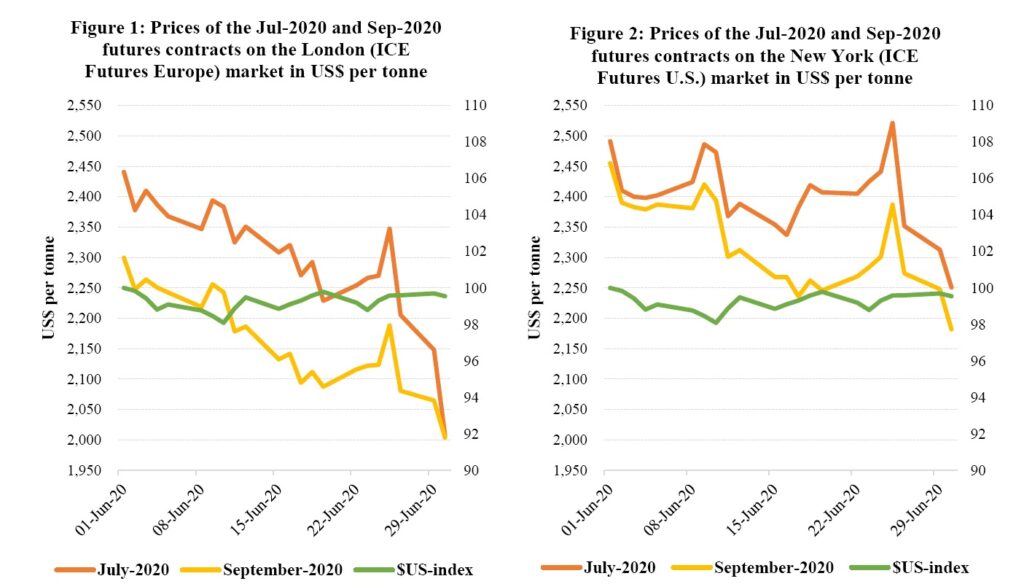

ABIDJAN, Côte d’Ivoire – This review of the cocoa market situation focuses on the prices of the July-2020 (JUL-20) and September-2020 (SEP20) futures contracts listed on ICE Futures Europe (London) and ICE Futures U.S. (New York) during the month of June 2020. It aims to highlight key insights on expected market developments and the effect of the exchange rate on the US-denominated prices of the said contracts.

Figure 1 shows the development of the aforementioned futures contracts prices on the London market whilst Figure 2 depicts the evolution of prices for the same futures contracts on the New York market at the London closing time.

Hence, by monitoring the development of the US dollar index in June, one can determine the impact of the US dollar exchange rate on the development of the futures prices – denominated in US dollar – during the period under review.

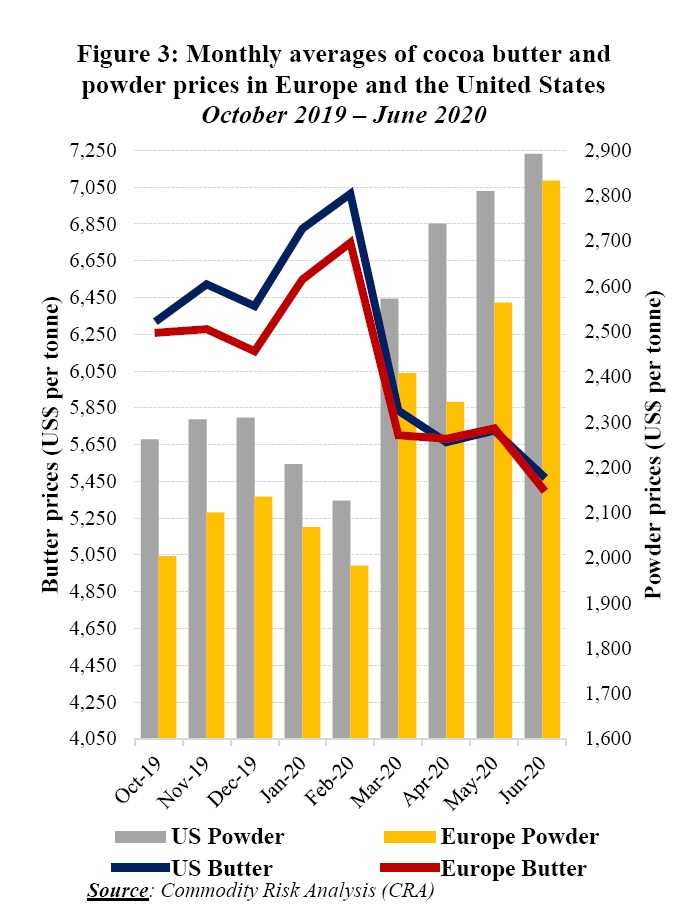

Finally, Figure 3 presents monthly averages of cocoa butter and powder prices in Europe and the United States since the start of the 2019/20 crop year.

Price movements

Both the London and New York futures markets were in backwardation during the month of June. The JUL-20 contract priced with an average premium of US$138 per tonne over the SEP-20 contract in London whereas in New York the premium was established at US$83 per tonne between prices of these futures contacts.

Regarding cocoa price movement (Figure 1 and 2) from the beginning to the end of June, the front-month cocoa futures contract (JUL-20) prices sharply plummeted by 18% from US$2,440 to US$2,008 per tonne in London whilst in New York, they ebbed by 10% from US$2,491 to US$2,251 per tonne.

Worries on the demand size due to the unabated surge of the Coronavirus (COVID-19) pandemic in some consuming regions, namely the Americas as well as Asia and Oceania, supported the bearish stance.

In addition, ample stocks also contributed to the bearish stance seen in prices as certified stocks reached a peak in Europe and the United States. Indeed, as compared to their levels recorded at the beginning of the month under review, certified stocks of cocoa beans increased from 107,360 tonnes to 111,190 tonnes in Europe whilst in the United States, they climbed from 2,281 tonnes to 6,940 tonnes by the end of June.

It is worth noting that the developments seen in prices were stimulated by markets fundamentals without any impact of the US dollar.

It should be noted that cocoa futures and cocoa butter prices movements are positively correlated, whereas cocoa powder prices are inversely correlated to that of cocoa futures.

Figure 3 shows that compared with the average prices recorded at the start of the 2019/20 cocoa year, prices for cocoa butter plunged during June in both Europe and the United States, the world’s largest cocoa consuming markets. Indeed, prices for cocoa butter plummeted by 13% from US$6,331 to US$5,483 per tonne in the United States, while in Europe they declined by 14%, moving from US$6,260 to US$5,413 per tonne.

Compared to the levels reached in October 2019, prices for cocoa powder substantially rose on both markets, increasing by 28% from US$2,261 to US$2,893 per tonne in the United States. During the same time frame in Europe, powder prices rose by 41% from US$2,003 to US$2,833 per tonne.

In addition, compared to their average values recorded at the start of the 2019/20 cocoa year, the nearby cocoa futures contract prices shrank by 5% from US$2,423 to US$2,305 in London at the end of June 2020. Conversely, in New York, the front-month contract prices declined by 3% from US$2,467 to US$2,402 per tonne over the same period.

Cocoa supply and demand situation

While the 2019/20 cocoa year has entered its last quarter, cocoa production in Côte d’Ivoire is lagging behind the level attained last season. Indeed, as at 12 July 2020, cumulative cocoa arrivals at Ivorian ports, since the current season started, reached 1.986 million tonnes, down 5.9% from 2.111 million tonnes reached during the same period in the previous season. As at the time of writing, no recent information on purchases of graded and sealed cocoa beans has been posted for Ghana.

On the demand side, grindings are anticipated to weaken worldwide as a direct drawback of the ongoing COVID-19 pandemic. It is worth noting that main regional cocoa associations will be publishing grindings data for the second quarter of 2020 by mid-July for their respective regions.