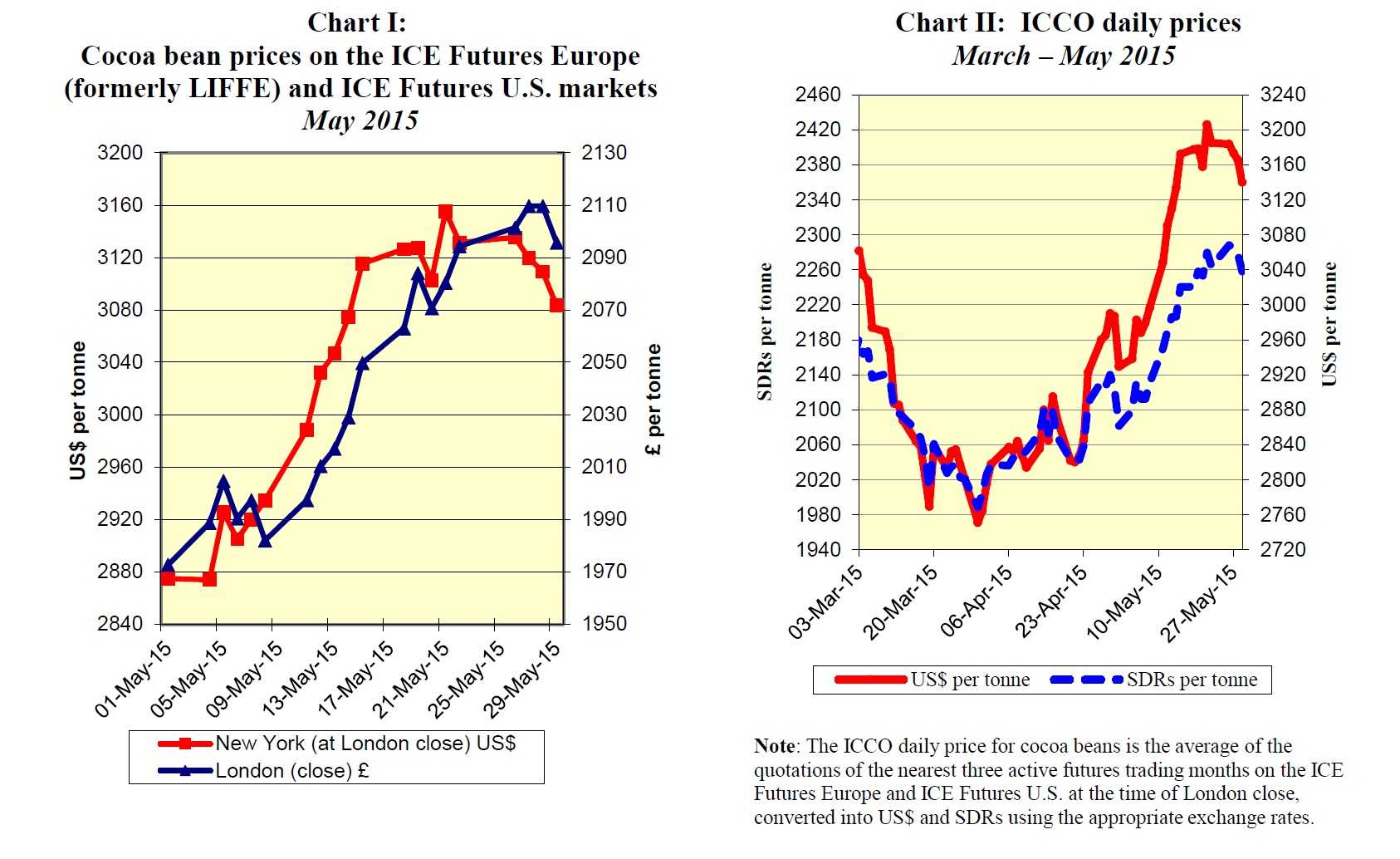

The current review reports on cocoa price movements on the international markets during the month of May 2015. Chart I illustrates price movements on the London (ICE Futures Europe) and New York (ICE Futures U.S.) markets for the month under review.

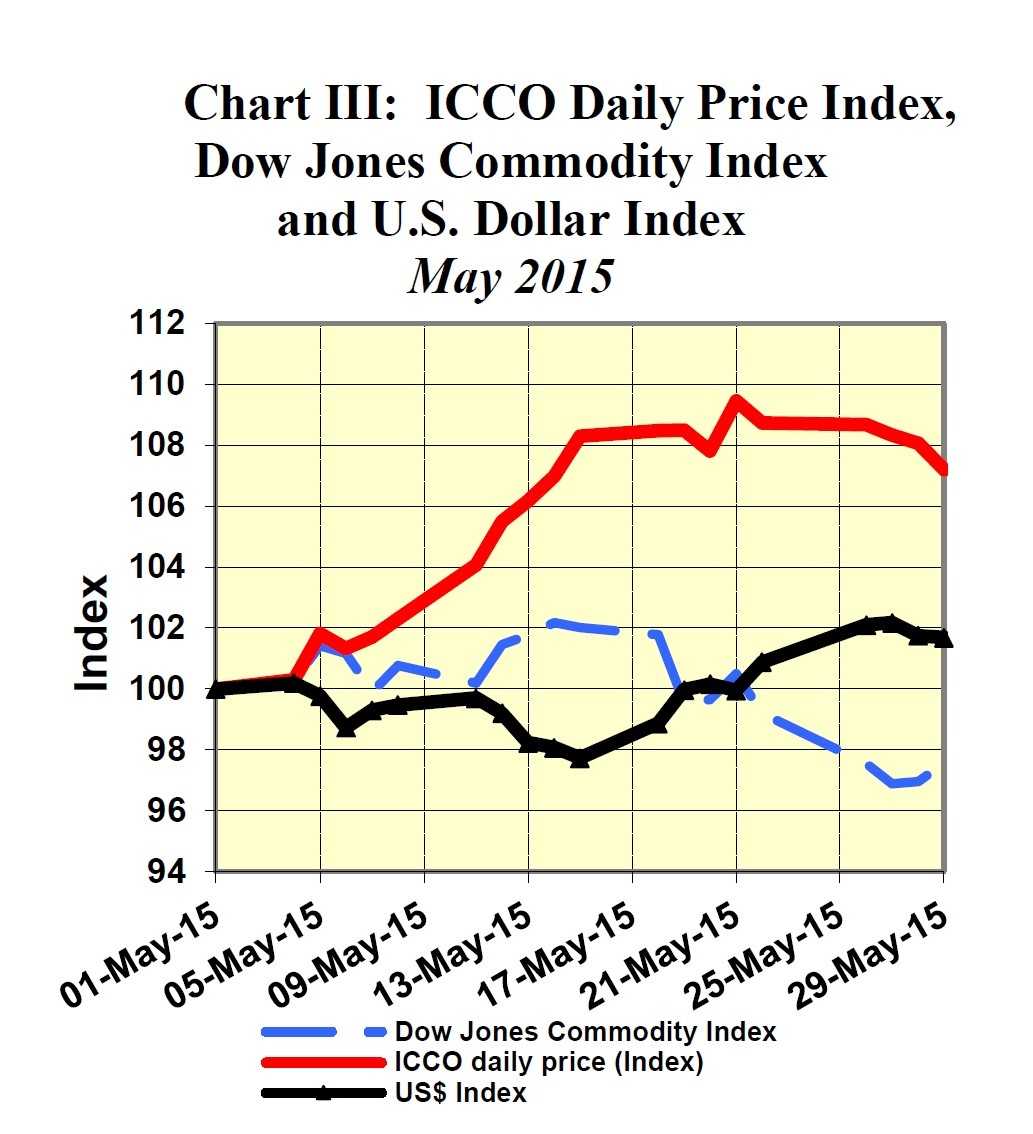

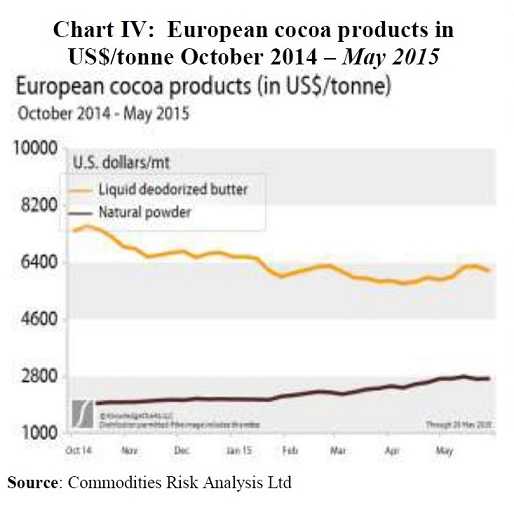

Chart II shows the evolution of the ICCO daily price, quoted in US dollars and in SDRs, from March to May 2015. Chart III depicts the change in the ICCO daily price Index, the Dow Jones Commodity Index and the US Dollar Index in May, while Chart IV presents the prices of European cocoa products since the beginning of the current cocoa year.

Price movements

Price movements

In May, the ICCO daily price averaged US$3,096 per tonne, up by US$228 compared to the previous month’s recorded average (US$2,868), and ranged between US$2,929 and US$3,206 per tonne.

Cocoa prices on the futures markets were generally buoyant in May. Indeed, the steady rise initiated from the latter part of April continued throughout the month under review. Compared to the price levels recorded at the start of the month, of £1,973 per tonne in London and of US$2,875 per tonne in New York, cocoa prices rose by five per cent and eight per cent respectively by the end of the third week.

Moving towards the end of the month, both markets attained seven-month highs, at US$3,155 per tonne in New York and at £2,110 per tonne in London. Persisting concerns in relation to Ghana’s worse-than expected 2014/2015 crop, coupled with the potential of an El Niño strengthening in time for the upcoming cocoa season, were the main factors behind this sharp upward movement. El Niño is a meteorological event known to have a significant detrimental effect on weather patterns and estimated to reduce cocoa production on average by 2.4% at world level, according to an ICCO study.

As depicted in Chart I, cocoa futures reached their peak earlier on the New York market than on the London market, as the latter was also supported by a weakening Pound Sterling. However, both markets changed direction in the last sessions of the month and lost some ground.

As displayed in Chart III, cocoa prices outperformed most commodities throughout the month, supported by concerns in relation to the Ghanaian crop and the impact of El Niño on the forthcoming 2015/2016 main crop.

Supply & Demand situation

According to news agency data, cocoa arrivals at ports in Côte d’Ivoire were around 1,482,000 tonnes by 7 June, compared to 1,499,000 tonnes during the same period of the previous season. Notwithstanding this one per cent decrease in port arrivals, the weather has continued to be favourable for the ongoing development of the mid-crop, although in some regions, farmers are concerned about heavy rains.

In Ghana, cocoa purchases were reported to have reached over 600,000 tonnes by the end of May, which is still considerably down compared with the same period of the previous season. With purchases falling so far short of earlier expectations, news agencies reported that Cocobod had extended its main crop buying period to fill sales contracts. Reports also indicated that by doing so, Cocobod aimed to prevent bean smuggling to Côte d’Ivoire, as the farmgate price is now around four per cent below the price in Côte d’Ivoire in US dollar terms.

On the demand side, cocoa butter ratios were quoted at 1.85-1.95 times of London futures, down from 1.95-1.98 in April. As illustrated in Chart IV, while powder was on the rise, butter ratios were lower, as grinders hoped to encourage more sales and offset higher bean and powder prices. Overall, the outlook for grindings has not been favourable, as large stocks of cocoa powder, very low processing margins and moderate growth of demand for chocolate weigh on this activity.

Final comments

As published in the latest ICCO Quarterly Bulletin of Cocoa Statistics, the ICCO Secretariat expects world demand for cocoa beans to outstrip world supply during the 2014/2015 season by 38,000 tonnes, revising upwards its earlier projected deficit of 17,000 tonnes. World production is projected to reach 4.168 million tonnes, while world grindings are now forecast at 4.164 million tonnes.