This review of the cocoa market situation reports on cocoa price movements on international markets during the month of March 2018. It aims to highlight key insights on expected market developments and the effect of the United States dollar exchange rates on cocoa prices.

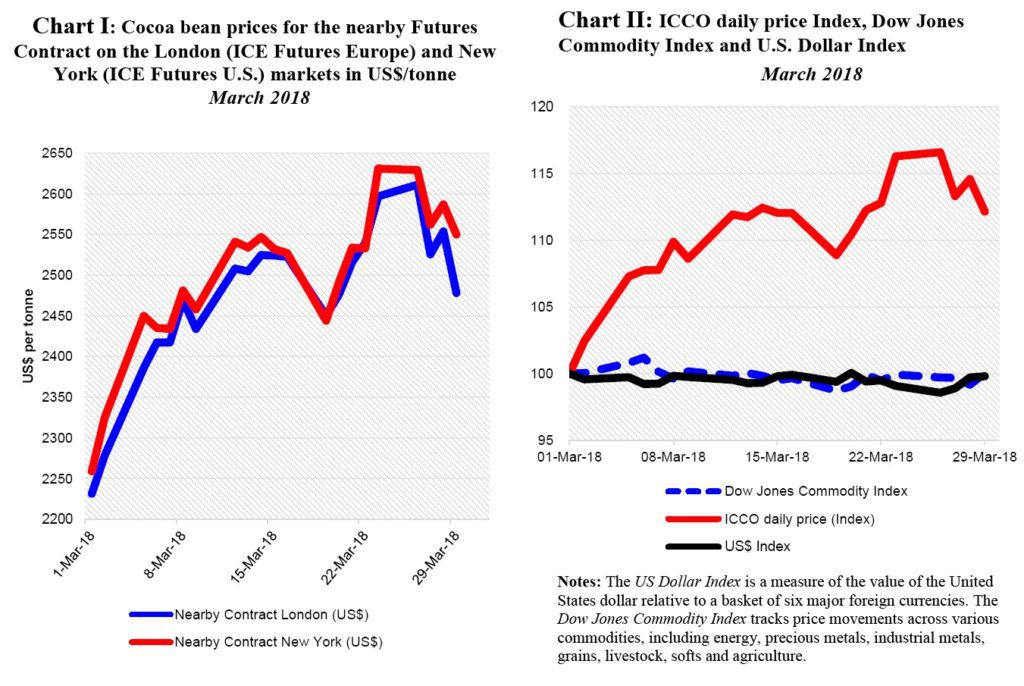

Chart I shows the historical developments in the prices of the nearby cocoa futures contracts on ICE U.S. (New York) and ICE Europe (London) at the London closing time. Both prices are expressed in US dollar.

The London market is pricing at par African origins, whereas the New York market prices at par Southeast Asian origins. Thus, the London futures price is expected, under the same market conditions, to be higher than that of New York.

As a result, the relative price difference provides insights into the relative, expected availability of cocoa beans on these exchanges at the expiry of the futures contract.

Chart II depicts the change in the ICCO daily price Index, the Dow Jones Commodity Index and the US Dollar Index in March.

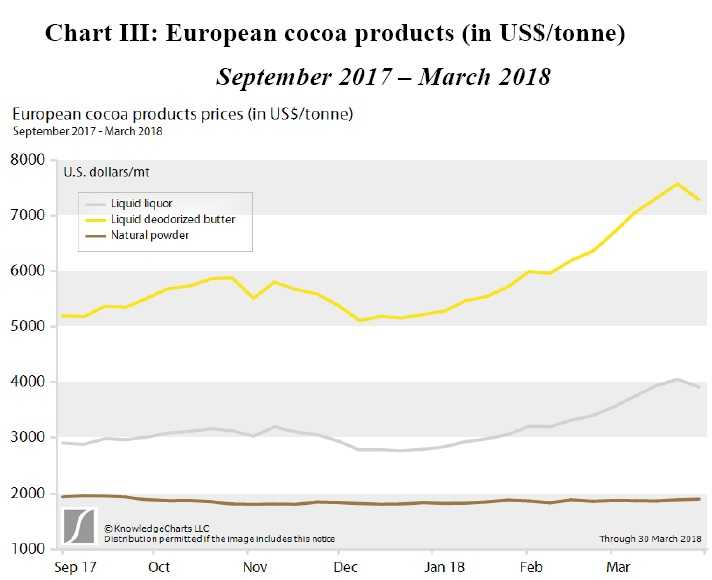

Finally, Chart III shows European cocoa products’ price trends since the beginning of the 2017/18 crop season.

Price movements

Cocoa prices witnessed a general upward trend during the month of March. They increased on average by 11% and 13% in the London and New York futures markets, respectively.

This followed a re-assessment of both production and grindings, respectively lower and higher than previously estimated, by the end of 2017/18.

As shown in Chart I, during the first two weeks of month the price of nearby futures contract increased by about 13% on both markets and settled at US$2,527 in New York and US$2,522 in London on 16 March 2018.

This price rally was supported by raising concerns over the dry and hot weather, prevailed in West Africa in previous months, and to some extent by the decision of the Conseil du Café-Cacao (CCC), Côte d’Ivoire’s cocoa marketing board, to halt cocoa production boosting programmes in response to falling international prices.

During the third week of the month, the futures prices weakened. On 19 March 2018, the London and New York Market and closed respectively at US$2,450 and US$2,444.

Indeed, the overall market expectations for the 2017/18 mid-crop outlook changed following the news of abundant rainfall occurred in West African cocoa producing countries. Nevertheless, such a bearish stance was however brief.

Anticipated higher levels of grindings published in the news contributed to firm cocoa price during the last trading days of the of the third week.

Even though the US dollar index and the broad commodity complex remained stable during the month under review, the ICCO daily prices index rose by 12% compared to its value at the beginning of the month (Chart II). The upward trend in prices was fully supported by market fundamentals.

Supply and demand situation

Côte d’Ivoire’s mid-crop starts in April with the Government’s decision to maintain the farmgate price at CFA700 (US$1.32) per kilogram of cocoa beans. The expected output of the Ivorian mid-crop is estimated to settle at 500,000 tonnes making the 2017/18 output reach approximatively 1.9 million tonnes.

This expected crop output is down from 2.020 million tonnes recorded last season. Data released by news agencies indicated that, as at 31 March 2018, cumulative arrivals at Ivorian ports for the 2017/18 crop year reached 1.441 million tonnes, down nearly by 4% from 1.507 million tonnes in the same period last season.

Cocoa production in Ghana is challenged by ageing cocoa trees stock, mostly diseased and unproductive, in addition to the recent dry spell witnessed in the country during previous months.

As at 15 March 2018, purchases were reported at 642,451 tonnes, down from 660,095 tonnes last year. In March, the two top cocoa producing countries agreed on harmonizing their cocoa production and marketing strategies to efficiently manage price-related risks.

With regards to demand, as depicted on Chart III, since the start of the 2017/18 crop season, cocoa butter and cocoa liquor prices generally followed an upward trend and traded over US$5,000 /tonne and US$3,000 /tonne respectively. On the other hand, cocoa powder prices remained steady at US$2,000/tonne approximatively.

On the other hand, cocoa powder prices remained steady at US$2,000/tonne approximatively.

Markets participants will be adjusting their expectations of prices while closely monitoring the pace of arrivals in the top producing countries.

In addition, grindings data for Europe, Americas and Asia for January to March 2018 is expected to be released by mid-April by main regionals cocoa associations.