ABIDJAN, Côte d’Ivoire – At the start of the month under review, the cocoa market did not appear to be looking past the period of supply tightness and price rallies. Several price swings occurred in the first half of June. At the time, reports from news agency including Reuters revealed that the surge in price stemmed from supply concerns in Ghana, as the country plans to postpone the delivery of up to 350,000 tonnes of cocoa beans until next season due to poor crops.

Côte d’Ivoire was also reported to have also halted forward sales of the next season’s crop at 940,000 tonnes, about 35% less than a year ago, as it awaits more clarity on expected production.

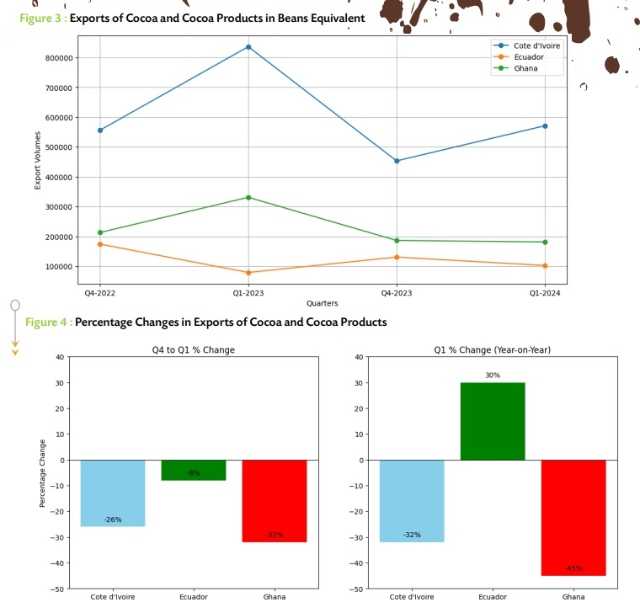

The implication of these news from the leading producers heightened concerns about the ongoing supply deficits from West Africa and consequently prices. Compared to prices at the start of the month, by 13 June, the front month contract price (Jul-24) reached the highest level for the month and was up by 18% in London from US$9,798 per tonne to US$11,530 per tonne. In New York, over the same time frame, prices rose by 12% from US$9,590 per tonne to US$10,782 per tonne (Figure 1).

A year ago, as shown in Figure 2, the average price in London for the month of June was US$3,182 and prices ranged between US$2,917 and US$3,460 per tonne. For the same period in New York, the average was US$3,159 per tonne and prices ranged between US$3,008 and US$3,324 per tonne.

Despite the current shortage of beans, from mid-June till the end of the month, prices pulled back and broke out of their rallies. The driving force behind the softening in prices may have come from reports of conducive weather conditions supporting crop development and the consequent anticipation of a better main crop output for the upcoming 2024/25 cocoa season. Compared to the month’s maximum price, on the last trading day, prices declined by 18% to US$9,510 per tonne and by 28% to US$7,729 per tonne in London and New York, respectively.

Several observations can be derived from the decline in prices. First, in anticipation of more price declines (due to a better harvest for the next season), to make profit, traders may be taking a short position to sell more now and buy these contracts later at a lower price. Another observation during this period was the backwardation that occurred while prices were declining. In London, the difference in prices between the nearby contract (Jul-24) and the later contract (Sep-24) was far wider than in New York.

Though the supply tightness is felt in both London and New York, the magnitude can be said to be more significant in London than New York especially considering that most of the cocoa from West Africa is destined for Europe, and with less cocoa in West Africa, this can impact the volume in London.

Supply and demand

For the current season, in addition to unconducive weather conditions, cocoa bean production in Côte d’Ivoire and Ghana has also been battered by the Cocoa Swollen Shoot Virus Disease (CSSVD).

According to the Cocoa Health and Extension Division (CHED) of the Ghana Cocoa Board, the Western North region which is the hub of Ghana’s cocoa production covers an area of 410,229 hectares and has 330,456 hectares infected by CSSVD.

This reflects that a large share of around 81% of the area of Ghana’s production hub is infected with CSSVD. At the time of writing, CSSVD is also spreading in Côte d’Ivoire and the region with the highest prevalence of the disease is yet to be made public by the Ivorian authorities.

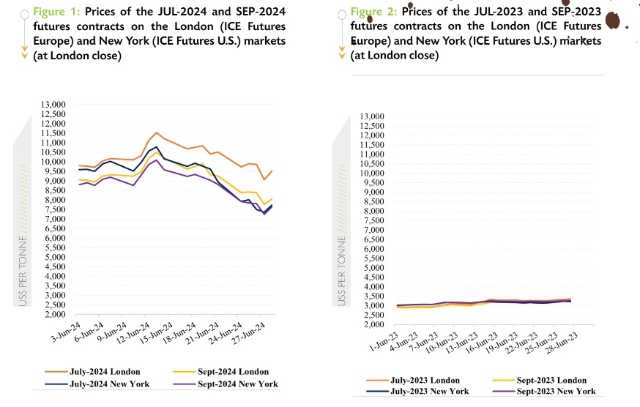

Though there is a global shortage of beans, it is not proper to tag all producing countries as having a lower production for the ongoing season. Outside West Africa, production and consequently exports from countries in the Americas, like Ecuador among others, have been increasing. Moreover, these countries are benefitting from the ongoing high international prices and investing in cocoa production.

Figure 3 and 4 illustrate the performance of exports for the top three producing countries. For the aggregate of Q4_2023 to Q1_2024, though all three countries depicted a year-on-year decline, Ecuador performed better than Côte d’Ivoire and Ghana. On a Q1_2024 basis, while the percentage change for Ecuador was positive, it was rather negative for Côte d’Ivoire and Ghana (Figure 4). The Secretariat will continue to monitor the trade data of leading producers and provide updates in subsequent reports.