LONDON – The current review reports on cocoa price movements on the international markets during the month of March 2015.

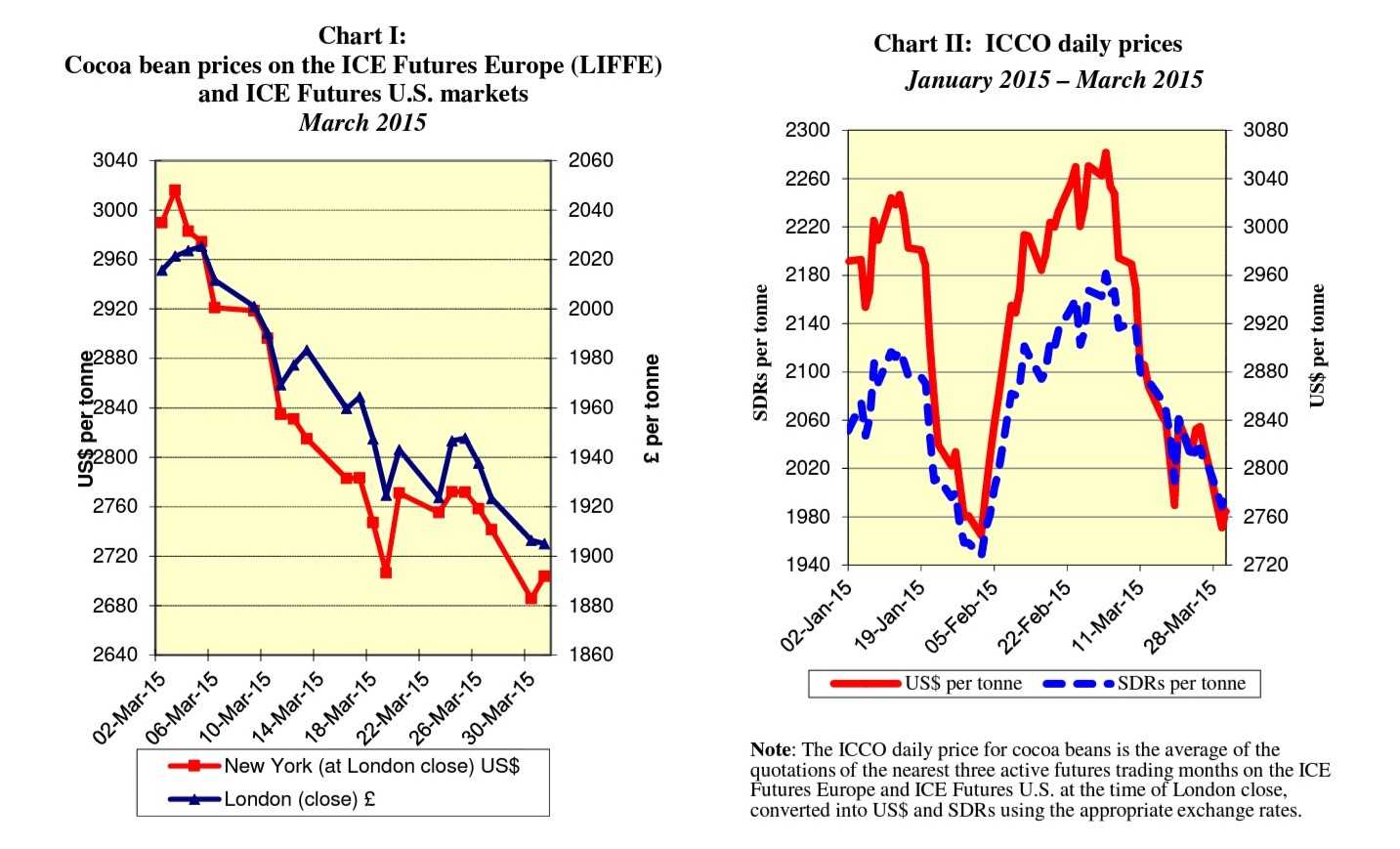

Chart I illustrates price movements on the London (ICE Futures Europe) and New York (ICE Futures U.S.) markets for the month under review.

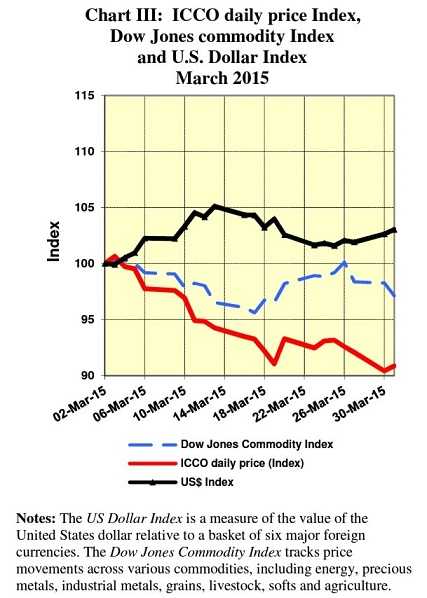

Chart II shows the evolution of the ICCO daily price, quoted in US dollars and in SDRs, from January to March 2015.

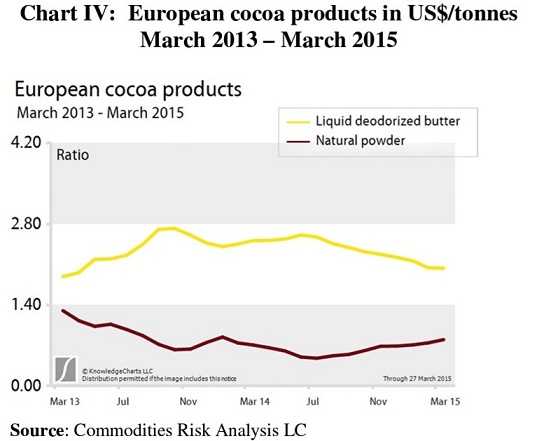

Chart III depicts the change in the ICCO daily price Index, the Dow Jones Commodity Index and the US Dollar Index in March while Chart IV presents the ratios of European cocoa products over a two-year period from March 2013.

Price movements

In March, the ICCO daily price averaged US$2,882 per tonne, down by US$65 compared to the previous month’s recorded average (US$2,947), and ranged between US$2,751 and US$3,062 per tonne.

The general rise in cocoa futures prices that occurred during the last week of the previous month continued during the first few trading sessions of March, with quotations attaining their highest level for the month in London at £2,025 per tonne and at US$3,016 per tonne in New York.

Nevertheless, moving from the peaks reached earlier in both ICE Europe and ICE U.S. markets, the subsequent trading sessions witnessed a sustained downward trend which was reinforced in the middle of the month by favourable weather conditions coupled with the strengthening of the US dollar, as depicted in Chart III.

By the end of the month, expectations of disappointing first quarter 2015 grindings data (to be released in mid-April), in addition to the aforementioned bearish factors, continued to weigh on the markets.

Thus cocoa prices plummeted to their lowest level for the month, at £1,905 per tonne in London and at US$2,686 per tonne in New York. Strong cumulative figures related to port arrivals in Côte d’Ivoire also contributed in setting the bearish tone on both markets

Launch of Euro-denominated cocoa contracts

On 30 March, both the CME Group and ICE launched Euro denominated cocoa contracts. As almost half of the cocoa traded originates from Cote d’Ivoire, Cameroon and Togo, whose currencies are pegged to the Euro, and that a third of this cocoa is processed within the Eurozone, the new contracts will reduce the need to hedge against foreign exchange risks in cocoa trade.

Whether these two new contracts will both be successful remains to be seen, as the limited liquidity in the markets is anticipated to be a strong constraint.

Supply & demand situation According to news agency data, cocoa arrivals at ports in Côte d’Ivoire were around 1,275,000 tonnes by 6 April, as against 1,233,000 tonnes during the same period of the previous season.

The Government maintained the cocoa farm-gate price previously set for the main crop at 850 CFA per kg for the mid-crop. In Ghana, cocoa purchasing figures are still to be released. Nevertheless, as published in the previous report, concerns remain in relation to the total output which is expected to be significantly lower than that of the previous season.

In Indonesia, reports from the Indonesian Cocoa Association raised concerns that both exports and output may drop this season, as Government efforts to support production have not yet managed to yield significant results.

This is expected to put further pressure on the country’s grinding industry. On the other hand, reports from the same Organization suggest that cocoa bean imports could increase to 100,000 tonnes this year as grinders look overseas to meet demand.

With regard to demand, as seen in Chart IV, cocoa butter ratios decreased further during the month under review, attaining their lowest level since April 2013.

Weak demand from Europe combined with the dependence of chocolate manufacturers on existing stocks were the main reasons behind this fall. Butter ratios, a key indicator of demand, were quoted at between 1.90 and 1.95 times London cocoa futures.

Meanwhile, prices of cocoa powder have witnessed a steady rise. Market participants will continue to monitor closely the pace of cocoa bean arrivals/purchases for the mid-crops during the coming months in Côte d’Ivoire and Ghana, the two major cocoa-producing countries.

Alongside grindings data for Europe and North America by the European Cocoa Association and by the National Confectioners’ Association for the first quarter of 2015, this will be a decisive determinant for price direction in the coming weeks.