely from the appreciation of the US dollar and the Chinese yuan. The consolidation impact, in the fourth quarter, of Zummo, acquired last summer, amounted to €10m*.

This performance confirms the sound resilience of the Group in a tense geopolitical environment and compared to the record performance reported in 2021. Versus 2019, the most recent normal year, 2022 revenue was up 8.2% and confirms the Group’s positive trajectory over time.

After reaching a low point in the third quarter (-8.1% LFL vs 2021), sales declined at a slower pace in the closing quarter of the year, by 5.6% LFL (-3.6% reported). This improvement reflects slightly more favorable trends in the Consumer business (-7.3% vs -8.8% in the third quarter LFL), driven by the main regions: EMEA, the Americas and China. It also includes the solid revenue progression at the Professional Division, as anticipated: +17.6% vs. -0.2% LFL in the third quarter, for which 2021 comparatives were high.

At the end of the fourth quarter which held up better, annual Consumer sales amounted to €7,234m, down 5.9% LFL vs. 2021. This decline in business should be considered in light of the demanding historic performance in 2021 (+16% growth vs. 2020), driven by a phenomenon of oversales in Small Domestic Equipment. It largely contributed to the decrease in volumes experienced in 2022.

As mentioned in the nine-month sales press release, 2022 activity was heavily penalized by:

- underperformance in France (down 22% vs. 2021) and in Germany (-13%) owing to the rebalancing of household consumption towards other sectors to the detriment of Small Domestic Equipment, an unfavorable category mix effect (cooking categories overweighted and oversold during the Covid period) and the non-recurrence in 2022 of major loyalty programs;

- the impact of the Russia-Ukraine war, where LFL sales collapsed more than 30% vs. 2021.

The drop in sales in these four countries, which represent one-third of Consumer revenue, is responsible for all of the contraction in sales at the Consumer business.

In the other regions, business was mixed, with:

- the confirmation of the positive momentum in China, where Supor sales exceeded the 2 billion euro mark for the first time and reported 5% organic growth. In a volatile market environment (zero-covid policy, lockdowns), Supor continued to outperform the competition and reinforce its positions;

- 6% LFL sales growth in Eurasia – excluding Russia and Ukraine -, driven by Turkey, Egypt and Poland;

- 6% LFL sales growth in South America, driven by Colombia;

- resilient sales (-5% LFL) in Western Europe excluding France and Germany, with notably satisfactory performances in the UK, Italy, and the Netherlands;

- a decline in revenue in North America of close to 10% LFL – in line with market trends – as well as in Asia excluding China (-6%, mainly due to Japan and South Korea).

* consolidated over 5 months

In terms of products, in 2022, the Group maintained its solid development strategy, leveraging innovation and extending its offering (notably in EMEA, China, Mexico, Colombia, etc), with the roll-out of best-sellers (Cookeo, oil-less fryers, versatile vacuum cleaners…) to new geographies and the recovery of linen care.

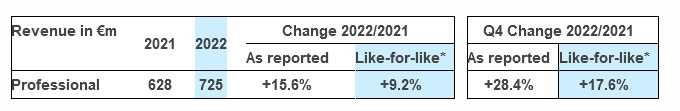

Full-year sales at the Professional division came out at €725 million, up 15.6% including 9.2% organic growth compared with 2021. This performance confirmed the continuation of the recovery which started during the second half of 2021 and includes an excellent fourth quarter, as expected.

In Professional Coffee, annual revenue growth was driven both by machine deliveries and services. The acceleration in Germany and the ramp-up of commercial synergies between Schaerer and Wilbur Curtis in the United States, as well as the roll-out of the Luckin Coffee contract in China were the main drivers of this growth. Hotel equipment also turned in a very good year in 2022, benefiting from a strong catch-up effect compared with 2021.

Professional

2022 Professional sales (mostly Professional Coffee) came out at €725 million, up 16% and 9.2% LFL compared with a year earlier. This strong sales performance confirms the recovery that began in the second half of 2021, following the reopening of the hotel and restaurant sector. Growth was driven by all activities: professional coffee, hotel equipment and Krampouz. Zummo, acquired in July 2022 and world leader in automatic juice extraction machines, was consolidated from the fourth quarter (over five months).

In Professional Coffee, the Group achieved a buoyant end to the year, with fourth quarter organic growth of 17% driven by all geographies and significant machine delivery flows.

For the year as a whole, sales dynamics was fueled both by machines and services, with the latter posting double digit growth. This was underpinned by the extended and more diversified customer portfolio as well as a policy of continuous development in services, which enhance the recurring proportion of sales.

Among the highlights of the year, three are particularly noteworthy:

- the marked acceleration in Germany;

- the strong ramp-up in commercial synergies between Schaerer and Wilbur Curtis in the United States, which translated to sales growth of more than 20% in the fourth quarter;

- the vigorous roll-out of the business with Luckin Coffee, which continues its fast expansion in China, with the opening of several hundreds of points of sale.

This impressive resumed vitality in 2022 confirms the company’s confidence in the steady expansion of the global Professional Coffee market and the Group’s ability to continue to make further progress in this industry.

Hotel equipment also turned in an excellent performance, both quarterly and for the year as a whole, benefiting from a strong catch-up effect after a moderate 2021.

2022 Operating Profitability Estimate

Groupe SEB is confirming its ORFA margin guidance for 2022 which is now expected to be in the high-end of the 7.0% to 7.5% range.

* ORFA: Operating Result from Activity